- DOGE whales have dialed back their on-chain activity, steering the memecoin into a volatile September on a sour note.

- Despite this downturn, can DOGE navigate these choppy waters and potentially stage a rebound?

Dogecoin [DOGE] bears have pushed its price close to the level where it faced rejection just four weeks ago, around the $0.09436 mark. At press time, the memecoin traded at $0.09466.

If the downturn deepens, DOGE could be forced to test the crucial support level at $0.0841.

Historically, whenever DOGE has tested this support level, it has often bounced back, sparking a surge in its price. However, AMBCrypto’s analysis of recent whale activity suggests a bearish outlook for Dogecoin.

Does this mean DOGE could slip past its previous support, leading to a deeper price plunge, or will other investors step in, betting on a rebound?

Whale inactivity casts doubt on DOGE’s dominance

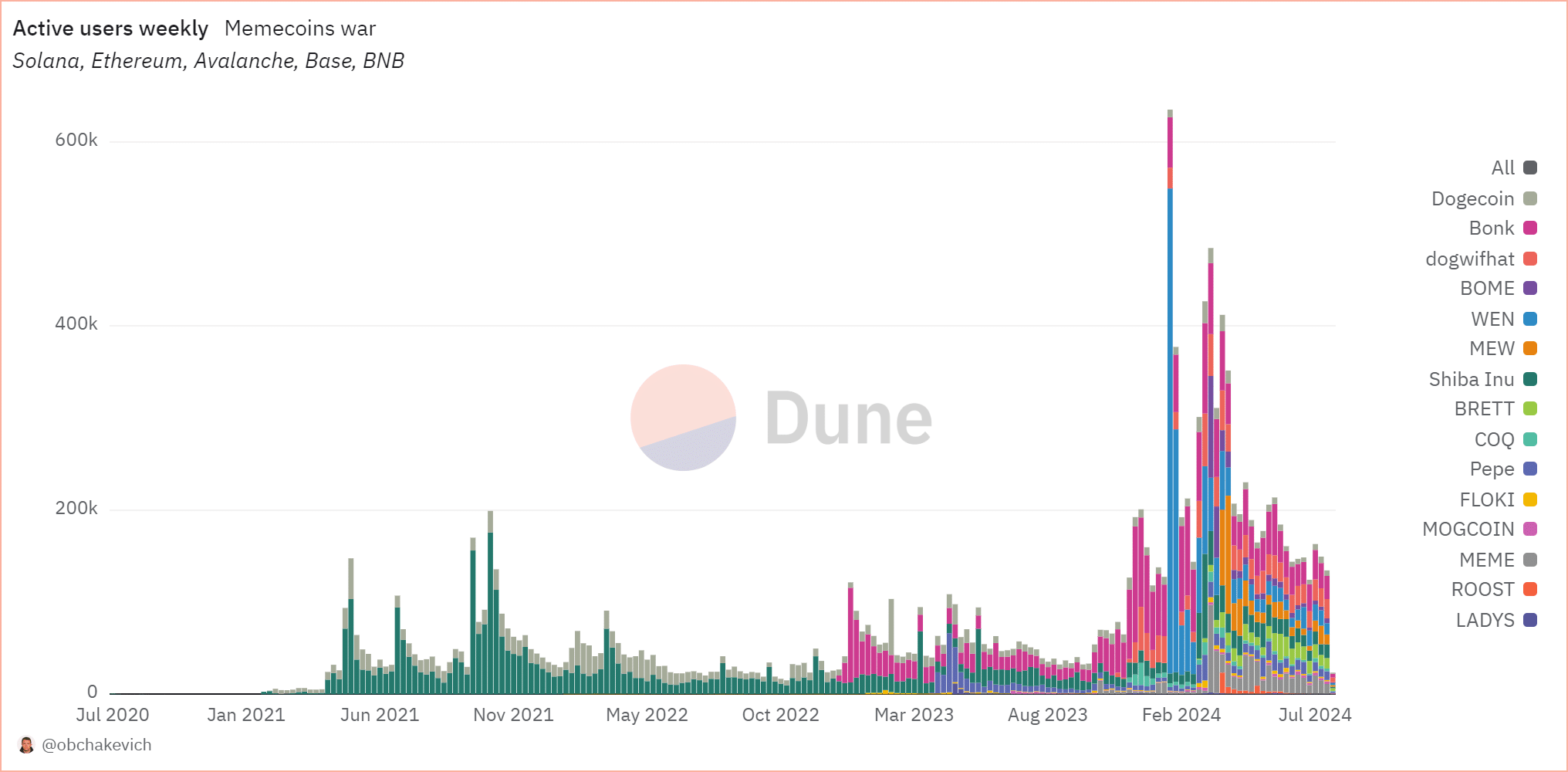

Interestingly, recent events have eroded Dogecoin’s memecoin dominance.

According to AMBCrypto’s analysis, increased competition has prevented DOGE bulls from replicating the bullish trend seen at the end of July when DOGE tested the $0.143 resistance.

However, since March, Dogecoin has experienced a bearish pullback, failing to retest the $0.2 ceiling.

Source : Dune

Adding to this, the active weekly user count has plummeted from 30K to less than 10K, underscoring a noticeable decline in interest for Dogecoin.

Meanwhile, other memecoins are capturing attention, leaving Dogecoin struggling to maintain its dominance.

Prompted by this sudden shift, AMBCrypto explored the role of whales in swinging the potential downward trend for Dogecoin.

