- WIF made a strong comeback with a 79% surge in trading volume and a 13.33% hike in price

- An analyst is eyeing a sustained rally to a ATH past $8.7

Dogwifhat [WIF], the market’s largest Solana-based memecoin by market capitalization, has seen significant price recovery lately. At press time, it was trading at $1.85 on the charts.

This marked a 13.33% hike in the last 24 hours alone. Prior to this uptick, however, WIF had been on a downward trajectory, hitting a low of $1.07 over the past 2 weeks.

Despite the memecoin’s recent gains, WIF remains well below its May highs of $4.07 and 60.7% down from the all-time high of $4.8. Hence, the question – Do its recent gains position the memecoin for further gains?

According to SJLTrading, a popular crypto analyst and trader, Dogwifhat [WIF] may be in the early stages of Wave 3 of the impulsive Elliot wave cycle.

Prevailing market sentiment

In his analysis, SJLTrading highlighted one significant sign, suggesting that WIF may be well set for a rally.

Source: SJLTrading on X

According to the analyst, WIF has formed a solid impulsive Elliot wave cycle which strengthens the memecoin for strong price action in wave 5 of 5.

This means that WIF might see a strong upward move, with potential for further significant gains. Mostly, the final push in the trend is usually driven by positive market sentiment and momentum.

Furthermore, SJlTrading posited that WIF may be in the early stages of wave 3 after completing a 1-2 setup. The early stages of wave 3 suggest that the memecoin is in the strongest and most extended wave of the Elliot wave cycle. Thus, Wave usually results in the strongest and fastest price movement, indicating that upward momentum is expected.

Based on this analogy, WIF might hit $8.7 with the potential to extend itself if the buying interest remains strong.

Is WIF set for a rally?

While this analysis offered by SJLTrading offers a promising outlook, it’s essential to look at what other metrics tell us.

