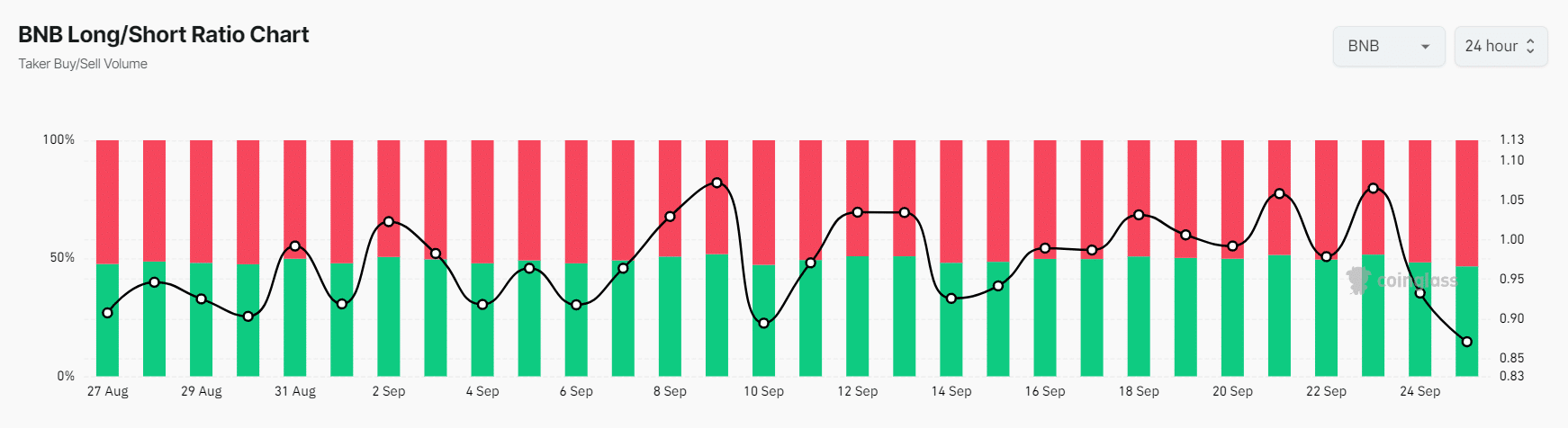

- BNB’s Long/Short Ratio was 0.871 at press time, indicating bearish market sentiment.

- 53.44% of traders held short positions, while 46.56% held long positions.

Binance Coin [BNB], the world’s fourth-biggest cryptocurrency by market cap, appears bearish as it has formed a bearish price action pattern on a daily time frame.

In less than three weeks, BNB has surged by over 25%, but it has now reached a level where it is facing extreme selling pressure along with major cryptocurrencies.

