- BNB Chain started migrating the Beacon Chain’s functionalities in April, initiating the sunset process

- BNB Beacon Chain validators will stop running by mid-November, halting any new transactions

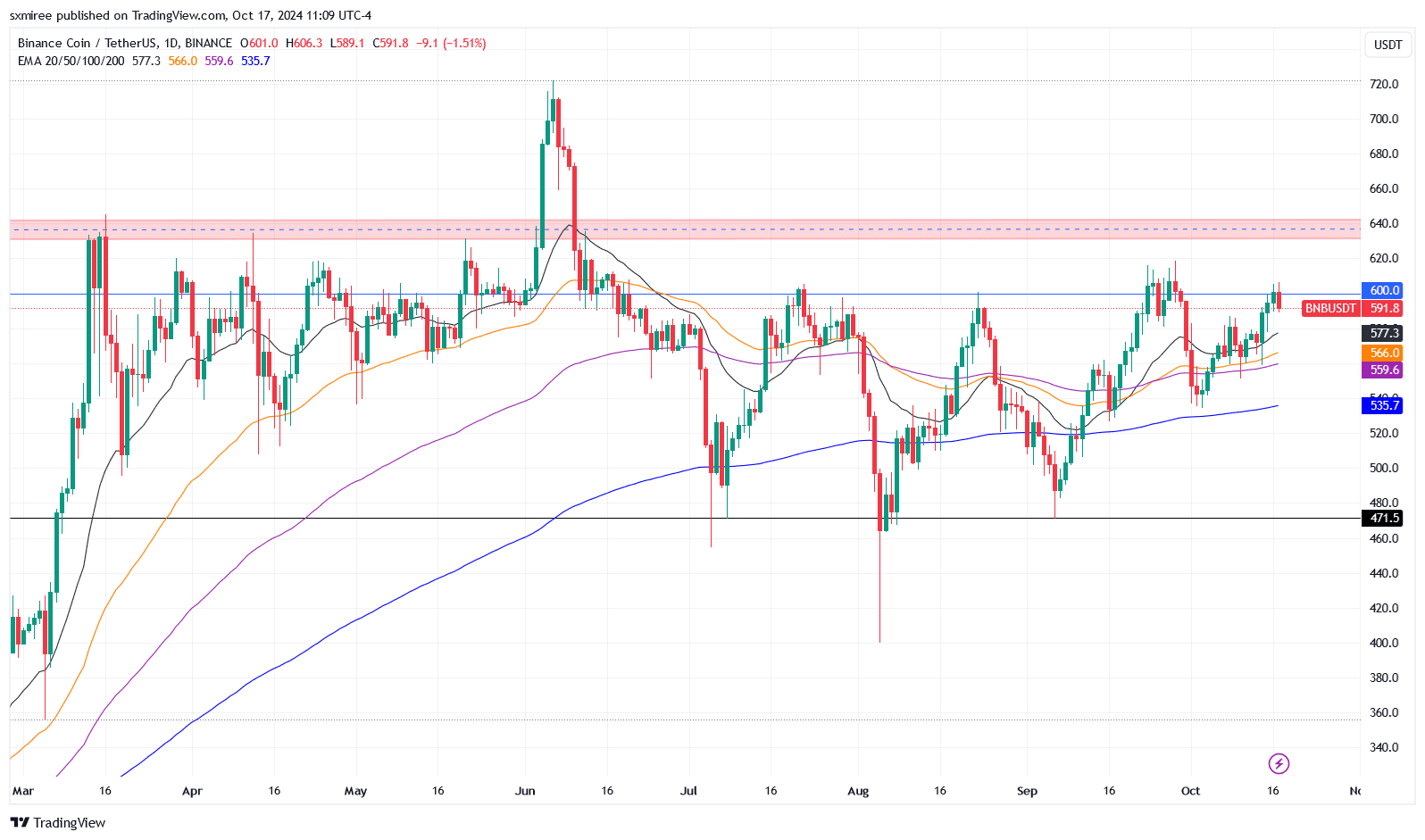

The value of most cryptocurrencies rose on Wednesday, led by Bitcoin (BTC) as it accelerated to an intraday peak of $68,267. Meanwhile, Binance Coin (BNB) rose as high as $606, before cooling off and retreating to $592 at press time.

Here, it is worth noting that BNB is up 90% this year, almost twice Bitcoin’s 58% returns over the same period. BNB’s midweek gains have also brought into view the key resistance level around $600 where the token was rejected on three separate occasions since June – Most recently in the last week of September.

Notably, BNB faces no recently defined barrier between its current range and its yearly high of $721 dated 6 June. In fact, the next resistance zone, near $620, was established and retested before June’s year-high.

BNB Beacon Chain’s final sunset plans

While price action takes center stage for speculators, the larger Binance ecosystem is still in a transition window as BNB Beacon Chain’s stoppage approaches. BNB Beacon Chain is based on the Tendermint consensus mechanism, while the BNB Smart Chain (BSC) uses a hybrid consensus mechanism combining Proof-of-Stake and Proof-of-Authority.

