- Long-term holders’ confidence in Litecoin has increased over the past months.

- A metric suggested that LTC was overvalued, indicating a price correction.

As the market turned bullish, Litecoin [LTC] managed to trade above a crucial level. Will this development allow LTC to begin its journey towards $100? Let’s have a closer look at the coin’s state to find out whether that’s possible.

Litecoin trades above a key level

Litecoin bulls were having a good time in the market as the coin’s price increased by over 3% last week. The bullish trend continued in the last 24 hours because the coin witnessed yet another 3% surge in its value.

At the time of writing, LTC was trading at $65.58 with a market capitalization of over $4.9 billion, making it the 19th largest crypto.

Despite the price increase, only 22% of Litecoin investors were in profit, as per IntoTheBlock. However, the trend might change as the coin managed to test a crucial support level.

Crypto Tony, a popular crypto analyst, recently posted a tweet revealing that LTC’s successful test of the support could result in a price rebound. In fact, a price rebound could allow LTC to move towards the resistance of $100 in the coming days or weeks.

Source: X

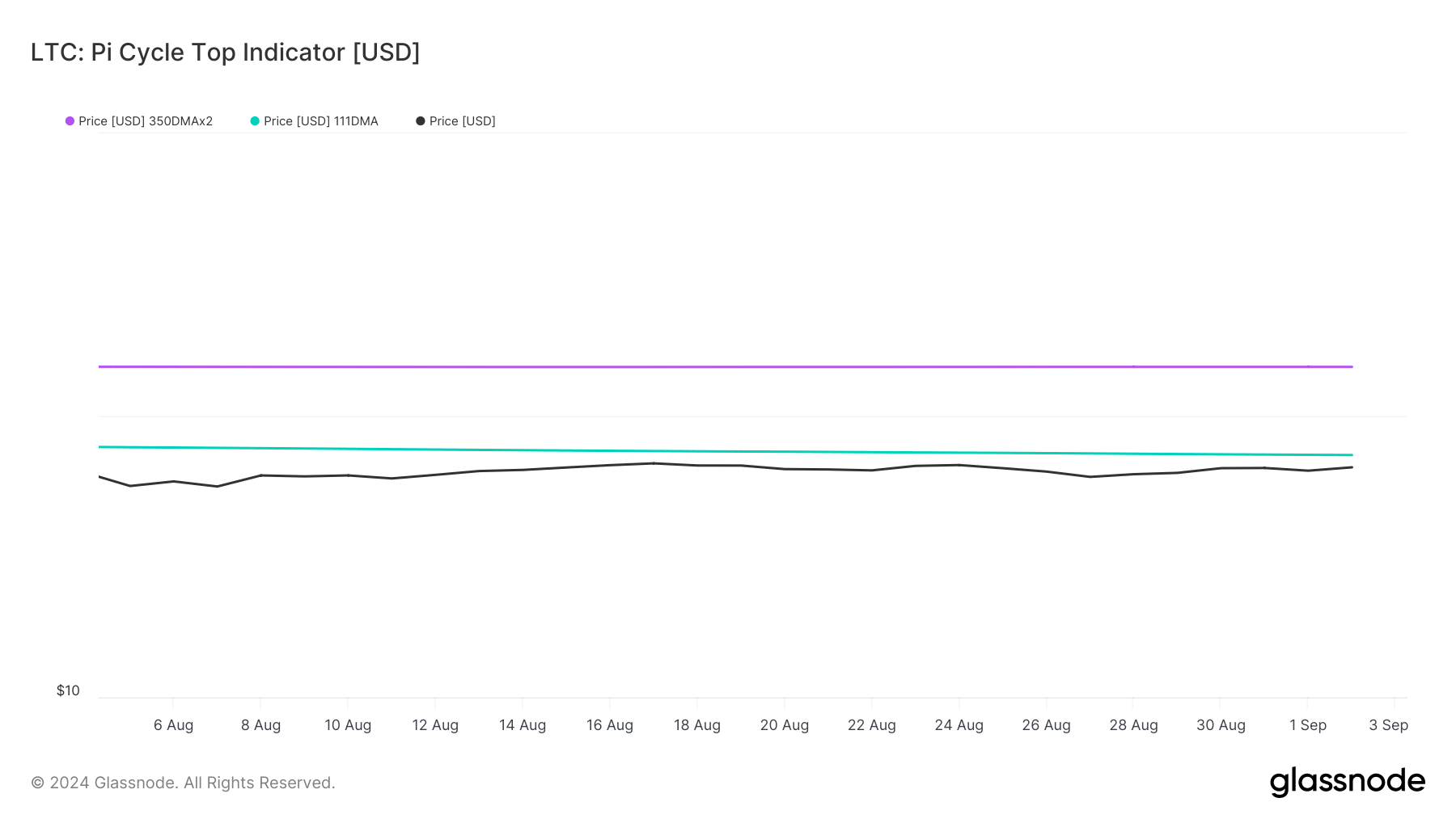

Glassnode’s data also pointed out a similar possibility. As per the Pi Cycle Top indicator, the possible LTC market top was near $148. This suggested that it won’t be a long shot to expect LTC climbing towards $100 in the coming days.

Source: Glassnode

Is LTC set for a breakout?

AMBCrypto’s analysis found that long term holders (investors holding LTC for more than 1-year) confidence in the coin increased over the last few months as the graph increased.

To be precise, more than 78% of LTC holders were long-term investors.

Source: IntoTheBlock

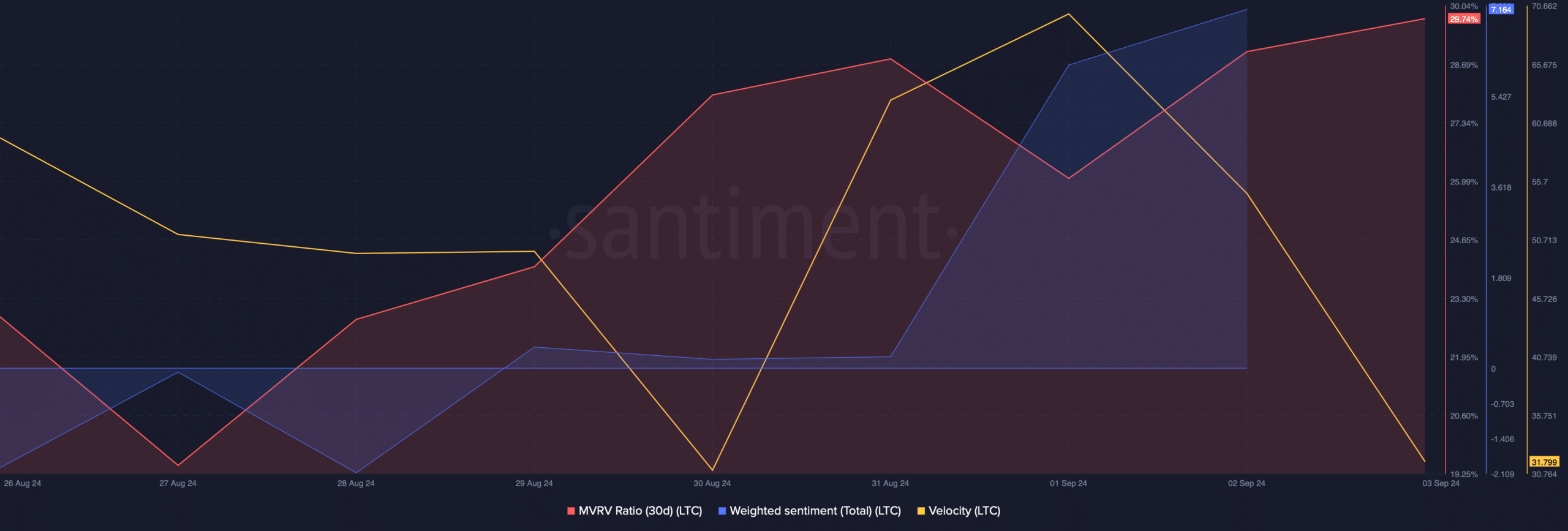

Our analysis of Santiment’s data revealed that LTC’s MVRV ratio increased significantly. Additionally, its weighted sentiment also followed a similar route, meaning that bullish sentiment around the coin was dominant in the market.

However, not everything looked favorable.