BNB technical analysis and key levels

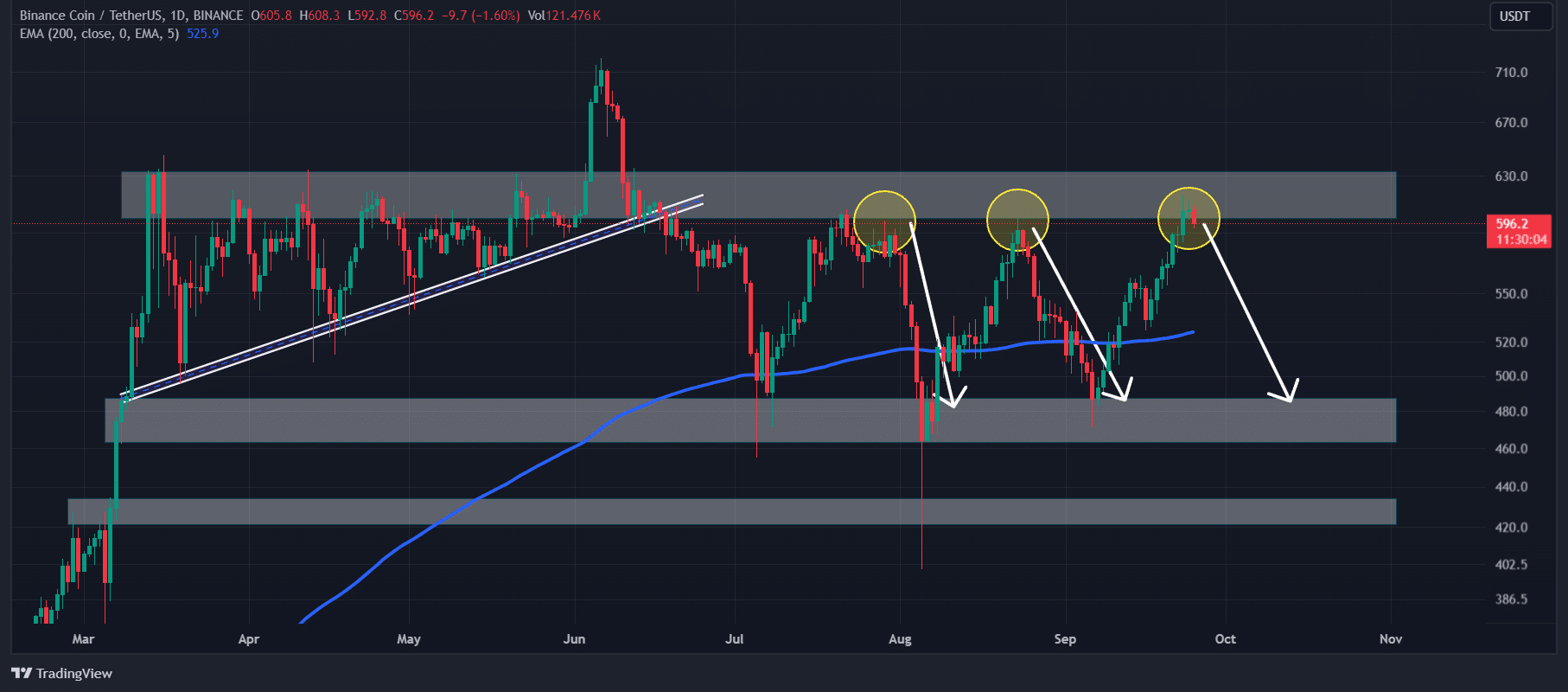

According to AMBCrypto’s technical analysis, BNB has formed a bearish triple top price action pattern on its daily time frame.

In addition to this, the asset has also formed an evening star candlestick pattern at the resistance level near $605, further supporting the bearish outlook.

Source: TradingView

Based on the historical price momentum, there is a strong possibility that BNB could fall by 20% to reach the $480 level in the coming days.

This negative outlook for BNB holds as long as it trades below the $625 level, otherwise, it may fail.

However, it is still trading above the 200 Exponential Moving Average (EMA) on a daily time frame, indicating an uptrend.

Traders and investors often use the 200 EMA to determine whether an asset is in an uptrend or downtrend.

