- Bitcoin whales accumulated 20,000 BTC worth $2 billion in the last 24 hours

- On the price front, the crypto appreciated by just 1.39% though

Bitcoin [BTC] has shown significant resilience over the last 24 hours, with the crypto climbing from a low of $96,463 to reclaim $100k again.

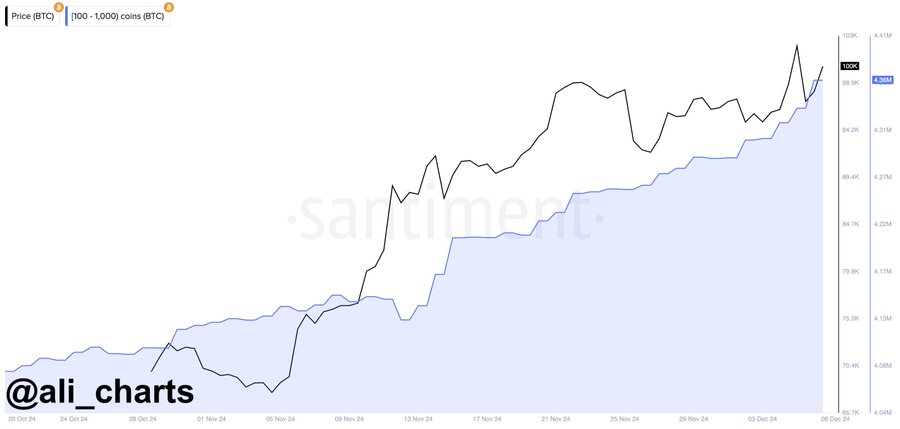

Needless to say, its prevailing market momentum has left analysts and other key holders deliberating on the factors driving it. In fact, according to popular crypto analyst Ali Martinez, whale activity may be propelling BTC’s strong movement lately.

Bitcoin whales accumulate 20k tokens

In his analysis, Martinez noted that whale accumulation for BTC is going parabolic now. According to him, whales scooped up 20,000 BTC tokens worth $2 billion in the last 24 hours alone.

Source: X

When whales accumulate assets, it demonstrates institutional and large holders’ confidence in market prospects. Often, greater whale accumulation precedes price hikes.

Historically, massive whale activities have significantly driven BTC’s price. For instance, in July 2020, after the Covid market crash in March, whale accumulation grew exponentially, leading to a 550% hike in BTC between July and January 2021.

