- ARB’s breakout from consolidation and golden cross signals potential for further price increases.

- RSI, daily active addresses, and funding rate show strong bullish support for ARB’s upward momentum.

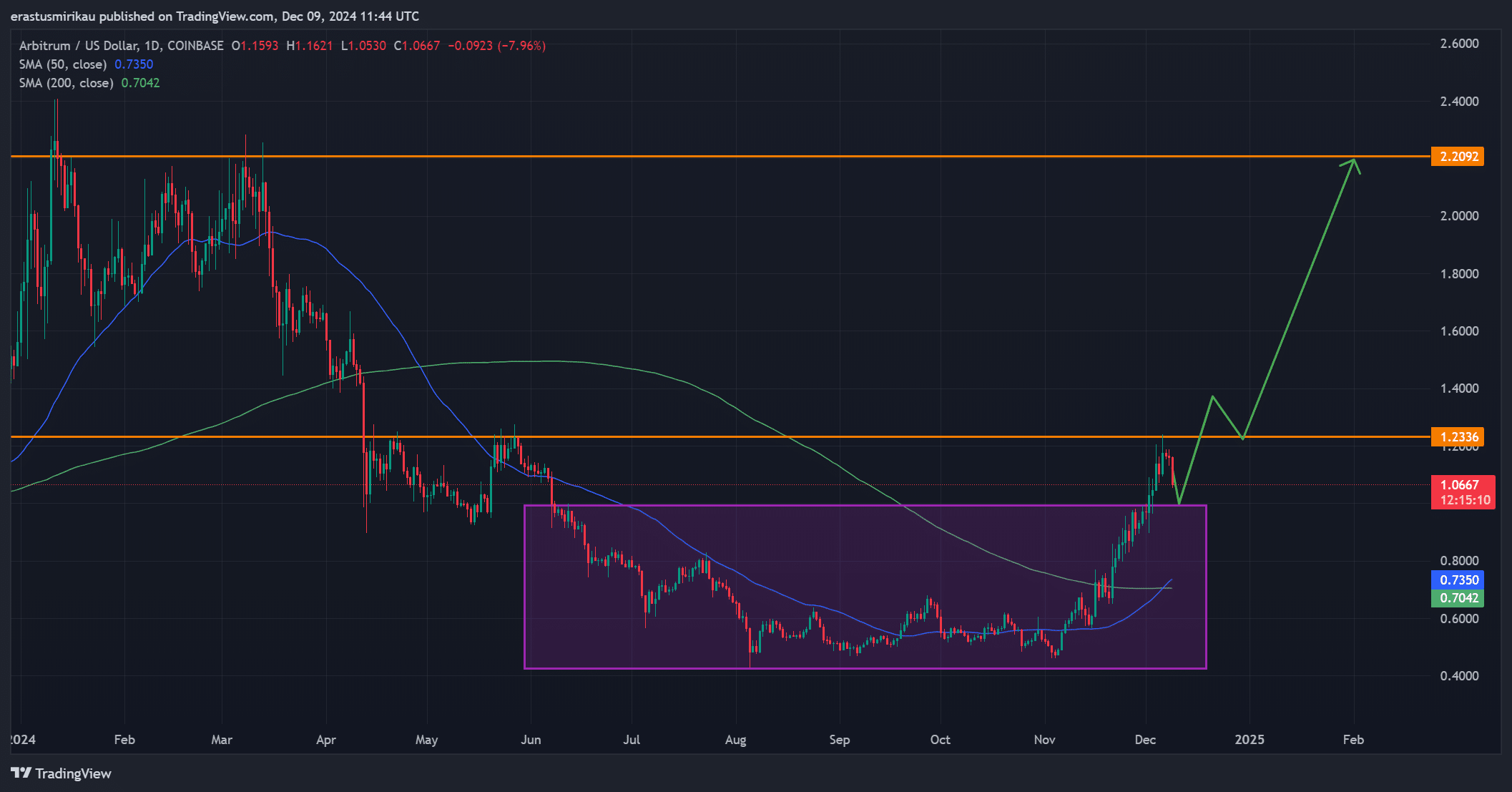

Arbitrum [ARB] has achieved a significant milestone with an all-time high TVL of $5 billion, reflecting growing investor confidence and market interest. This success indicates a strong commitment to the project’s potential, and the technical charts show a bullish breakout from a prolonged consolidation phase.

