- The early release of Changpeng Zhao was supposed to be a bullish trigger.

- The exchange token showed signs of a potential price retracement.

Binance Coin [BNB] was trading at the 10-week-old range highs once more. The early release from jail of former Binance CEO Changpeng Zhao was expected to stir up bullish fervor in the market.

It did whip up some bullish activity on social media, but not so much on the price action charts. For BNB, the “gm” tweet from CZ was followed by a 3.9% dip over the next six hours. Combined with the longer-term range highs, some questions about the future trends of the exchange token were raised.

Range breakout likelihood

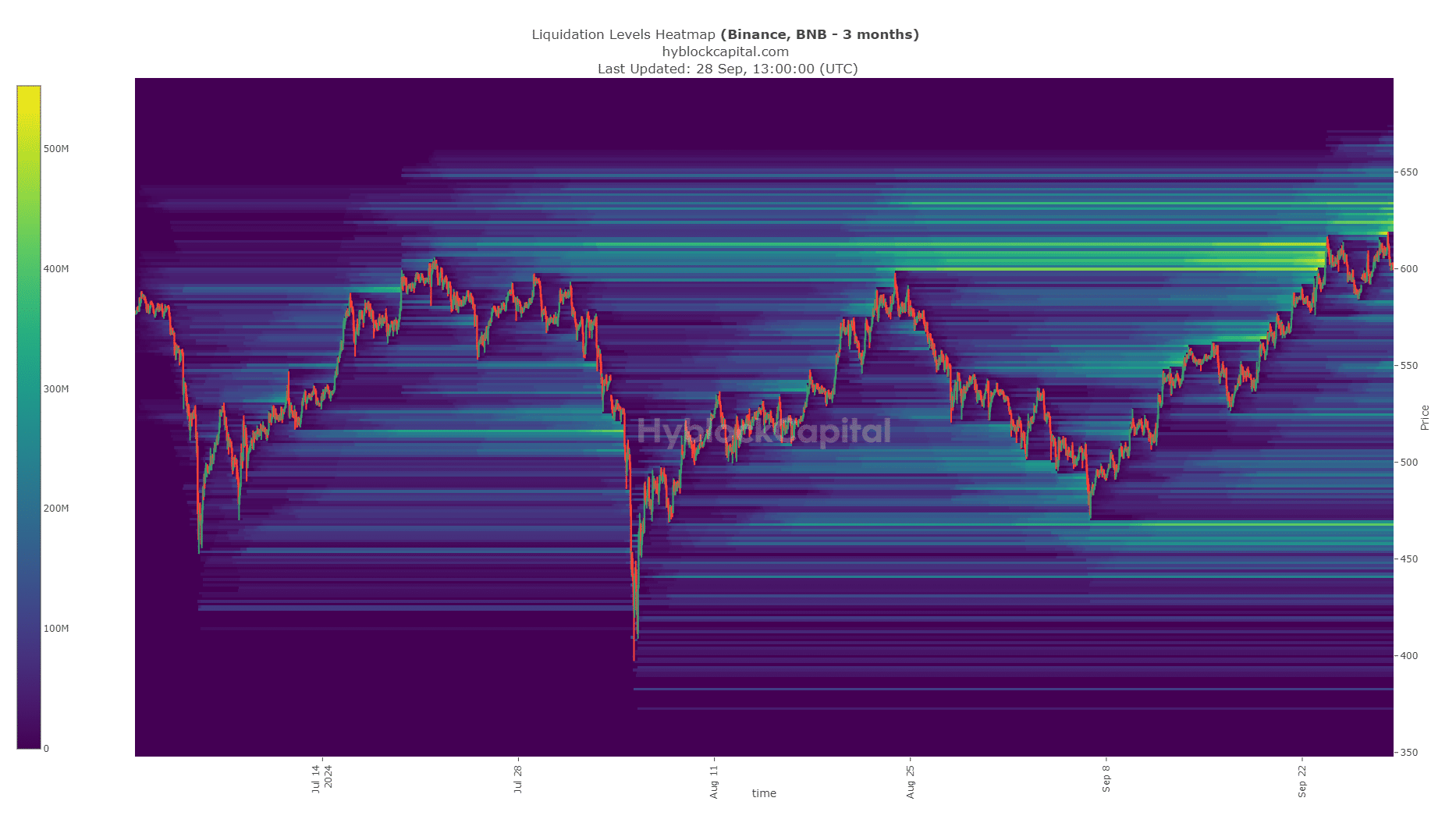

Source: BNB/USDT on TradingView

The nearly three-month old range reached from $464 to $604, with the mid-range level at $535. This level has served as both support and resistance in recent weeks. In mid-September, BNB retested this level as support before rallying 12.7% to reach the range highs.

