- Shiba Inu’s Large Transactions dropped 66.15% in 48 hours, hitting a 2-week low in whale activity.

- If SHIB fails to close above $0.00001478, it could slide further to $0.00001387.

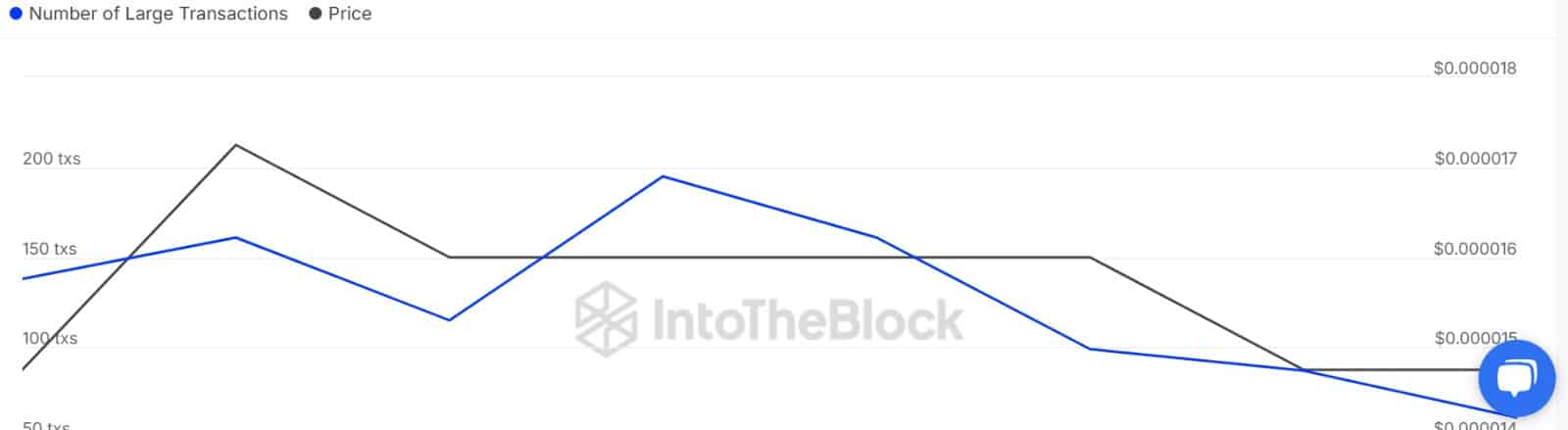

Over the past three days, Shiba Inu [SHIB] has experienced a significant drop in its whale activity. Since the market correction, it seems whales have taken a step back and their participation in the market has declined considerably.

Whale transactions plunge to 2-week low

In fact, SHIB’s Large Transactions fell from 195 to 66 in just 48 hours—a 66.15% collapse.

That’s the lowest figure in two weeks. Naturally, such a steep decline signals that whales are retreating from both buy and sell sides.