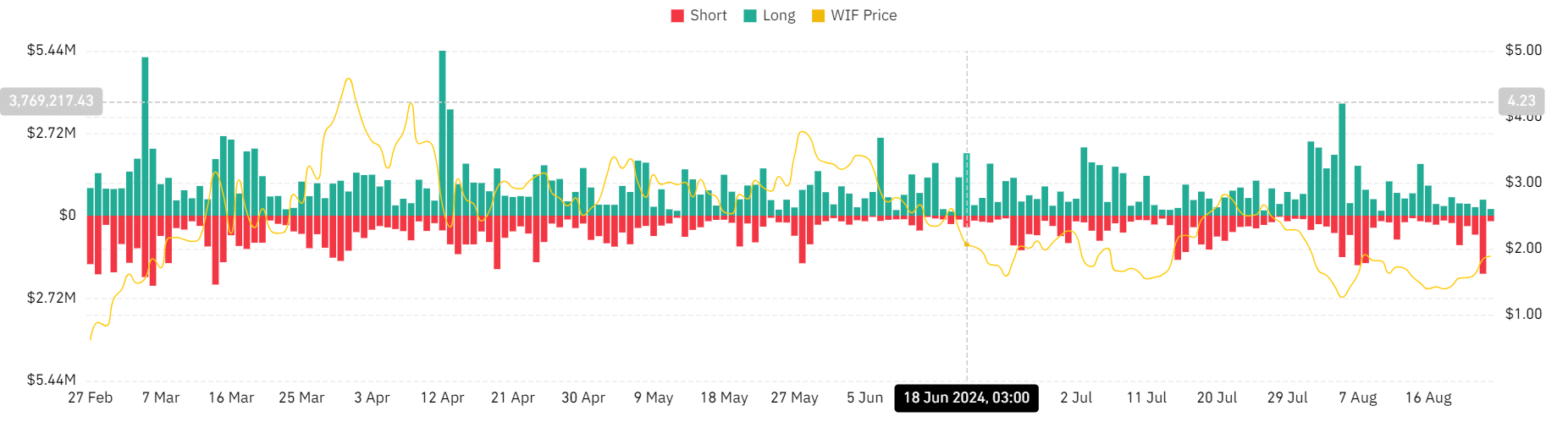

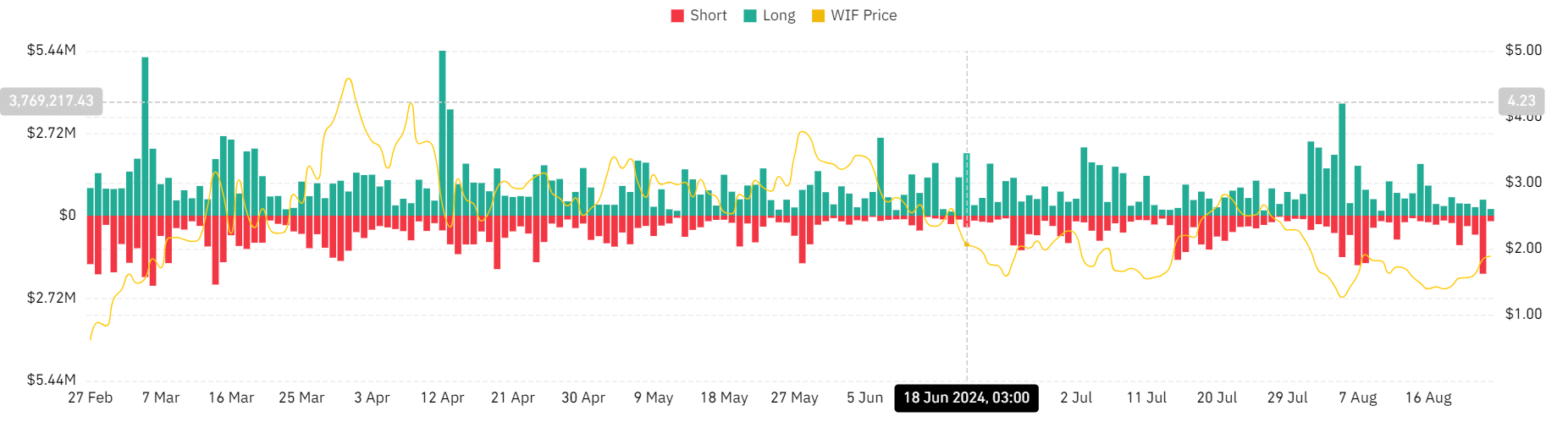

Source: Coinglass

For starters, since the market crash on 5 August, liquidations for long positions declined from $3.7 million to $218 at press time. This is a sign of increased investor confidence in the memecoin’s direction.

Although WIF’s price has declined over this period, long position holders have paid a premium to hold their positions. Equally, short position liquidations have risen, hitting $2 million over the past 24 hours. Thus, those betting against the market have been forcefully liquidated.

Source: Coinglass

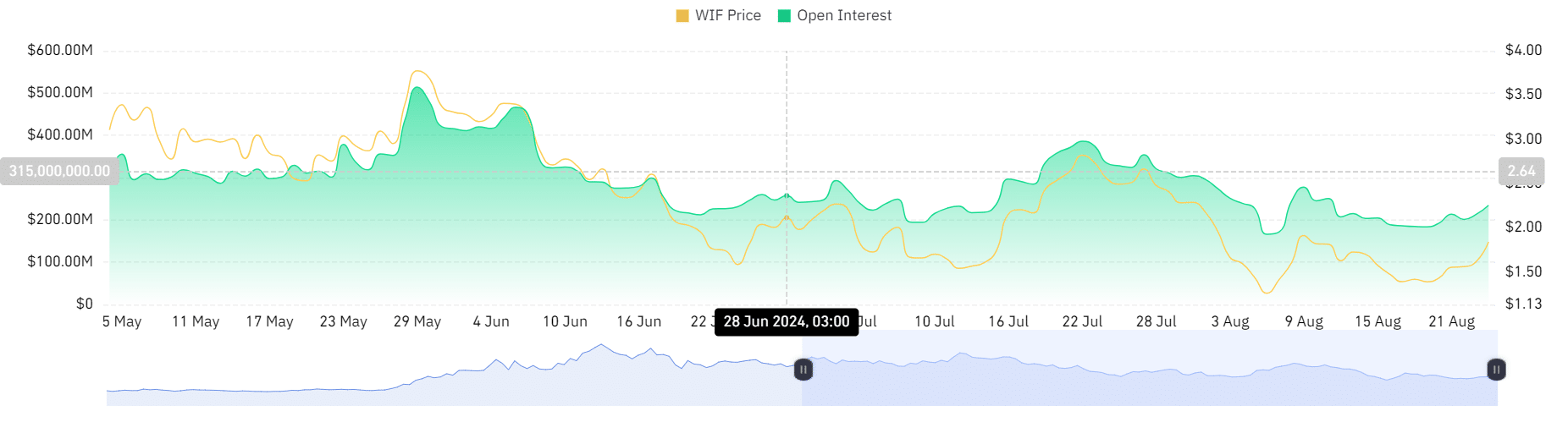

Additionally, Open Interest climbed over the last 24 hours from $213 million to $236.6 million.

This means investors are now opening positions while existing ones continue to hold their current positions. This is a bullish market sentiment as it indicates investors’ confidence in WIF’s future prospects.

Source: Tradingview

Therefore, if the prevailing market sentiment holds, WIF will break out of the descending channel at $1.96. A breakout from this resistance level will strengthen the memecoin to challenge the $2.3 resistance level.