- SUI’s price breakout above $4.27 signaled bullish momentum, backed by strong technical indicators.

- Social dominance and positive funding rates reinforced optimism despite minor price corrections.

Sui [SUI]’s decentralized exchange ecosystem has made remarkable progress, with its Total Value Locked (TVL) increasing from $1.51 billion to $1.87 billion since the 2nd of December. This significant growth underscores strong network engagement and rising adoption of its DeFi offerings.

The coin was trading at $4.67, down by 1.65%, at press time. SUI’s trajectory raises the question: Can it maintain its upward momentum and secure its place among leading DeFi platforms?

SUI’s price action reflects key bullish signals

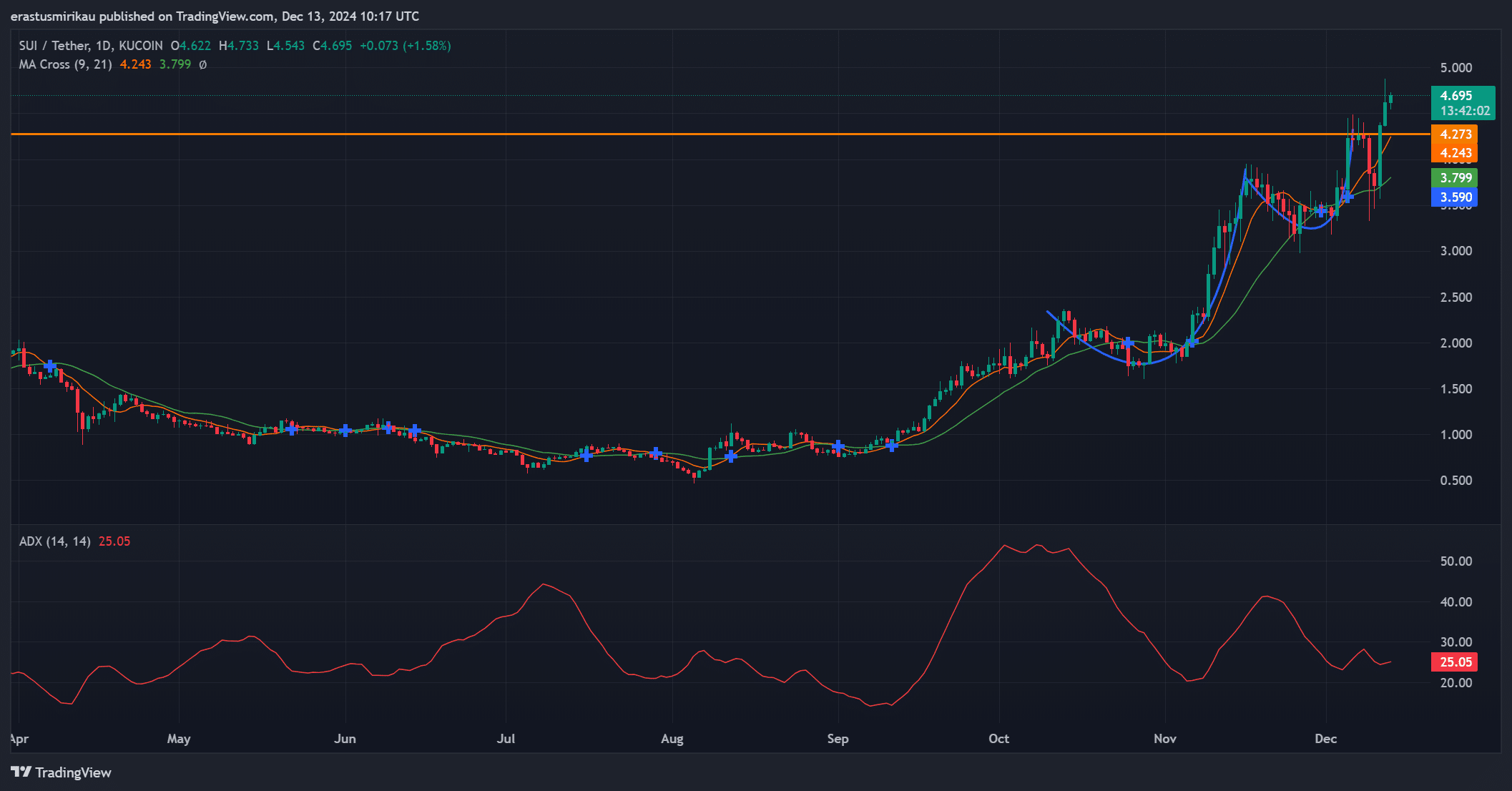

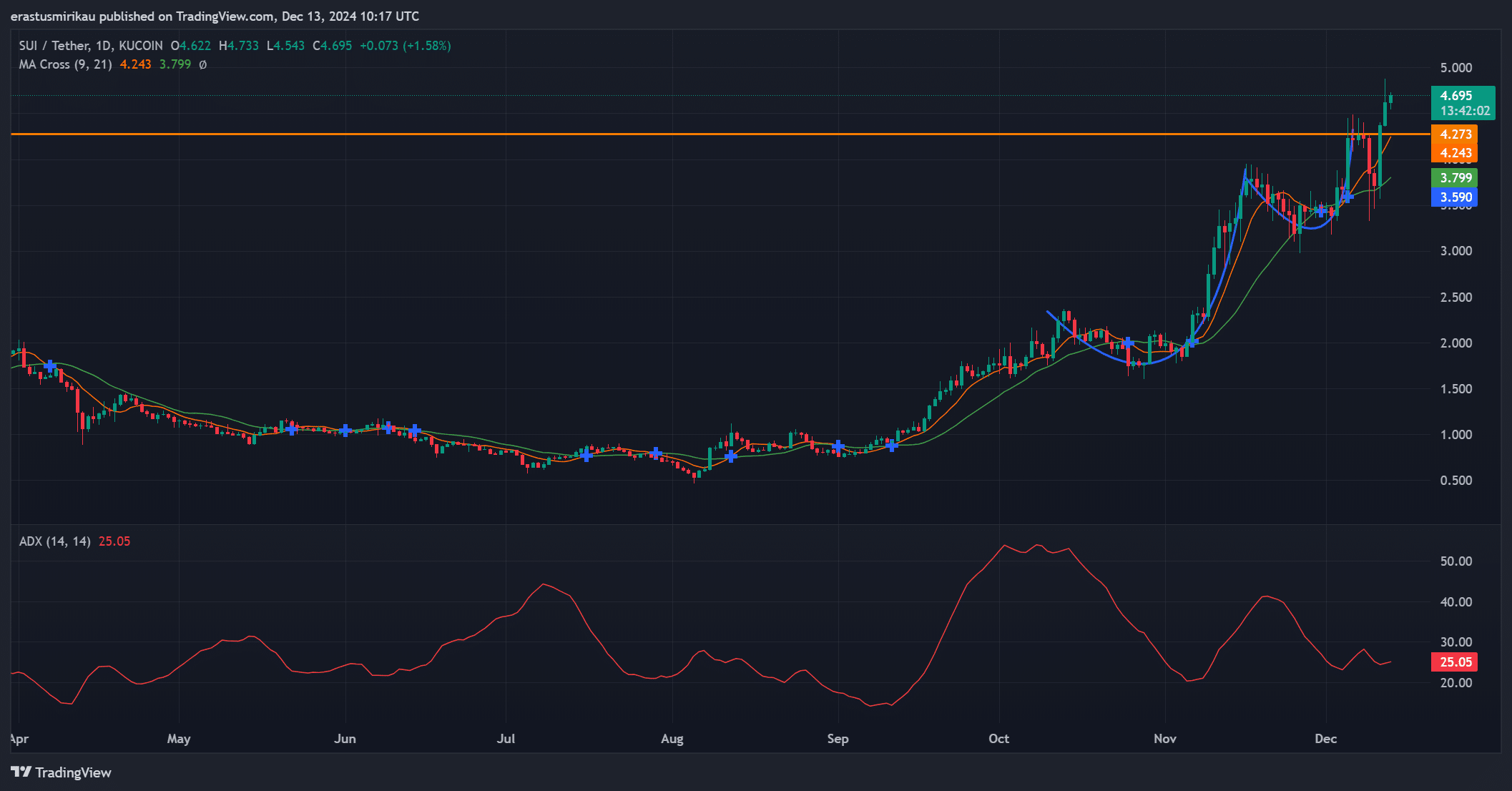

Sui’s price movement suggests a promising trend, having recently broken above the critical resistance level at $4.27. This breakout, coupled with a Moving Average (MA) crossover between the 9-day and 21-day lines, demonstrates strong bullish momentum.

However, the Average Directional Index (ADX) at 25.05 indicates moderate trend strength, suggesting a potential for short-term consolidation.

Therefore, holding support above $4.27 will be critical for sustaining this rally and building further upward momentum.

