- FLOKI experienced an impressive 33% surge over the past seven days.

- Long-term holders anticipate FLOKI to surge past the $0.00020 resistance level.

Floki Inu [FLOKI] surged this past week, with transaction volume spiking and long-term holders making strategic moves. This led to an impressive 33% price increase.

At press time, FLOKI traded at $0.00015512, with its market cap climbing by about 5% to $1.48 billion.

It is no surprise that the memecoin is capturing community interest amid the bullish surge in Bitcoin and altcoins.

However, there is more driving the surge. On the 29th of August, FLOKI will take a snapshot of its holders for a future distribution of Simon’s cat [CAT] tokens.

Put simply, Binance FLOKI holders will get 10% of the CAT supply, while on-chain holders will receive 3.5%.

The strategy involves FLOKI offering CAT tokens as rewards to its holders, but can this strategy hold up in the long run? AMBCrypto investigates.

Airdrop conditions boost FLOKI’ short-term growth

In an official announcement on X (formerly Twitter), CAT developers revealed that to qualify for the airdrop, users must hold at least 400,000 FLOKI on Binance.

Furthermore, Binance conducted the first snapshot on the 22nd of August.

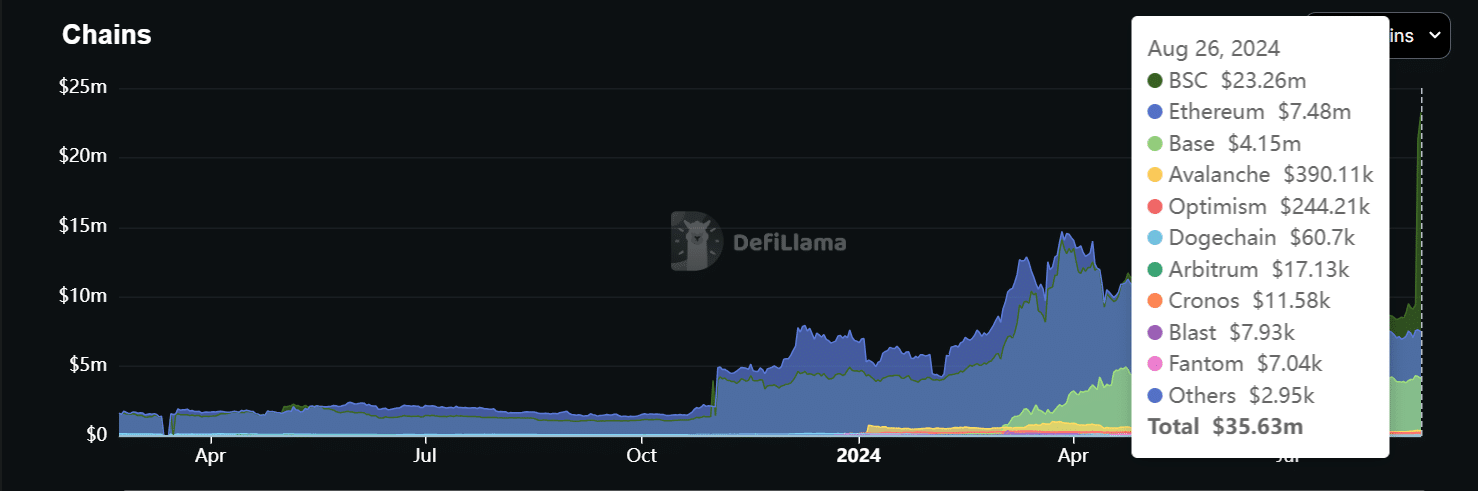

Following the launch, the meme token’ Total Value Locked [TVL] on the BSC chain doubled, reaching $26.3 million.

This showed growing investor confidence and increased participation within the ecosystem, as more users are staking or locking their tokens to meet airdrop criteria and gain potential CAT rewards.