In an update on 16 October, BNB Chain communicated the imminent retirement of the BNB Beacon Chain, scheduled for next month. The retirement of the Beacon Chain is part of BNB Chain’s strategy to consolidate its blockchain ecosystem and focus on the Smart Chain, its primary platform. This BNB Chain Fusion initiative aims to improve efficiency by merging the Beacon Chain’s functions into the BNB Smart Chain.

BNB Smart Chain’s active addresses stabilize

The fusion of Beacon Chain’s functionalities eliminates the need for the cross-chain bridge that previously connected the two, thus simplifying the network architecture. BNB Chain highlighted the development complexities and security risks arising from this cross-chain bridge as a factor compelling its deprecation.

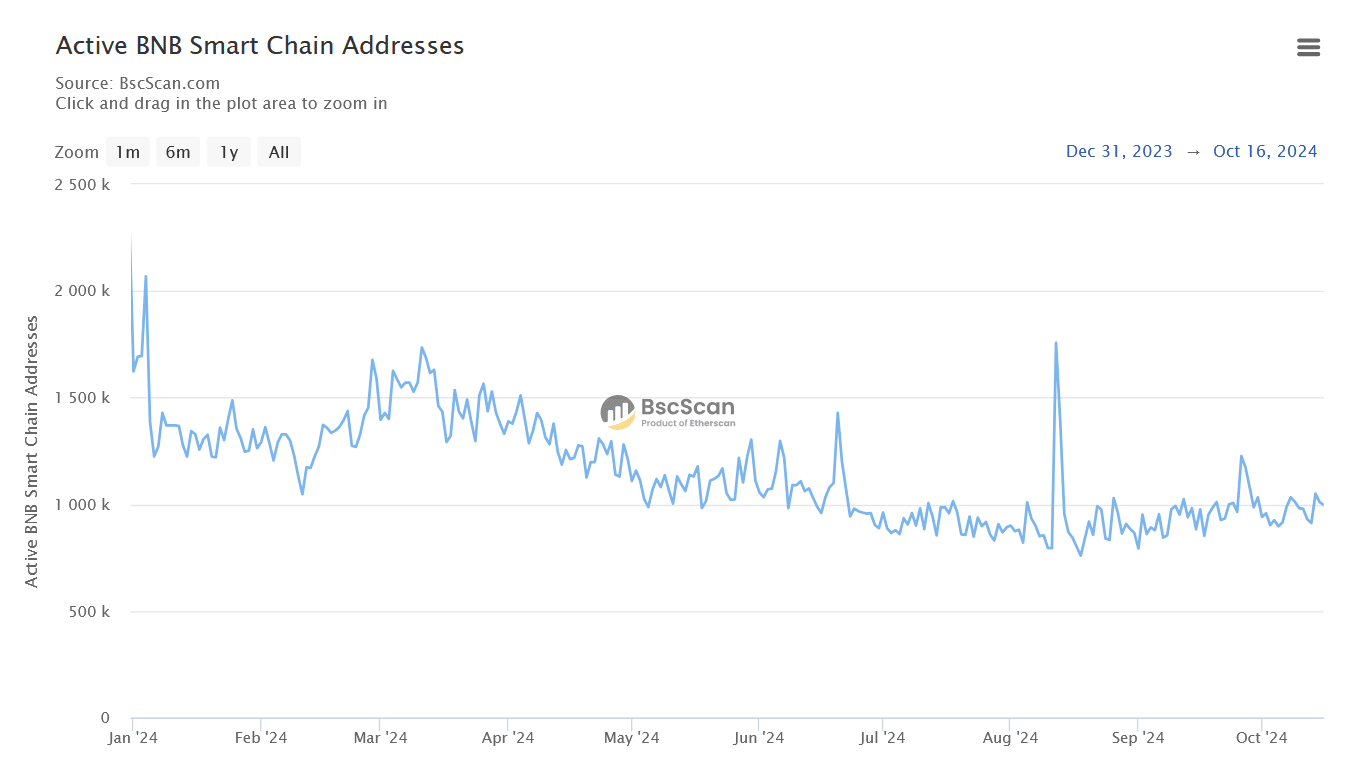

Here, it’s worth pointing out that the BNB Smart Chain explorer tool BSCScan revealed that on-chain activity on the BNB Smart Chain is healthy.

Source: BscScan

Active daily addresses stabilized above 1 million in recent weeks after experiencing a drop between June and September – A sign of steady user engagement as the chain evolves.

Will BNB finally break above $600?

BNB climbed to $587 on 14 October, before printing another daily green candle on the back of another move above $595 on 15 October. The sustained positive midweek action has put BNB’s price in a critical range on the charts.

Source: TradingView

While holders are keen to achieve a new year high, a rejection near the all-time high could tempt short-term bulls to book profits, sending the price down. A sustained drop below the 50-day and 100-day exponential moving averages tightly bundled between $566 and $560 on the daily chart will indicate further price weakness.

Meanwhile, the long-term 200-day EMA at $535 would represent key support for a minor pullback. This, on the back of a stronger demand zone above $471, near the lower boundary of BNB’s range-bound action.