- Pepe declined by 7.8% over the past 24 hours as bearish sentiments persisted.

- A Pepe whale has transferred 254.65 billion tokens to Binance.

Over the past week, Pepe experienced a strong downside as the overall crypto market has turned red.

Since hitting a high of $0.00002567, the memecoin has declined to hit a low of $0.000018. This downtrend has caused panic selling, especially among large holders.

Pepe whale sells 254.65 Billion tokens

Pepe whales have turned to selling. As such, according to Spotonchain, one whale deposited 254.65 billion tokens worth $5.15 million to Binance over the past 24 hours.

Usually, a deposit into exchanges by whales shows they are preparing to sell. When whales turn to sell it usually causes selling pressure, thus driving prices down.

This increased selling among whales arises as the memecoin has experienced a sustained downtrend over the past week.

During the market downside, whales turn to sell to minimize their losses or take their realized profits. Such market activity often precedes price correction.

Impact on price charts?

As expected, increased selling pressure, especially from large holders, usually leads to price drops. True to this, Pepe was trading at $0.00001863 after a 7.80% decline on daily charts and a 7.56% dip.

While whale dumps could result in price drops, AMBCrypto’s analysis shows that Pepe was experiencing a shift in market sentiment from bullish to bearish.

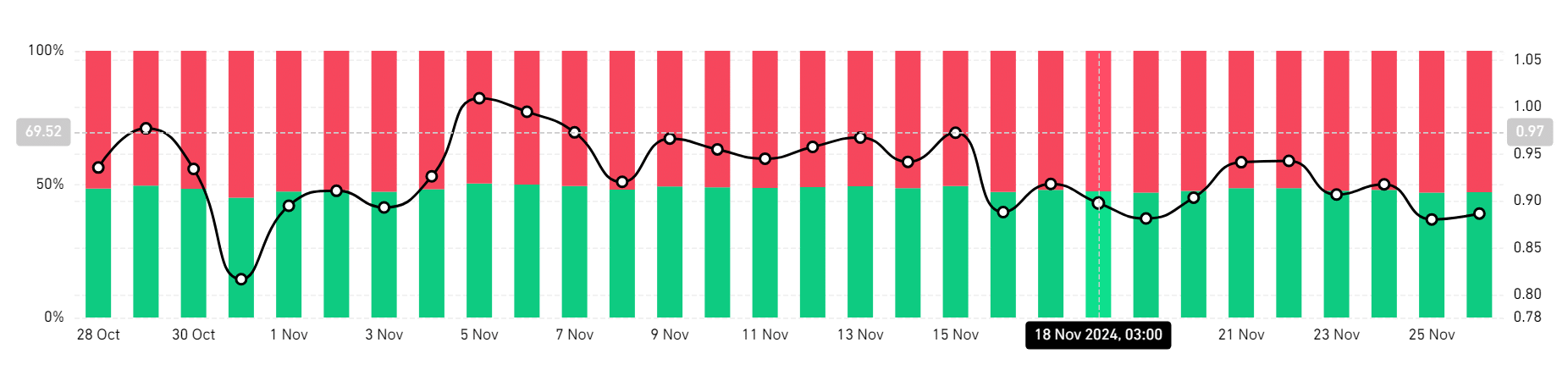

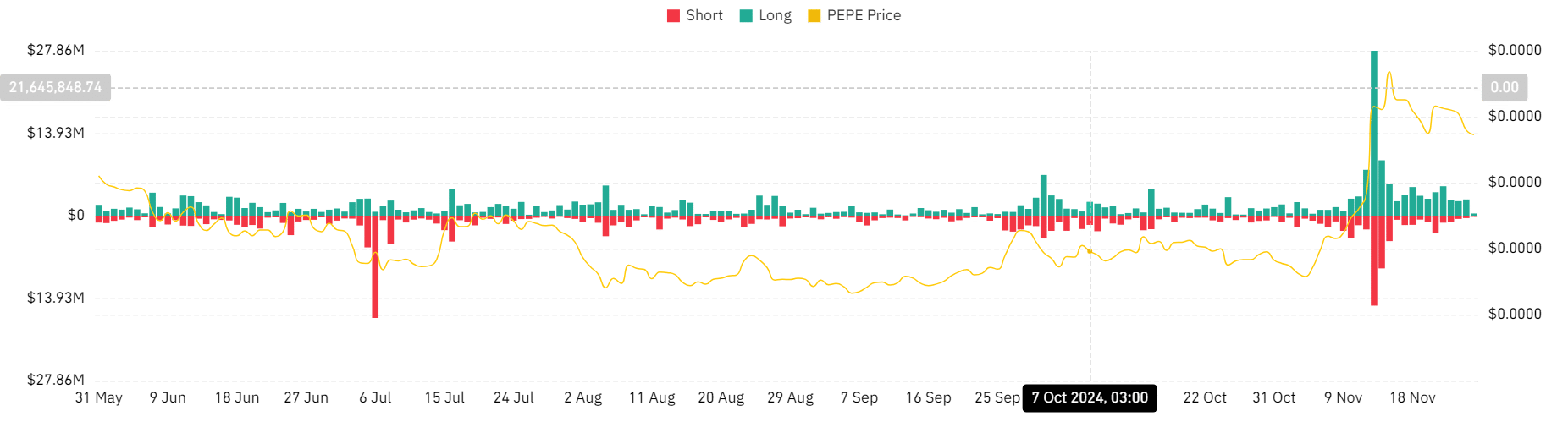

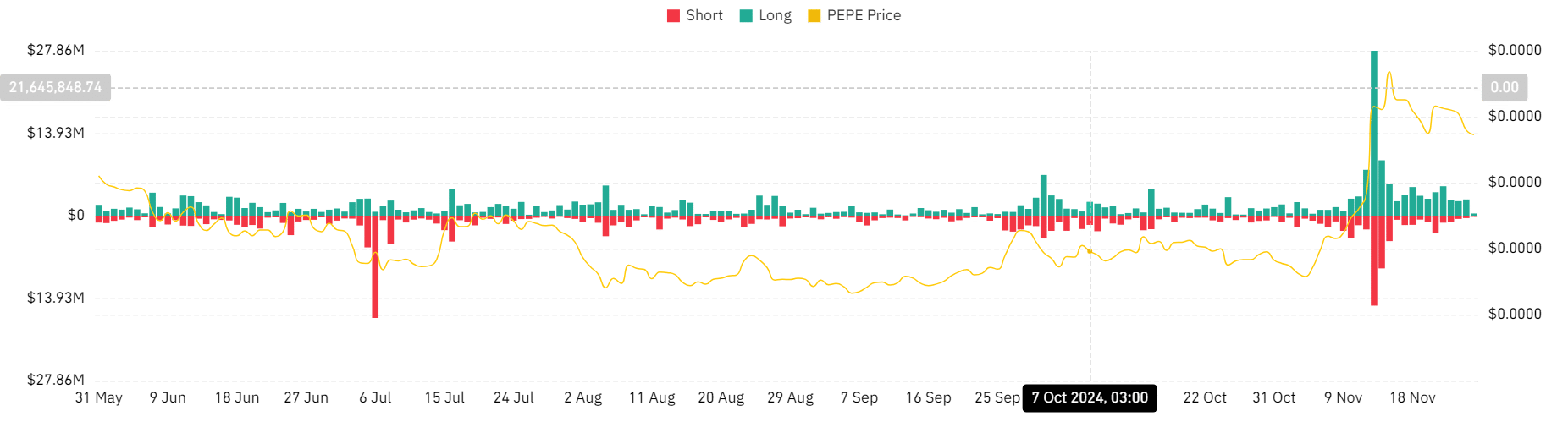

Source: Coinglass

For example, Pepe’s Long/Short Difference shows that short positions are dominating the market. With shorts taking 53% of the positions, it suggests that most traders are bearish and expect prices to drop further.