Source : DeFiLama

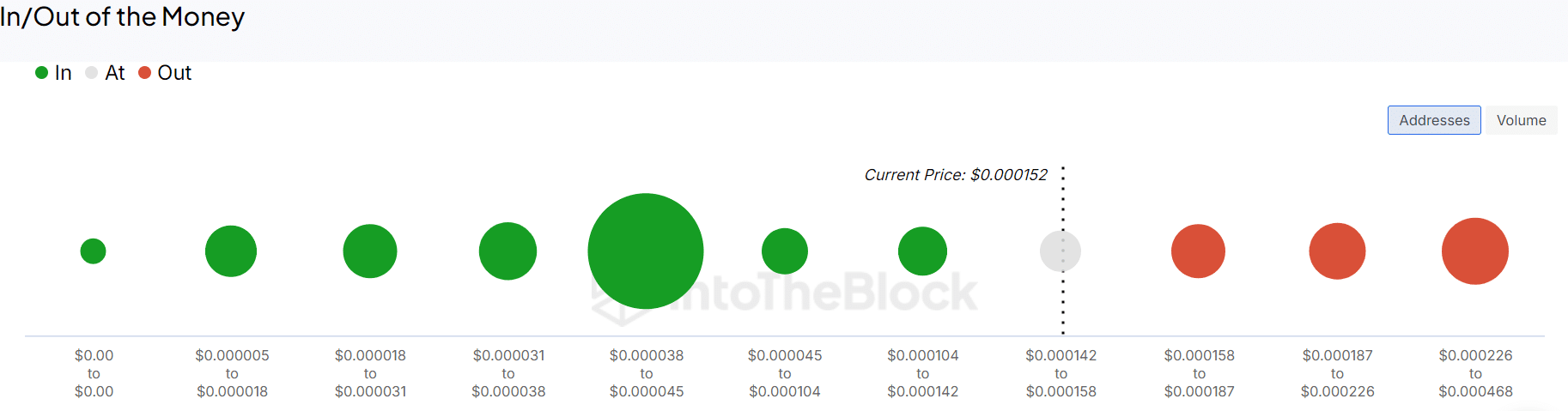

Consequently, analysts expect a notable reaction after the second snapshot on the 29th of August. With over 70% of FLOKI holders currently in profit, the atmosphere is charged with short-term optimism.

Source : IntoTheBlock

The anticipation of upcoming rewards could propel the token price, which recently tested the crucial $0.00015 level after the first snapshot.

This price action was supported by a positive Chaikin Money Flow (CMF) and an increasing Relative Strength Index (RSI), indicating bullish momentum and potential for further gains.

Put simply, the short-term rise in the token price could be linked to the strategic reward plan for holders and an overall positive economic sentiment upheld by Bitcoin rally.

However, the key question is whether this strategy can push FLOKI past its previous resistance level. AMBCrypto explored the latest market trends and uncovered the following insight.

Confidence among long-term holders could fuel the price

Captivated by Bitcoin’s current bullish appeal, analysts are contemplating whether FLOKI could rally to test the $0.00020 price range.

