- Ethereum’s price declined by nearly 8% in the last 24 hours alone.

- A whale with a good track record sold ETH at a loss.

Ethereum [ETH] investors were having a tough time as the king of altcoins’ price dropped drastically last week. While several might expect this to be ETH’s market bottom, that might not be the case as per a recent analysis. Let’s see what’s happening with ETH.

Ethereum bears take control

CoinMarketCap’s data revealed that Ethereum bears pushed the token’s price down by more than 4% last week. Things got worse in the last 24 hours as the token witnessed a nearly 8% price plummet.

At the time of writing, ETH was trading at $2,481.07 with a market capitalization of over $298.4 billion. After the price decline, about 77 million ETH addresses remained profitable, which accounted for 63.9% of all ETH addresses.

Source: IntoTheBlock

While the latest price drop already looked concerning, a latest analysis suggested that there were chances of Ethereum going down further. UNKNOWN TRADER, a popular crypto analyst, recently posted a tweet highlighting a few “yellow” zones.

The tweet mentioned that the analyst would consider buying ETH once the token’s price enters those yellow zones, like $2,172-$2,085.

Source: X

Therefore, AMBCrypto planned to check the overall market sentiment around ETH to find out whether investors were waiting for a further drop or did they start buying the dip.

Are investors selling ETH?

