- U.S. Senate advances stablecoin regulation with GENIUS and STABLE Acts under the Trump administration.

- Stablecoin activity surges, signaling potential market rebound amid growing regulatory clarity.

In a move that underscores the shifting momentum of U.S. crypto policy under the Trump administration, Senate Majority Leader John Thune has signaled plans to push forward stablecoin regulation ahead of the Memorial Day holiday.

U.S. lawmakers target Stablecoins

As reported by Politico, Thune informed fellow Republican senators during a closed-door session that the chamber would soon take up the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act.

This bill introduced in February by Senator Bill Hagerty and has already been approved by the Senate Banking Committee.

This development reflects a broader drive within the U.S. government to bring clarity and structure to the fast-growing stablecoin market, amid rising interest in digital assets both domestically and abroad.

While Senator Thune has not publicly addressed any crypto-specific legislation in his commentary on President Trump’s first 100 days, significant developments have unfolded behind the scenes.

Since taking office, Trump has issued several executive orders that, while not yet law, hint at a new direction for U.S. crypto policy, particularly regarding stablecoins.

One such order, signed on the 23rd of January, initiated a working group to explore the formation of a national crypto reserve and a regulatory framework for stablecoins.

Details of the bill

This effort has dovetailed with Republican lawmakers’ introduction of two complementary bills: the GENIUS Act and the STABLE Act.

If enacted, the GENIUS Act would limit the issuance of payment stablecoins exclusively to approved entities, signaling a more controlled approach.

Meanwhile, Trump’s connection to World Liberty Financial — the company behind the newly launched USD1 stablecoin has stirred political concern, with critics warning of potential conflicts of interest as lawmakers deliberate over the proposed legislation.

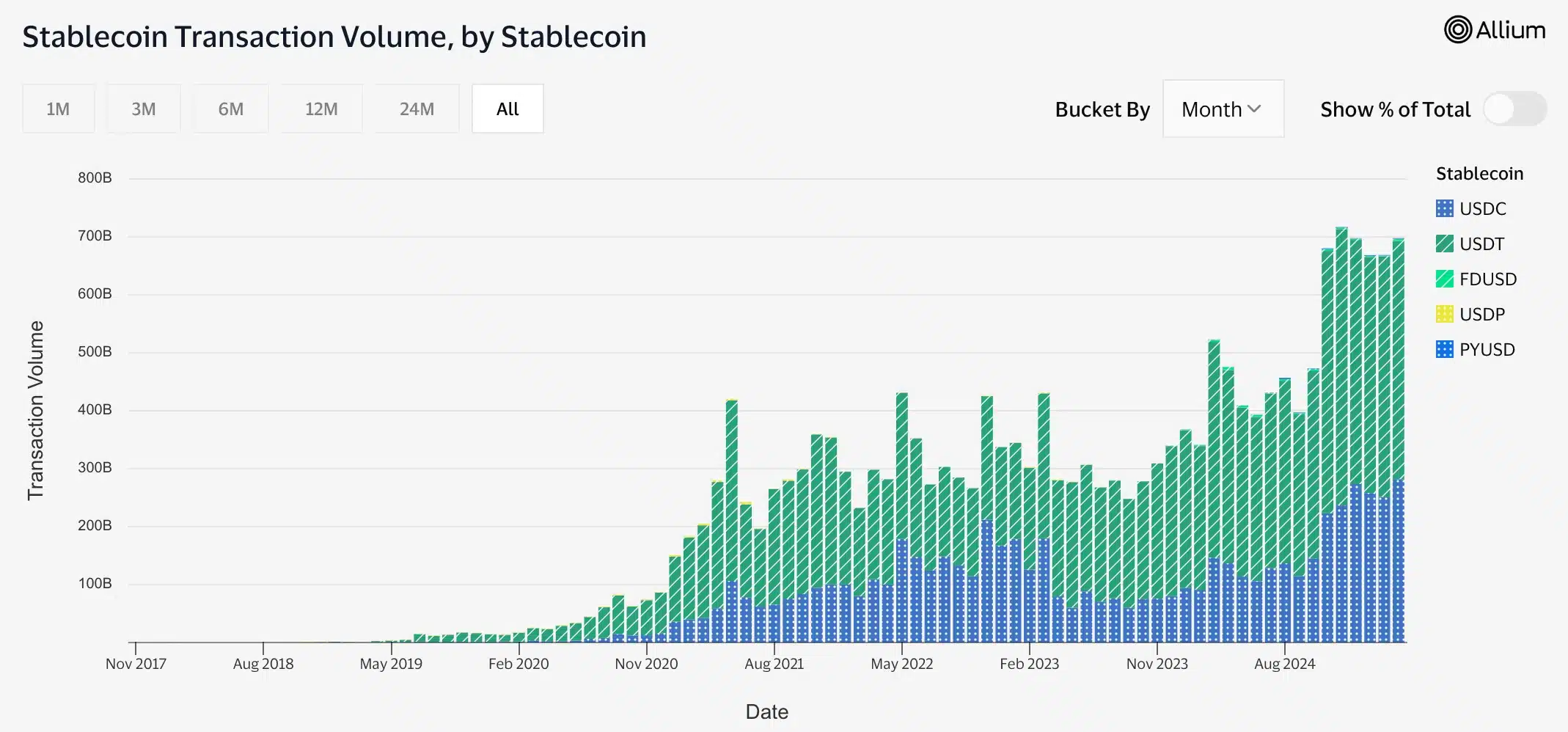

Interestingly, these regulatory moves arrive at a time when stablecoins are seeing a resurgence in activity.

Stablecoins current status

According to VisaOnChainAnalytics, stablecoins recorded a staggering $697.69 billion in transaction volume in April alone, with Tether’s USDT leading the charge, followed closely by Circle’s USDC.

Source: VisaOnChainAnalytics

Notably, USDT reserves on Binance have been quietly increasing, a development seasoned traders often interpret as a signal of renewed market participation.

Historically, such inflows have preceded phases of heightened buying activity and broader crypto market recoveries.

Thus, while the overall market remains cautiously poised, the underlying data suggests that momentum may be quietly building, fueled by both regulatory clarity and capital readiness.