- 78% of Litecoin addresses have held their LTC for over a year.

- LTC has decline by 11.09% over the past 24 hours.

Since hitting a recent high of $147 two weeks ago, Litecoin [LTC] has struggled to maintain an upward momentum.

The past 24 hours especially have seen the highest drop for the altcoin hitting a local of $94. In fact, at the time of writing, Litecoin was trading at $96. This marked a 11.09 % decline on daily charts. Equally, the altcoin has declined by 20.12% over the past week.

Despite the recent dip on its price charts, LTC’s long-term holders remain optimistic and expect more gains.

78% of Litecoin long term addresses remain bullish

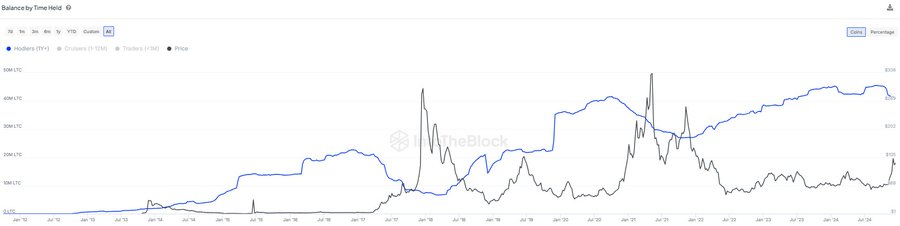

According to IntoTheBlock, 78% of Litecoin addresses have held their LTC for more than a year. These addresses have been accumulating during bear markets and selling near the peak prices.

Source: IntoTheBlock

While previous cycles have seen an increase in long-term holdings selling, this cycle has been different.

In this cycle, LTC has seen a slight drop in long-term holdings. However, this reduction is less pronounced compared to previous cycles. This indicates that fewer long-term holders are selling their LTC compared to previous bull markets.

Therefore, many holders are anticipating further price growth, as they are still awaiting the peak in the current cycle. This signals optimism among long-term holders.

What LTC charts suggest

While long-term holders have sold less compared to other cycles and remain optimistic, the overall market remains bearish.

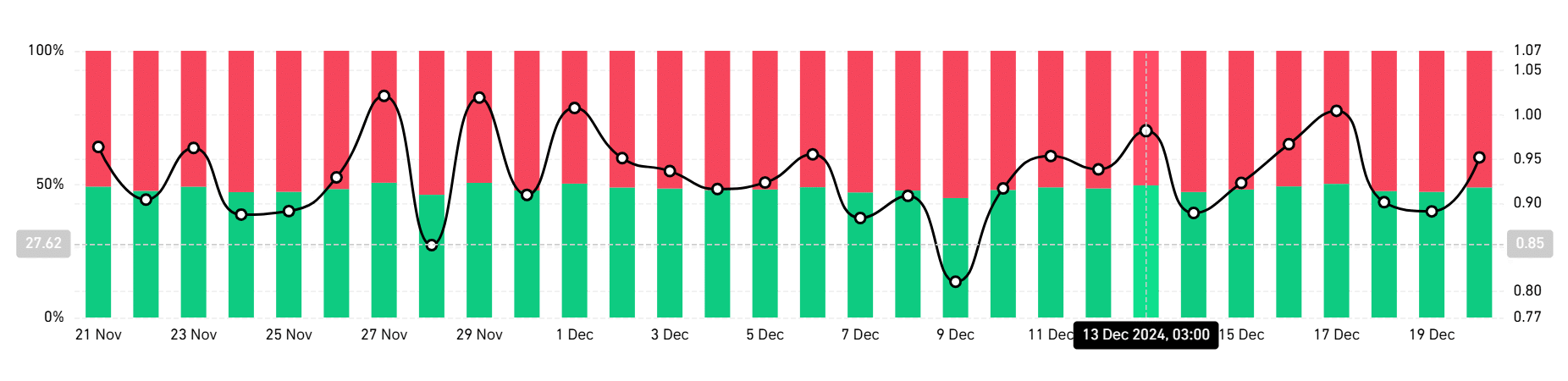

Source: Coinglass

As such we can see this bearishness as most investors are taking short positions. According to Coinglass, the long/short ratio shows those taking shorts are dominating the market. This implies that most traders anticipate prices to drop.