Source: Santiment

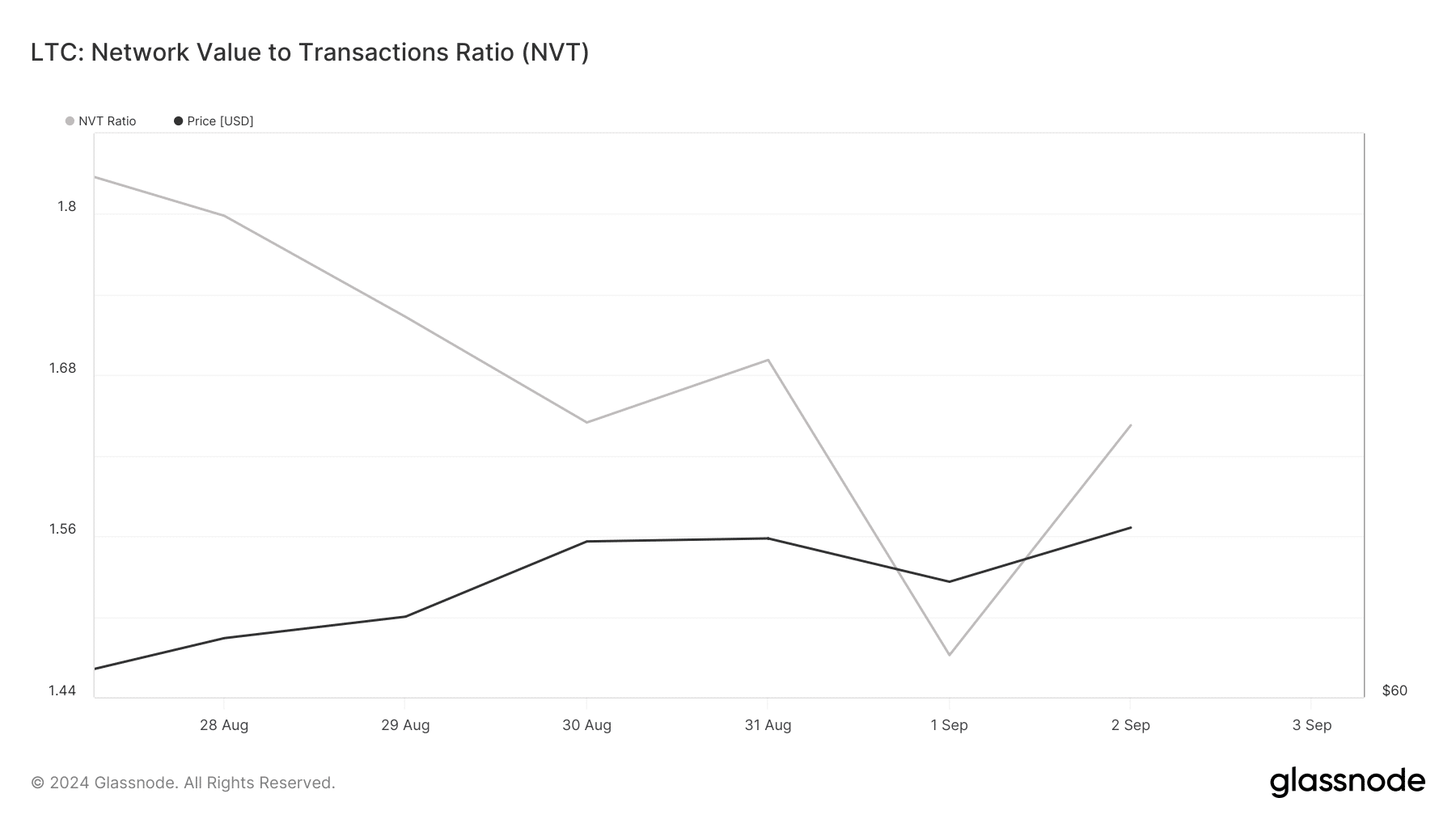

For example, Litecoin’s velocity dropped. This meant that LTC was used less often in transactions within a set timeframe. Moreover, its NVT ratio registered an uptick.

Whenever the metric rises, it indicates that an asset is overvalued, hinting at a price correction.