The daily RSI remained in bullish territory above neutral 50 but formed a bearish divergence. The RSI made a lower high while the price pushed higher, signaling a retracement is likely.

Moreover, the OBV was unable to test the July highs. The same situation played out in mid-August, and BNB faced a stern rejection from the $600 level. Together, the technical indicators showed that a rejection from the range highs is the more likely scenario.

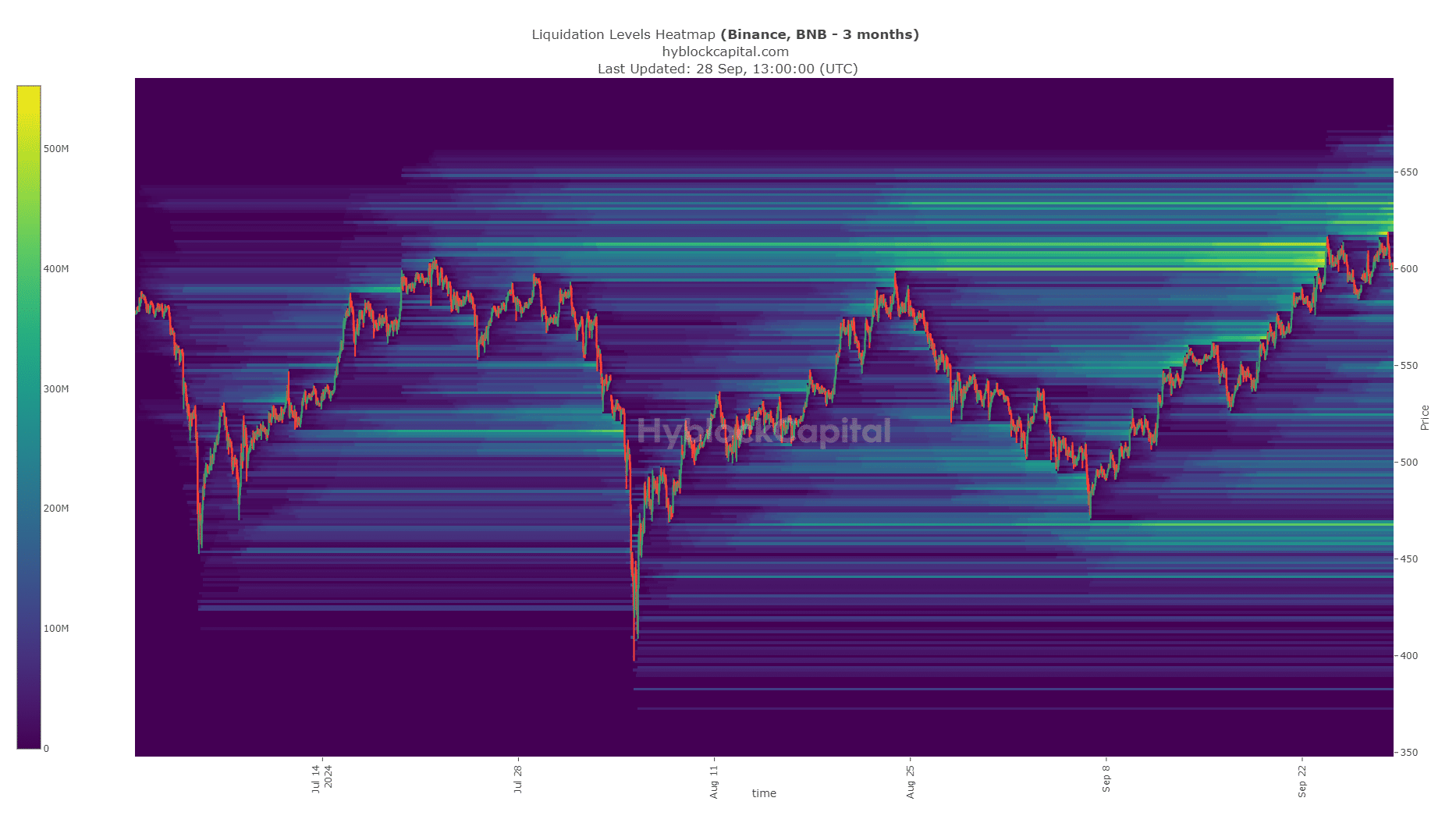

Liquidation levels highlight the $635 zone as price target

Source: Hyblock

The 3-month liquidation heatmap showed that the $621-$635 area was a magnetic zone for the price. Before this, it was the $600-$614 area that attracted prices to it before a pullback to $585.

Read Binance Coin’s [BNB] Price Prediction 2024-25

In a similar manner, a false breakout past the range highs to reach $635 before a retracement was a distinct possibility. Traders should be prepared to take profits as BNB approaches these levels and wait for a pullback and a buying opportunity.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion