- ai16z crypto has rallied by more than 27% in 24 hours and formed a fresh ATH at $1.77.

- These gains came amid plans to launch a layer-one network.

ai16z [AI16Z], at press time, traded at $1.61 after a 27% gain in 24 hours. These gains follow rising interest in the altcoin after trading volumes spiked by 101% per CoinMarketCap.

ai16z was among the top performers in December 2024, given that during the month, its market capitalization increased four-fold from below $400 million to $1.75 billion at press time.

In fact, these gains saw the token hit an all-time high of $1.77 on the 31st of December.

One factor behind the recent rally to an ATH is a proposal to “position ai16z as an L1 [layer one] network.” This proposal also outlines plans to improve tokenomics and drive more value to AI16Z.

The ai16z crypto currently runs on the Solana [SOL] blockchain. However, if it launched its own layer-one blockchain and boosts utility, it could bode well for long-term gains.

ai16z crypto price prediction

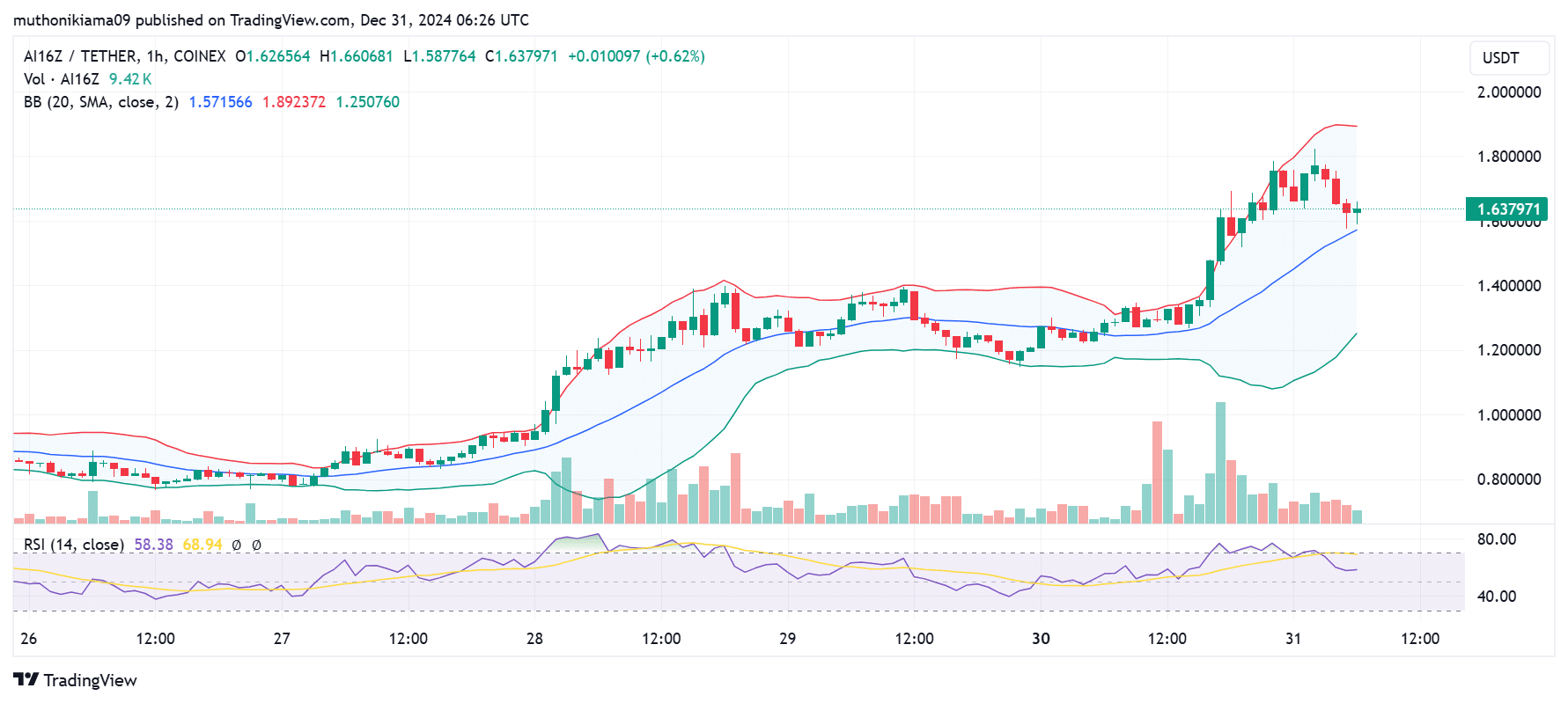

ai16z’s hourly chart shows a tussle between buyers and sellers, as traders who bought during the uptrend booked profits once the rally faltered.