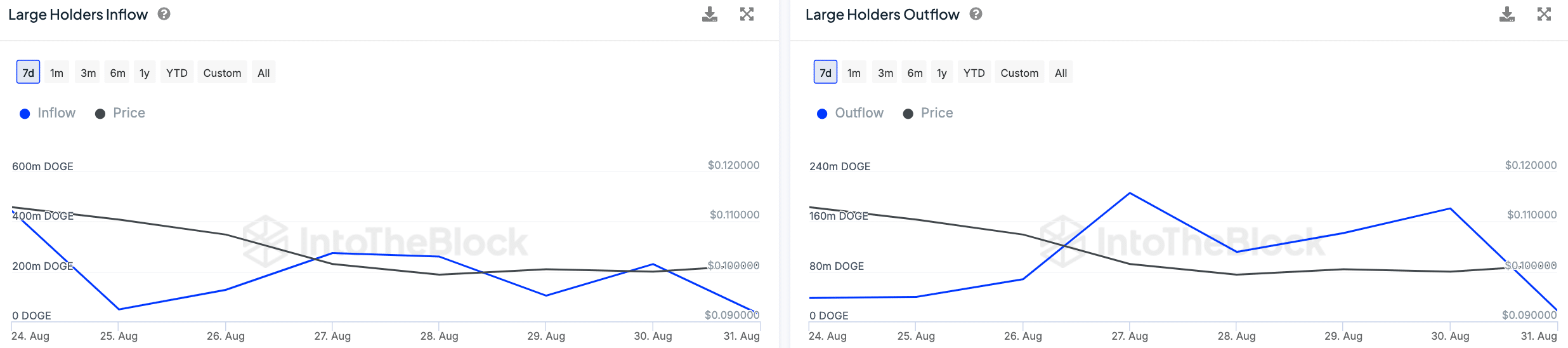

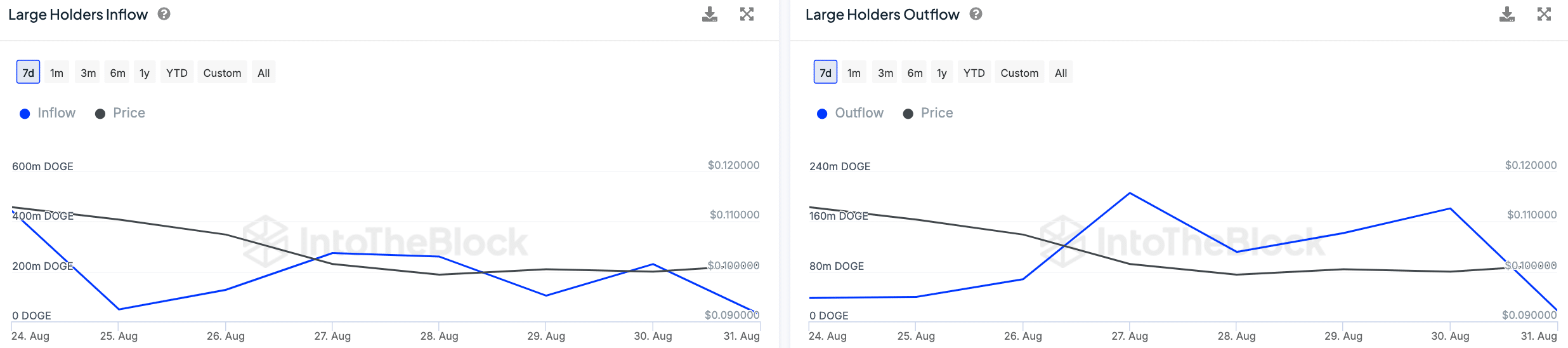

Source : IntoTheBlock

Coincidentally, IntoTheBlock data revealed a striking trend. Whales — those holding at least 0.1% of DOGE’s circulating supply have significantly dialed back their on-chain activity since early September.

Notably, outflows from major investors’ wallets have plunged from 181.29 million to 17.42 million DOGE, a reduction of 80.7%. Similarly, daily inflows have dropped dramatically from 229.49 million to 27.96 million DOGE.

Consequently, the net flow of DOGE into whale wallets has dwindled to 10.54 million DOGE, a staggering fourfold decrease from the previous day.

Put simply, the lack of whale activity pushed Dogecoin to absorb a 6% decline from the previous day’s close on the 1st of September, diminishing its chances of a rebound in what is typically a volatile month.

But, is it too early to say?

On-chain data signals a clear ‘NO’

While large DOGE holders have reduced their daily activity, AMBCrypto analyzed on-chain data to assess short-term holders’ engagement with the memecoin.

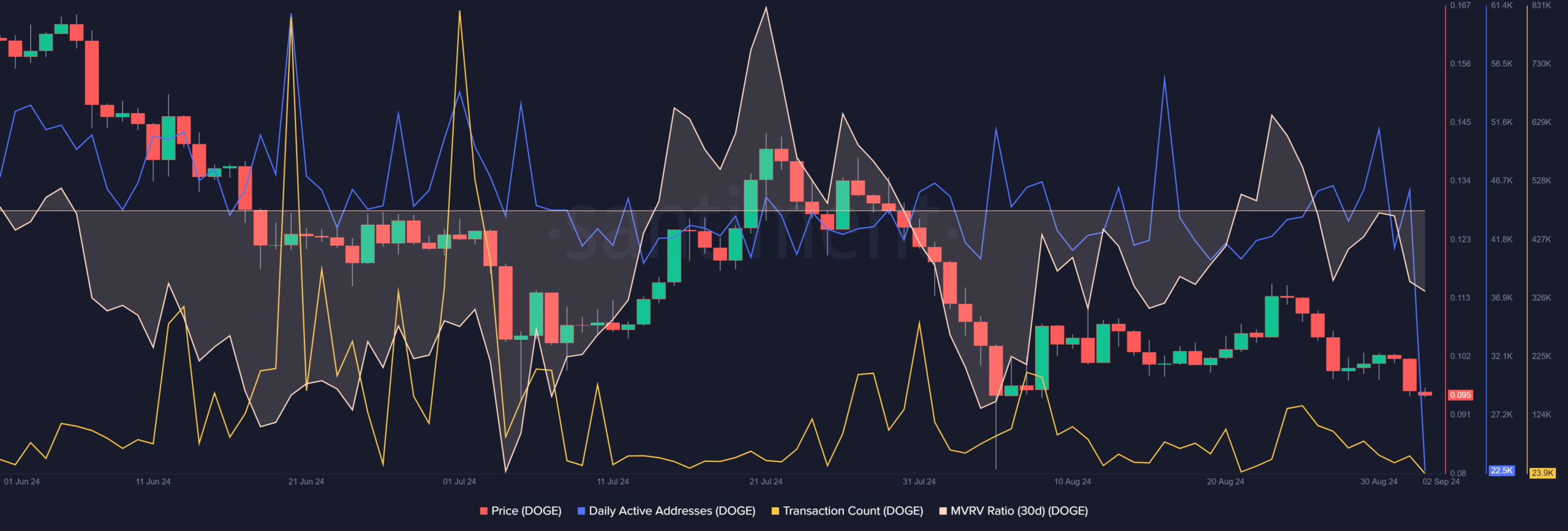

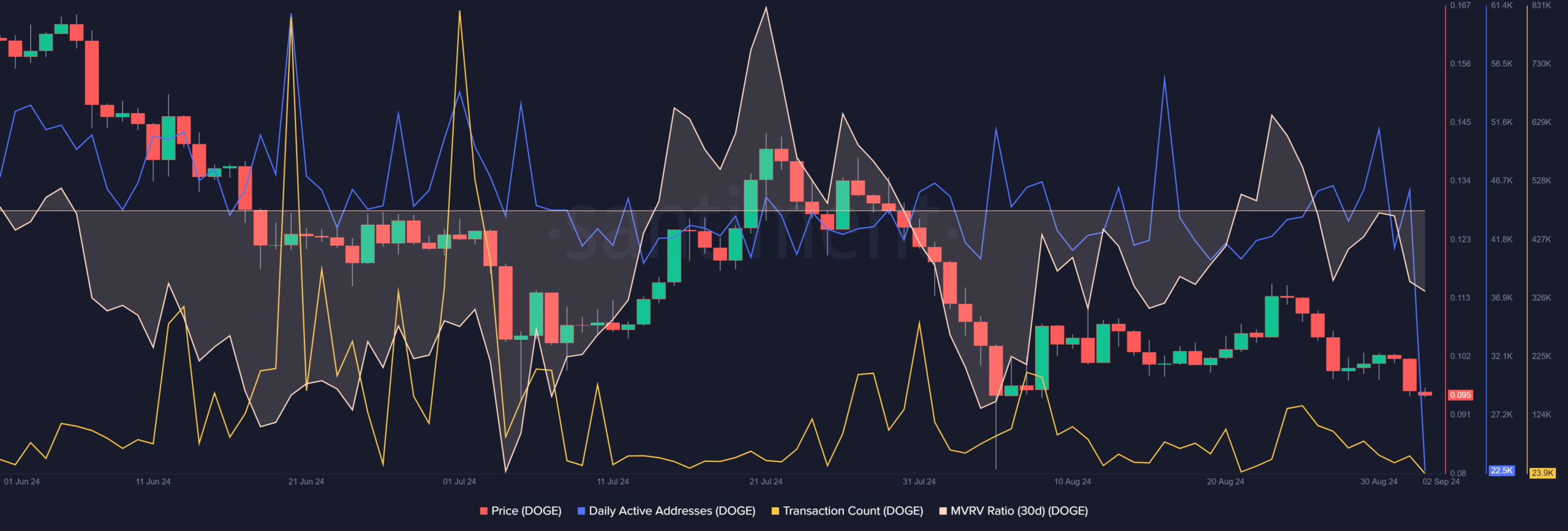

Source : Santiment

Unsurprisingly, on the day of increased whale inflows into exchanges, the number of daily active addresses dropped sharply from 50K to 22K.

This indicated a sharp contrast from the day when Dogecoin tested the previous rejection level at $0.14 on the 22nd of July, when the transaction count was close to 50K, which has fallen dramatically to 23K at press time.

Adding to the pessimism, the MVRV ratio has also shifted to negative, indicating that short-term holders are in a loss position. This could lead to increased selling pressure.

Is your portfolio green? Check out the DOGE Profit Calculator

Overall, AMBCrypto noted that reduced whale activity and increased competition from new meme tokens could hinder DOGE’s rebound.

Without a boost in short-term trader engagement, Dogecoin faces a potential bearish swing, potentially plunging closer to the previous support level of $0.81.