- Bitcoin’s recent 5% dip to $95K isn’t a typical shakeout of weak hands.

- With all economic signs pointing to a volatile rally ahead, it’s time to stay sharp and cautious.

A week of relief, and the crypto market delivers another twist. Bitcoin [BTC] printed a glaring red candlestick on its daily chart, signaling a 5% drop.

Surprisingly, overheating isn’t the culprit here. So, who’s pulling the strings this time?

The buzz points to another case of potential “manipulation”. With no technical signs warning of a downturn, this drop feels more like a calculated move than a market correction.

Either way, the risk is sky-high

New data just dropped, revealing strong PMI numbers, high job openings, and a surprisingly resilient U.S. economy. But what followed? A sharp crash in volatile assets, marking the second such blow in under a month.

Bitcoin’s first crash saw it tumble to $91K, just two weeks after hitting a record high of $108K. But, in true Bitcoin fashion, it bounced back quickly, reclaiming $100K in just seven days.

Similarly, this latest drop in BTC could be a bullish sign. Despite the dollar index [DXY] hitting a two-year high of 109.27, a 5% dip still shows strength.

Additionally, Bitcoin has a track record of bouncing back, especially when institutional investors swoop in to scoop up liquidity, meaning a potential supply shock could be looming.

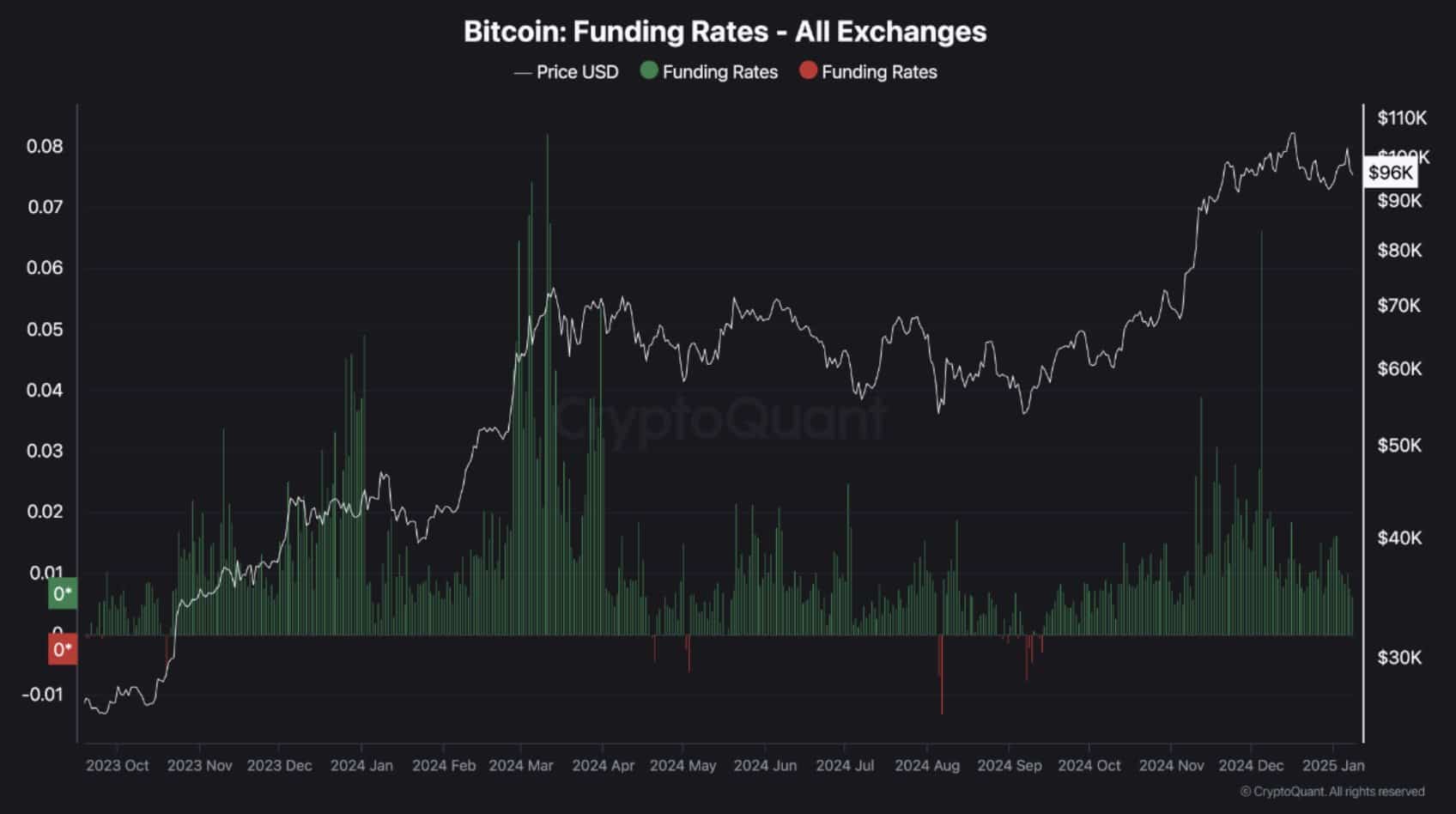

However, there’s one cloud hanging over this recovery: the “high-risk” sentiment gripping the market. With over $114 million in long positions wiped out, Funding Rates are steadily declining.