With a golden cross formation now visible, ARB approaches a crucial resistance level at $1.2. Will this bullish momentum continue, or will resistance put the brakes on its upward progress?

Breakout from consolidation likely, but a test lies ahead

Arbitrum has broken out of a prolonged rectangular consolidation phase that lasted over two years. However, it may need to retest this resistance before a definitive breakout. A successful move past $1.2 could push ARB prices to $2.2.

Therefore, traders and investors are closely monitoring this resistance, eager to see if a sustained breakout confirms a bullish trend. The golden cross formation adds weight to this bullish outlook, suggesting more upward movement may be on the horizon.

Source: TradingView

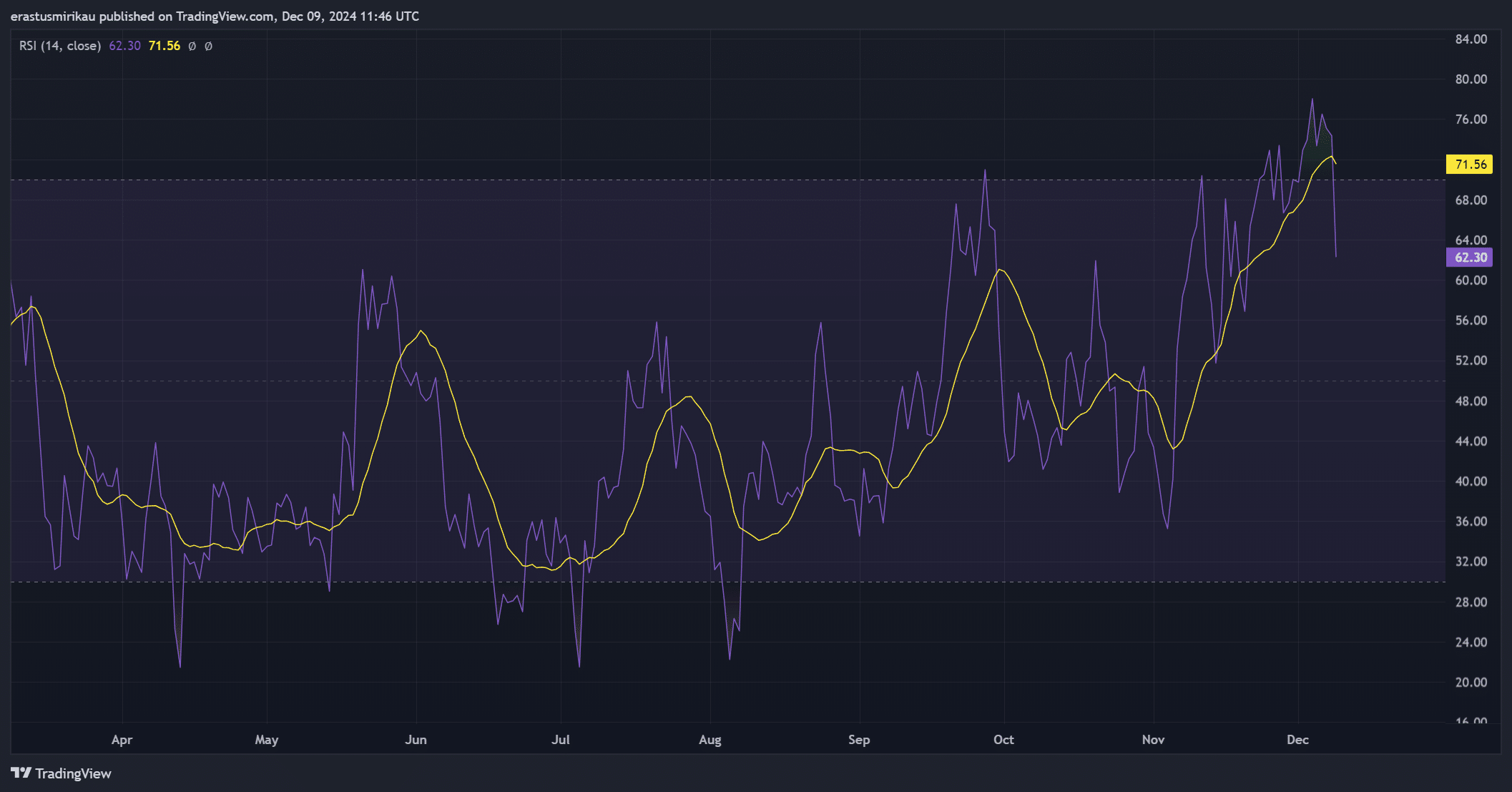

At press time, Arbitrum traded at $1.07, reflecting a 7.15% drop over the past day. However, the RSI remains at 62.3, a sign of strong bullish momentum. This resilience indicates that buyers still drive the market, despite short-term declines.

Such a high RSI value suggests that ARB retains solid support from investors, maintaining a bullish outlook even amidst recent price adjustments.

Source: TradingView

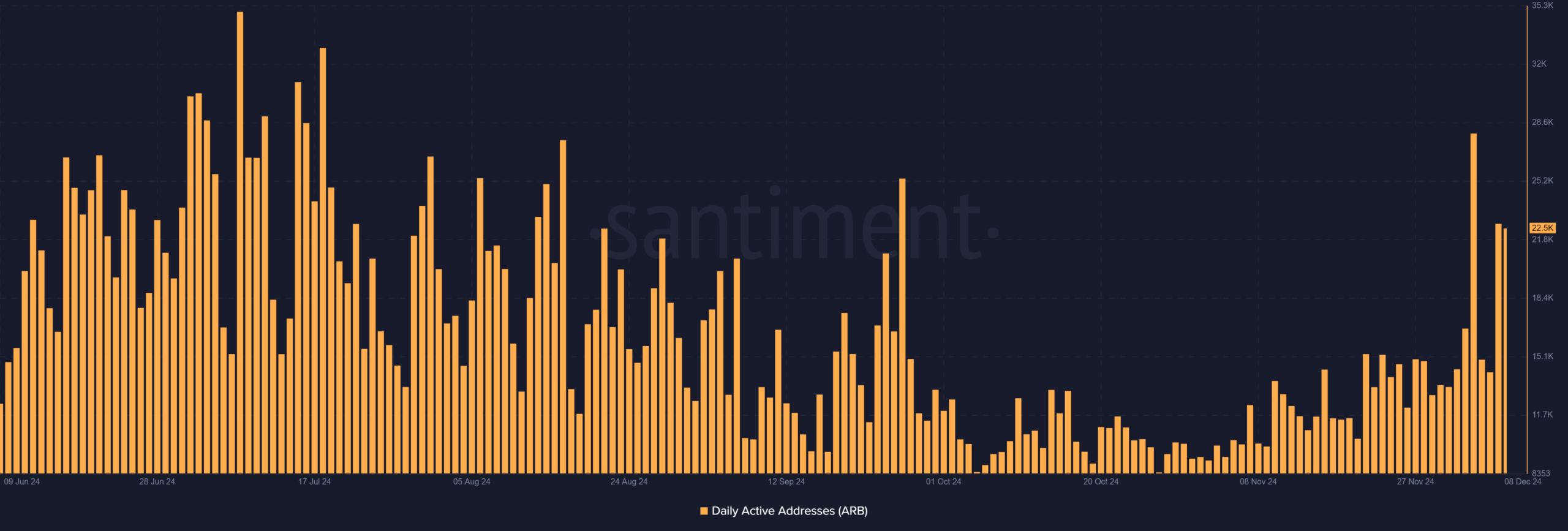

ARB: A healthy level of engagement?