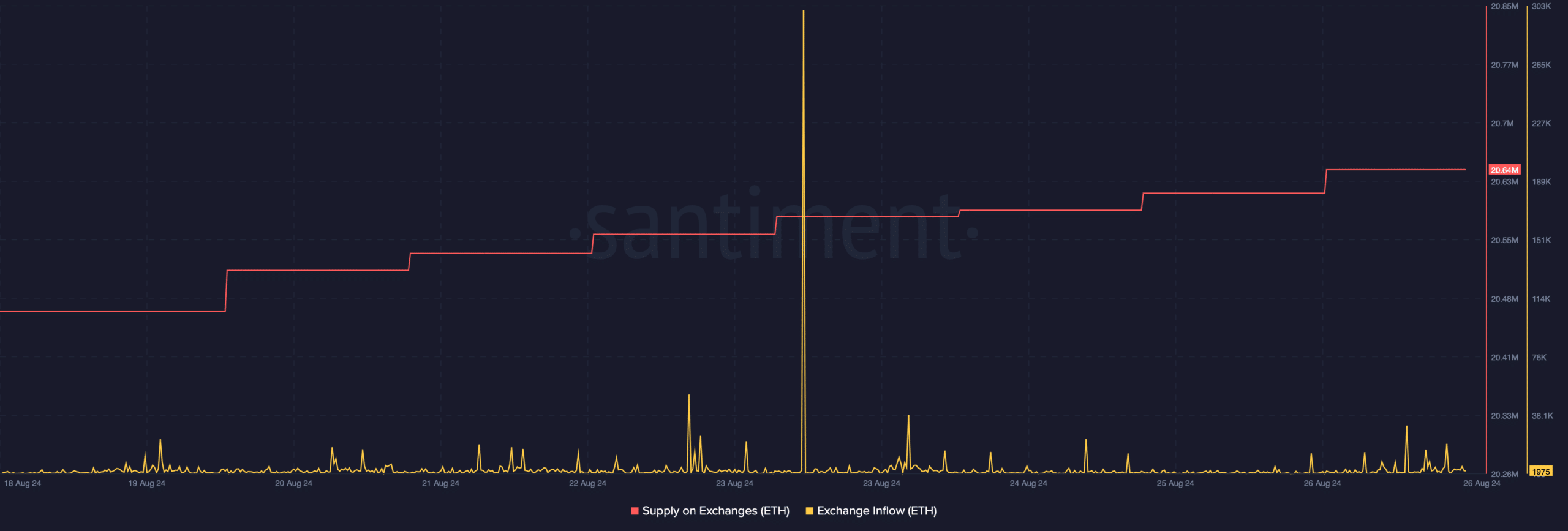

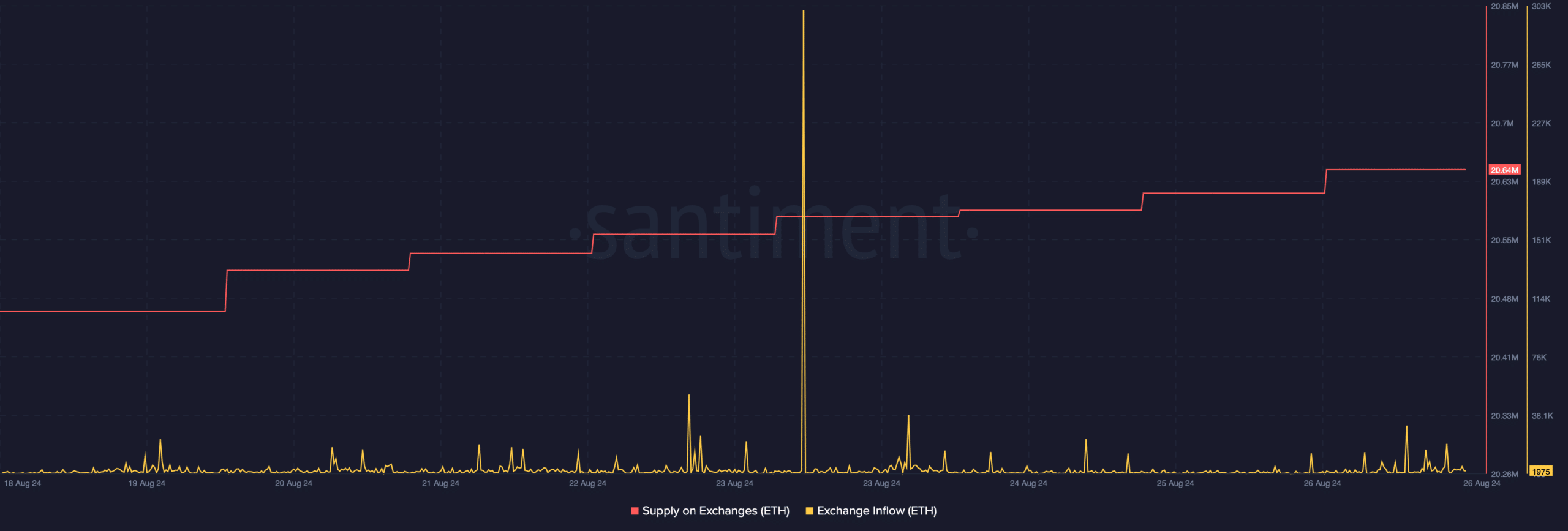

AMBCrypto’s analysis of Santiment’s data revealed that ETH’s supply on exchanges was rising. A hike in the metric indicates that investors are selling more.

Additionally, Ethereum’s exchange inflow also spiked, further proving the fact that selling pressure was high.

Source: Santiment

Lookonchain recently posted a tweet highlighting an interesting development. A whale with a good track record, sold 5,088 ETH, $13.58 million, at a loss of $3.66 million. Does this mean that ETH’s price would plummet further?

