- Uniswap whales have accumulated more than 1.68M tokens this week amid rising interest in DeFi tokens.

- UNI’s weekly chart also shows bullish signs that could push UNI to $27 if buying activity strengthens.

Uniswap [UNI] was trading at $17.47, at press time, after a more than 6% drop in 24 hours. Despite this dip, UNI is still up by nearly 40% month-to-date. Its market capitalization has also increased from $7.81 billion at the start of the month to $10.48 billion.

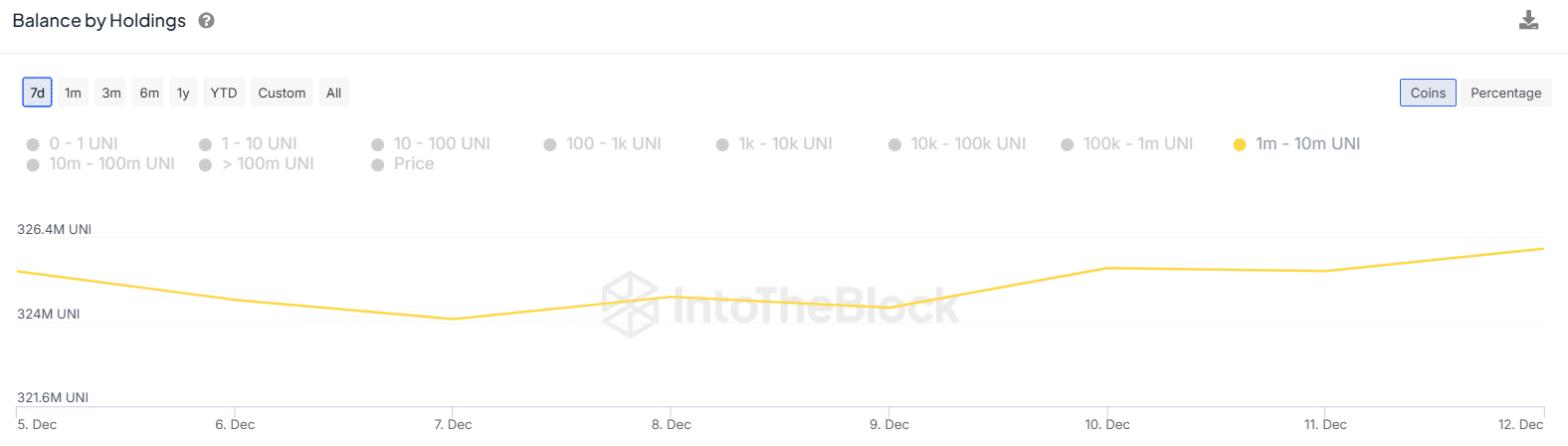

Uniswap whales seem optimistic about more gains, given that large addresses holding between one million and ten million UNI tokens have increased their holdings by 1.68 million UNI tokens within four days.

Source: IntoTheBlock

One of the whale addresses accumulating UNI is Galaxy Digital. According to Lookonchain, the digital asset manager withdrew 1.07 million UNI from exchanges on the 12th of December amid rising interest in Decentralized Finance (DeFi) tokens.