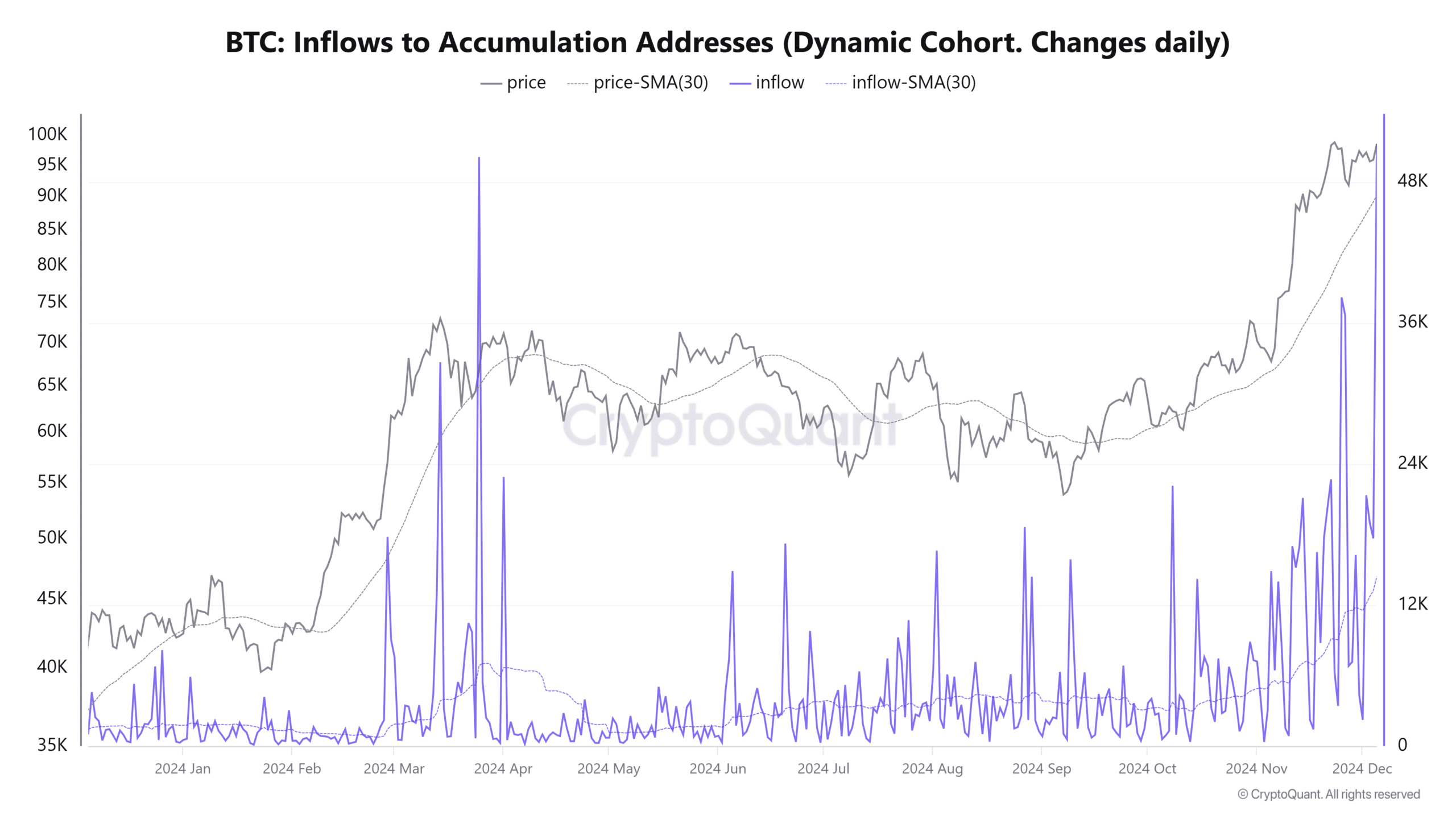

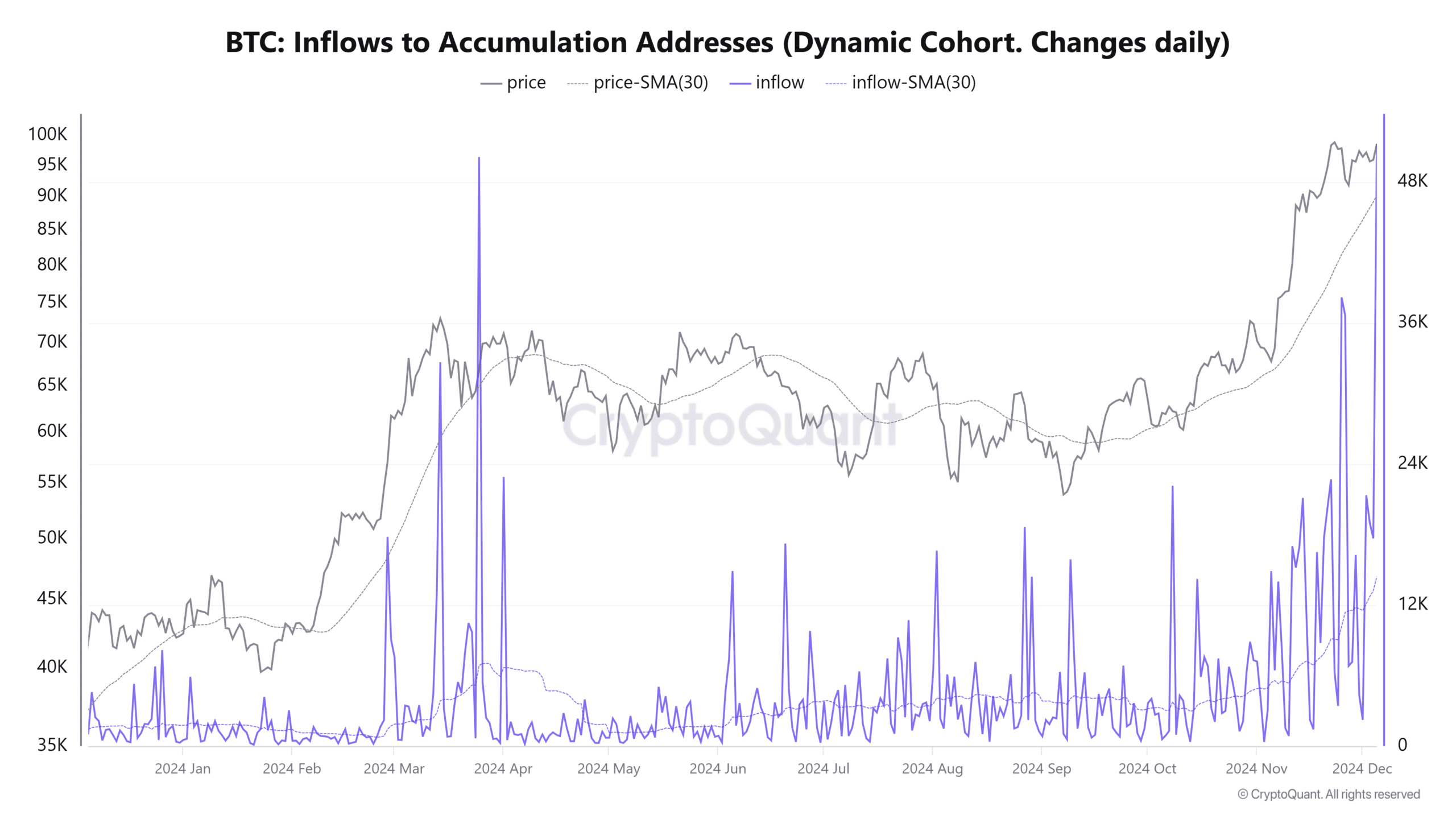

Source: CryptoQuant

Similarly, on 25 March 2024, whale accumulation reached a daily high of 50.1k, according to CryptoQuant. This led to BTC’s price rallying from a low of $63k to $72k.

This trend occurred again on 26 November 2024, when inflows hit a daily high of 36.6k. At the time, the cryptocurrency climbed from $90,742 to $103,647.

