- Bitcoin’s rally above $98K contrasts sharply with persistently negative investor sentiment; disbelief may signal opportunity.

- Substantial ETF inflows are boosting BTC, but 2022-style risks could still derail the momentum.

Despite Bitcoin’s [BTC] impressive hold above the $98K mark, investor sentiment has taken a sharp turn lower. This brings along a wave of doubt that feels oddly out of place in a bull market.

Is the market caught in disbelief, priming for a euphoric breakout? Or do these signals mirror the 2022 bear market?

With BTC’s recent surge reigniting momentum, the current climate may be driven as much by psychology as by fundamentals.

A bull run clouded by doubt

Recent data revealed a striking divergence between Bitcoin’s price and prevailing sentiment on X (formerly Twitter) and news platforms.

Even with BTC trading confidently above $98K, the 7-day average sentiment remained firmly negative – a pattern historically associated with local bottoms and contrarian buying opportunities.

Source: Alphractal

This persistent disbelief suggests that the market is psychologically lagging behind price action.

While such sentiment drops have previously preceded bullish reversals, it’s worth remembering the cautionary tale of 2022, where extended negativity coincided with a prolonged bear phase.

The institutional engines behind BTC

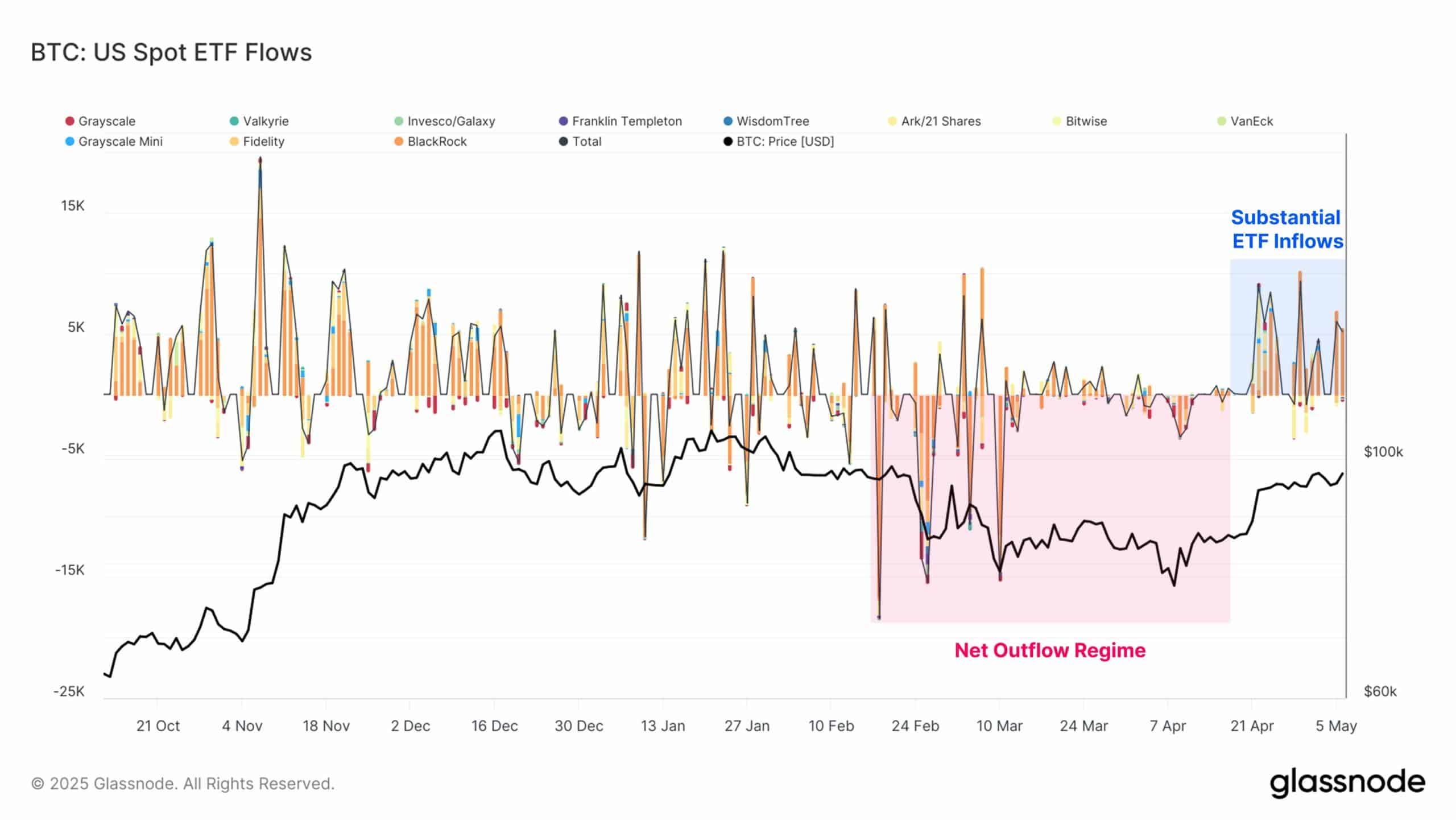

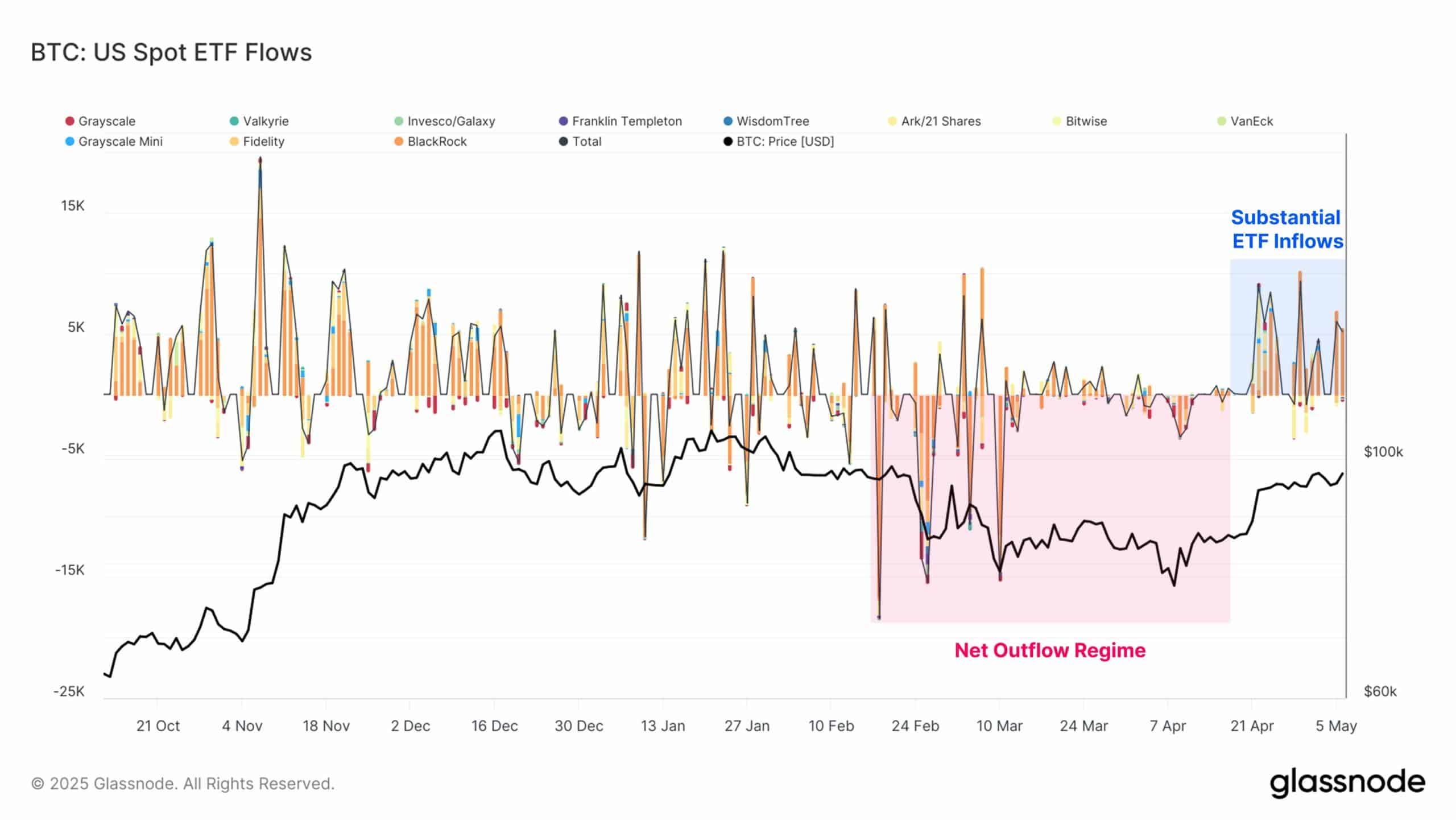

A sharp shift is visible on the ETF flow chart: after weeks of consistent outflows, April ushered in a regime of substantial spot ETF inflows.

This renewed institutional interest, primarily led by giants like BlackRock and Fidelity, appears to have reignited Bitcoin’s upward momentum, pushing it past the $98K mark.

Source: Glassnode

Unlike the volatile flows of earlier months, this phase shows steady daily net inflows, signaling strong long-term conviction.

Institutional confidence may be the key force behind the surge, even as retail sentiment remains cautious.

What could go wrong?

While ETF inflows signal optimism, history reminds investors to stay cautious.

In 2022, bullish sentiment, driven by institutional products and macro trends, collapsed due to liquidity shocks and excess leverage.

A sudden shift in risk appetite or regulatory pressures could trigger rapid outflows, reversing recent gains.

Although ETFs offer transparency, they don’t shield Bitcoin from market volatility. If inflows slow or turn to redemptions, Bitcoin could face sell-offs similar to past cycles.