- Whale accumulation of over 43,100 BTC and falling exchange reserves signal bullish strength.

- Bitcoin’s ascending triangle and rising network activity support a potential breakout toward $98K.

Bitcoin’s [BTC] MVRV ratio has recently formed a golden cross with its 365-day SMA, a pattern that historically precedes major bullish rallies.

At the same time, price hovered just below key resistance, with bulls intensifying accumulation. At press time, BTC traded at $94,650.57, slightly down 0.18% on the day.

Therefore, the convergence of technical and on-chain signals is raising expectations for a breakout. A key question now is whether this setup can propel BTC beyond $95.3K and toward the $98K target.

Are whales quietly preparing Bitcoin for lift-off?

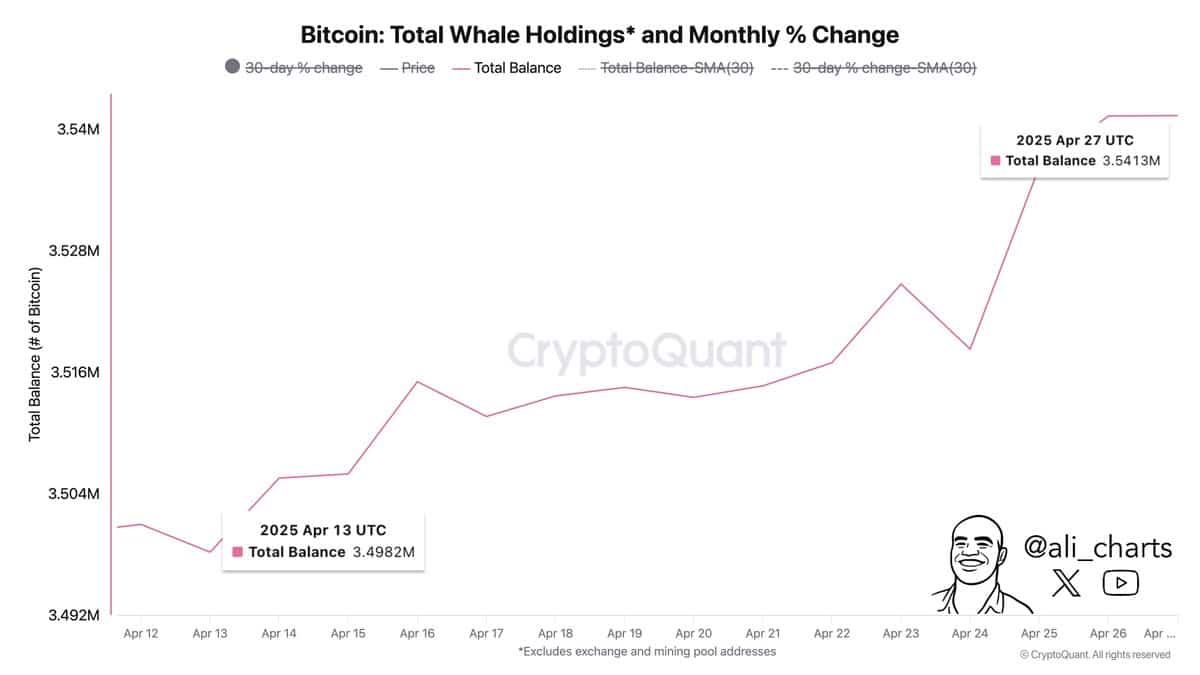

Over the past two weeks, whales acquired 43,100 BTC, increasing their holdings from 3.498 million to 3.541 million BTC.

This aggressive accumulation, worth nearly $4 billion, signals strong conviction among large investors and typically foreshadows bullish momentum.

Besides, such buying during consolidation reflects long-term confidence rather than short-term speculation. Therefore, this surge in whale activity adds significant upside pressure and reinforces the potential for a breakout.

In fact, past rallies have often followed such accumulation phases, especially when prices flirted with resistance zones.

Source: X | Ali Charts

Will shrinking exchange reserves trigger a supply squeeze?

On top of that, Exchange Reserves declined by 2.33% in just seven days, now resting at 2.48 million BTC. This sustained decline confirms that fewer coins remain available for sale on centralized exchanges.

When combined with increased accumulation, this trend often indicates a tightening supply dynamic that can amplify price surges.

Therefore, the probability of a supply-driven breakout increases as reserves continue to decline.

Source: CryptoQuant

Is BTC on the verge of breaking past $95.3K?

Bitcoin was forming an ascending triangle on the 4-hour chart at press time, with price repeatedly testing the $95.3K resistance.

Each failed rejection from resistance showed sellers losing strength, while bulls continued to apply pressure. Therefore, a breakout appears imminent if bulls sustain pressure.

Should Bitcoin close above this threshold, it could rally toward $98K, in line with historical technical behavior following similar formations and supply conditions.

Source: TradingView

Does network activity justify the current bullish setup?

The NVT ratio has dropped to 187.33, suggesting increased transaction volume relative to Bitcoin’s market cap.

This decline typically signals healthier network fundamentals and growing utility, supporting a sustainable price move.

Additionally, the falling NVT ratio during price consolidation indicates that the rally may be driven by real usage rather than hype.

Source: Santiment

Despite bullish signals, sentiment remains slightly bearish, with 115 bears versus 111 bulls, according to IntoTheBlock.

However, sentiment often trails behind actual market shifts, especially when large investors are driving accumulation. If Bitcoin breaks above $95.3K, sentiment could quickly reverse and attract broader market participation.

Will BTC break out toward $98K?

Bitcoin now stands at a tipping point. Whale accumulation, falling reserves, and technical strength all point toward a $98K move.

Despite mixed sentiment, underlying metrics argue that momentum is building, and if bulls stay active, a breakout looks inevitable.