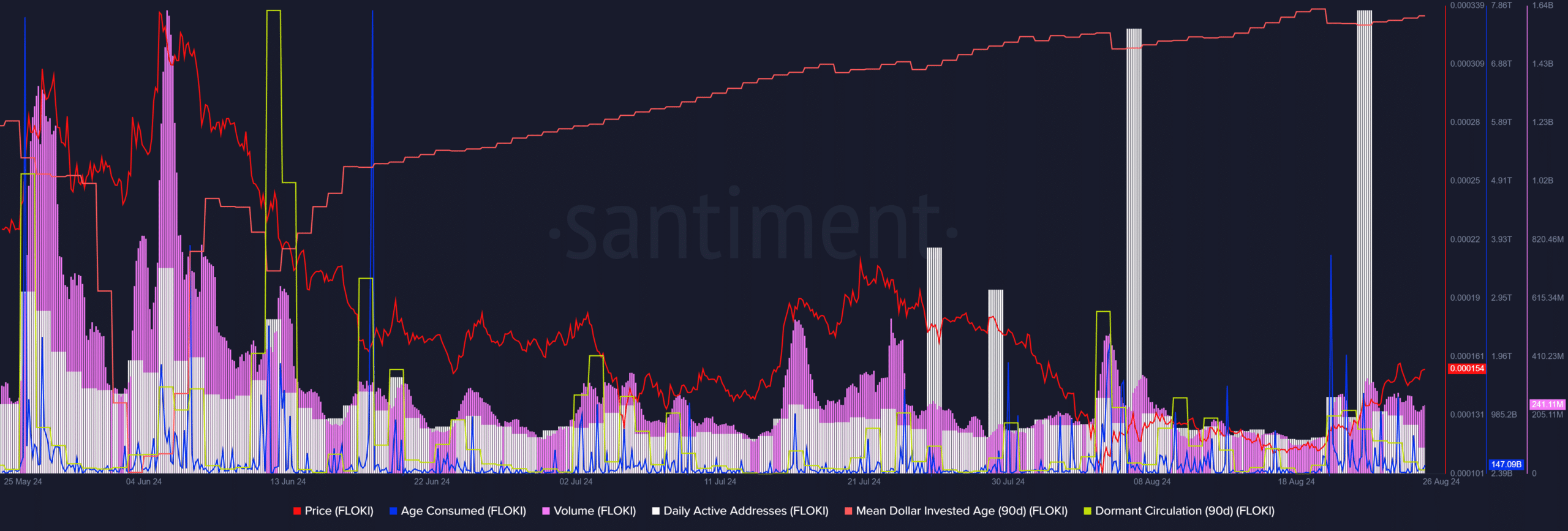

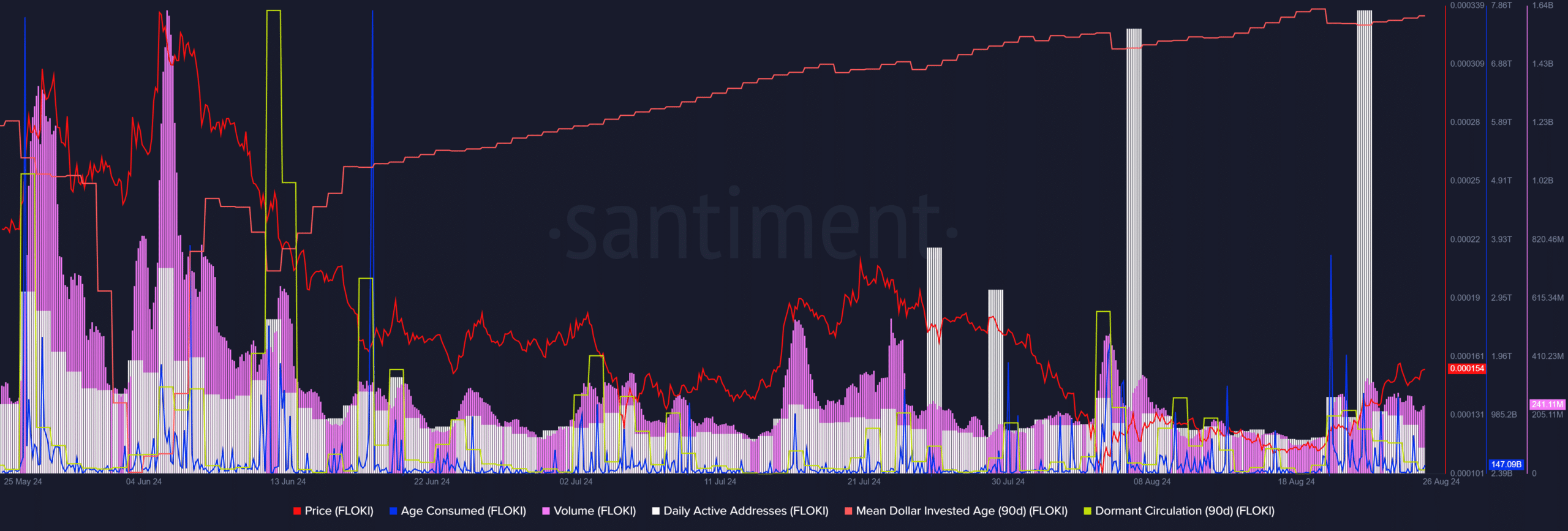

According to AMBCrypto’s analysis, on-chain data shows growing optimism among long-term holders, suggesting they are confident in the token’s potential for further gains.

On the day of the first snapshot, daily active addresses surged from 1.7K to 14K, while the mean coin age hit 1.05 trillion, suggesting that long-term holders are maintaining their positions.

Source : Santiment

Apart from the network volume, the current growth mirrored the mid-July trend, when the token price surged past $0.00020.

Read Floki Inu [FLOKI] Price Prediction 2024-2025

However, AMBCrypto also notes that the CAT strategy could very well attract more stakeholders, further driving the network volume.

Together, these factors could propel the memecoin beyond its previous rejection levels, paving the way for a new price surge.