- Baby Doge saw a surge in demand, likely triggered by a post by Elon Musk.

- Whales controlled most of Baby Doge’s supply, suggesting bullish anticipation.

Baby Doge [BABYDOGE] just rocketed onto the list of the top gainers in the last 24 hours. This was courtesy of a robust uptick that saw it push to a 10-month high, but the reason for this bullish performance is quite interesting.

Baby Doge holders were redeemed on the morning of the 7th of December, as the token found favor with the bulls.

The memecoin previously attempted a rally in November, which was shot down, resulting in it giving up its previous gains. It also kicked off December with slow momentum.

Despite the recent slow performance, Baby Doge did deliver an impressive bullish performance in September.

It rallied by slightly over 82% in the last 24 hours, suggesting that it was still capable of commanding bullish attention.

Source: TradingView

The Elon Musk phenomenon

The heavy Baby Doge bullish price action was not random, but may have been a reaction to a post by Tesla head, Elon Musk. For the uninitiated, the market has a history of rallying around his social media posts.

But could this signal that Baby Doge’s upside might be limited? That may not necessarily be the case. Notably, IntoTheBlock’s data revealed that whales held 98.99% of the memecoin’s total circulating supply at press time.

It is worth noting that Baby Doge is yet to be listed on major exchanges like Binance or Coinbase.

Listing on these exchanges sometime down the road could signal that there is room for growth. On the other hand, it could require robust demand from the retail segment.

