- Bitcoin reserves have sparked intense controversy, with countries deeply divided on their potential.

- As Japan faces mounting economic pressure, could its struggles provide the perfect case study?

The debate over Bitcoin [BTC] reserves is dividing the market. Some see it as a crucial hedge against the dollar’s volatility, while others remain deeply cautious, concerned about the speculative risks tied to it.

The divide is so sharp that even the Fed and the Trump administration are at odds, each taking a starkly different stance on the issue.

Now, Japan is joining the conversation, raising concerns about the potential risks of including Bitcoin in its foreign reserves.

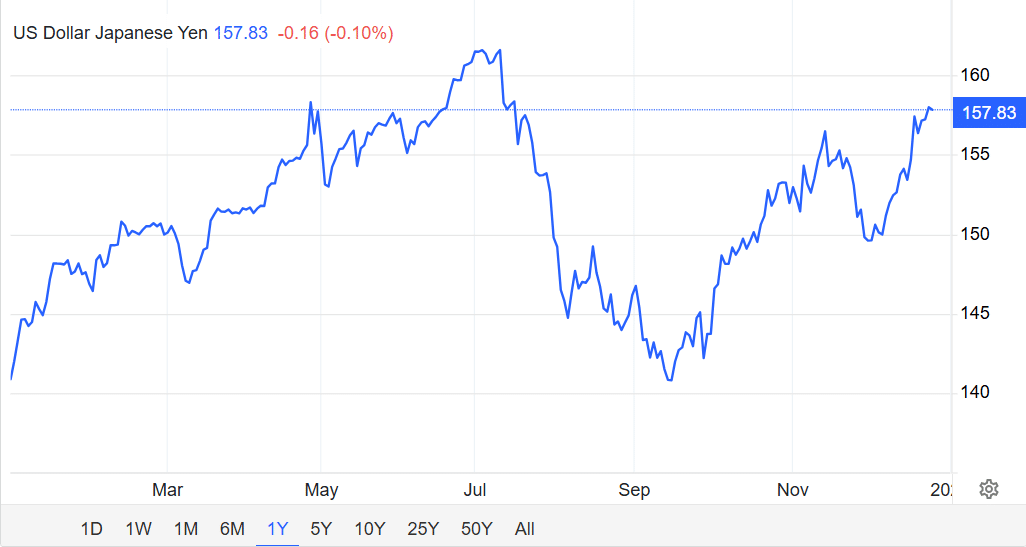

But here’s the catch: The Japanese yen has hit a five-month low against the U.S. dollar, joining a growing list of G20 currencies struggling to keep up with the dollar’s dominance.

So, will Japan’s cautious approach to Bitcoin reserves be seen as a missed opportunity? Or will this economic pressure push Japan – and other nations – to finally recognize BTC as a serious alternative?

Unraveling Japan’s economic storm in 2025

The recent FOMC rate cut triggered a ripple effect across markets, sparking an ‘unexpected’ twist.

On the 18th of December, as the Fed’s decision made headlines, the U.S. dollar index surged to a staggering two-year high of 108.54.

The fallout was quick and brutal. Bitcoin plunged 14% in just three days, while global currencies crumbled under the pressure. The Japanese yen wasn’t spared, plunging to a five-month low of 158 per dollar.

Source : Trading Economics

In immediate response, the Bank of Japan (BOJ) held its ground, keeping interest rates steady. But the real storm may be ahead.

The long-term impact of a surging dollar could be far-reaching, with inflationary pressures set to climb.

The signs are already here. Japan’s annual inflation rate spiked to 2.9% in November 2024, up from 2.3% the previous month, marking its highest reading since October 2023 – and it’s more than just a number on a chart.

This inflation surge is a clear signal of what’s to come. Rising inflation, coupled with the strong dollar, is putting Japan in a tough spot. Imports are growing more expensive, squeezing both businesses and consumers.

All of this is unfolding against the backdrop of Japan’s demographic crisis – an aging population and declining birth rates.

This shift is weakening the labor force, making the challenges of 2025 even more daunting.

So, are Bitcoin reserves the right solution?

The answer isn’t clear-cut – it’s both a ‘yes’ and a ‘no’. On one hand, Bitcoin’s limited supply makes it a strong hedge against rising inflation.

Unlike the U.S. dollar, which can be printed at will, Bitcoin’s capped supply offers Japan and other economies a safeguard against currency devaluation.

However, there’s a significant downside. Bitcoin’s price can be highly volatile, making it a risky asset for a country like Japan, which values stability above all.

That said, with Japan’s economy facing increasing strain, the idea of embracing Bitcoin reserves may not be as far-fetched as it once seemed. In fact, it could soon become a necessity for economic resilience.

And this shift isn’t just about national economies. On a smaller scale, major exchanges are also stacking Bitcoin. For instance, Bitfinex’s Bitcoin reserve recently hit over $230 million, a level last seen three years ago.

As more countries eye Bitcoin as a ‘safety net’ against the growing volatility of global markets, high liquidity is expected to flood the market, with exchanges readying for increased demand.

Read Bitcoin’s [BTC] Price Prediction 2025-26

So, while the U.S. dollar continues to dominate, many economies are searching for alternatives. Bitcoin could be the answer, but only if its price stabilizes in the year ahead.

If it does, the possibility of using Bitcoin as a hedge and even a mode of payment may no longer be a distant dream.