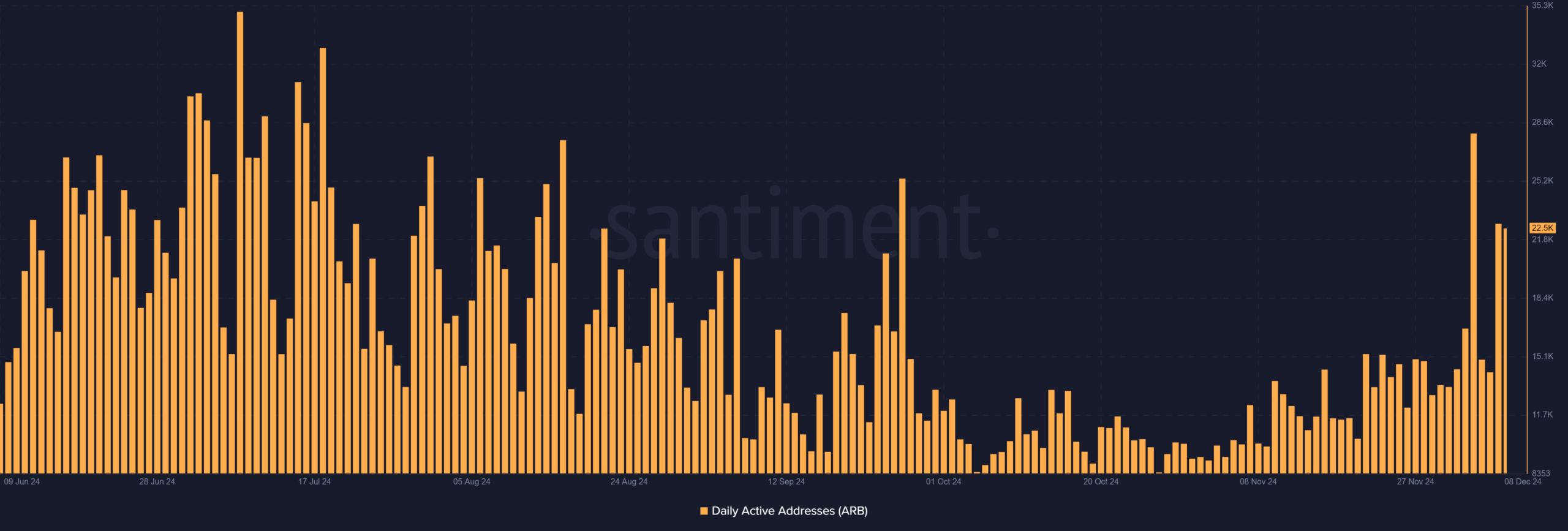

ARB currently sees a moderate 22.5K daily active addresses. This shows consistent user activity but leaves room for further growth. As more users engage with ARB, trading volume could increase, strengthening market dynamics and overall investor participation.

Therefore, higher engagement would signal greater interest and potentially higher trading momentum in the near future.