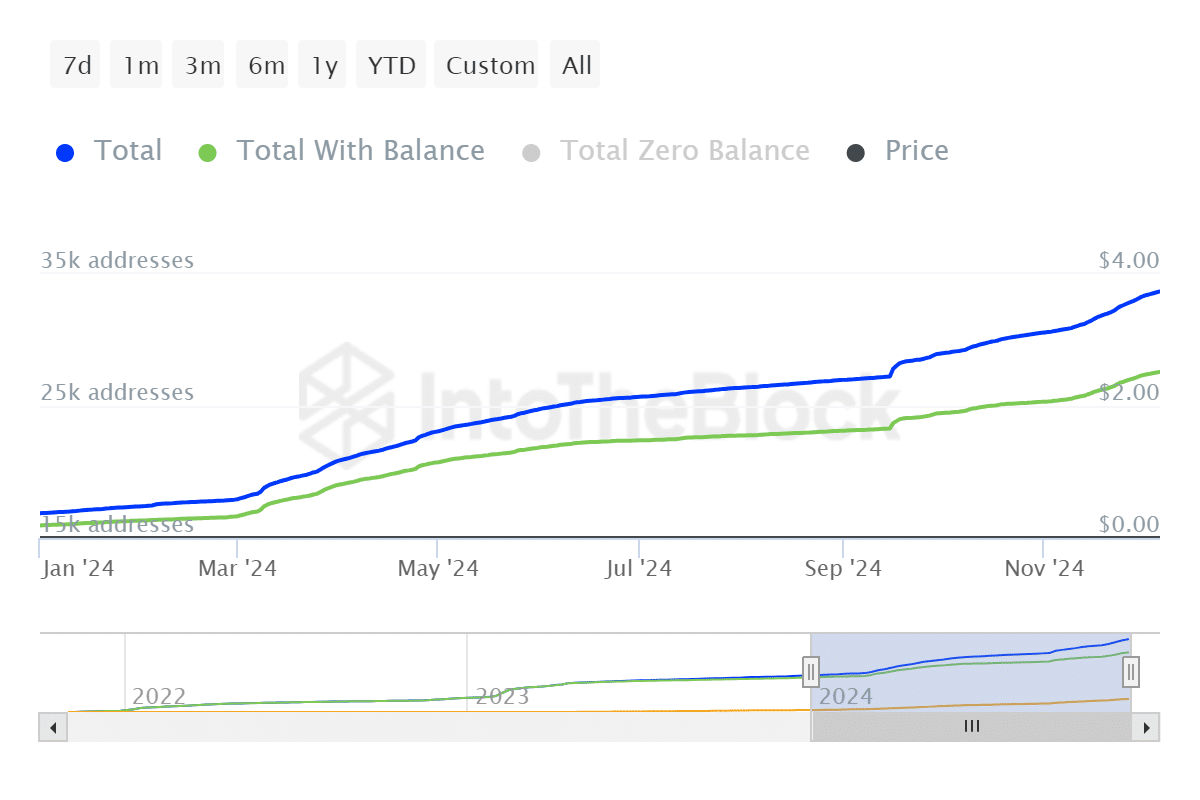

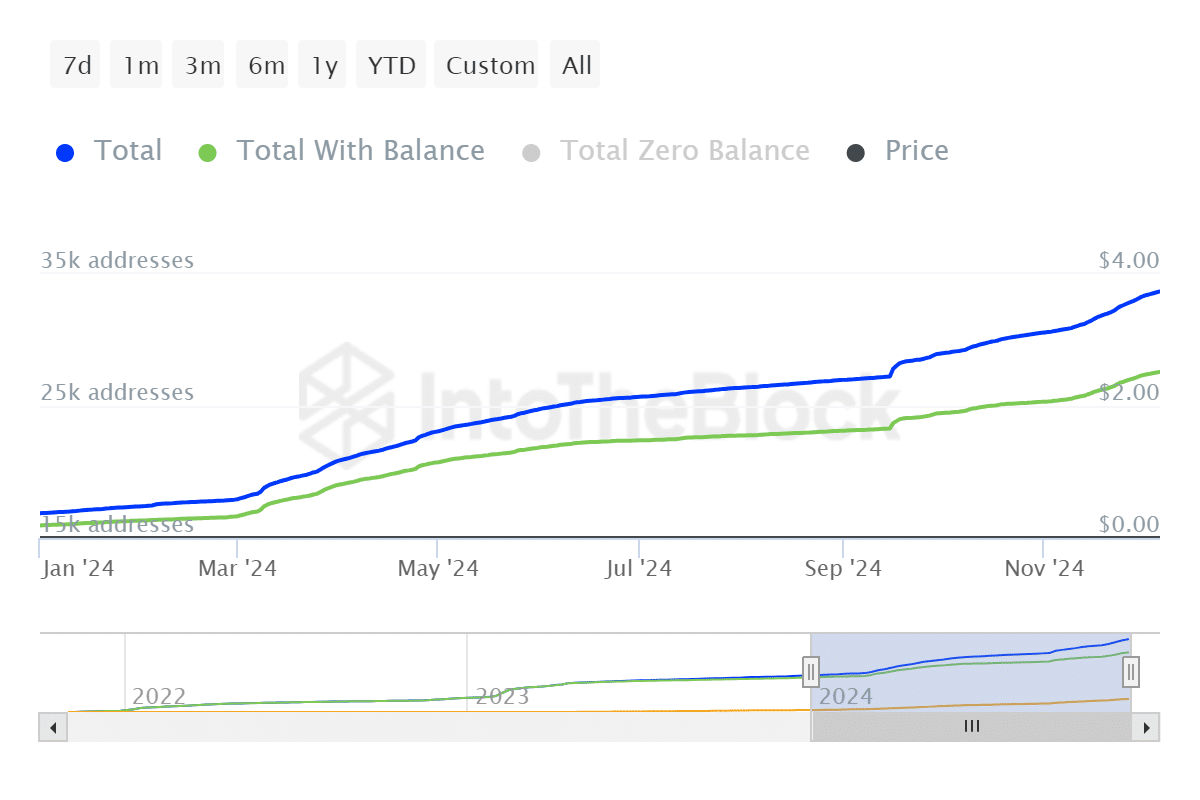

Speaking of retail, Baby Doge coin addresses have been on the rise since the start of 2024. It had slightly less than 16,000 addresses with balance, and that figure has since grown to 27,580 addresses.

The latest stats revealed that it had 33,680 addresses.

Source: IntoTheBlock

On the other hand, Coinglass recorded Baby Doge -$2.51 million worth of spot netflows in the last 24 hours. This is despite the large price uptick during the same period.

Meanwhile, Open Interest in the derivatives segment pushed to $2.41 million.

The above observations were also accompanied by a surge in short liquidations, peaking at $51,010. This suggests that most of the demand was primarily in the derivatives segment.

Read Baby Doge’s [BABYDOGE] Price Prediction 2024–2025

It may also indicate that the rally may have been induced by massive whale accumulation.

The fact that whales still control the majority of the coin suggests anticipation for a surge in demand from the retail segment. Investors should thus keep an eye out for listings on major exchanges.