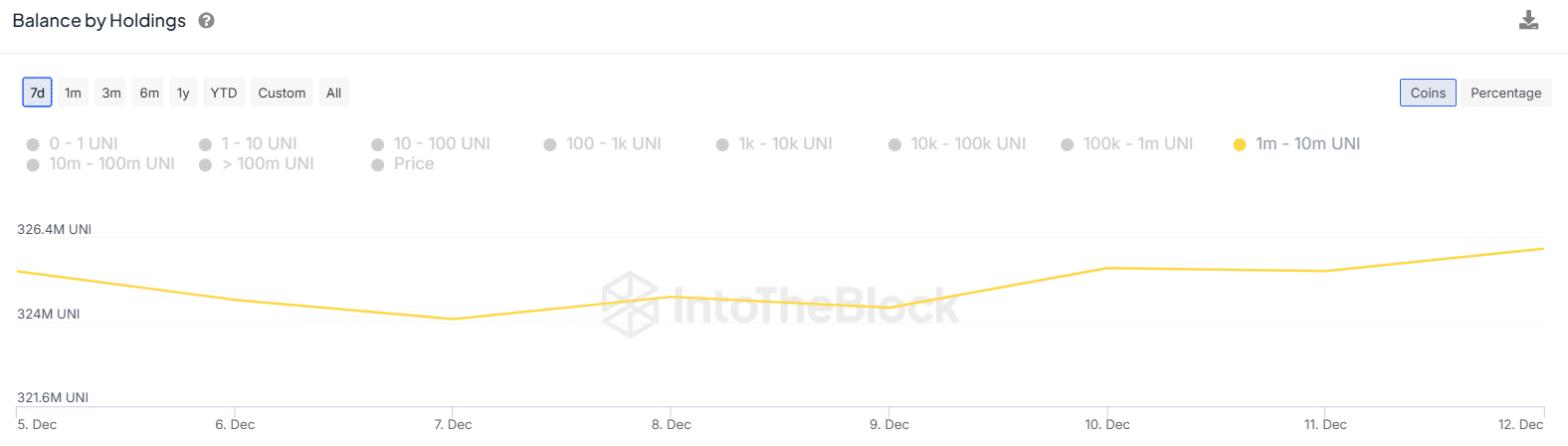

This whale activity has coincided with bullish signs on Uniswap’s weekly chart, suggesting that it could make a bullish reversal despite the recent dip.