Source: TradingView

Social dominance underscores the growing interest

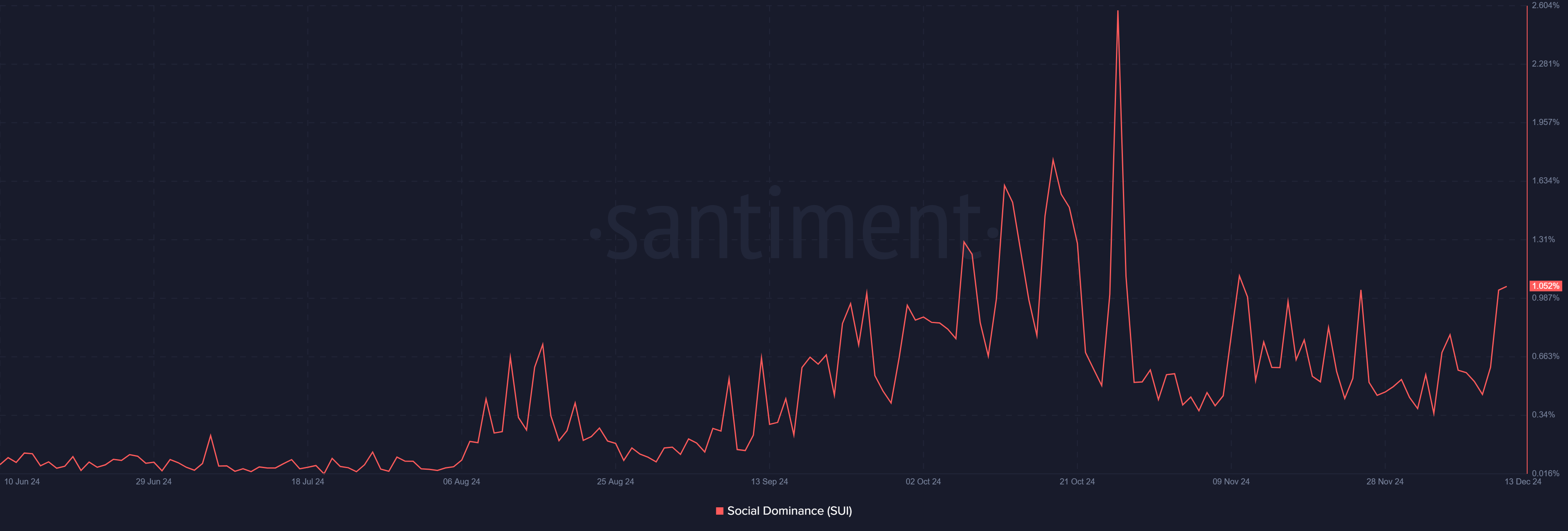

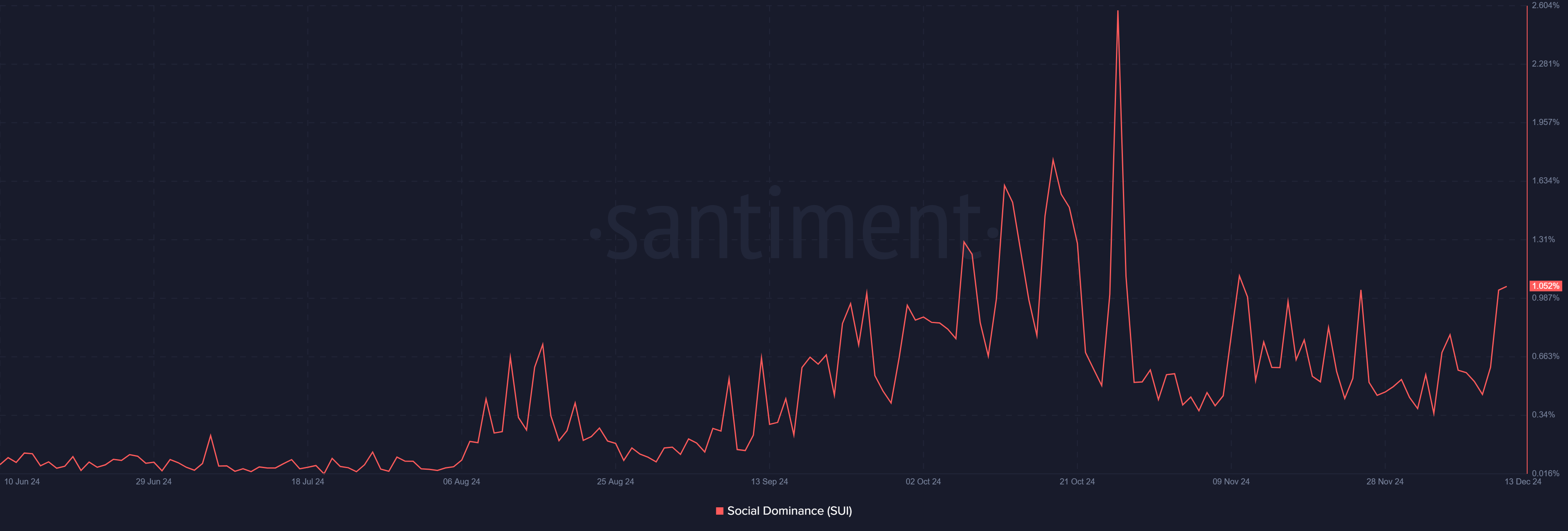

Additionally, the rising social dominance reflects heightened community engagement, with metrics now exceeding 1%. Increased mentions and discussions often translate into higher investor confidence, reinforcing positive sentiment in the market.

As such, Sui’s growing presence in social conversations is likely to sustain interest and further drive adoption.

