- BEAM saw a 10.83% price rise and a 217.05% increase in trading volume.

- High concentration by large holders at 85% could impact BEAM’s market stability, reflecting significant control by a few entities.

Beam [BEAM] has shown a notable price increase, valued at $0.01863 at press time, reflecting a 10.83% rise in the last 24 hours, per CoinMarketCap.

This surge in price has brought BEAM’s market capitalization to $921,524,187, a 10.90% increase, indicating a growing interest and investment.

The 24-hour trading volume is $36,608,453, a 217.05% rise, suggesting heightened trading activity.

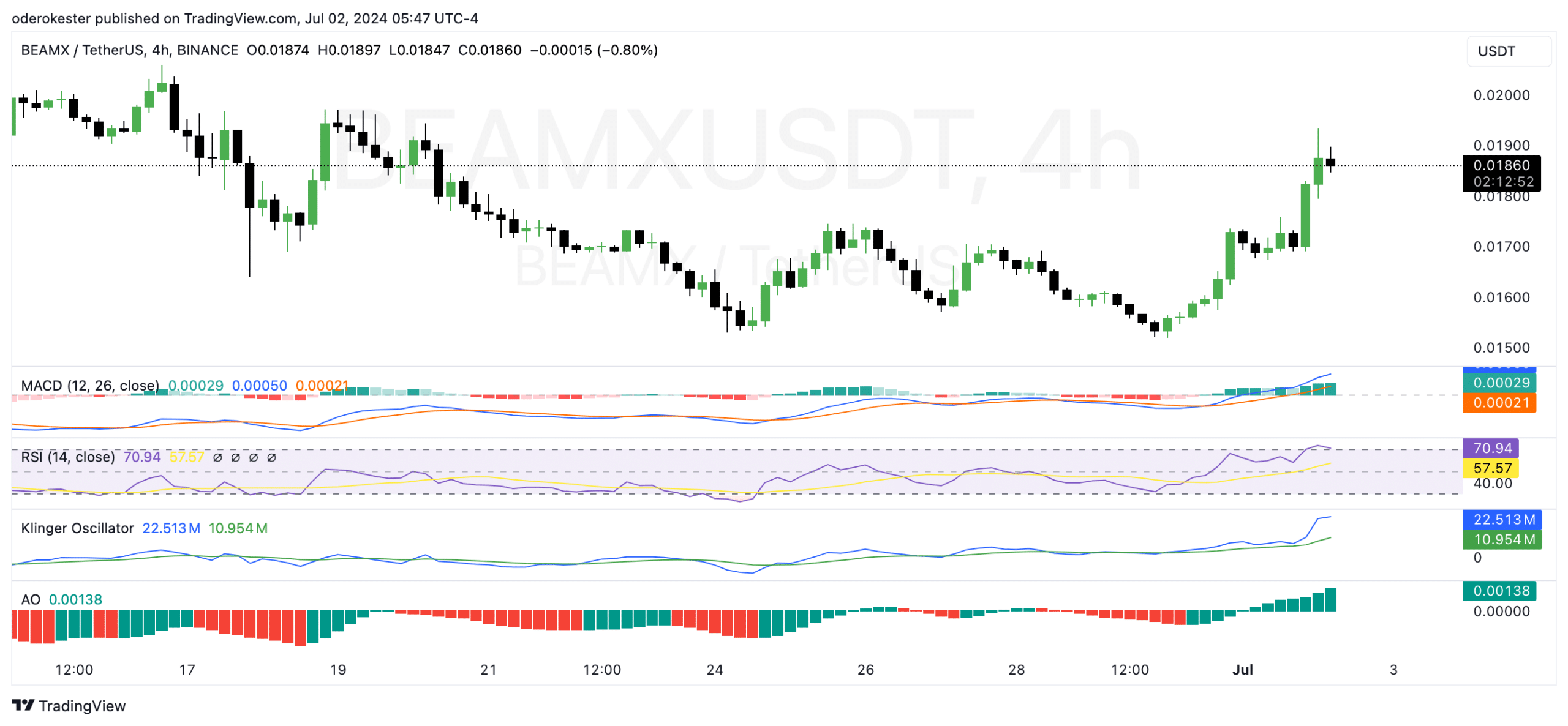

As of press time, the MACD was positive with a value of 0.00029, indicating increasing buying pressure. The RSI (14) was at 70.94, suggesting that BEAM was nearing overbought territory.

Additionally, the Klinger Oscillator showed a strong positive value of 22.516M, reinforcing the upward trend. The Awesome Oscillator (AO) also supported the bullish sentiment, with a value of 0.00138.

Source: TradingView

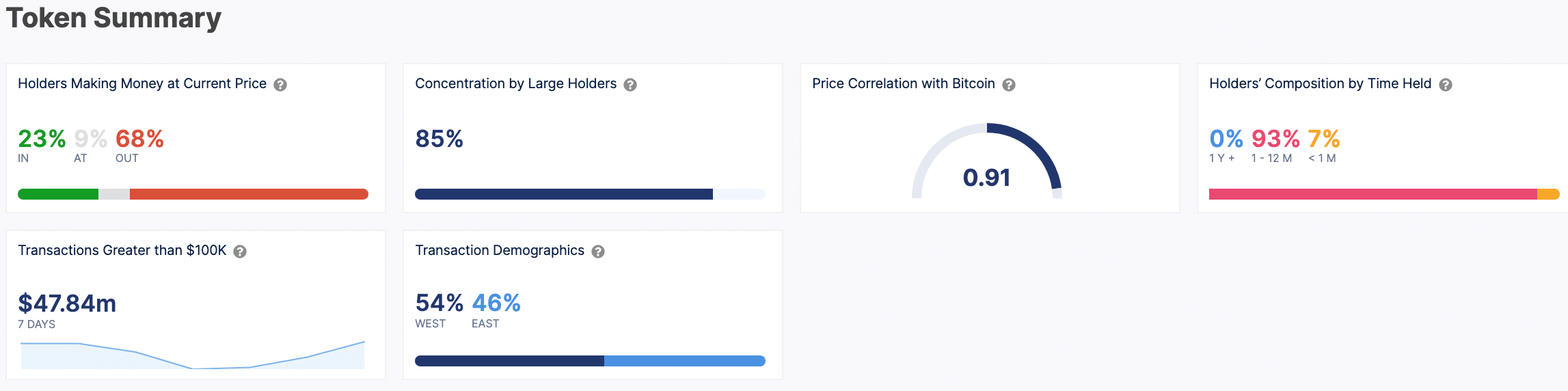

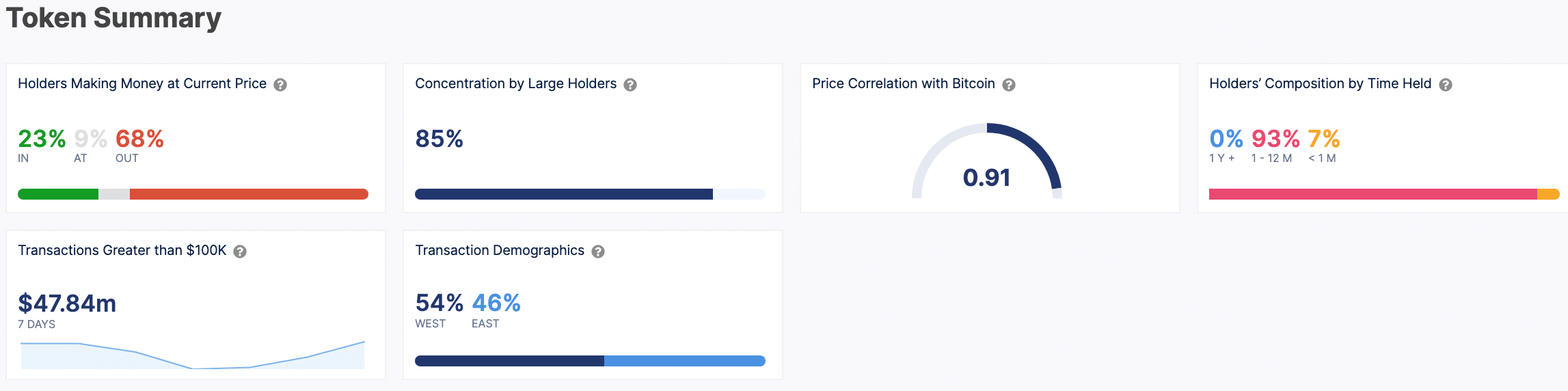

Holder profitability and market concentration

Despite the recent price increase, only 23% of BEAM holders were in profit, while 68% are at a loss, according to AMBCrypto’s look at IntoTheBlock data.

The concentration of large holders was high at 85%, indicating that a few entities controled a significant portion of the token supply.

BEAM’s price correlation with Bitcoin [BTC] was strong at 0.91, implying that BEAM’s price movements closely followed the king coin.

This correlation is typical for many altcoins, which tend to mirror Bitcoin’s market behavior. Hence, BTC recovering its $62,500 support and the market sentiment is turning bullish is setting the pace for BEAM’s rally to continue.

Source: IntoTheBlock

However, holder composition showed that 93% of holders have had their tokens for 1 to 12 months, with only 7% holding for less than a month and none for over a year.

This reflected relatively short-term investment behavior.