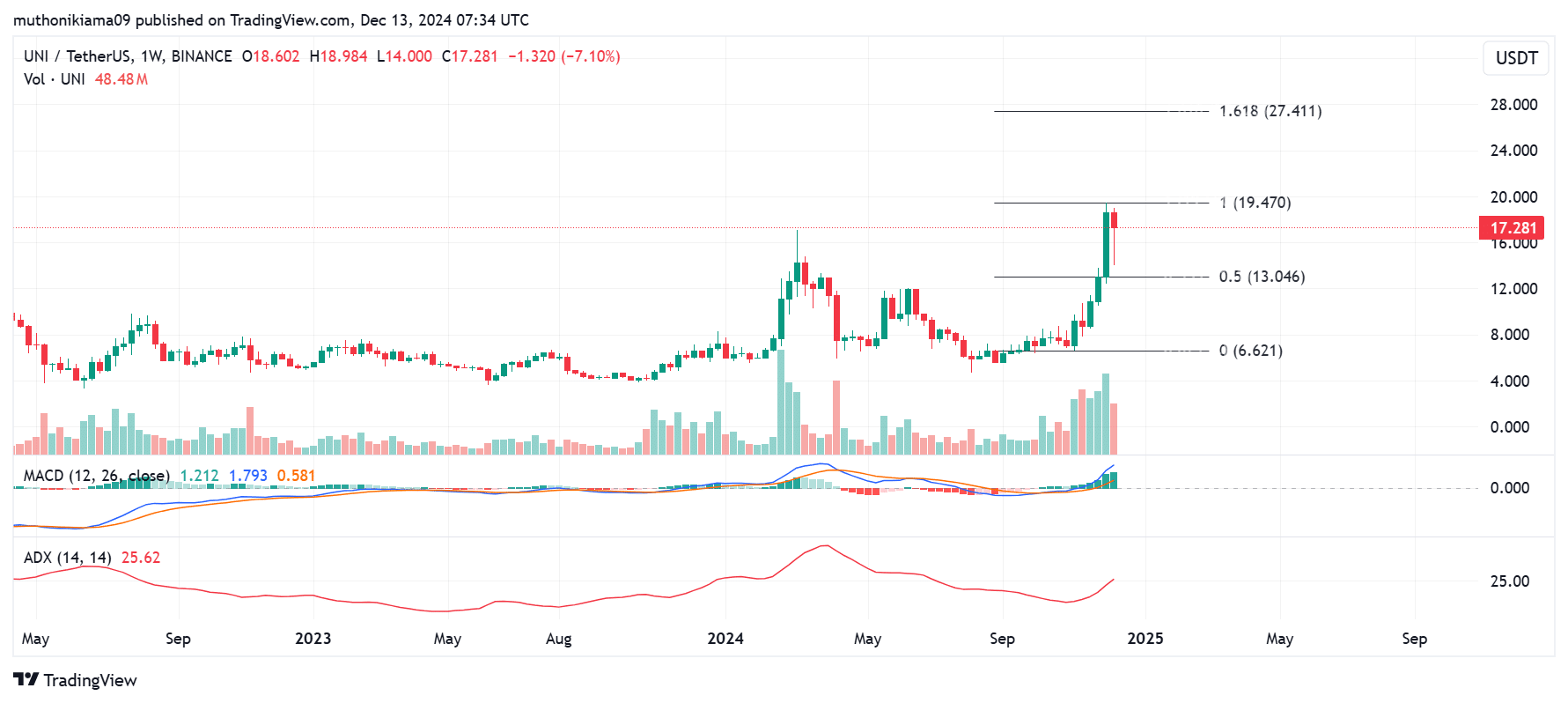

UNI’s price analysis

Uniswap’s weekly chart showed that a bullish trend is in play after breaking the neckline of a rounding bottom pattern, an indication that buyers were gaining strength.

The Moving Average Convergence Divergence (MACD)was bullish, as seen by the green histogram bars and the MACD line that is above the signal line.

The Average Directional Index (ADX) line was seen tipping further north, showing that the current uptrend is strong.

Source: TradingView

If UNI can recover from the temporary pullback from multi-month highs and the momentum remains bullish, the next target for price is the 1.618 Fibonacci level at $27.41.

Exchange supply ratio surges

The whale accumulation and bullish trends on UNI’s weekly chart have failed to fully absorb the sell-side pressure after the exchange supply ratio surged to a seven-day high.

According to CryptoQuant, the ratio has reached 0.0025, indicating an increase in UNI’s supply on exchanges. This could lead to bearish trends if buying activity remains weak.

Source: CryptoQuant

One of the factors that might have caused a rise in this ratio is profit-taking behavior. According to IntoTheBlock, the percentage of UNI wallets in profits has increased to 62%, the highest level since 2021. Therefore, traders that were previously underwater might choose to sell to book profits.