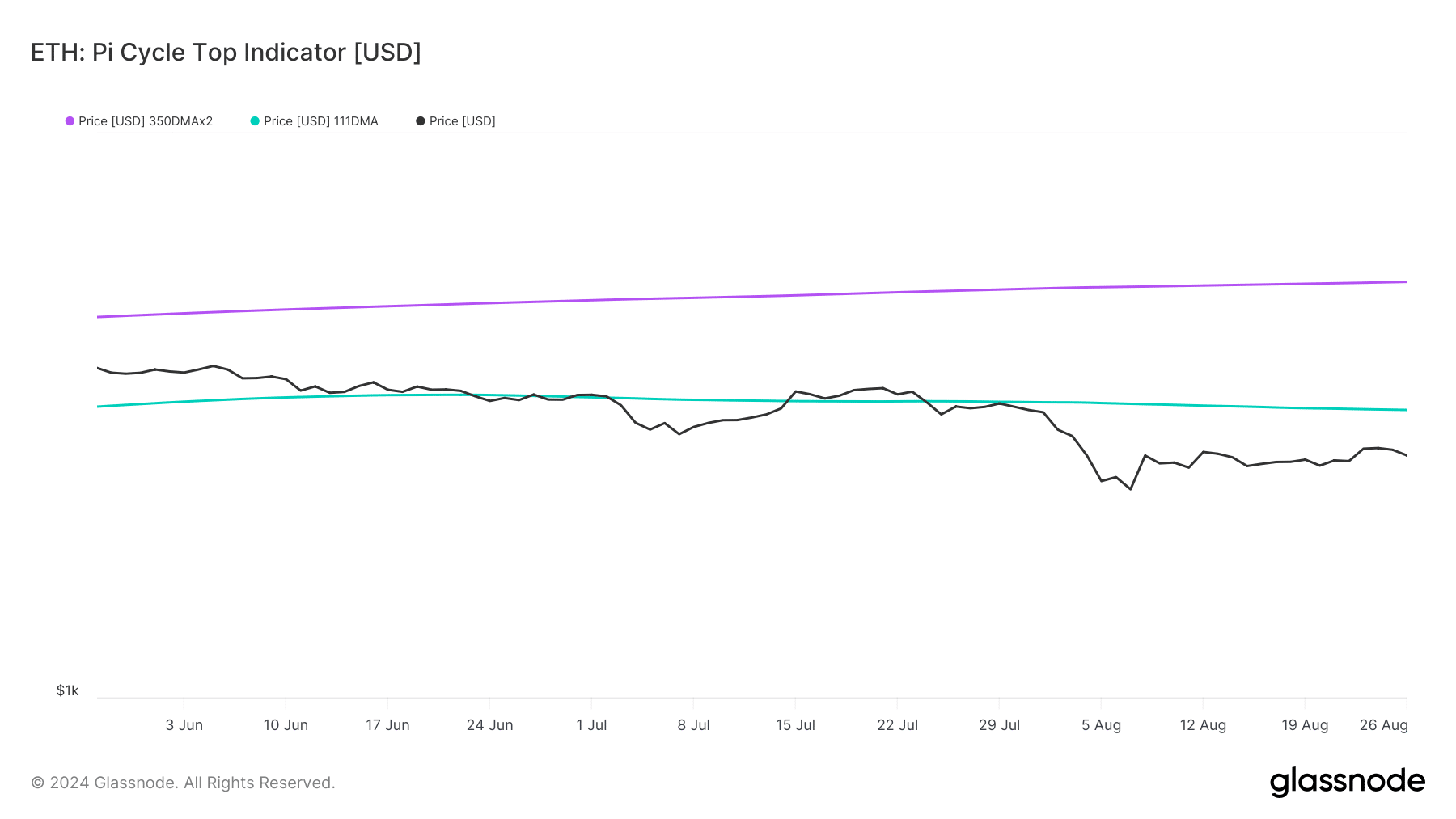

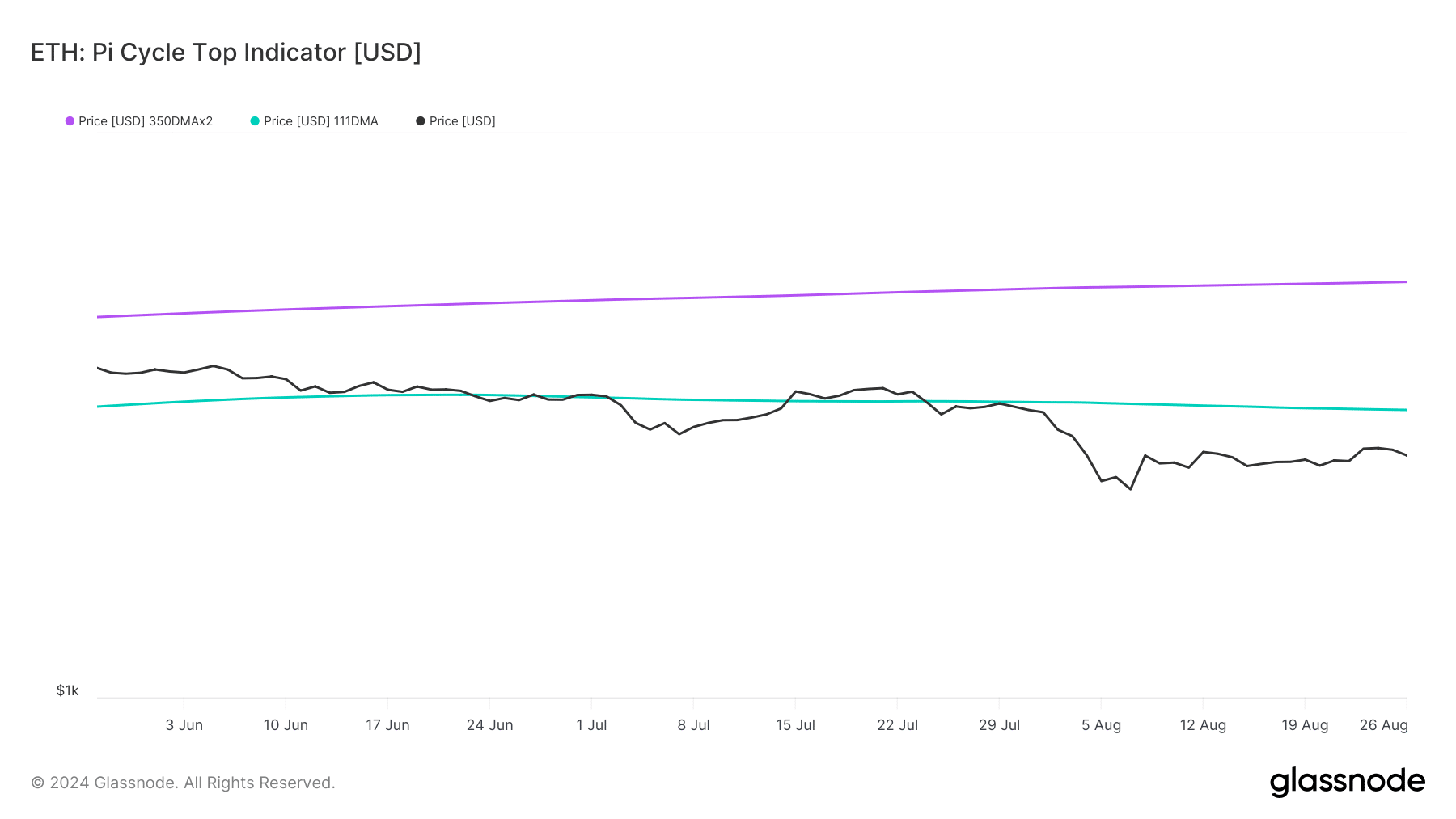

Interestingly, AMBCrypto’s look at Glassnode’s data revealed that ETH was already trading way below its possible market bottom.

According to the Pi Cycle Top indicator, Ethereum’s market bottom was at $3.2k. This suggested that the possibility of a bullish takeover can’t be ruled out.

