- Bitcoin faced significant resistance between $98K and $100K.

- Shrinking exchange reserves and inflows signaled reduced selling pressure, leaning in favor of long-term bullish sentiment.

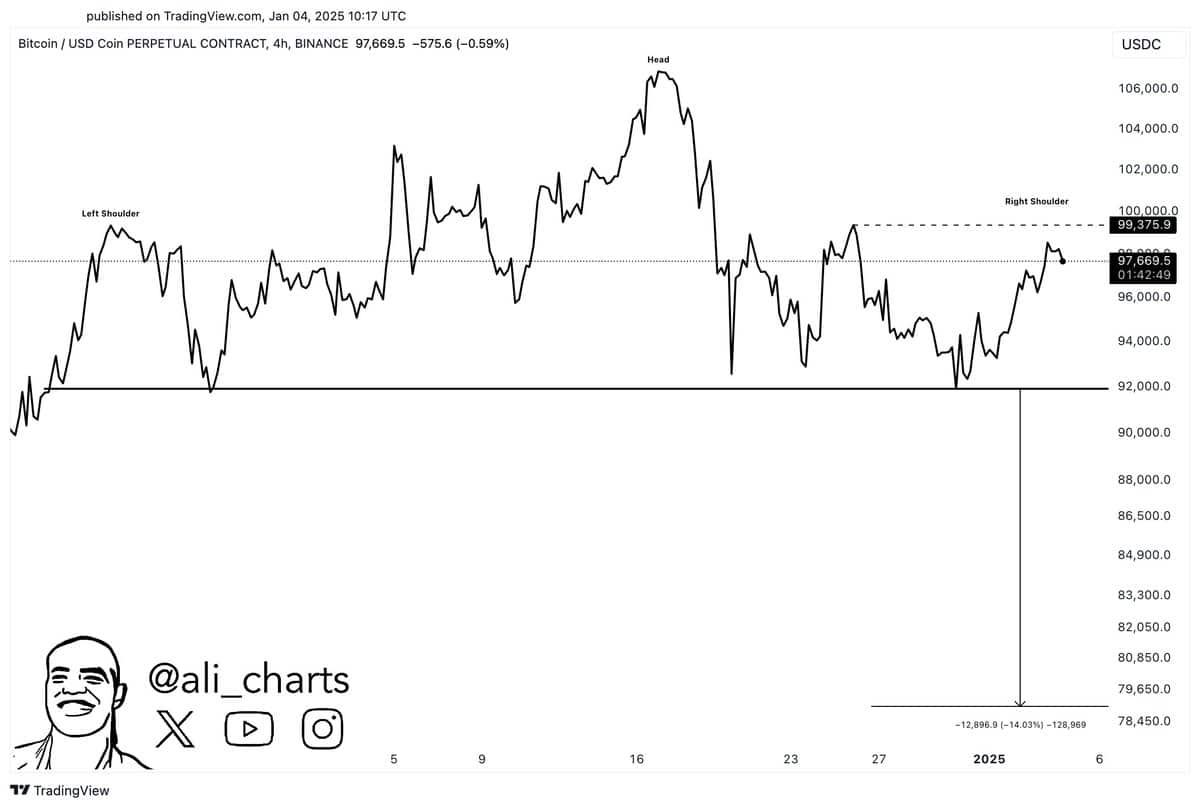

Bitcoin’s [BTC] journey to reclaim the psychological $100K price level has encountered a stiff resistance. At press time, the price hovered near a key pennant supply zone between $98K and $100K.

This key resistance zone has proven challenging for bulls, as short position takers were defending it vigorously.

Breaking through this resistance level is vital for Bitcoin to continue its upward trajectory and avoid a potential bearish reversal.

Source: TradingView

Head-and-shoulders pattern looms

According to a renowned analyst on X, Bitcoin’s price chart suggested a possible head-and-shoulders pattern. If confirmed, this bearish setup could push the price down to the $78,000 region.

Such a correction would align with technical expectations, given the pattern’s historical accuracy.

However, the pattern remains invalidated until a decisive break below the neckline.

For bulls, a strong daily or weekly close above $100K is critical. This would invalidate the bearish outlook and set the stage for Bitcoin to explore new highs.

