- Bitcoin is entering a high-stakes game, where the bold may thrive

- While FOMO builds, there’s still plenty to unpack

Two crashes in less than a month may have you thinking about exiting, but Bitcoin [BTC] is holding firm above $90k, defying the odds. Clearly, the market is gearing up for the next Trump trade to kick off – but the stakes couldn’t be higher. So, brace yourself.

Market teetering on the edge of greed and fear

Despite the two major clashes with the Fed, Bitcoin’s reputation as a safe haven is proving its worth. A year ago, this shock could have triggered a much harsher reaction. But here we are – Bitcoin fell from its yearly high of $102k just a week ago. And yet, it’s still holding steady, down only 7%. That’s resilience.

Now, with Trump’s inauguration looming, there’s talk of a repeat of the Q4 rally that saw Bitcoin surge to $108k. For many, holding on to Bitcoin seems like a smart play right now.

However, there’s a catch. The scale of losses during this dip was hard to ignore. Around 1.9 million BTC, bought at $106k, are at risk of being sold once Bitcoin hits that price, potentially triggering a massive $201 billion sell-off.

![Bitcoin [BTC] in/out of money](https://ambcrypto.com/wp-content/uploads/2025/01/Screenshot-2025-01-13-135907.png)

Source: IntoTheBlock

With the aftermath of two major crashes still lingering, the decision to HODL feels uncertain for many. Exiting may seem like the safer option rather than holding out for higher returns. The greed-fear balance is going to be key in the coming days – It’s delicate, and definitely one to keep a close eye on.

History shows that strong rallies are often driven by greed. When greed takes hold, investors become more willing to risk it all, believing the potential for higher returns ‘outweighs’ the threat of a crash.

Alas, with so many macroeconomic factors still in the mix, fear could easily dominate the market. If it does, a crash may quickly turn from social media chatter to a full-blown reality.

It’s flight or fight for Bitcoin

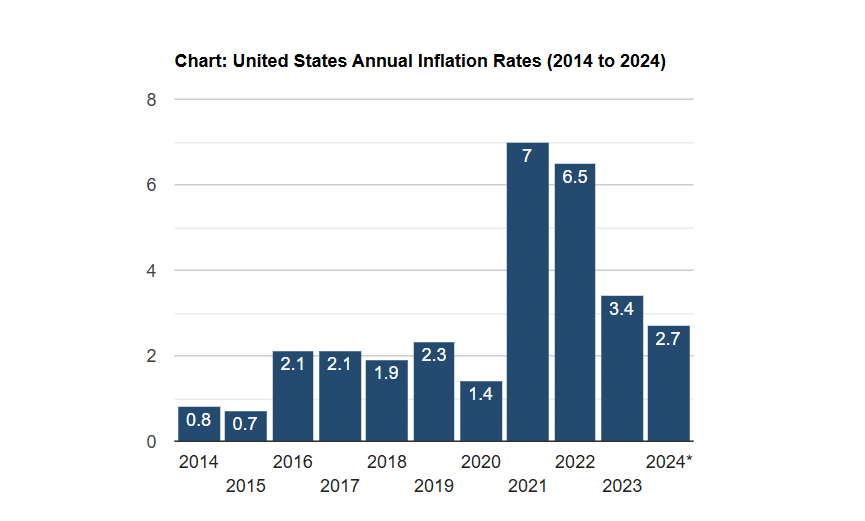

Apart from Trump’s inauguration, the January Fed meeting in just 16 days could impact the market. On top of that, we’re about to get the last CPI and PPI inflation data before the Fed’s decision.

With inflation sitting at 2.7%, well above the Fed’s 2% target, it’s likely the central bank will stay hawkish, potentially triggering a market pullback. These next few days will be key.

Source: US Inflation Calculator

Read Bitcoin’s [BTC] Price Prediction 2025-26

Given all this, panic-selling might rise as Bitcoin hits key levels. The Trump trade could be in trouble, and Bitcoin may face a tough year ahead. Clearly, the long rally is under pressure – fear could take over, making exiting the safer move.