- Bitcoin’s Binary CDD and HODL Waves indicated that long-term holders were accumulating, easing market sell-side pressure.

- New triggers could drive its next major price movement.

Bitcoin’s [BTC] on-chain metrics paint a compelling picture of reduced sell-side pressure, with long-term holders (LTHs) showing signs of accumulation rather than distribution.

Key indicators such as Binary Coin Days Destroyed (CDD), HODL Waves, and Exchange Netflow show a stabilizing market, but new catalysts may be needed to unlock the next growth phase.

LTHs take a backseat

The Bitcoin Binary CDD indicator, which measures long-term holders’ intensity of coin movement, has recently shown values consistently below 0.3.

This suggests that LTHs are not actively spending or selling their coins, a trend often associated with reduced sell-side pressure.

Source: Glassnode

Historically, periods of low Binary CDD have preceded bullish phases, as long-term holders tend to hold onto their coins during market uncertainty.

With Bitcoin’s price hovering around $102,000, this metric indicates that LTHs are likely waiting for stronger signals before making significant moves.

A growing preference for accumulation

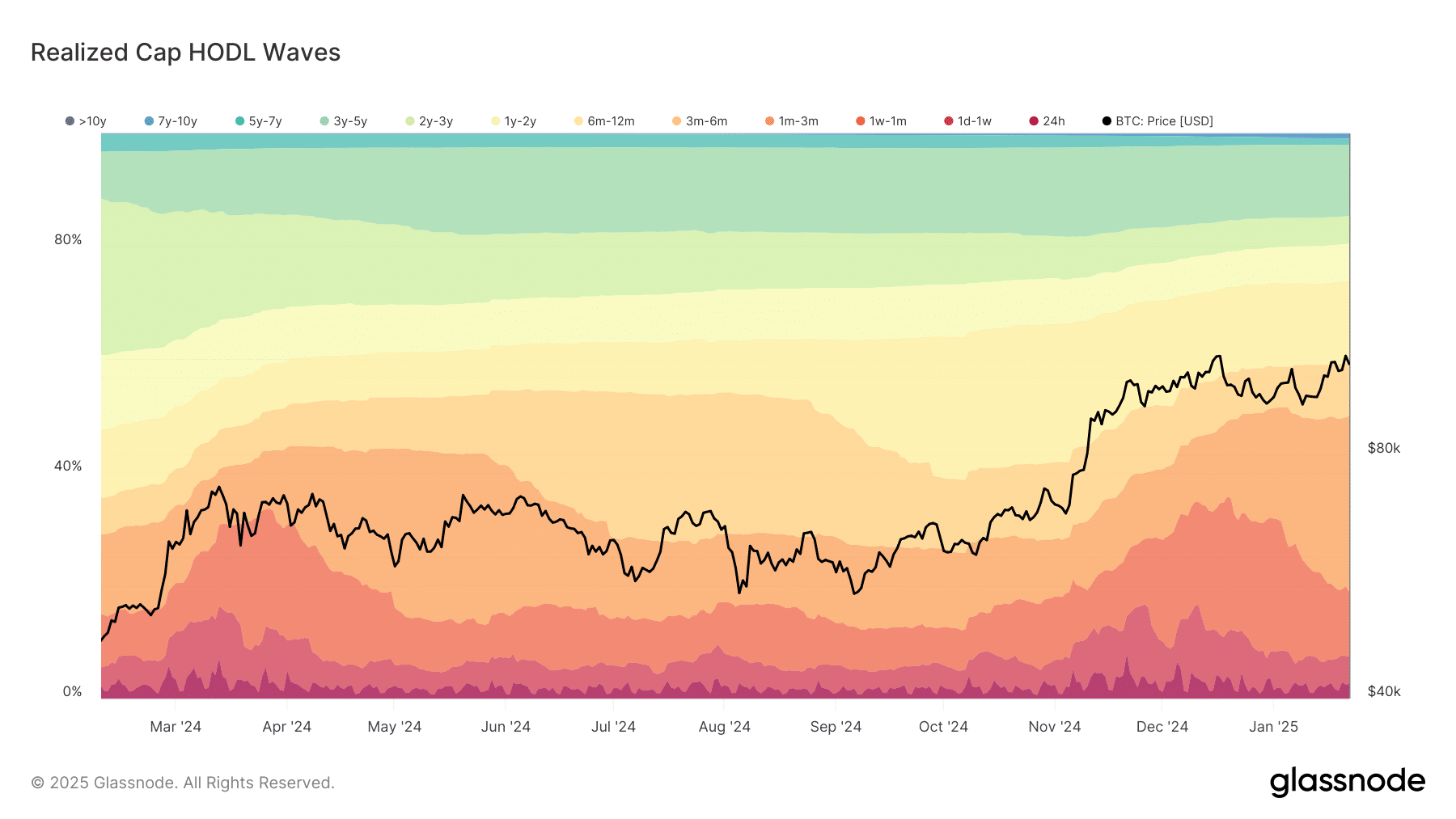

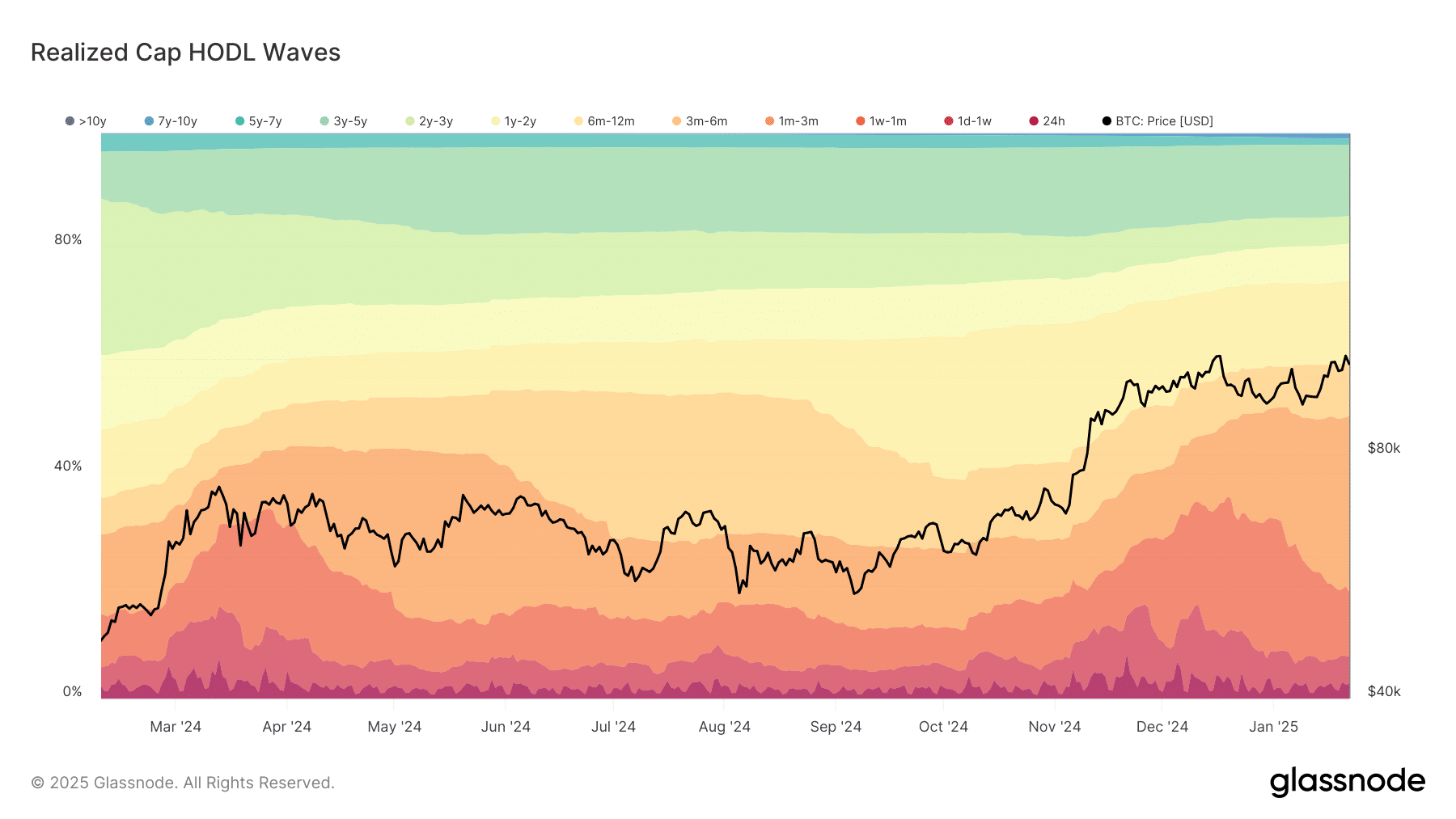

The Realized Cap HODL Waves chart from Glassnode further proves this trend.

The data reveals that a significant portion of Bitcoin’s supply is held by long-term holders, with coins aged 1–2 years and 2–3 years showing notable increases.

Source: Glassnode

Coins held for 1–2 years have grown steadily, indicating that investors who bought during the 2022 bear market are holding strong.

Similarly, coins held for 2–3 years have also expanded. It reflects confidence among those who accumulated during the 2020-2021 bull run.