Source: Glassnode

Is your portfolio green? Check out the LTC Profit Calculator

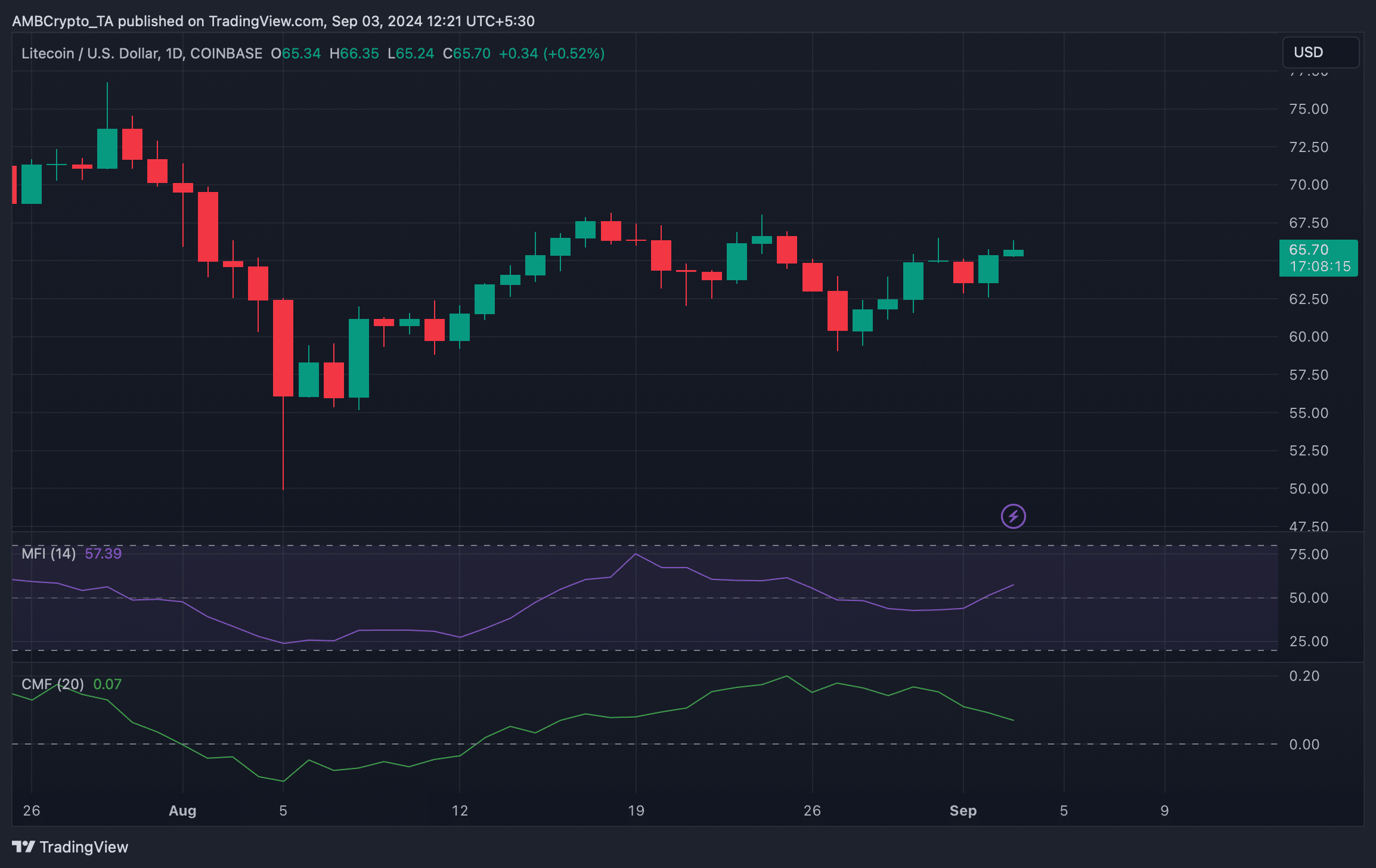

Therefore, AMBCrypto checked Litecoin’s daily chart to better understand which way it was headed. As per our analysis, the Chaikin Money Flow (CMF) registered a sharp recline, indicating a price correction soon.

However, the Money Flow Index (MFI) turned in buyers’ favor as it moved up, giving hope for a continued price increase.

Source: TradingView