Source: CryptoQuant

This is creating a psychological barrier, particularly for retail investors and day traders, who might be waiting for the right moment to re-enter for better profits.

The key? If the gap between $102K and the new price is wide enough, it could be the trigger that brings confidence back into the market.

So, where is the next Bitcoin bottom?

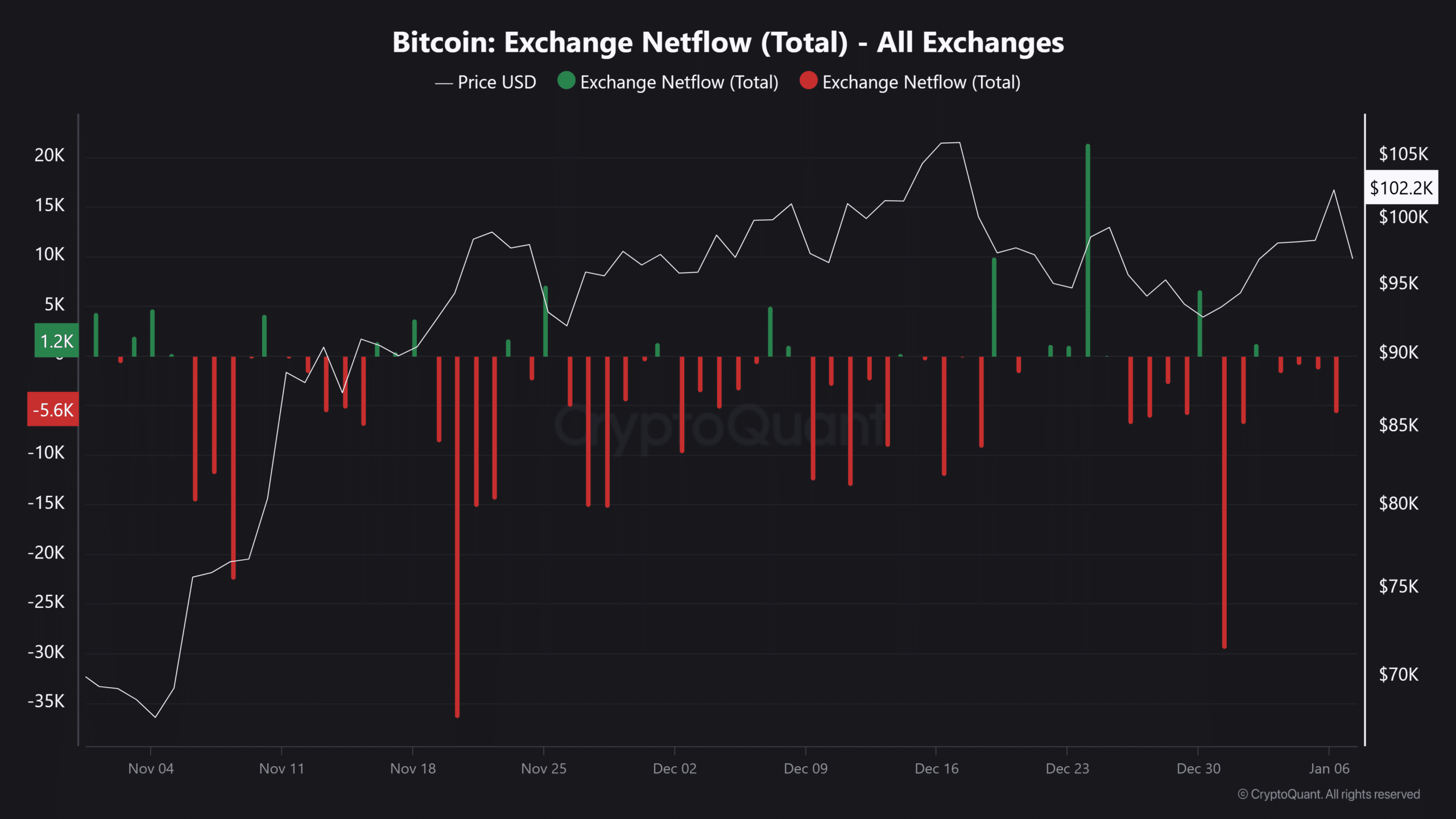

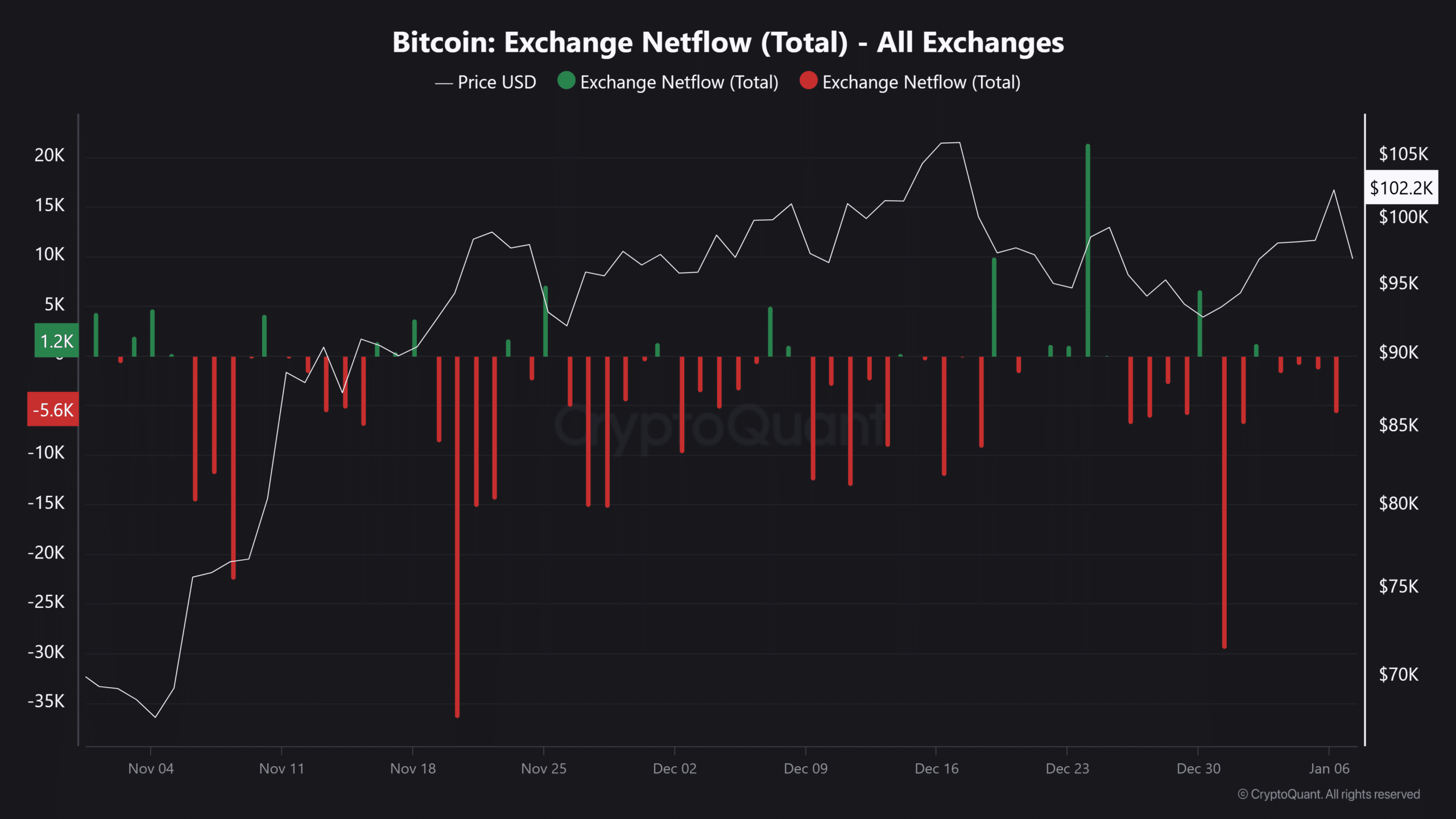

As mentioned before, when Bitcoin dropped to $91K, it made a strong comeback. A closer look shows that at this point, retail capital poured back into the market, with net outflows hitting $25K — the highest in a month.

But here’s the twist: while the net flow has turned red, it’s nowhere near those levels, sitting at just $5K.

Source: CryptoQuant

This suggests that the anticipated “buy-the-dip” moment hasn’t fully kicked in yet, confirming AMBCrypto’s theory that the market is waiting for the right trigger.

Read Bitcoin’s [BTC] Price Prediction 2025–2026

With the scars of the recent crash still fresh, expecting an instant rebound might be too hopeful. Instead, your patience may be tested.

While a sharp reversal isn’t imminent, a deeper pullback to $89K — $91K could be the sweet spot to watch for.