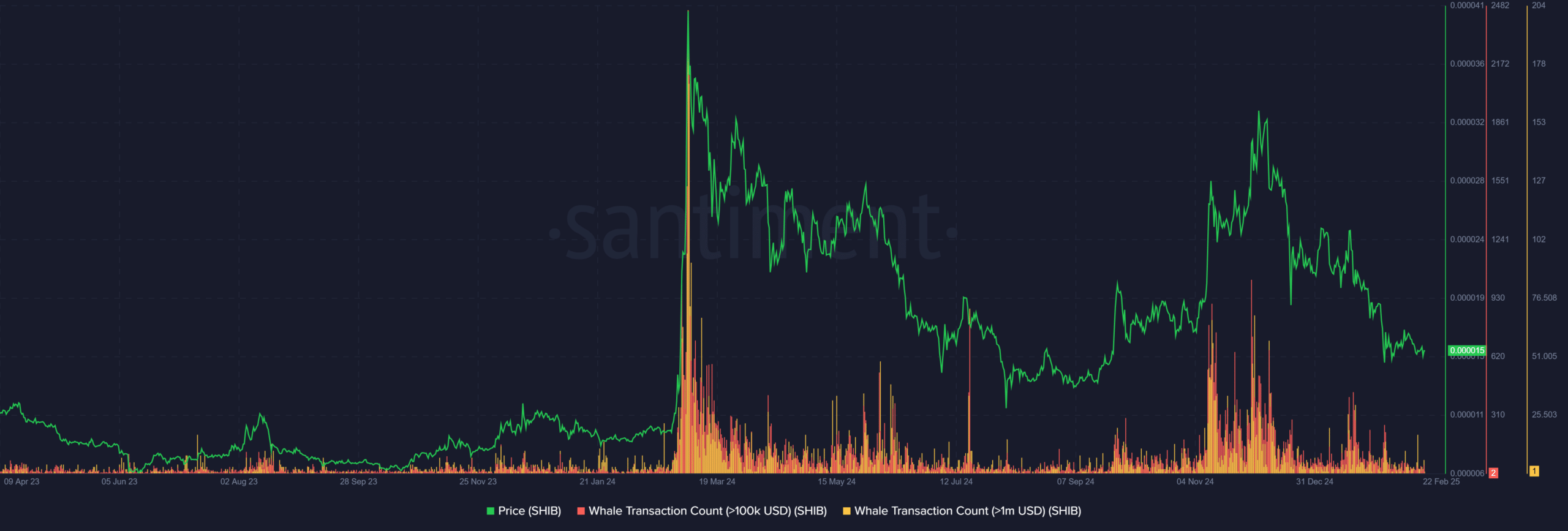

Shiba Inu whale activity plunges

Large SHIB transactions — especially those exceeding $1 million — have nearly vanished compared to their early-2024 peak.

Historically, SHIB’s price has closely followed whale activity: spikes in large transactions fueled previous rallies, like the surge in early 2024.

Now, with transactions fading, SHIB’s price is struggling, hovering around $0.000015.

Source: Santiment

This pattern isn’t new. Similar whale retreats followed SHIB’s 2021 and 2023 rallies, leading to extended corrections.

This suggests that SHIB’s current decline in whale interest may not be an anomaly but part of a recurring memecoin cycle.

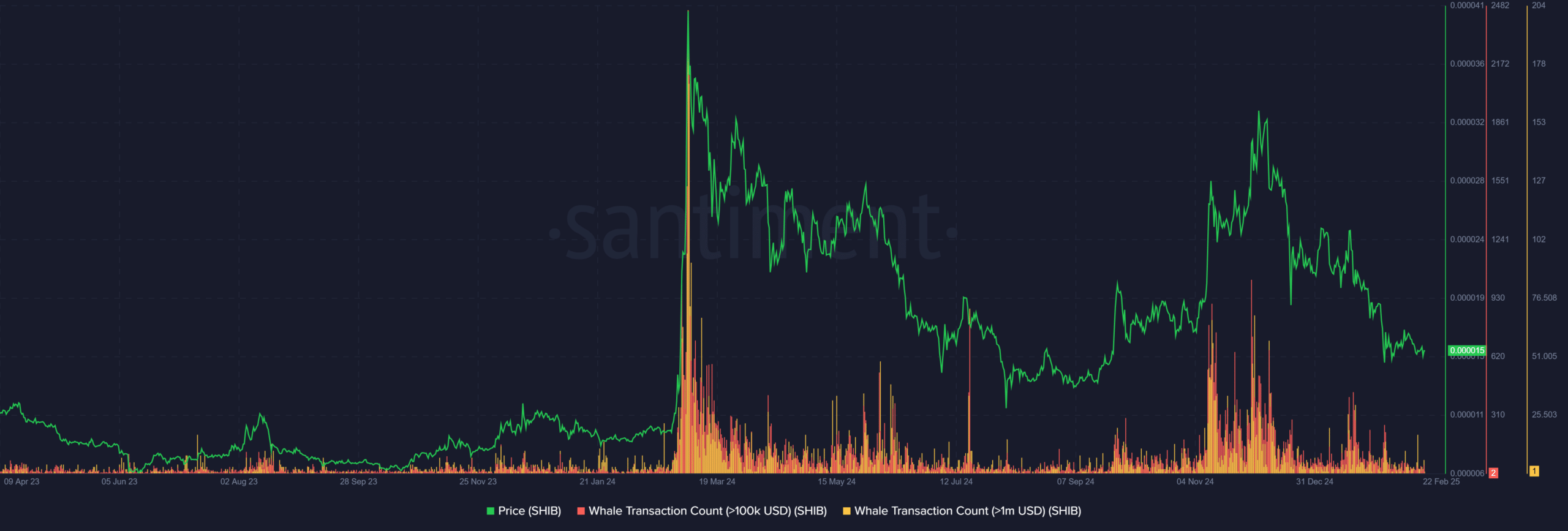

Is this just a seasonal trend?

Memecoins have historically shown seasonal trends, often surging ahead of major catalysts like bull market speculation, celebrity endorsements, or exchange listings.

Q1 tends to be a quieter period for speculative assets, while Q2 and Q4 have often brought stronger gains.

Source: Santiment

Dogecoin, for example, saw whale activity drop before its explosive rallies in April 2021 and October 2022. Similarly, SHIB’s October 2021 all-time high came after a summer accumulation phase.

These cycles suggest that whale movements often reflect shifting liquidity rather than a permanent loss of confidence.

With Bitcoin’s halving and ETF-driven liquidity shifts shaping broader market trends, SHIB’s whale exodus could be a sign of capital rotating elsewhere, rather than outright abandonment.

If past trends hold, whale activity may return as liquidity flows back into risk assets.

What this means for SHIB and memecoins

SHIB’s whale decline presents two possibilities: There is either a seasonal slowdown before a resurgence, or a deeper shift in investor sentiment.

One concern is competition from newer memecoins like PEPE and BONK, which have gained traction in recent months, fragmenting memecoin capital.

However, SHIB remains a major player, with its Shibarium ecosystem driving new developments. The recent MEXC exchange integration of Shibarium for deposits is one step toward boosting adoption and utility.

Despite reduced whale activity, SHIB’s price is still up 53.65% over the past year, rising from $0.000010 in February 2024 to around $0.000015 in February 2025.

This suggests that while whale interest has waned, SHIB isn’t necessarily in decline — its next move will depend on whether liquidity cycles bring fresh capital into memecoins.

While SHIB faces challenges from emerging competitors and reduced whale activity, strategic advancements in its ecosystem and historical performance trends indicate potential for recovery.