Source: X

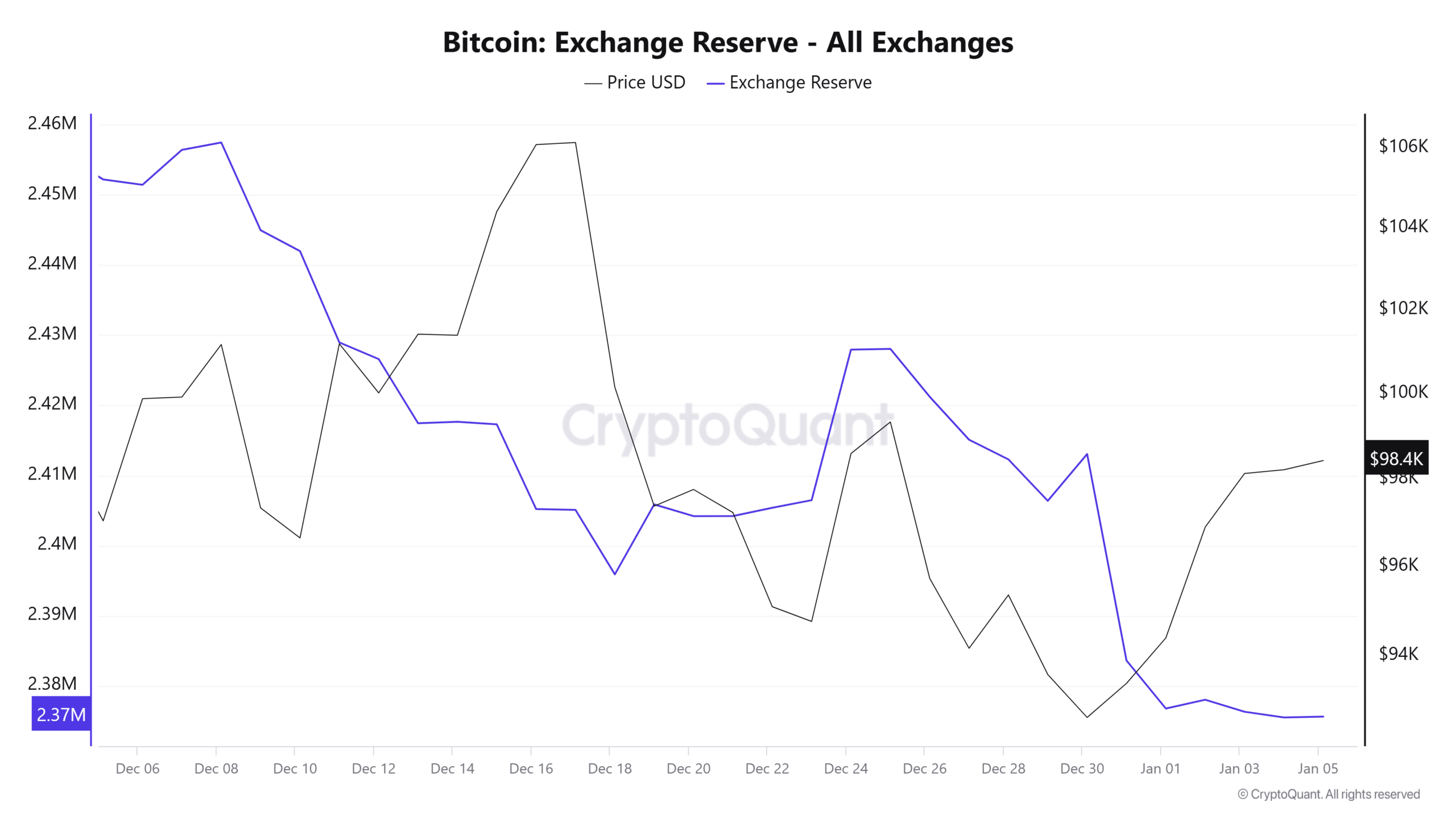

Decreasing exchange reserves point to a bullish potential

On-chain metrics provided a more optimistic perspective. Bitcoin exchange reserves have seen a consistent decline, signaling that fewer tokens are available for sale.

This suggests that market participants are increasingly opting to hold their Bitcoin, hence reducing the king coin’s selling pressure.

