- Bitcoin ETFs saw inflows after weeks of outflows, signaling a potential market shift.

- Wealth advisors quickly adopted Bitcoin ETFs, driving significant net flows despite limited institutional participation.

After weeks of continuous outflows, Bitcoin [BTC] Exchange Traded Funds (ETFs) have finally shown signs of recovery.

Between the 27th of August and the 6th of September, BTC ETFs saw a total outflow of $1,185.9 million, indicating a challenging phase for the asset.

However, on the 9th of September, BTC ETFs recorded a net inflow of $28.6 million, signaling a potential shift in market sentiment.

Matt Hougan’s take on Bitcoin ETF

Commenting on this development, Matt Hougan, Chief Investment Officer at Bitwise, noted that wealth advisers are adopting Bitcoin ETFs rapidly, reflecting growing confidence in the asset’s future.

In response to a previous post by investment researcher Jim Bianco, who offered a contrasting view on BTC ETF adoption, Hougan said,

“Jim is wrong here: Investment advisors are adopting Bitcoin ETFs faster than any new ETF in history.”

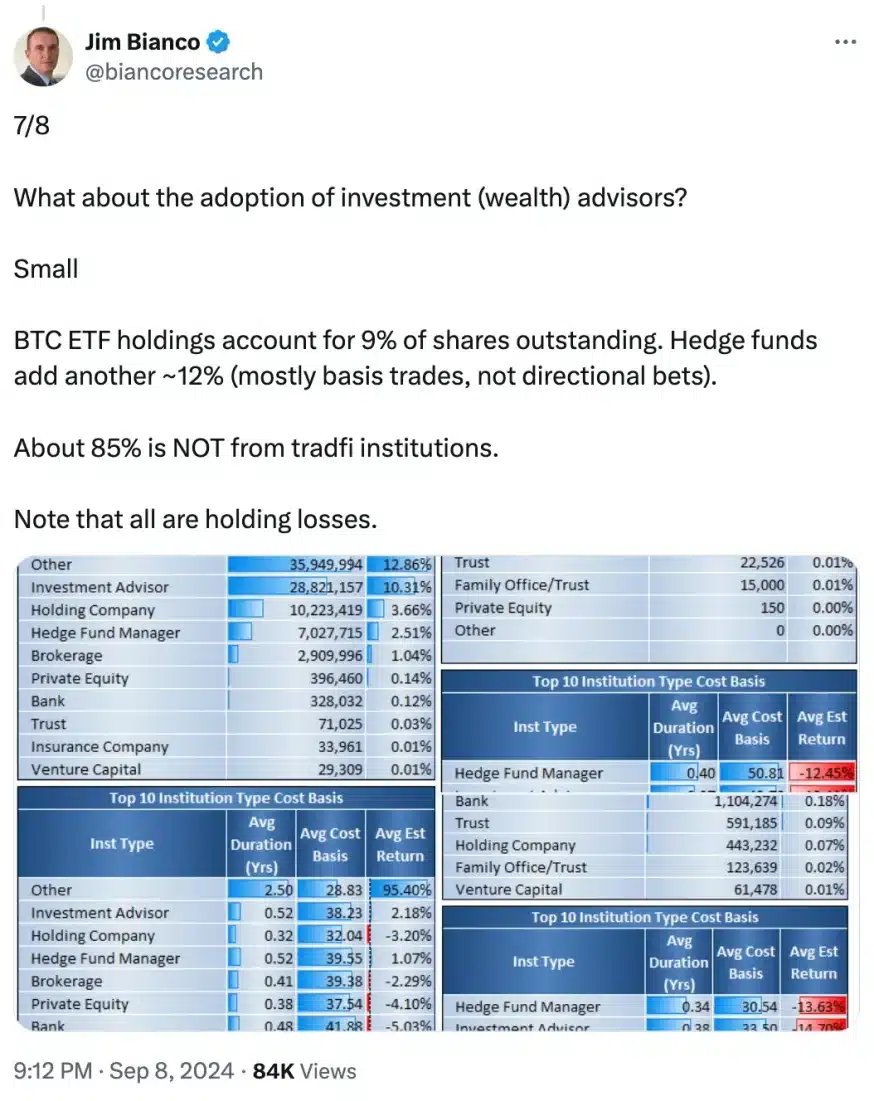

Jim Bianco had pointed out that traditional financial institutions are not driving the majority of Bitcoin ETF inflows, despite growing interest.

He noted that around 85% of BTC ETF uptake is from non-traditional finance (tradfi) sources, suggesting that while wealth advisers are increasingly adopting Bitcoin ETFs, institutional participation remains relatively limited at this stage.

Source: Jim Bianco/X

Is there more to it?

Contradicting Bianco’s point of view, Hougan noted,

“Per his [Jim Bianco] table, IBIT has attracted $1.45 billion in net flows from investment advisors. He calls this “small” because it’s a fraction of the $46 billion that has flowed into bitcoin ETFs in total.”

He added,

“But if you excluded all other flows, and just looked at the $1.45 billion linked to investment advisors, IBIT would be the 2nd fastest-growing ETF launched this year (excluding other BTC ETFs). Out of 300+ launches!”

Hougan further highlighted that the only ETF surpassing IBIT in terms of assets is KLMT, an ESG (Environmental, Social, Governance) ETF.

However, KLMT’s large asset size ($2 billion) is misleading because it was funded by a single investor, not through widespread market adoption.

Despite this significant seeding, KLMT has very low trading activity, averaging just 250 shares per day, and no adoption from investment advisors.

IBIT’s growth rate

In contrast, IBIT’s growth, while smaller, is driven by a broader base of investment advisors, making its expansion more organic and significant in the broader ETF market.

Adding to his explanation Hougan said,

“The truth is that investment advisors are adopting bitcoin ETFs faster than any other ETF in history. It is just that their historic flows are overshadowed by the even-more-historic purchases of other investors.”

Contradicting Bianco’s statement he further highlighted,

“It is accurate to say that investment managers represent a small fraction of buyers of bitcoin ETFs. But it is not accurate to say that investment manager purchases of bitcoin ETFs are “small.”

Bitcoin’s price action

Meanwhile, in the past 24 hours, BTC experienced a notable 3.61% increase, pushing its price to $56,873 as per CoinMarketCap.

This rise is encouraging, as BTC was confined to a tight trading range over the weekend.

There now appears to be potential for Bitcoin to break above the $56K threshold. Additionally, the MACD line is approaching the signal line, hinting at a possible bullish crossover.

However, the RSI, currently at 45 and running parallel to the neutral line, indicates that a bearish momentum remains present, signaling cautious optimism moving forward.

Source: Trading View