- Bitcoin’s Options OI saw a sharp decline, signaling reduced speculative activity and heightened trader caution.

- Low trading volumes and subdued price action pointed to a consolidation phase for the crypto market.

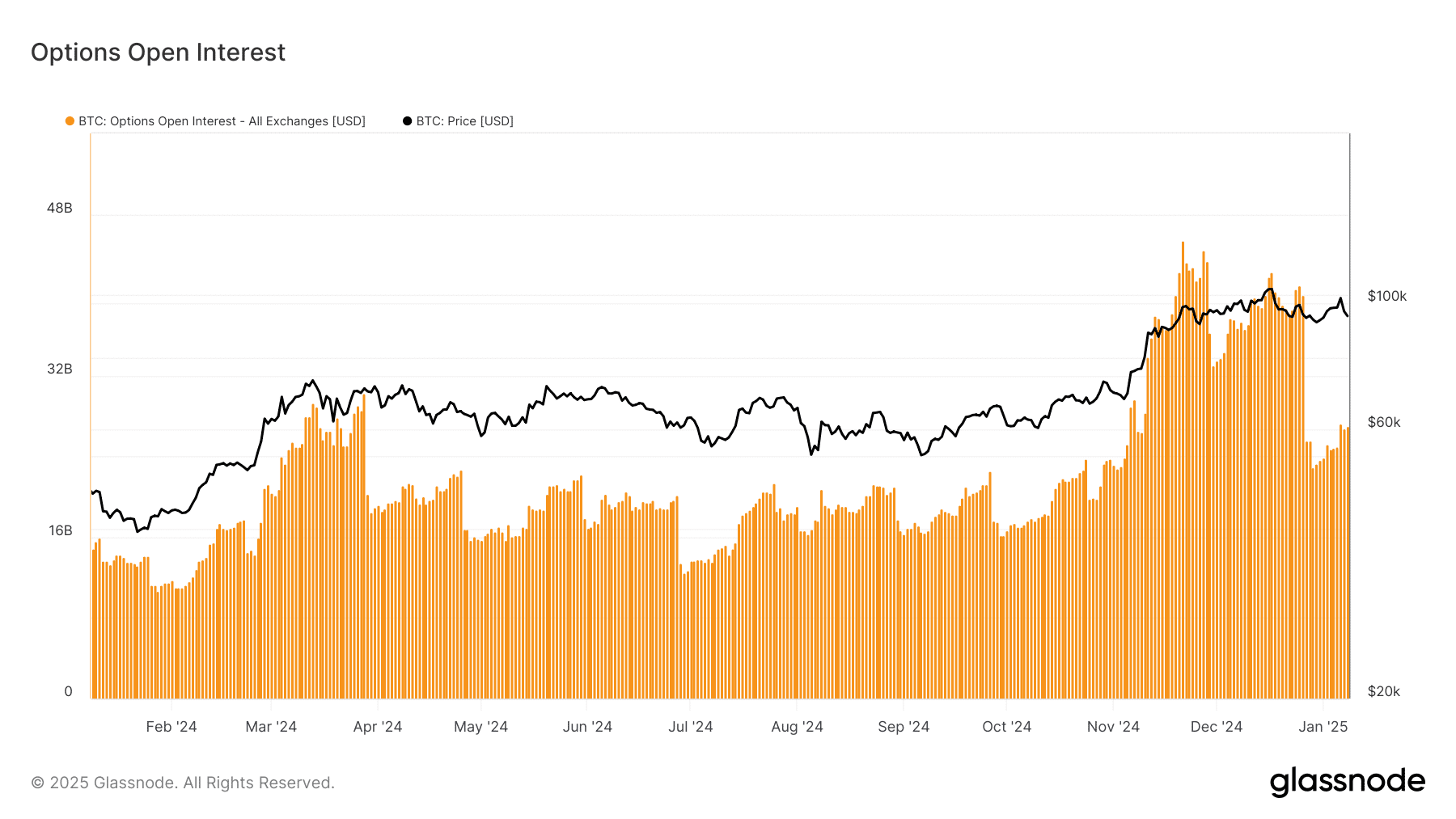

The cryptocurrency market was witnessing a shift in sentiment as Bitcoin [BTC] Options Open Interest (OI) recorded a historic decline.

This development reflected a broader market transition toward caution, driven by macroeconomic uncertainties and recent price volatility.

The attached Options OI and BTC price charts highlighted this significant shift in market dynamics.

Historic drop in Bitcoin Options OI

The Options Open Interest chart reveals a steep plunge in OI, with figures falling from their recent highs as traders adopt a more conservative approach.

Historically, OI serves as a barometer of speculative activity and overall market confidence.

AMBCrypto’s analysis showed that the OI dropped from almost $40 billion to the current range of $27 billion.

The current drop underscores a retreat by market participants from leveraged positions, likely influenced by global economic pressures and fears of sustained rate hikes by the Federal Reserve.

Source: Glassnode

The decline also coincides with a broader contraction in trading volumes, suggesting a lack of momentum to sustain speculative bets.

This shift could begin a consolidation phase for the market, where risk appetite remains subdued, and traders adopt a “wait-and-see” strategy.

Bitcoin price reflects caution

Bitcoin’s price action mirrors the cautious sentiment evident in the derivatives market.

Trading at $93,316 at press time, Bitcoin has dropped below its 50-day moving average of $97,654, signaling a bearish turn in the short term.

Meanwhile, the 200-day moving average at $72,962 acted as a critical long-term support level.

Source: TradingView

At 2.64K, volume levels remained relatively low, further highlighting the reduced trading activity and lack of directional conviction among market participants.

This low activity reflected hesitancy in the face of external macroeconomic uncertainties, including strong labor market data and potential Federal Reserve tightening.

The Ichimoku Cloud analysis and moving averages suggested that Bitcoin may remain range-bound between $90,000 and $95,000 in the near term.

A breach of these levels could either accelerate a further sell-off or trigger a recovery, depending on the broader market sentiment.

Market implications and broader trends

The plunge in Bitcoin Options OI signals a shift in market dynamics, with traders and investors turning more cautious in their approach.

This trend is further amplified by declining volumes and subdued price action, which collectively indicate a lack of strong catalysts for significant market moves.

While caution currently dominates, this phase could pave the way for greater stability, as reduced leverage minimizes the risk of extreme volatility.

However, the market remains highly sensitive to external triggers, including macroeconomic data and regulatory developments, which could either reignite speculative interest or deepen the consolidation phase.

A market in transition

The historic drop in Bitcoin Options Open Interest highlights the evolving sentiment in the crypto market.

Read Bitcoin’s [BTC] Price Prediction 2025-26

As caution replaces speculative exuberance, traders are likely to focus on key support and resistance levels while closely monitoring global economic indicators.

Whether this transition leads to greater market stability or sets the stage for renewed volatility remains to be seen.