- Bitcoin whales have been accumulating for six weeks.

- BTC has continued to meander around the $60,000 price level.

Bitcoin [BTC] has experienced a robust 48 hours, successfully breaking through the critical $60,000 price level at press time.

This level, which has served as a significant psychological barrier, saw BTC oscillate around it as the market reacted to the renewed bullish momentum.

As Bitcoin’s price struggles to maintain its position above $60,000, some whale addresses seized the opportunity to accumulate more BTC.

Weeks of whale accumulation

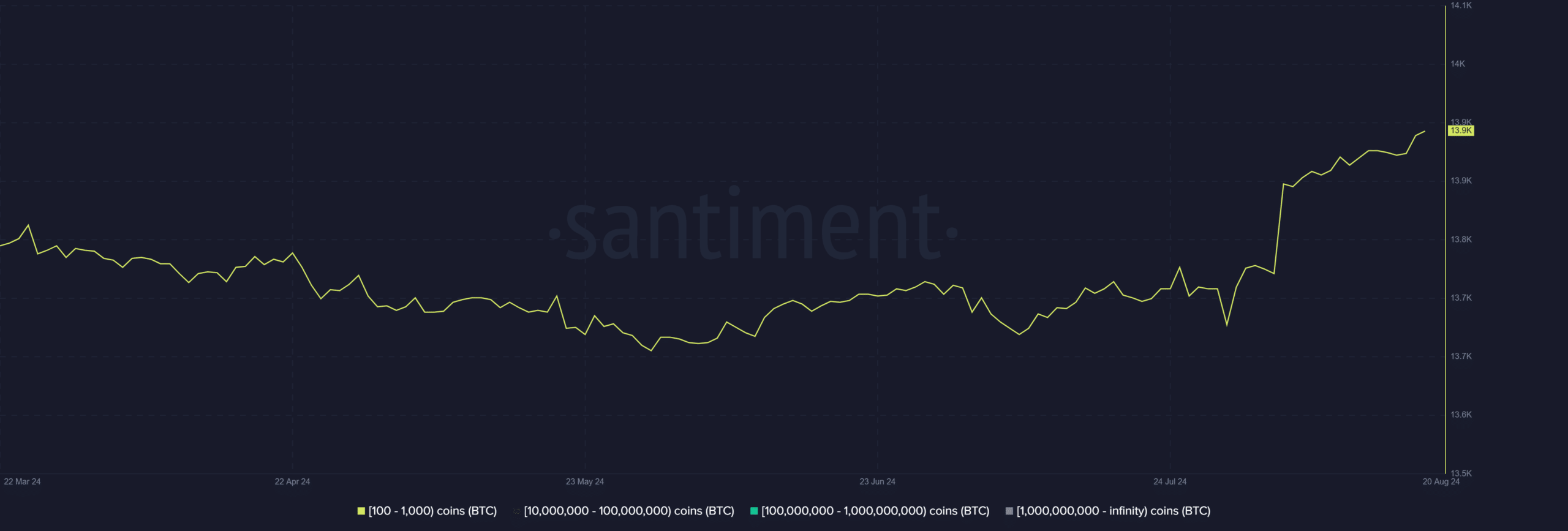

A recent analysis of Bitcoin whale addresses, specifically those holding between 100 and 1,000 BTC, revealed a significant uptrend in accumulation.

Previously, there was a slight decline in the number of these addresses, suggesting that some holders might have been selling or redistributing their BTC holdings during that period.

However, the trend has now reversed, with a clear increase in the number of addresses holding 100-1,000 BTC.

This suggests that mid-sized holders, often considered influential in the market, have begun accumulating Bitcoin once again.

Over the past six weeks, these addresses have collectively accumulated approximately 94,700 more BTC, representing a 2.44% increase in their holdings.

Source: Santiment

The increase in BTC held by these addresses could provide underlying support for Bitcoin’s price, particularly as it attempts to maintain and build upon the recent breakthrough of the $60,000 level.

Possible implications of these accumulations

The recent uptick in accumulation by mid-sized whale addresses holding 100-1,000 BTC indicates a growing confidence in Bitcoin’s price prospects.

These holders are likely anticipating further gains and are positioning themselves strategically by accumulating more BTC.

