PENGU Crypto – All you need to know

The launch of the PENGU token by Pudgy Penguins is set to create waves in the cryptocurrency and NFT communities. Making its debut on 17 December, PENGU will be available for trading against popular pairs such as USDT, BNB, FDUSD, and TRY. With a total supply of 88.88 billion tokens, PENGU aims to cater to its vast ecosystem, including the Pudgy Penguins NFT collection, which has been seeing a surge in interest.

Of the total supply, 25.9% is allocated to the NFT community and 24.12% is dedicated to other popular NFT projects such as Azuki and Bored Ape Yacht Club.

A significant portion – 17% – will go to the project team with a vesting period, while 12.35% is earmarked for liquidity pools. The distribution strategy ensures wide participation across various NFT communities and liquidity providers. Trading at $0.05 per token pre-launch, PENGU seemed to be valued at a fully diluted market capitalization of $4.4 billion.

The token’s launch follows the soaring popularity of Pudgy Penguins NFTs, which have recently surpassed a floor price of $100,000. This momentum has elevated market expectations, positioning PENGU as a promising player in the evolving memecoin space.

CAT – Market surge, impact on memecoin market

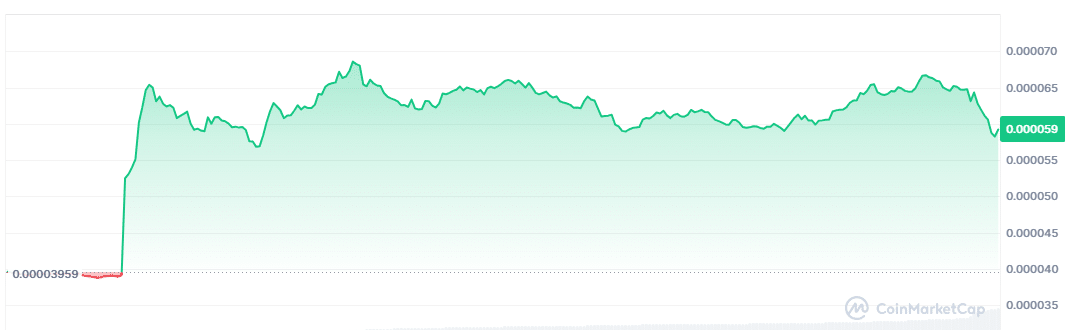

Simon’s Cat memecoin has made an explosive entrance into the market following its Binance listing, surging by over 60% to hit an all-time high of $0.00006811. This price rally was accompanied by a dramatic hike in market capitalization, reaching approximately $439 million. The success of Simon’s Cat highlights the continued fervor surrounding memecoins, especially when backed by a major exchange like Binance.

The listing sparked significant interest in memecoins, with many traders eager to capitalize on the initial price surge.

Source: CoinMarketCap

However, as seen with listings such as Magic Eden (ME) and Movement Network’s MOVE token, sharp price corrections often follow these rallies. Despite these risks, the appeal of high-return opportunities continues to attract traders, particularly those looking to profit from the fast-paced world of memecoins.

Binance’s role in fueling this volatility, coupled with the lack of long-term stability, has sparked debate about whether these tokens are more of a speculative gamble than legitimate investments.