Source: CryptoQuant

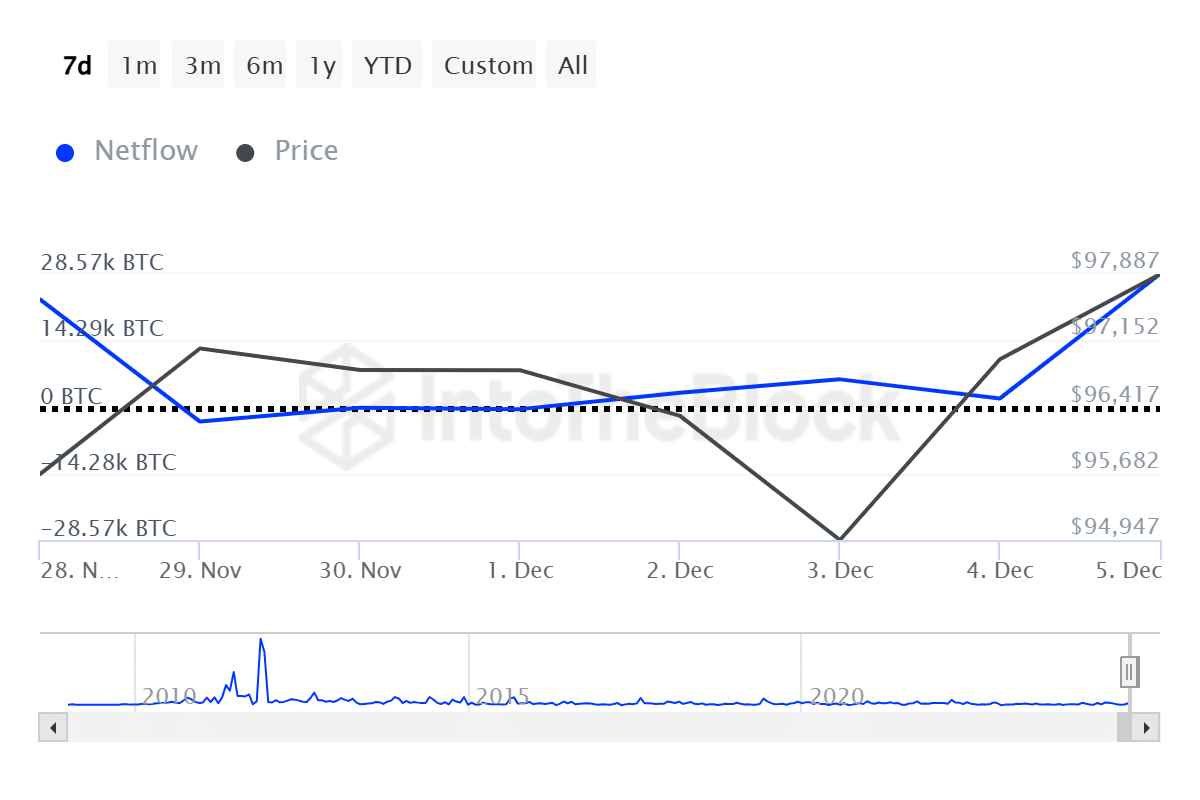

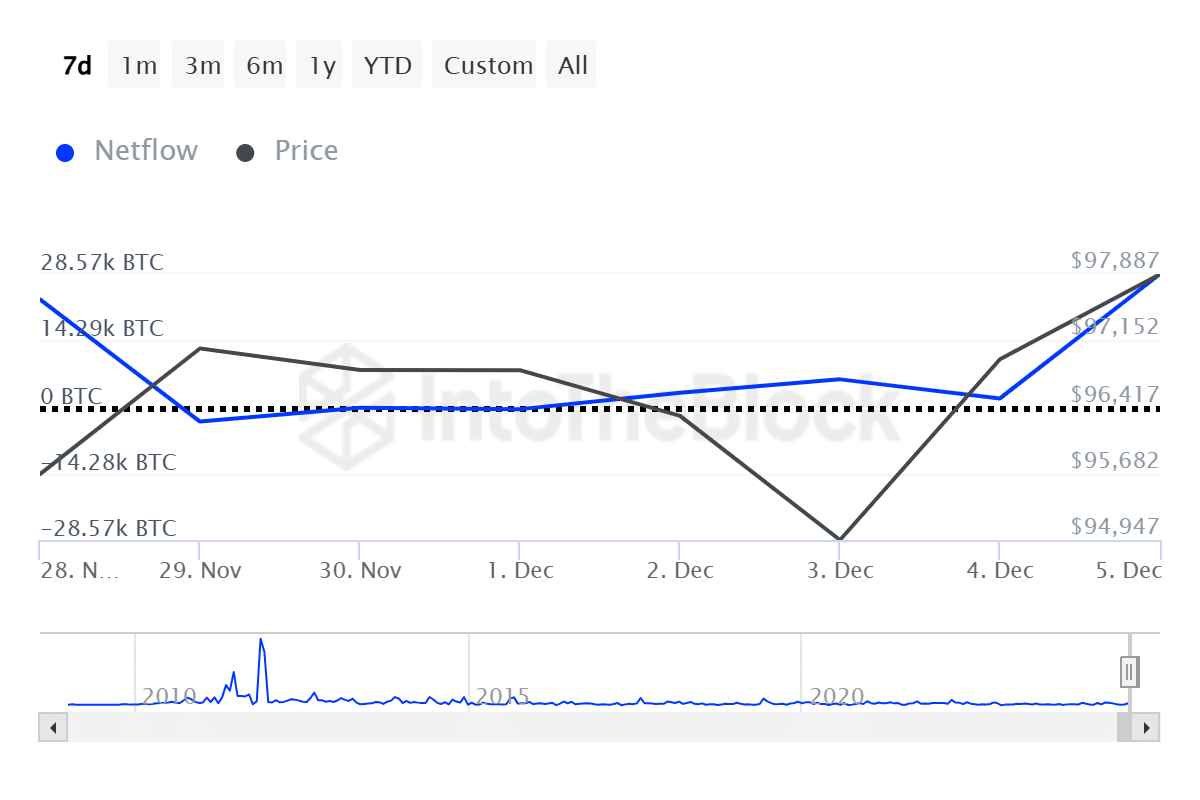

This accumulation trend has appeared again over the last 24 hours. For example, Bitcoin’s large holder’s netflows surged by 1453.8% from 1.84k to 28.57k. This pointed to there being more capital inflows from whales than outflows.