BEAM on-chain analysis suggests…

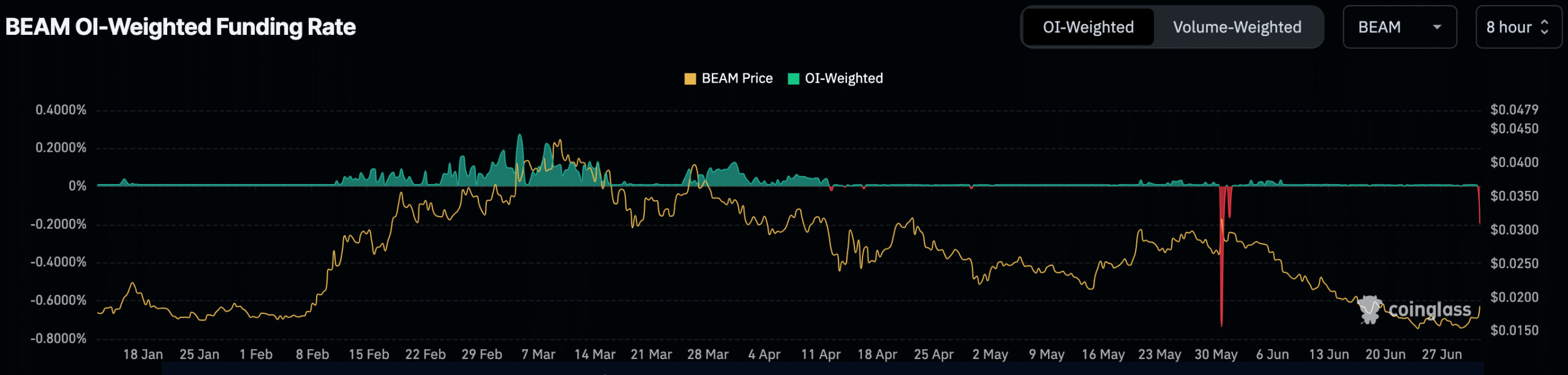

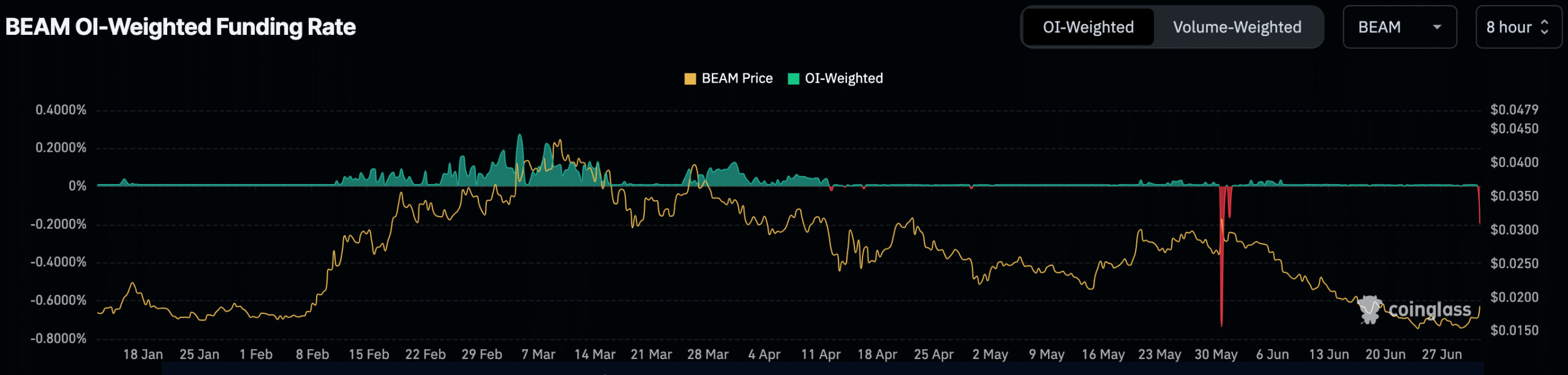

The Open Interest (OI)-Weighted Funding Rate for BEAM, displayed alongside its price, showed fluctuations around zero.

This rate indicated the cost of holding long or short positions in perpetual Futures contracts, with positive values suggesting long positions were paying short, and negative values indicating the opposite.

Source: Coinglass

Realistic or not, here’s BEAM’s market cap in BTC’s terms

From early January to the end of June, BEAM’s price generally trended downwards, from around $0.0450 to approximately $0.0180. During this period, the OI-Weighted Funding Rate showed minor fluctuations, with a few spikes.

These spikes often corresponded with sharp price movements, reflecting the dynamic interplay between futures market sentiment and BEAM’s spot price.