If the accumulation trend persists, it could lead to reduced selling pressure in the market. These mid-sized holders, having increased their positions, are likely to hold their BTC rather than sell in the short term.

This holding behavior could provide a stabilizing effect on Bitcoin’s price, especially if demand remains constant or increases.

While the current trend suggests accumulation is the dominant behavior, a significant price surge could eventually lead to profit-taking.

Mid-sized whales, who have accumulated at lower levels, may choose to capitalize on higher prices, which could introduce some selling pressure into the market.

However, this is likely to occur after the accumulation phase, and the current sentiment favors holding rather than immediate selling.

Bitcoin sees a slight recovery

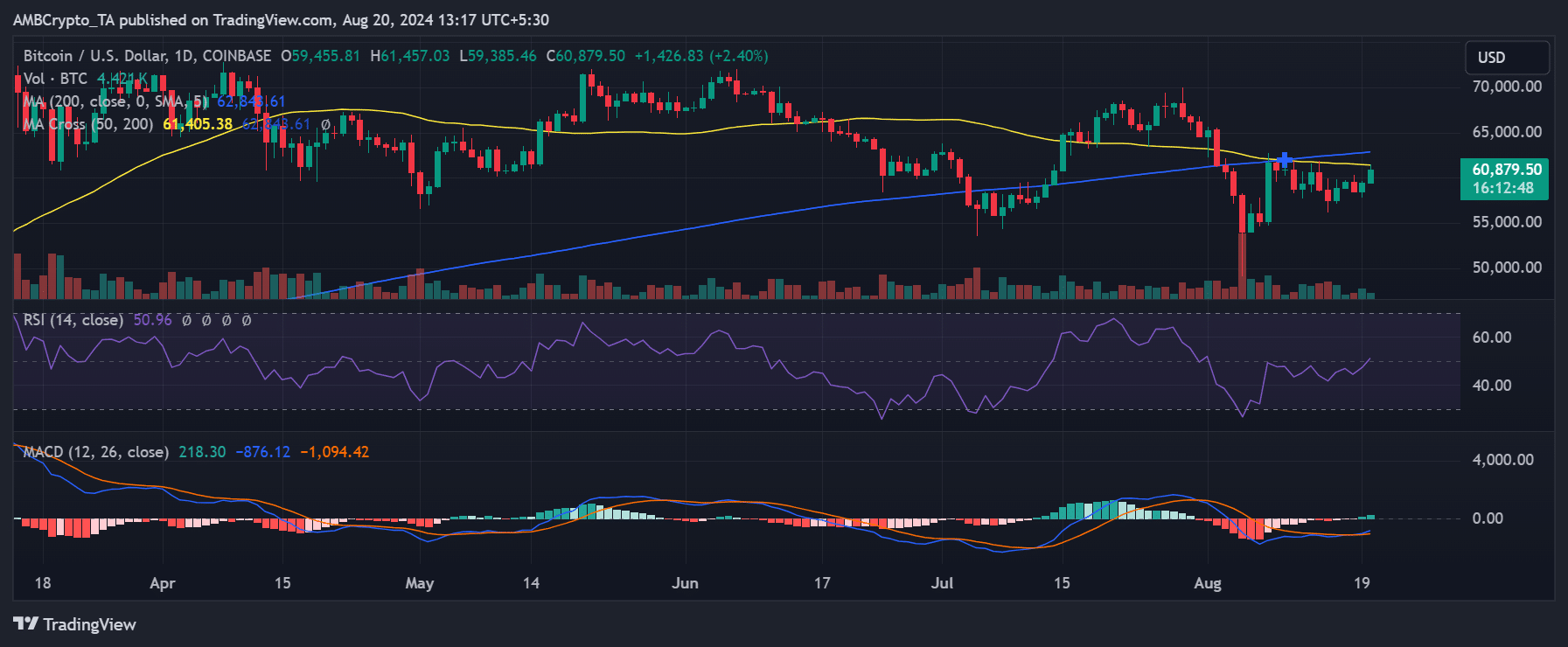

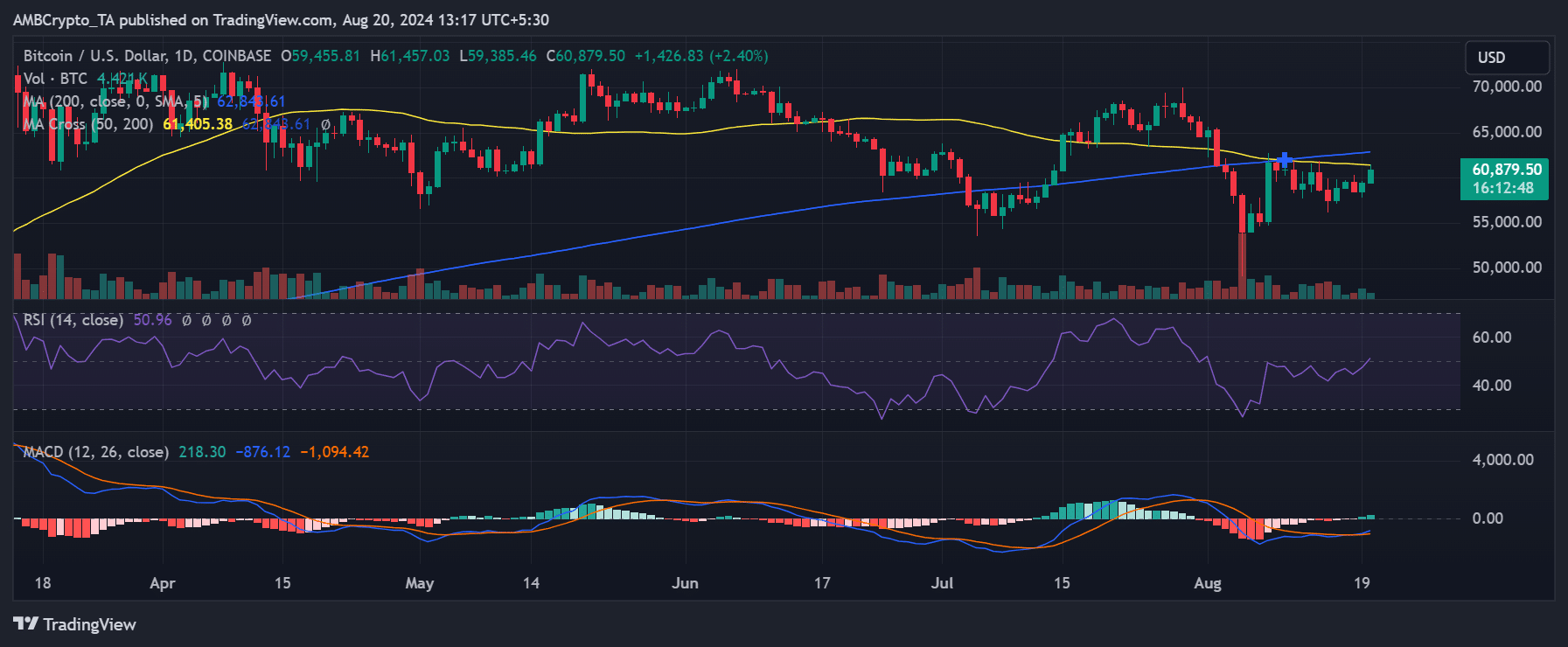

Bitcoin has experienced positive price trends over the last 24 hours, reflecting growing market momentum.

According to AMBCrypto’s analysis, Bitcoin saw a 1.74% increase in the previous trading session, bringing its price to around $59,400.

As of this writing, Bitcoin has continued its upward trajectory, reaching approximately $60,800 after an additional 2% increase.

Source: TradingView

This recent price movement has pushed Bitcoin’s Relative Strength Index (RSI) slightly above the neutral line, signaling a shift toward a more bullish sentiment.

The RSI crossing above the neutral level suggested that buying pressure was beginning to outweigh selling pressure, which could indicate further price appreciation if the trend continues.

While the price has shown positive movement, mid-sized whale addresses holding 100-1,000 BTC have not yet reacted significantly to this trend.

Read Bitcoin’s [BTC] Price Prediction 2024-25

These addresses may still be in an observation phase, waiting to see how the market develops before making any major moves.

Their continued accumulation or potential selling in response to further price increases will be key factors to watch in the coming days.