- WIF’s price has been strategically capped at $3.80, a level where both big and small players are quick to exit.

- The key to breaking through this barrier lies in one of two conditions.

One month ago, dogwifhat [WIF] exploded with a massive 30% surge, hitting $4.83 in a single day – the longest green candlestick in its history.

However, just as it seemed ready to break its all-time high, a sharp correction took it back to $2.90, proving how unpredictable memecoins can be.

While investors have taken a hit, the story isn’t over yet. A deeper pullback to $2.00 might seem like a tempting entry point. However, AMBCrypto’s analysis suggests that WIF could stage a comeback, but only if bulls play their cards right.

How a long squeeze has cost WIF a new ATH?

As the saying goes, timing is everything in crypto—and WIF bears have certainly proven it. After a massive 30% surge in a single day, pushing WIF near a new all-time high, the RSI hit overbought levels.

Interestingly, this coincided with Bitcoin’s[BTC] first close above $90K during the “Trump pump,” sparking real panic among investors.

The result? While Bitcoin dipped by 3% the following day, WIF endured a sharp fourfold decline in comparison. Since then, the bulls have made multiple attempts at a rebound, but the $3.80 resistance level remains firmly in place.

Why? Two main factors are at play: First, the market’s volatility is dragging memecoins, like WIF, into the red, as the allure of quick, high-reward gains grows more enticing.

Second, big players are cashing out as FOMO fades, unloading their positions before the market takes another turn. Together, these forces are keeping WIF’s price capped.

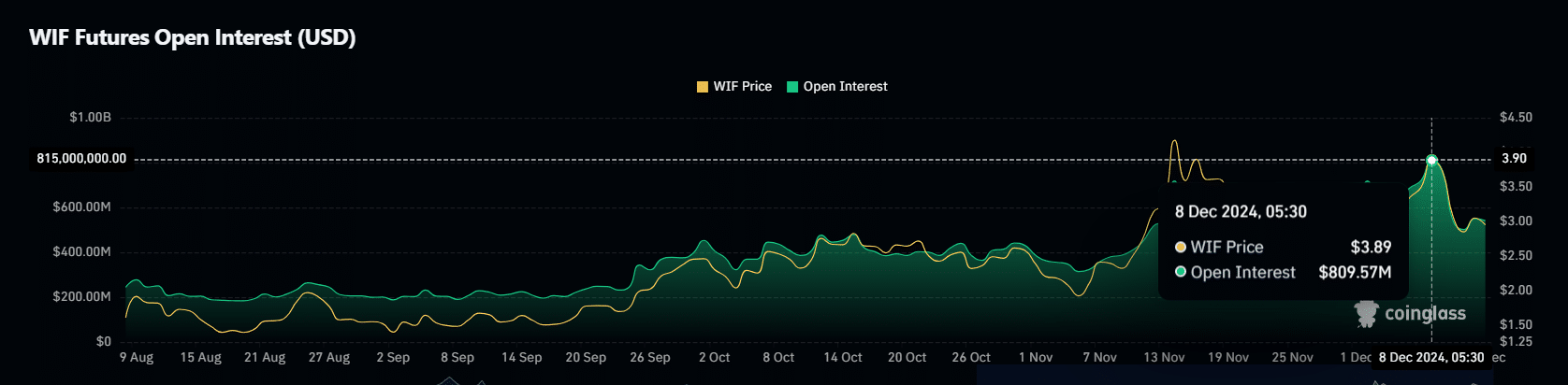

As a result, each time WIF nears that key price point, a massive liquidity cluster of long positions liquidates, forcing longs to close their positions. This is evident in the sharp drop in Open Interest (OI).

Source: Coinglass

The OI dropped from nearly $1 billion at $3.80 to $541 million, at press time. The impact on WIF was a sharp, long red candlestick, signaling a daily decline of over 17%, with WIF’s price now dipping below $3.

Now that $3.80 has proven to be a strong resistance point, if you’re “long” on WIF and want to see it rebound, forming the right bottom will be crucial.

If successful, the next step would be HODLing, allowing the price to consolidate and potentially break out. Keep your eyes peeled—this could be the turning point WIF bulls have been waiting for, but remember, conditions apply.

Should you HODL or let go?

With whales dumping 1.2 million WIF tokens worth $3.47 million just two days ago as the price broke through $3, it may still be too early to call a bottom. The market hasn’t fully shaken off the weak hands yet.

But there’s a glimmer of hope. The RSI has cooled off from overbought levels, spot traders are swooping in to catch the dip, and shorts are getting dangerously over-leveraged.

This sets the stage for new players to make their move, and for those holding WIF, HODLing could prove to be the smartest bet.

Read dogwifhat’s [WIF] Price Prediction 2024–2025

For a notable rebound, though, big players need to step in. Here’s why: When whales dominate the accumulation space, it draws in both spot and futures traders looking to grab the discount.

However, if buying momentum picks up and spot traders push the price, massive short positions will squeeze out, potentially triggering a ripple effect that could lead to the next big surge.

So, if either of these conditions materializes, WIF may finally break through the stubborn $3.80 resistance. Keep your eyes on the key factors mentioned above—tracking them closely in the coming days will be essential.