Source: Santiment

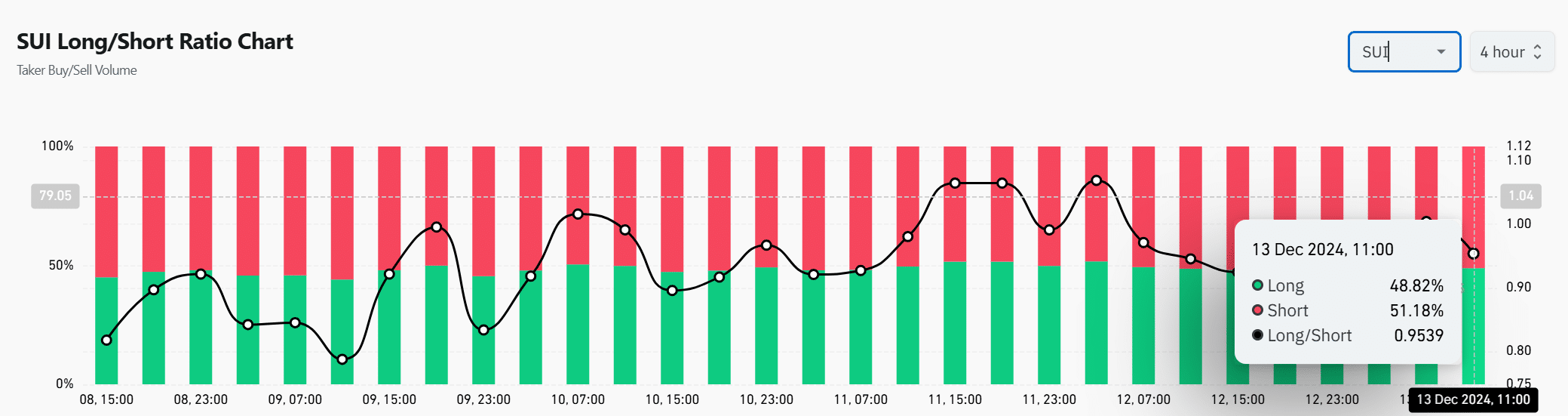

The Long/Short Ratio suggests cautious optimism

The Long/Short Ratio revealed an almost balanced sentiment, with 51.18% of positions being shorts and 48.82% longs.

This indicates cautious optimism among traders, who are preparing for possible corrections while still recognizing the potential for further upside. Therefore, this balance hints at both opportunity and caution in the near term.

Source: Coinglass

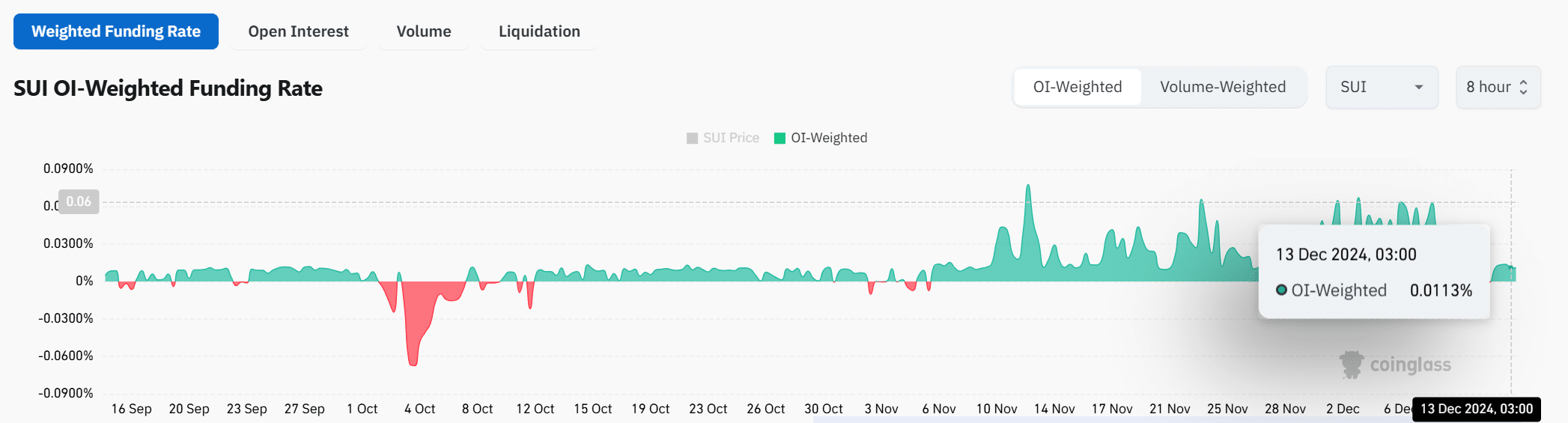

Positive funding rates reflect bullish sentiment

The Open Interest (OI)-Weighted Funding Rate at 0.0113% highlighted the market’s confidence, as traders are willing to pay premiums for long positions.

This aligns with Sui’s upward trajectory, suggesting that derivative traders believe in the project’s long-term potential despite recent minor pullbacks.

Source: Coinglass

Read Sui’s [SUI] Price Prediction 2024-25

In conclusion, Sui’s technical strength, rising social engagement, and positive funding rates indicate that it is well-positioned to sustain its growth.

By maintaining critical support levels and leveraging its community interest, Sui has the potential to solidify its dominance in the DeFi space and achieve even greater milestones.