- PEPE saw heavy selling pressure, but exchange reserves have been falling too

- With holders selling at a loss, faith in the memecoin’s recovery appeared to be extremely low

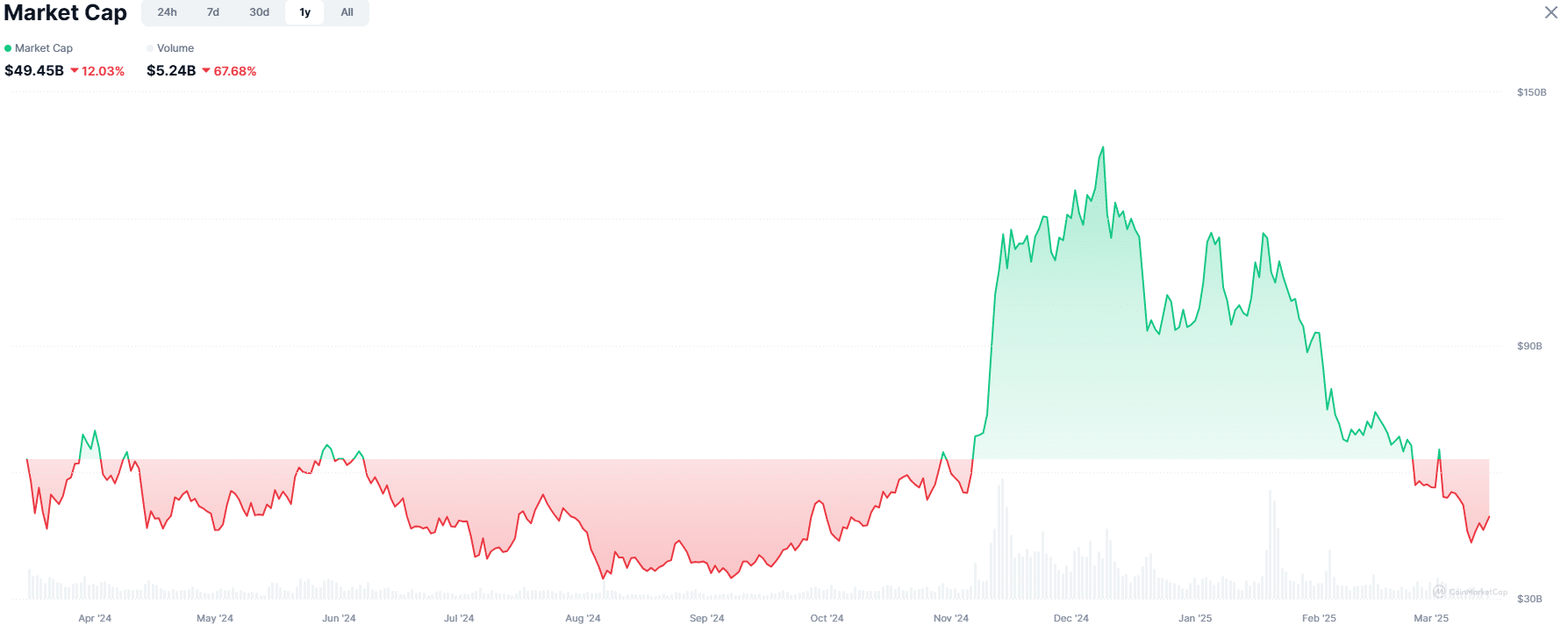

PEPE, at the time of writing, had bounced by 35.2% in just four days. However, its daily chart revealed that a downtrend was still in play and dominant. In fact, it faced a 75.1% drawdown from its December highs.

Worth noting, however, that the crypto market as a whole has suffered significant losses in the last three months.

Source: CoinMarketCap

The memecoin sector has been one of the worst performing ones in recent months.

It has shed $87.5 billion since 9 December – A 63% reduction. In light of the lack of significant bidding in the market, here’s why investors can have a little bit of hope in PEPE’s recovery.

PEPE holders decide – Accumulation or capitulation time?

Source: Glassnode

The balance on exchanges saw a relatively flat trend throughout 2024. Towards November, as the price began to rally higher, the balance on exchanges began to trend lower. Since then, this downtrend has continued, even though the price has also been in a freefall.

This hinted at HODL behavior from investors – Holders were withdrawing their PEPE and placing it in cold storage. While this accumulation can be seen as a bullish sign, so far, it has done little to halt the price’s decline.

Source: Glassnode

The spent output profit ratio (SOPR) divides the realized value of the spent outputs (price at which coins were sold) by the value at which they were acquired. Values above 1 indicate holders are selling at a profit, and values below 1 signal sales at a loss and bearish sentiment.

Since early February, the SOPR has been below 1 – A sign of capitulation among holders. This steady sell pressure forced PEPE to make a series of lower lows. This trend might not reverse itself until Bitcoin [BTC] does and PEPE records extraordinary demand.

Source: PEPE/USDT on TradingView

The MACD was below zero and showed the momentum was predominantly bearish. The market structure was also bearish and has been this way since late January. The OBV was in decline over the past three weeks, but hovered around its early February lows at press time.

Overall, the sellers were dominant. However, the falling PEPE balance on exchanges may be a glimmer of hope for investors. It is unlikely to be enough to reverse the downtrend, but it’s still a start.