Source: Santiment

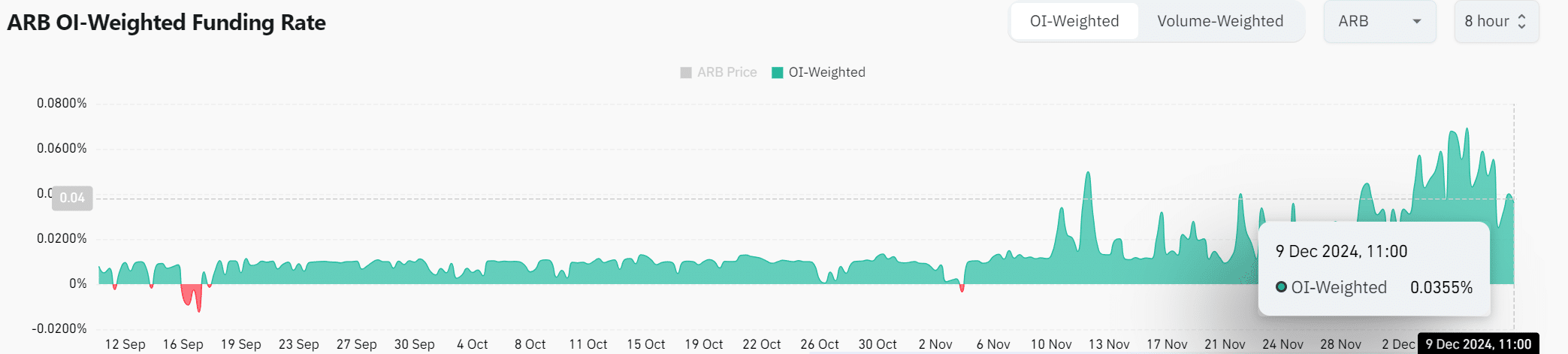

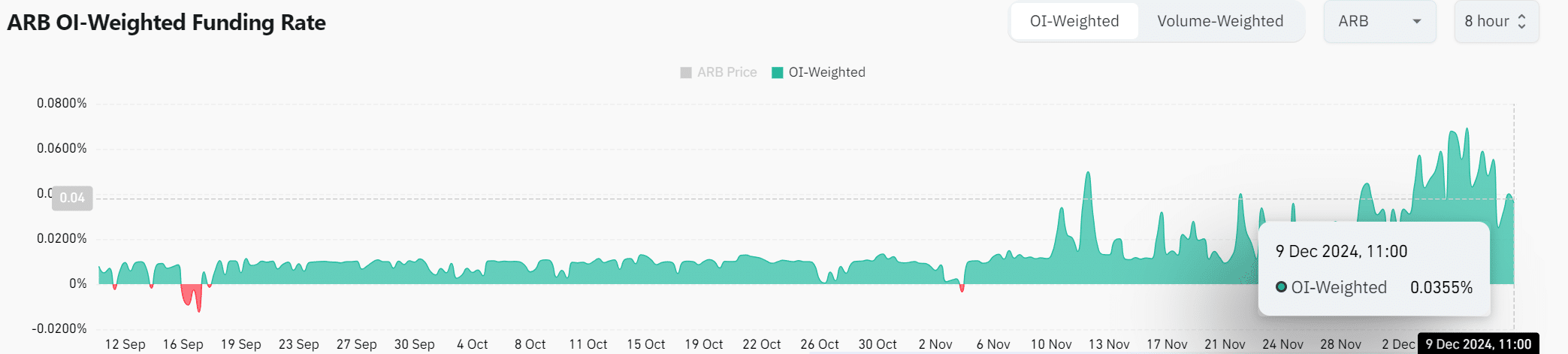

The Open Interest Weighted Funding Rate stands at 0.0355, indicating a positive sentiment among futures traders. This metric highlights investor confidence and interest in ARB contracts.

Additionally, it demonstrates that traders are willing to take long positions, which can contribute to further bullish momentum.

Source; Coinglass

Read Arbitrum’s [ARB] Price Prediction 2024–2025

Bullish momentum likely but resistance remains a key hurdle

ARB’s performance suggests a strong bullish trend, driven by a record-high TVL and a breakout from a prolonged consolidation phase. Although resistance at $1.2 poses a critical test, the golden cross and positive indicators suggest continued upward movement.

Therefore, while short-term pullbacks are possible, the bullish momentum looks robust, and a successful breakout above $1.2 could drive ARB prices significantly higher.