Source: IntoTheBlock

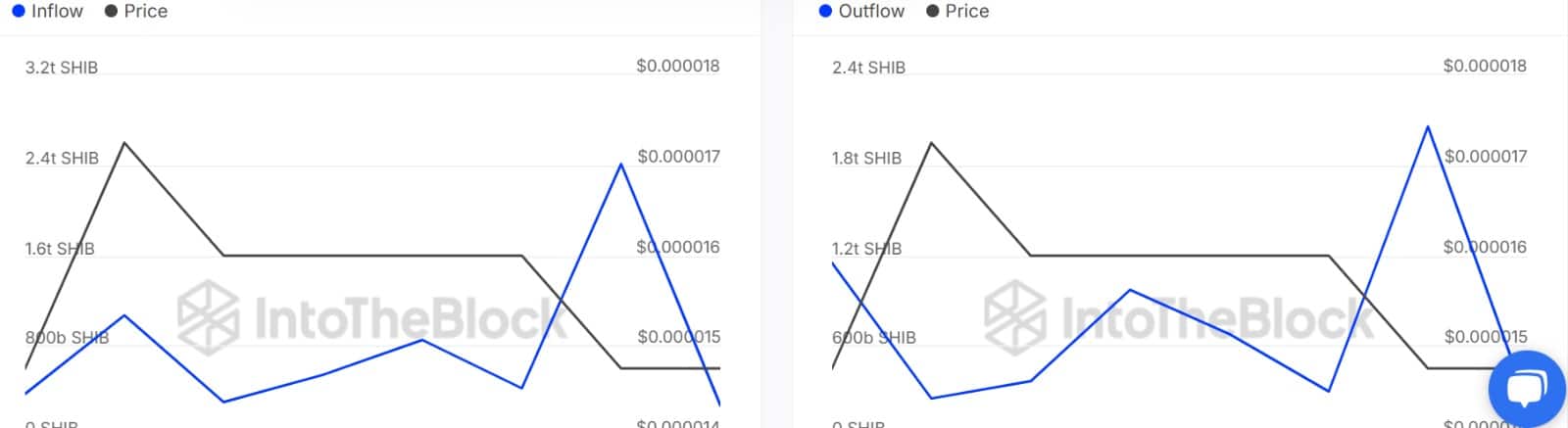

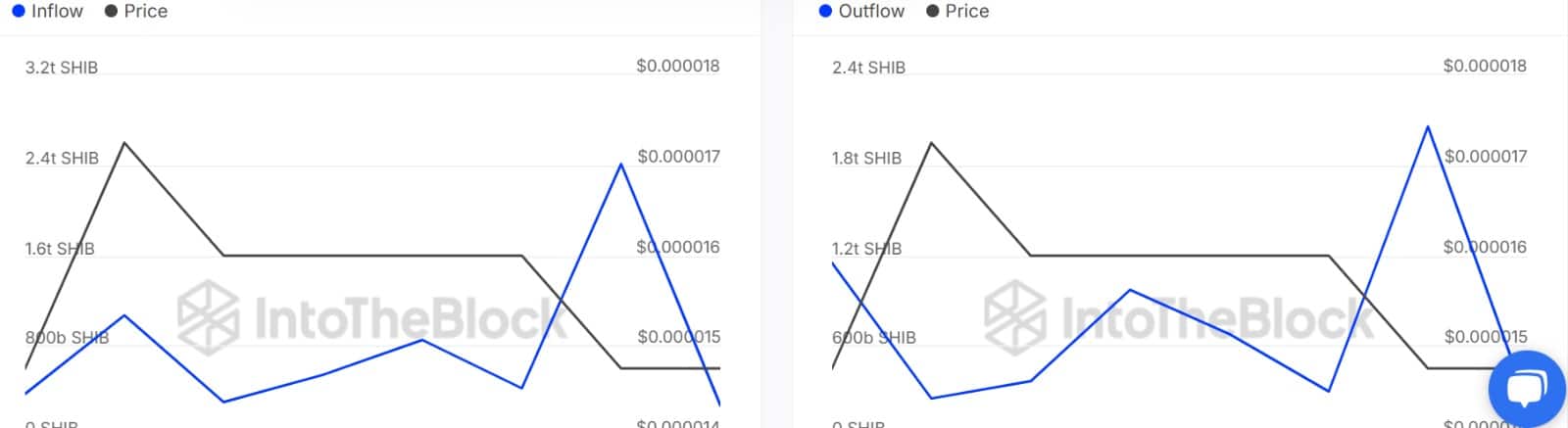

Looking at the memecoin’s Whale Outflow, it has plummeted from 2.06 trillion to 221.6 billion. This implies that whales are selling less SHIB, which is usually perceived as a bullish market signal.

The same pattern has emerged in Shiba Inu’s capital inflow.

As per IntoTheBlock data, SHIB whale buying has significantly declined from 2.4 trillion to 271.9 billion. Both outflow and inflow have declined by over 2 trillion each, signaling a massive drop in whale activity.

Source: IntoTheBlock

In short, the absence of conviction is loud. Buyers aren’t confident enough to enter, while sellers appear unwilling to offload at these levels.

For now, whales seem content to sit on the sidelines.

Price falls as retail traders take charge

With whales taking a step back in the market, demand for Shiba Inu has also dipped. This decline has negatively affected SHIB’s price action.

As of writing, SHIB traded at $0.00001429, down 5.65% in 24 hours. SHIB has closed with lower lows, dipping on its price charts for six consecutive days.

Source: TradingView

The recent decline indicates a change in market sentiment, with sellers now taking control. As a result, spot activity, particularly among retail traders, is primarily focused on selling.

This observation is further supported by the latest bearish crossover on the Shiba Inu RSI.

On the daily charts, the RSI has crossed over into bearish territory, signaling an increase in downward pressure as sellers become more dominant.

With the MA flipping its RSI, it signals a higher selling pressure.

Volume delta turns red as sellers dominate

Sell volume surged to 2.58 billion while buy volume hit 2.43 billion, leaving a negative Delta of -148.89 million. That’s another nail in the short-term bullish case.

Source: Coinalyze

Therefore, Shiba Inu is experiencing strong downward pressure as bearish sentiment dominates the market.

With whales and retailers all exhibiting bearishness, Shiba Inu risks further losses. If the prevailing market conditions persist, SHIB could drop to $0.00001387.

For a trend reversal, buyers need to return to the market to ensure a daily close above $0.00001478.