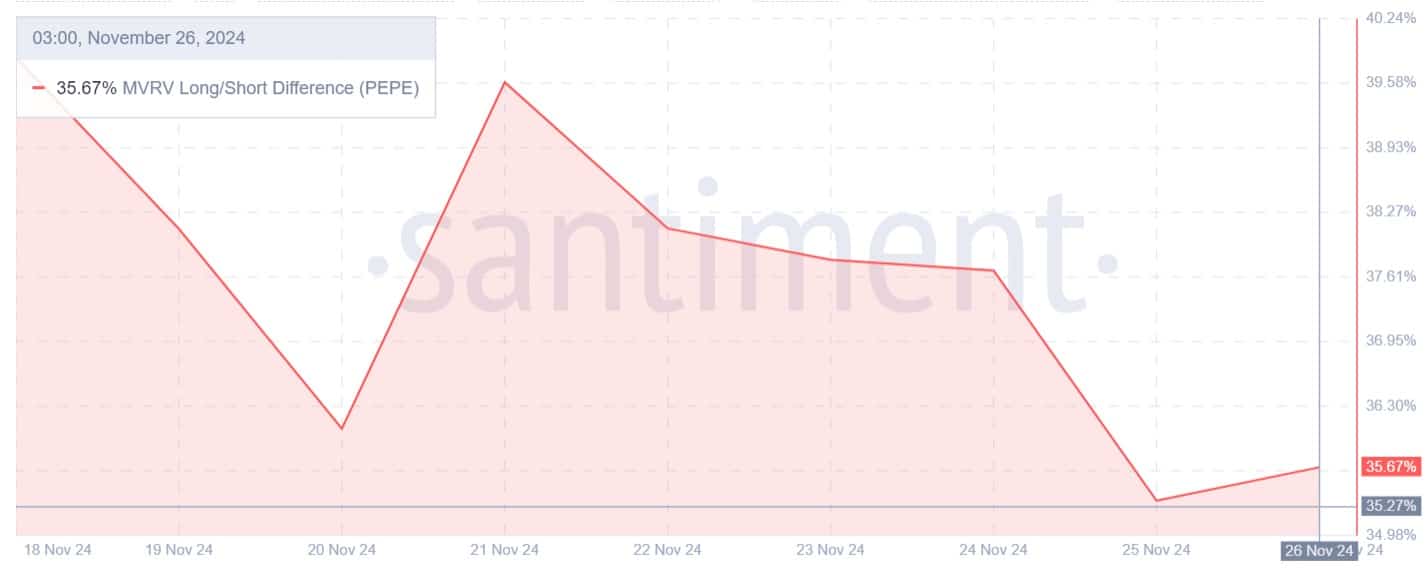

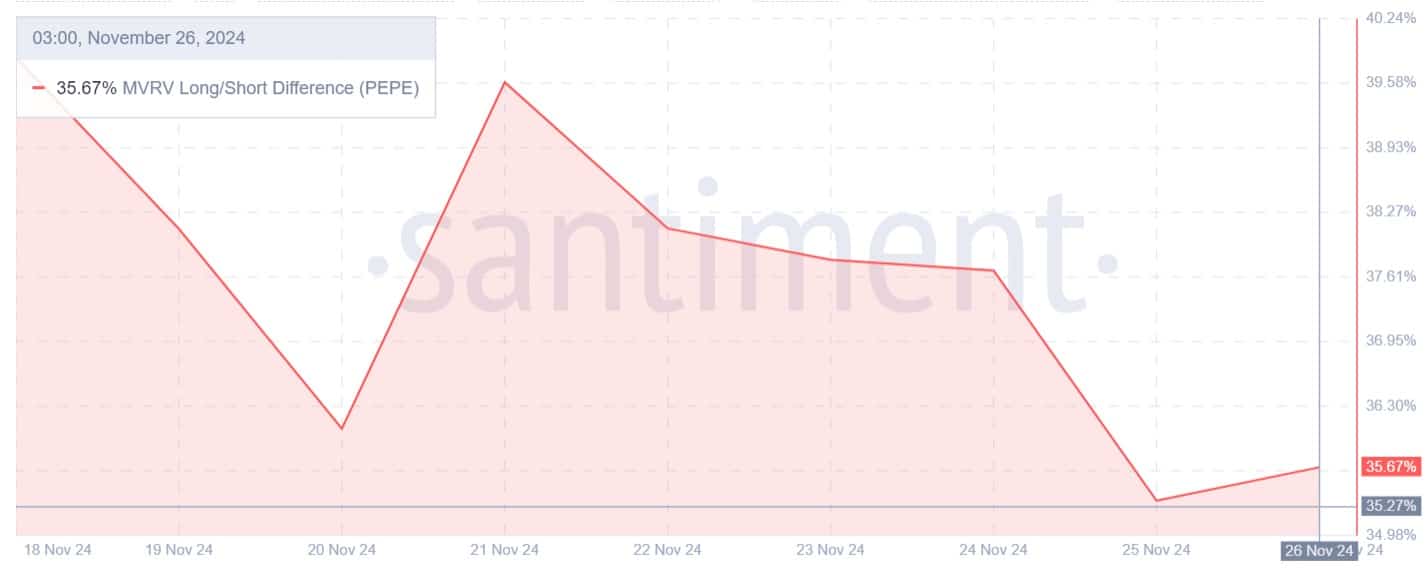

Source: Santiment

Additionally, Pepe’s MVRV long/short difference has declined over the past week from 39 to 35. This often arises from increased selling by long-term holders, signaling their lack of confidence with markets prospects.

Thus, long-term holders are bearish.

Source: Coinglass

Equally, total liquidation for long positions has surged over the past week, hitting a high of $4.97 million.

While investors could be forced out of their positions, their lack of conviction to pay premium fees and hold these positions shows their bearishness.

Source: Tradingview

Finally, Pepe’s MACD has done a bearish crossover. This not only signals a shift in sentiment from bullish to bearish, but also a strengthening downward momentum with sellers dominating the market.

Read Pepe’s [PEPE] Price Prediction 2024–2025

Simply put, Pepe is experiencing a strong shift in sentiment to bearish. These conditions have pushed whales to sell to minimize their losses or take realized profits.

With strong bearish sentiment, the memecoin could decline further. If so, Pepe will find support around $0.00001576.