The Relative Strength Index (RSI) on the lower timeframe was tipping south, which shows waning buyer interest. At the same time, the RSI line had formed a sell signal after crossing below the signal line.

Source: TradingView

The Bollinger band indicators also show a similar outlook, with the ai16z crypto dropping from the upper band to the middle band.

The token is also defending support at $1.57, but if it fails, it could be set for a correction to the lower band at $1.25.

On the other hand, the key resistance level lies at the upper Bollinger band at $1.89. If ai16z crypto rallies to this level, it will have formed a fresh ATH.

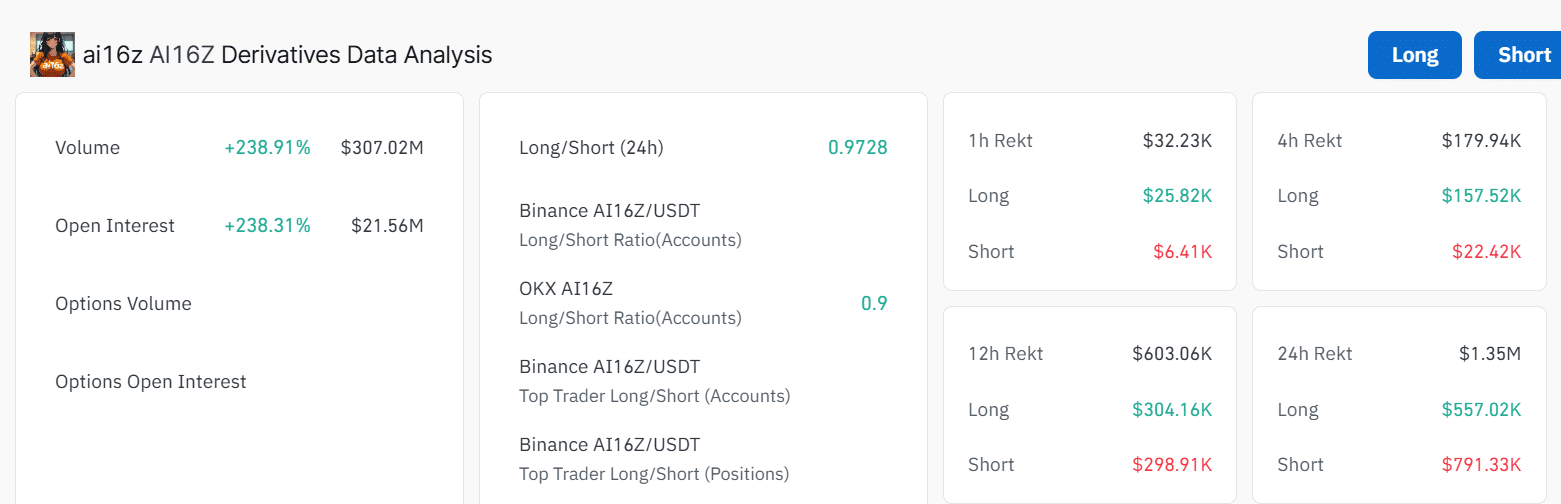

Derivatives data analysis

An analysis of ai16z’s derivatives market shows that speculative interest is notably high. At press time, open interest stood at $21 million after a staggering 238% gain in 24 hours.

Derivative trading volumes had also surged to $308 million.

Source: Coinglass

This surge shows that traders are taking advantage of the volatile price movements to open and close new positions.

A spike in Open Interest alongside price gains also shows conviction among traders about the price movements.

The surge in both long and short liquidations in the last 24 hours is also behind the volatile price movements.

Can ai16z sustain the gains?

One of the key factors behind ai16z’s rally is a spike in buying activity. If buyers can sustain the momentum, the crypto could sustain its gains.

However, if buying interest wanes and selling activity increases as traders seek to take profits, the rally could falter.

Read ai16z’s [AI16Z] Price Prediction 2025–2026

Additionally, the rising interest from derivative traders has stirred the recent volatile price movements.

Traders should watch out for sudden liquidations and closure of open positions, as that could also impact future price moves.