This also alluded to higher accumulation rates among large holders as they continue to pump funds into the crypto.

Source: IntoTheBlock

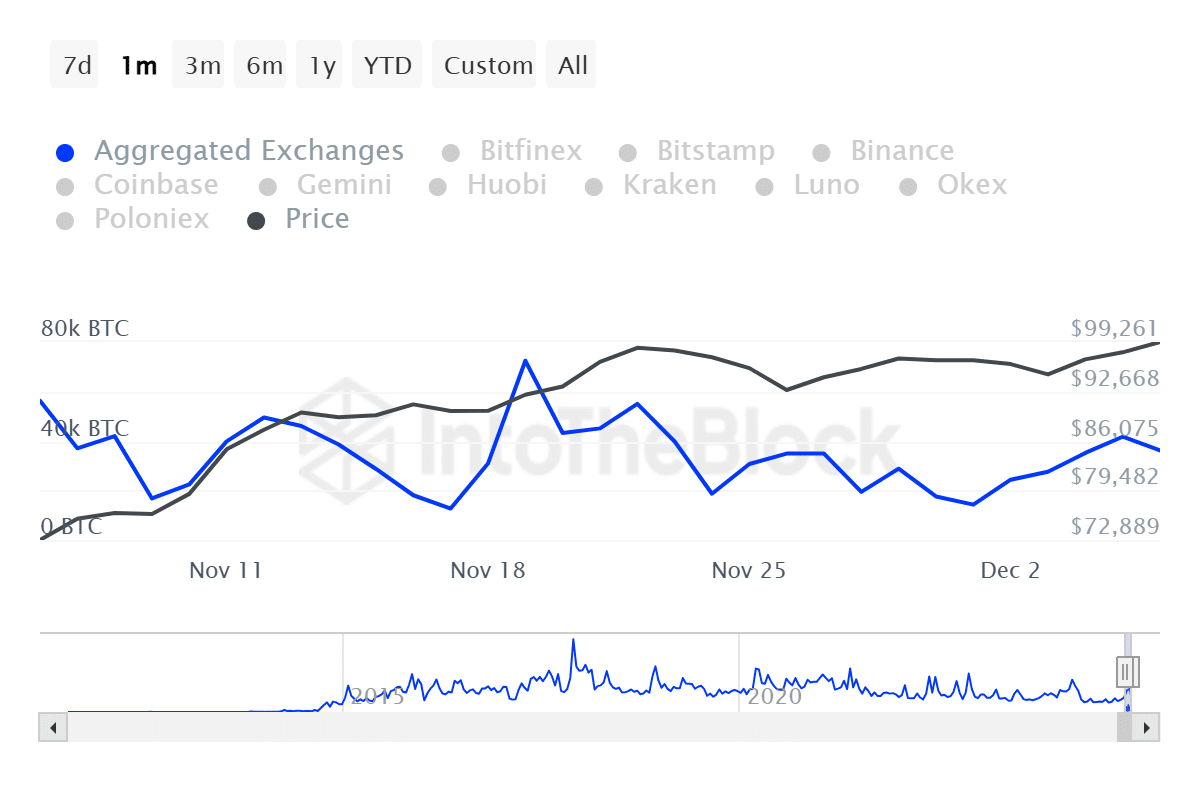

Additionally, the overall market has seen a strong accumulation trend lately, with more investors removing their tokens from exchanges. As a result, outflow volume has seen a sustained uptick over this period. This meant that whales, along with retail traders, have been actively hoarding their assets in anticipation of further gains.

Based on historical data, BTC whale accumulation results in price hikes due to buying pressure – Contributing to a supply squeeze.

Impact on BTC’s price charts

As expected, the last 24 hours have seen significant appreciation on the crypto’s charts, with Bitcoin briefly going past $100k again.

Read Bitcoin’s [BTC] Price Prediction 2024-25

With strong whale accumulation, BTC may be well-positioned for more gains. Historically, higher cash inflows have had a massive impact on BTC price charts.

If these conditions are maintained, BTC will reclaim $103,600 and move towards a new high.