Source: CryptoQuant

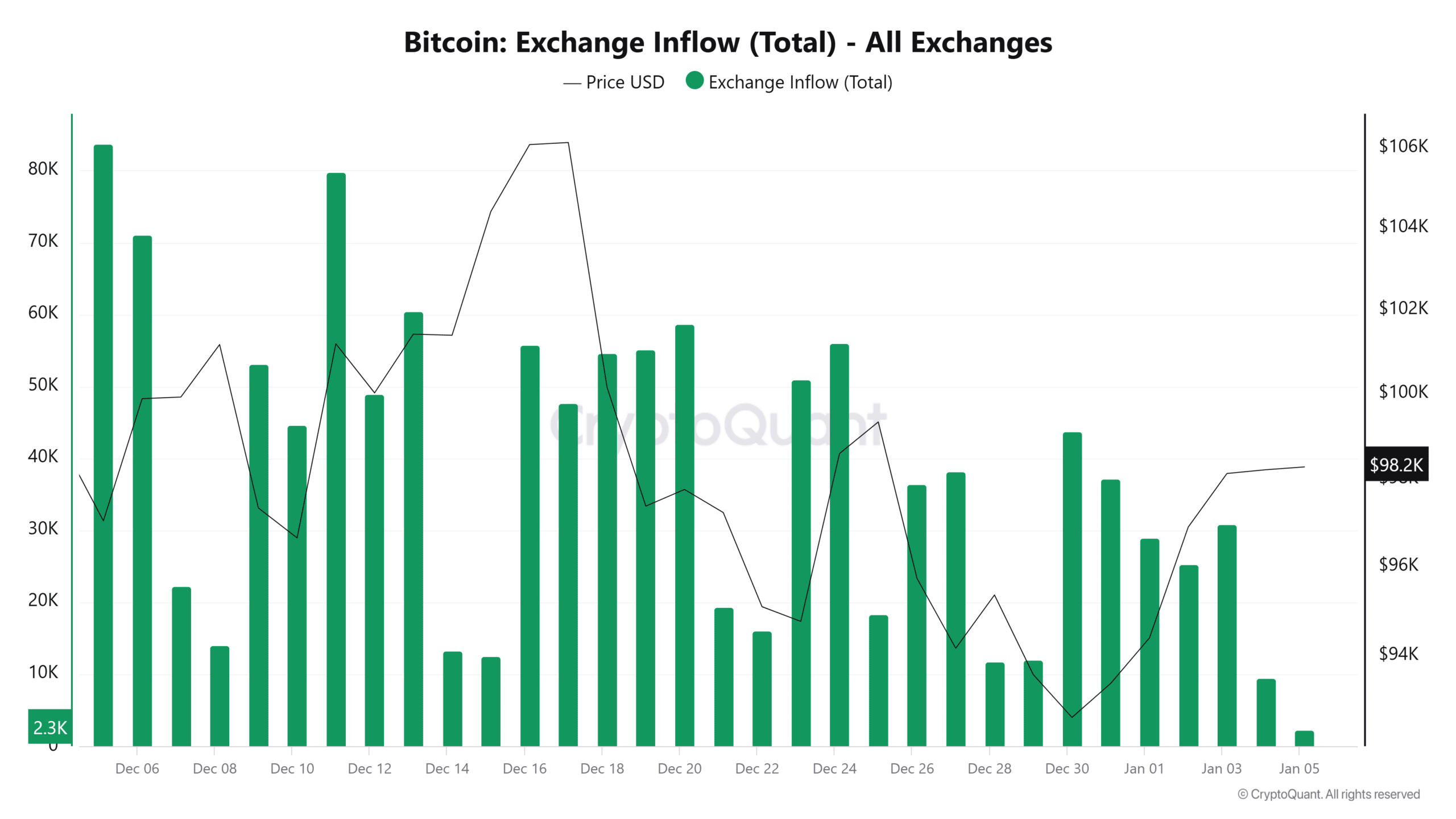

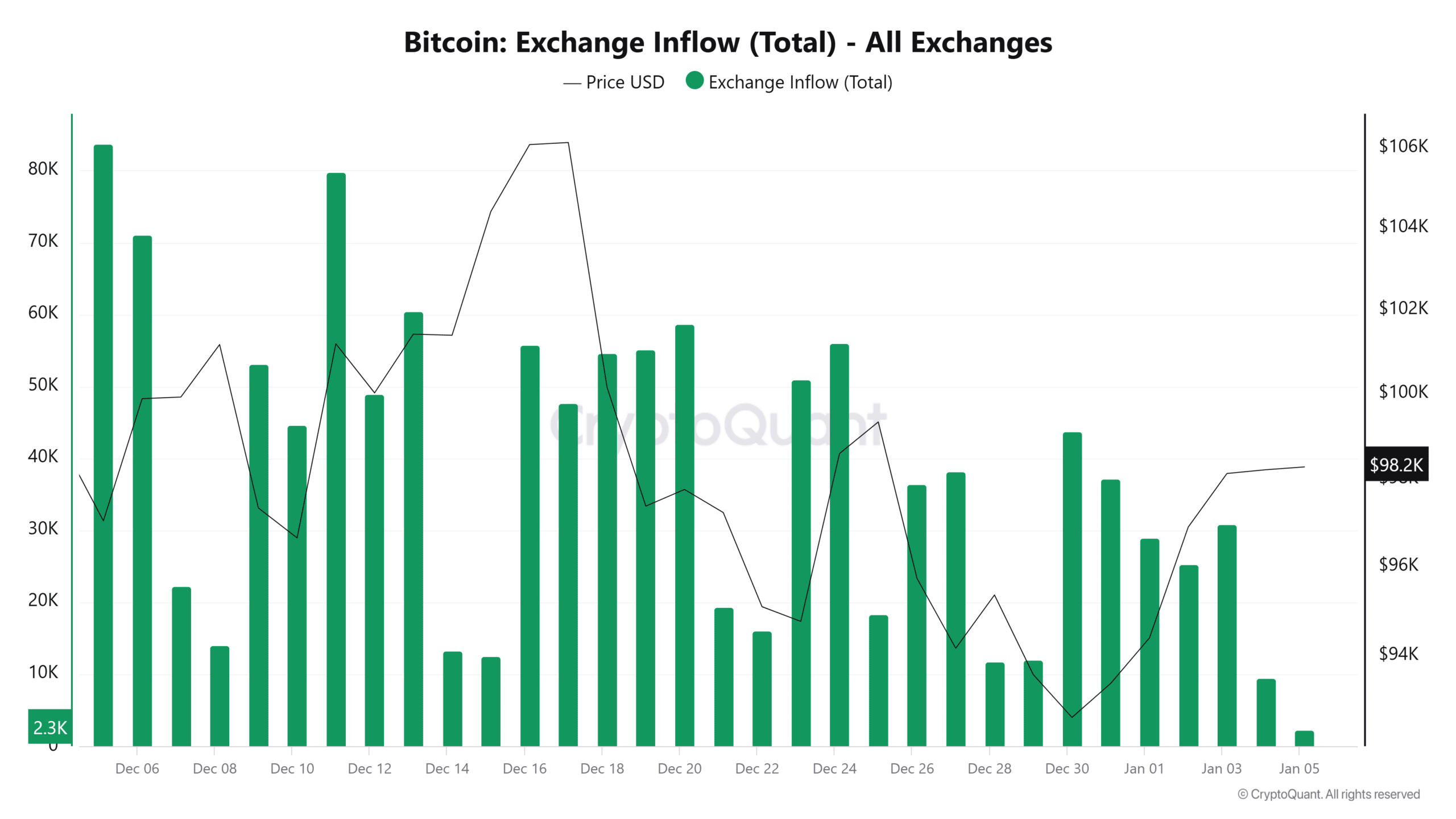

Adding to this, exchange inflows—a key metric for assessing potential selling activity—have been steadily decreasing since the 30th of December.

The reduced inflows reported by CryptoQuant suggest that less Bitcoin is being transferred to exchanges, which further supported its bullish outlook.

Source: CryptoQuant

What lies ahead for Bitcoin?

The battle between Bitcoin’s bulls and bears intensifies, the king crypto remains trapped beneath the $100K resistance level.

A breakout above this key resistance level could set the stage for further gains. However, failure to do so might validate the bearish head-and-shoulders pattern.

Despite this technical uncertainty, on-chain data paints a bullish picture.

Read Bitcoin’s [BTC] Price Prediction 2025–2026

Reduced exchange reserves and inflows suggest a shift in sentiment, with holders appearing more confident in Bitcoin’s long-term prospects rather than shorting their existing positions.

Bitcoin’s next move will majorly rely on its ability to overcome the $100K resistance.