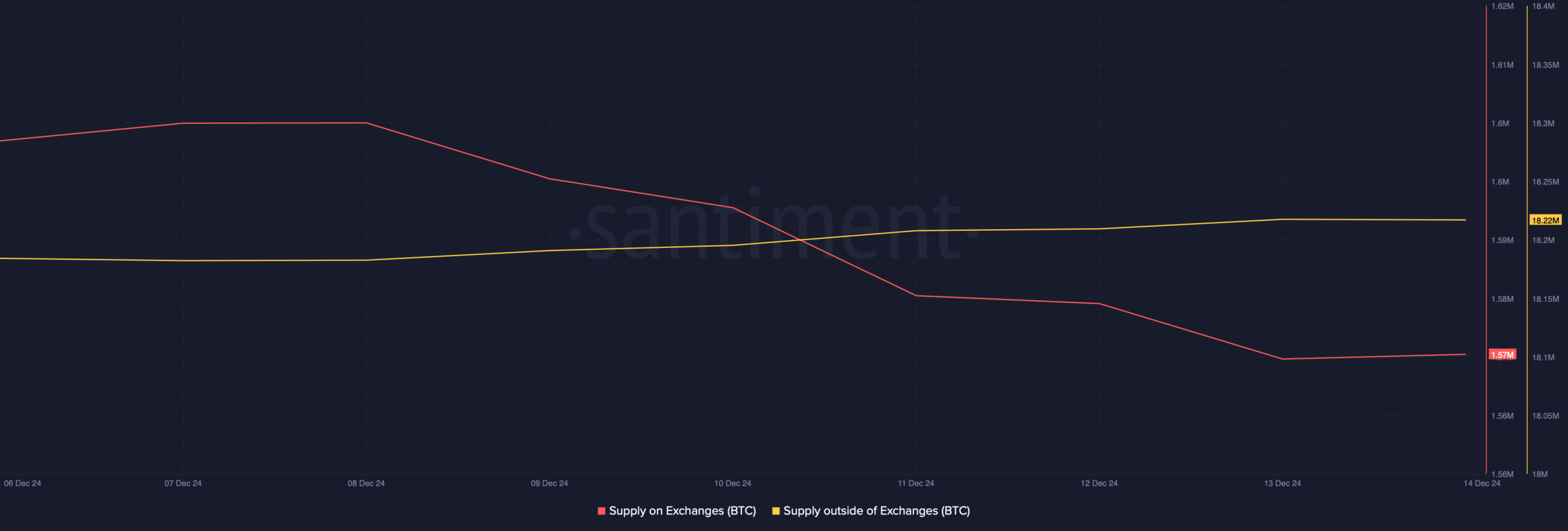

- Bitcoin’s supply on exchanges dropped over the last few days

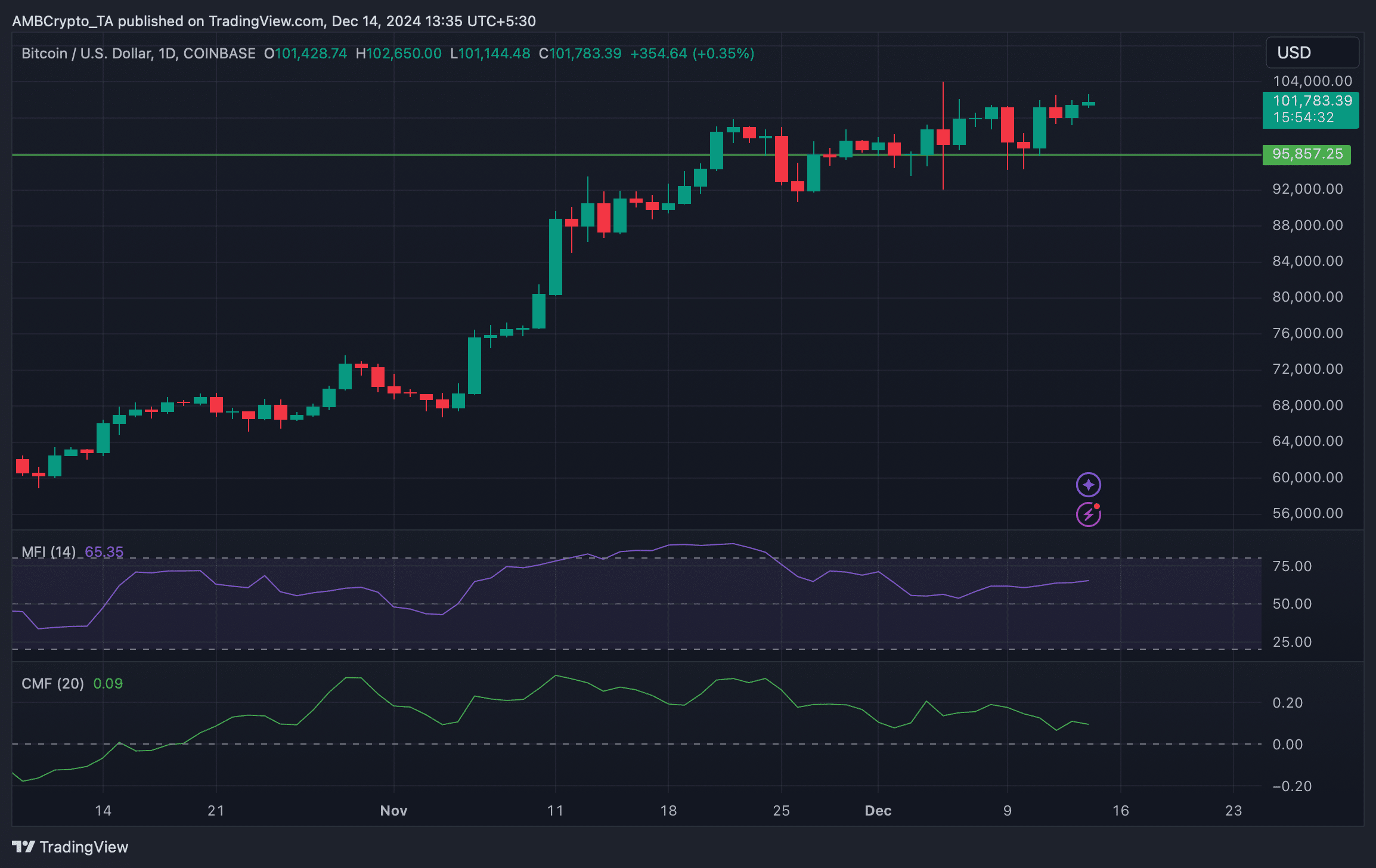

- The Money Flow Index (MF) repealed an uptick in buying pressure on the charts

Bitcoin [BTC], at press time, had successfully climbed above $100k, but there may be some trouble ahead. In fact, despite crossing this major resistance level, buying pressure has remained somewhat low.

Hence, the question – Will this low buying pressure cause BTC’s price to drop in the coming days?

What’s up with Bitcoin?

At the time of writing, the king coin was trading at $101.9k with a market capitalization of over $2 trillion. This, after it briefly dropped under $97.5k over the last 48 hours alone.

Soon after, Santiment, a popular data analytics platform, shared that as the week closed, buy calls were quiet on social media. For Bitcoin’s next big swing, this chart will be highly useful as to when to buy (while the crowd is panicked) and sell (while the crowd is greedy).

AMBCrypto found that over the last few days, BTC’s supply on exchanges dropped too. This meant that buying pressure on Bitcoin has been rising. While that happened, the coin’s supply outside of exchanges fell too, further pointing to a decline in selling pressure.

Source: Santimemt

What to expect from BTC

Apart from this, BTC’s exchange reserves have been falling too, as per CryptoQuant’s data. This further established the fact that buying pressure was high.

Additionally, Bitcoin’s Rainbow chart revealed yet another positive signal. According to the same, BTC is still within the accumulation trend. This suggested that there may be a further price hike in the coming days.

On the contrary though, the fear and greed index revealed that the market was in a “greed” phase over the last 24 hours. This meant that there was a possibility of a price correction.

Hence, AMBCrypto checked Bitcoin’s daily chart. As per our analysis, BTC’s Money Flow Index (MFI) registered an uptick, indicating a rise in buying pressure. If the uptick in buying sustains itself, Bitcoin might soon breach $102k.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Worth pointing out, however, that the Chaikin Money Flow (CMF) moved south. This can hold back any Bitcoin efforts to head north.

Source: TradinghView