Source: Glassnode

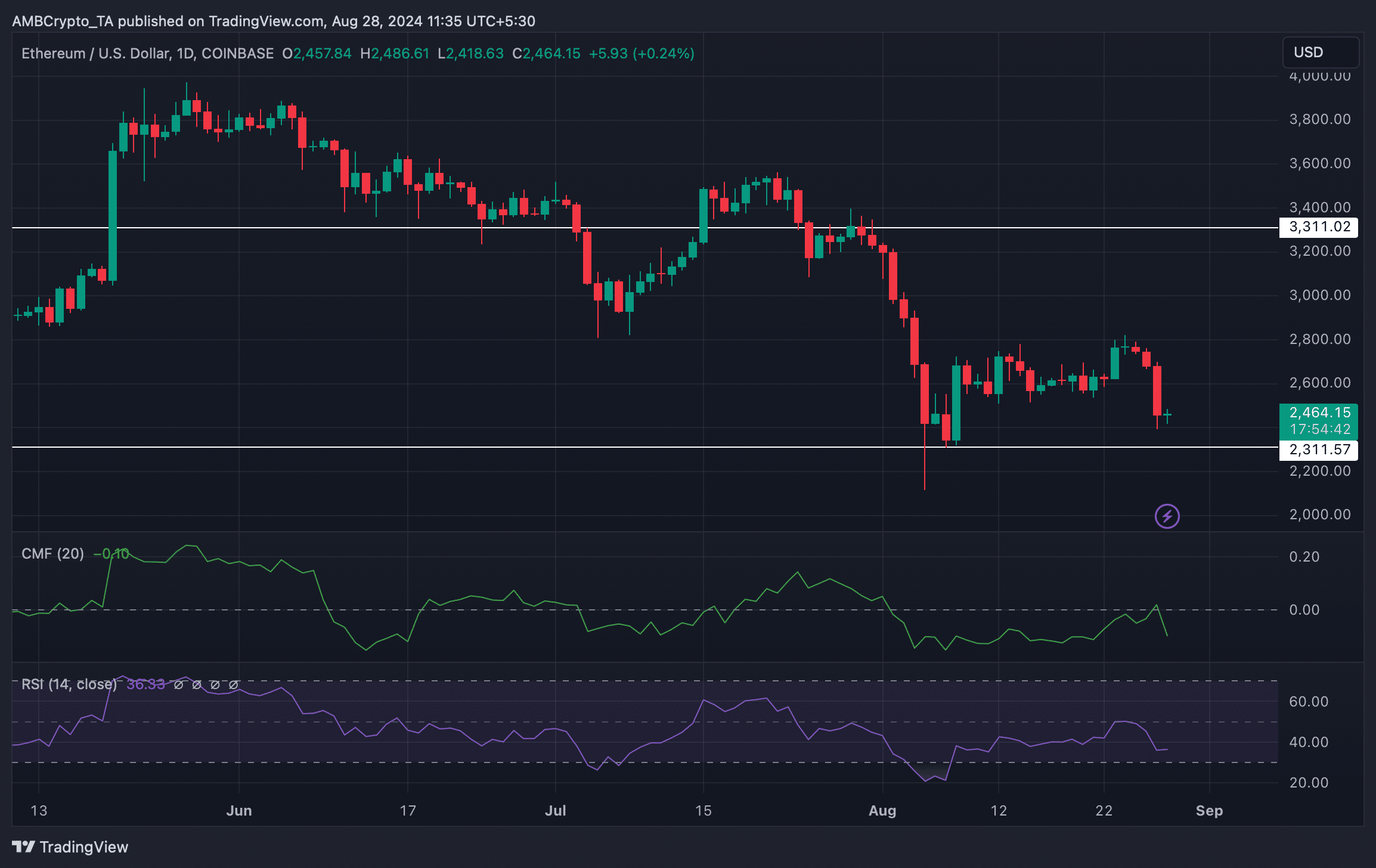

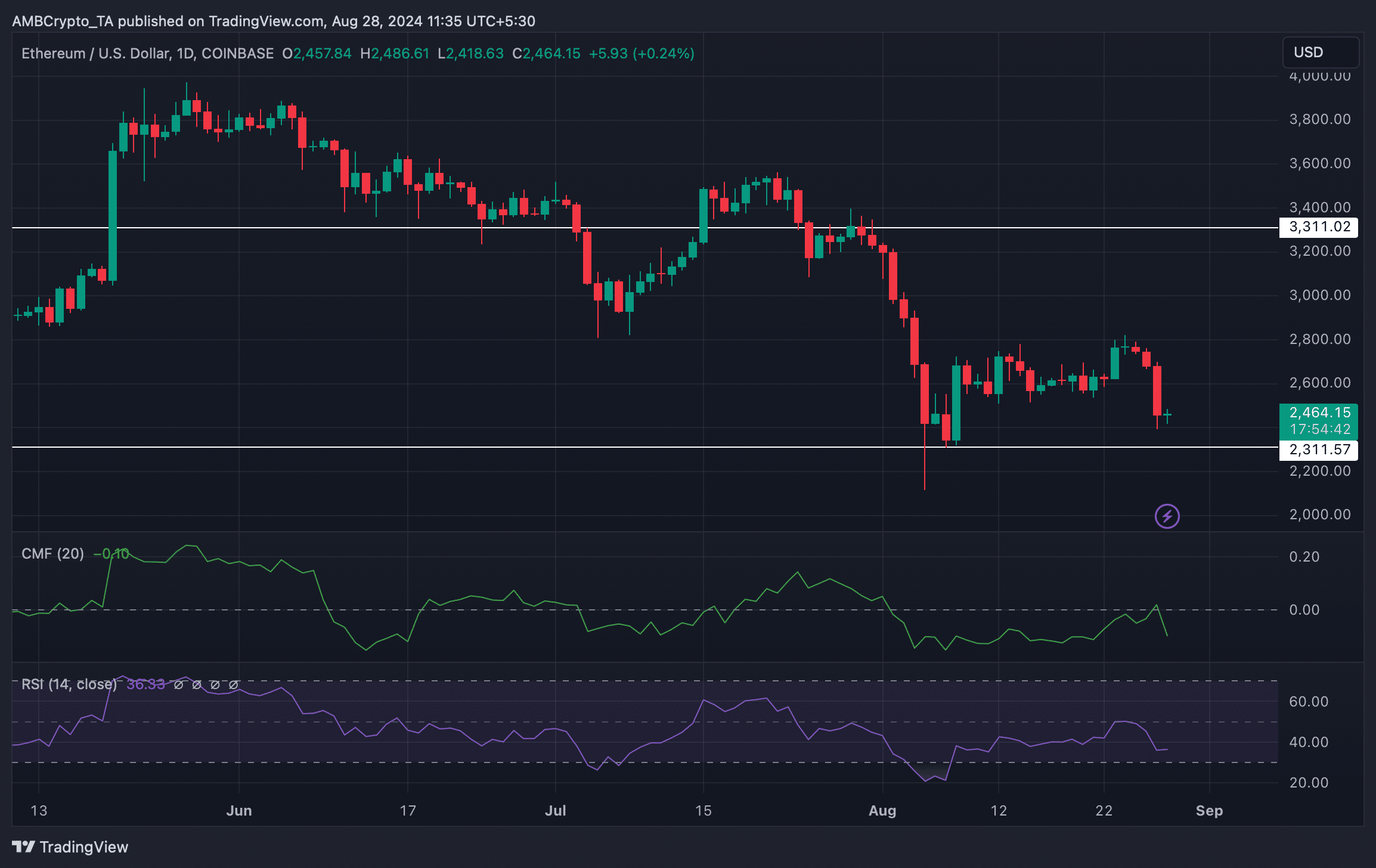

AMBCrypto then checked the king of altcoins’ daily chart to better understand what to expect from it in the coming days.

Read Ethereum’s [ETH] Price Prediction 2024-25

Though the Pi Cycle Top indicator revealed that ETH was under its market bottom, most technical indicators suggested a further price decline.

For instance the Chaikin Money Flow (CMF) registered a downtick. Ethereum’s Relative Strength Index (RSI) also followed a similar declining trend, indicating a continued price drop towards $2,311.

Source: TradingView