These HODL Waves suggest that long-term holders are not only refraining from selling but are also accumulating more Bitcoin, further reducing available supply on the market.

Bitcoin shows negative flow

The Bitcoin Exchange Netflow metric, which tracks the movement of coins to and from exchanges, has shown a consistent negative trend over the past few months.

This means more Bitcoin is being withdrawn from exchanges than deposited. This trend is a strong indicator of accumulation.

Recent data shows the netflow has been predominantly negative, with outflows spiking during key price movements. As of this writing, the netflow was negative, with over 258 BTC recorded.

For example, during Bitcoin’s recent surge, exchange netflow dipped significantly, suggesting investors moved their coins to cold storage.

Source: CryptoQuant

Negative netflow reduces immediate sell-side pressure, as fewer coins are available on exchanges for trading. This trend aligns with the behavior of long-term holders who prefer to hold rather than trade.

What’s next for Bitcoin?

While the current on-chain metrics point to a stabilizing market, Bitcoin’s price action may require new catalysts to break through key resistance levels.

The recent chart analysis provides additional insights into Bitcoin’s potential trajectory.

Source: TradingView

The chart shows Bitcoin’s price hovering around $102,587.51. It had a daily high of $103,779.99 and a low of $101,512.88.

Read Bitcoin’s [BTC] Price Prediction 2025-26

The 50-day and 200-day moving averages are at 98,599.97 and $75,750.86, respectively, indicating a bullish crossover. This suggests that despite short-term volatility, the long-term trend remains upward.

Bitcoin’s on-chain metrics show that long-term holders hold strong and sell-side pressure is easing. While this creates a foundation for market stability, the next major price movement will likely depend on external catalysts.