- Melania token’s value has dropped to $4.40, representing a staggering decline.

- MELANIA has been on a downward trend since peaking above $12.

On the 20th of January, a whale executed a major transaction in the crypto market, acquiring 440,136 Melania Meme [MELANIA] tokens worth $5.1M at an average price of $11.60 per token.

At the time of writing, the token’s value has dropped to $4.40, representing a staggering decline.

A high-stakes bet in the market

Whale activity often signals potential price shifts in the crypto market. In this case, the whale’s MELANIA purchase at $11.60 shows high confidence despite the token’s downtrend.

However, the drop indicated a mismatch between market sentiment and the whale’s expectations.

The current floating loss suggests limited buying pressure to counter the price drop. If the whale decides to sell, further declines could occur.

On the contrary, whales holding assets could stabilize the market, with a reversal possible if smaller investors follow their lead.

Decoding MELANIA’s downward price spiral

MELANIA has been on a downward trend since peaking above $12. Analysis on the meme coin shows a descending channel that eventually broke into a consolidation zone near $4.40.

This indicated bearish momentum transitioning into potential accumulation.

Source: TradingView

Also, the consolidation zone suggests that sellers may be losing strength, which could lead to a reversal if buyers step in. However, breaking below the current range could trigger another bearish leg.

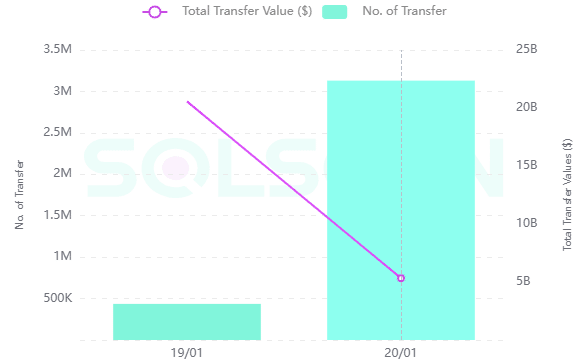

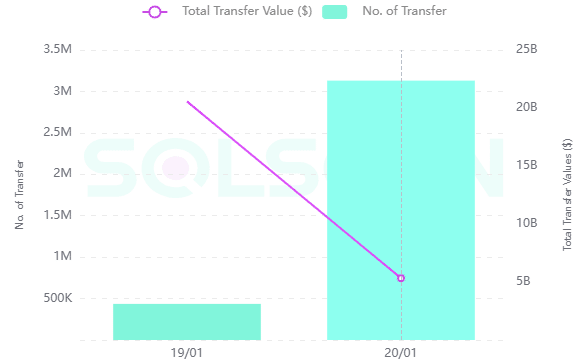

Contrasting transfers

The Solscan chart highlighted contrasting trends in transfer activity and total transfer value. On the 19th of January, the total transfer value was significantly lower despite a moderate number of transfers.

Conversely, there was a sharp increase in transfer value on the 20th of January, coinciding with the whale transaction.

Source: Solascan.io

This disparity implied concentrated activity driven by a few large players. Declining smaller transfers reflect reduced retail interest, which might indicate skepticism.

Although, sustained high transfer values could hint at institutional moves, potentially stabilizing the token’s price.

Concentration and risk: The impact of large holders

The token distribution chart illustrates the concentration of MELANIA among various holders. A significant portion is controlled by large wallets, including the whale, who recently acquired 440,136 tokens.

Such concentrated ownership indicates potential price volatility, as actions by a few keyholders could drastically impact the market.

Source: Solascan.io

If the whale opts to hold, it may signal confidence, encouraging smaller investors to accumulate. Conversely, any sell-off could exacerbate the current downtrend.

Broader distribution among holders would reduce volatility and promote market stability.

The recent whale activity in MELANIA, highlights the volatility associated with concentrated holdings.

While the whale’s significant investment demonstrates confidence, the market’s bearish sentiment remains evident through declining price action and reduced retail participation.

Read Melania Meme’s [MELANIA] Price Prediction 2025–2026

The token’s consolidation around $4.40 suggests a potential turning point, but broader market sentiment and whale behavior will likely dictate the next movement.

The disparity between transfer values and counts, along with concentrated token ownership, underscores the need for careful observation of market dynamics.