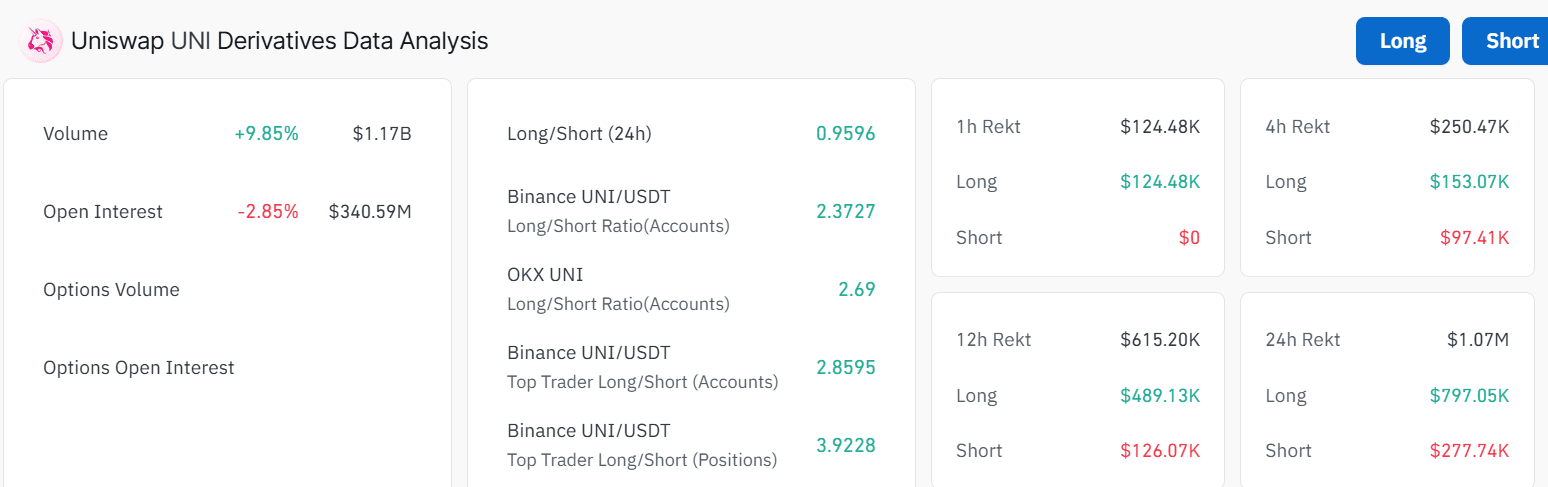

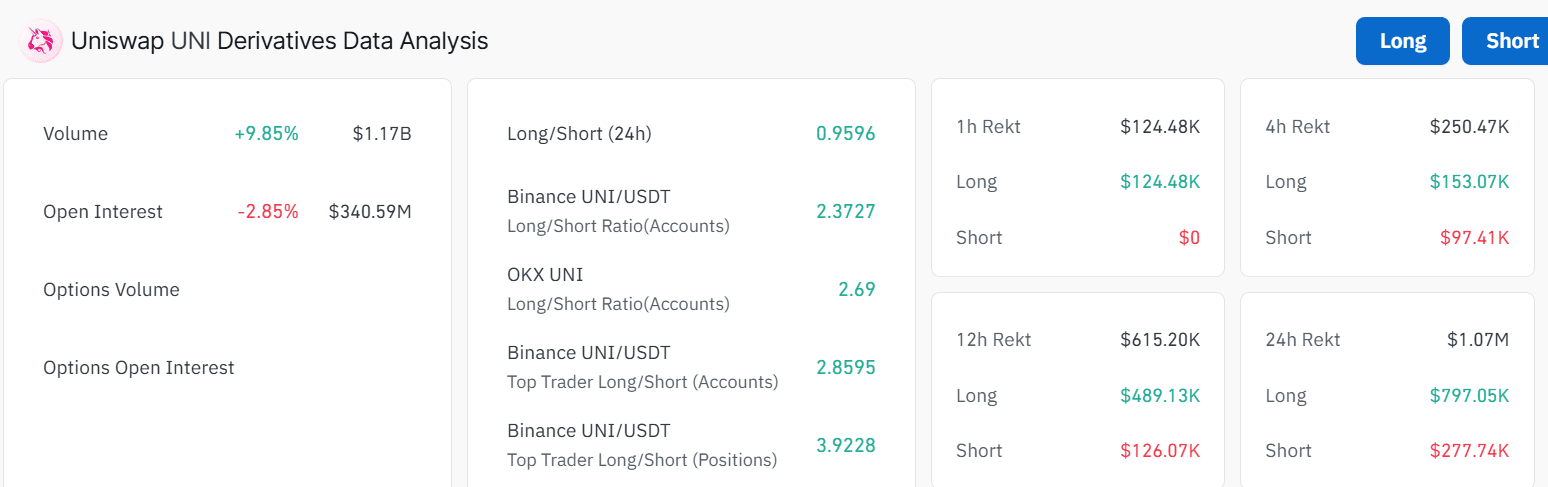

Derivatives’ data suggests…

Uniswap’s derivative market data shows the recent drop caused a significant increase in long liquidations. The Long/Short ratio also dropped to 0.959, suggesting that short sellers were slightly more than long buyers.

Source: Coinglass

Open Interest dropped by 2% alongside the price decline, but it remains at elevated levels of $340M, suggesting that market participation is high.

Read Uniswap’s [UNI] Price Prediction 2024–2025

The increase in derivative trading volumes also shows that despite the price decline, speculative interest in UNI remains high, indicating there was room for a recovery.