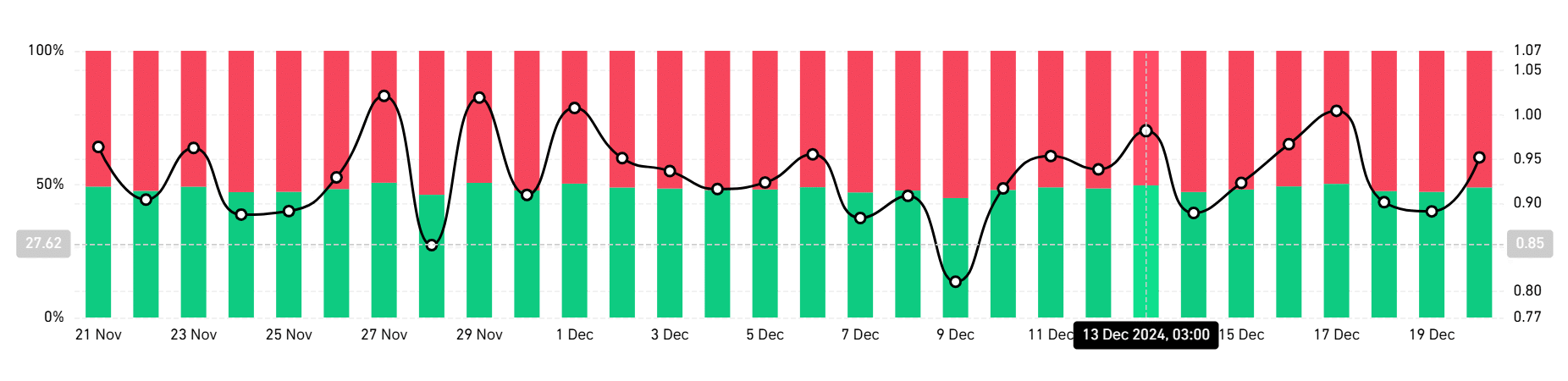

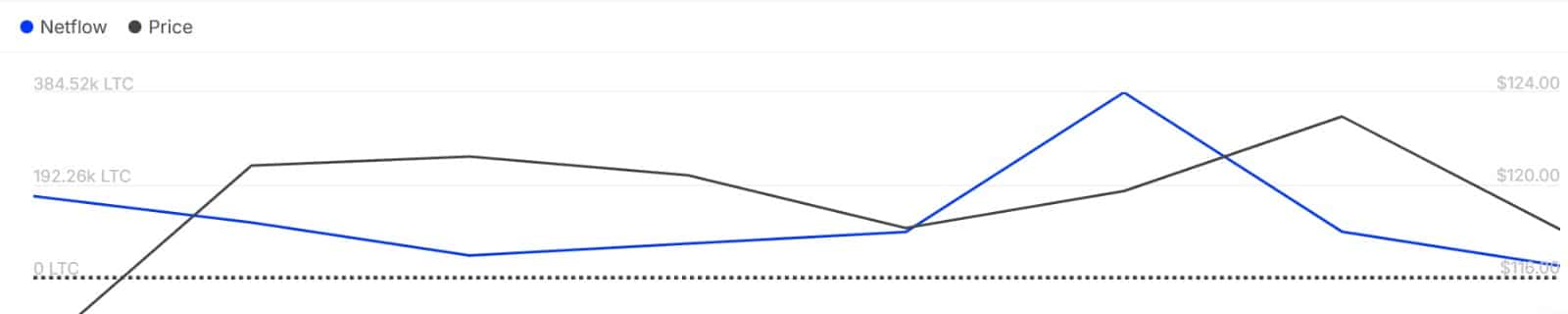

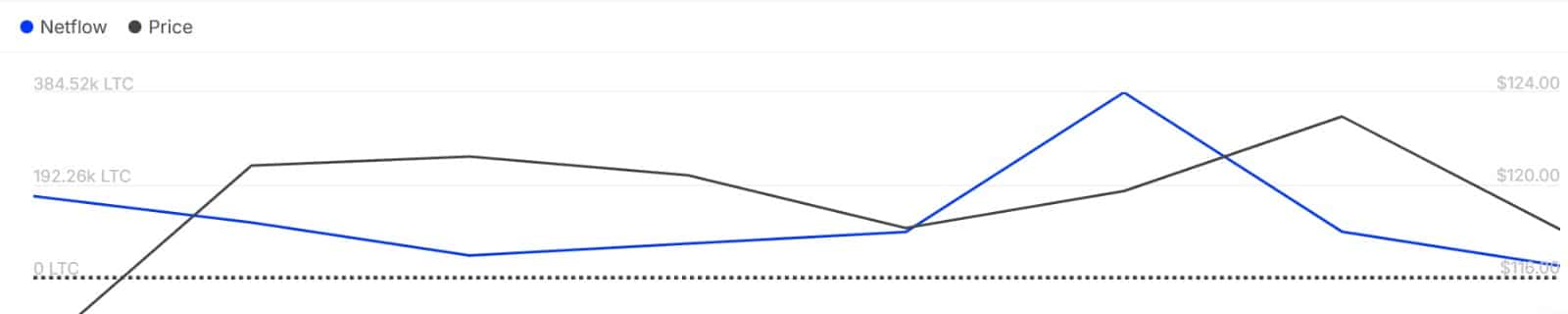

Source: IntoTheBlock

Additionally, large holders are also bearish and have continued to reduce their capital inflow into LTC. As such, Litecoin’s large holder’s netflow has declined from 384.52k to 21.89k.

This implies that outflow has surpassed inflow for 4 consecutive days.

Source: Tradingview

Finally, sellers have dominated the market for the last 12 days. This dominance is evidenced by a sustained decline in the Relative strength index. The RSI has dropped from 71 to 40 nearing oversold territory.

Read Litecoin’s [LTC] Price Prediction 2024–2025

In conclusion, while long-term holders are optimistic, retail traders are not. Thus, the market is experiencing short-term negative sentiment. If this sentiment holds, LTC could drop to $91.47.

However, if long-term holders’ bullishness spreads across the market, LTC will reclaim $100 levels.