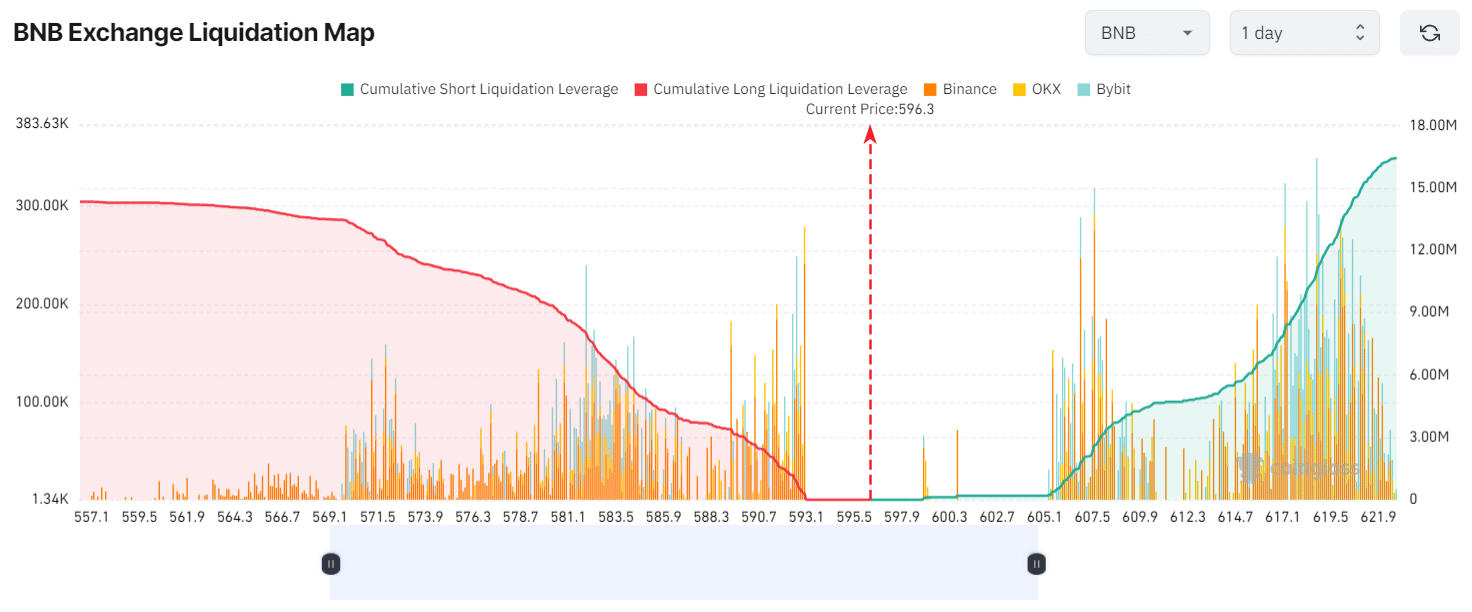

Major liquidation levels

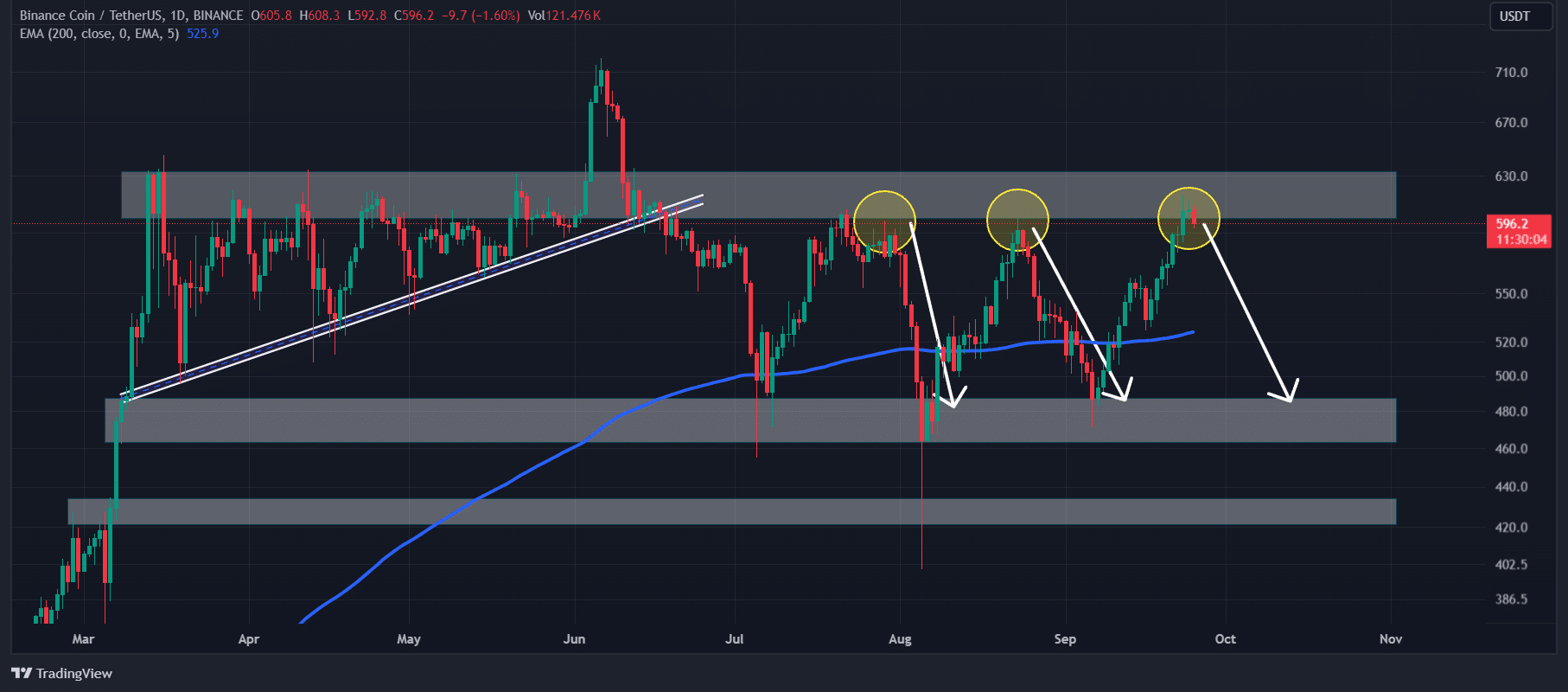

Currently, the major liquidation levels are near $593 on the lower side and $607.5 on the upper side, as traders are over-leveraged at these levels, according to an on-chain analytics firm Coinglass.

Source: Coinglass

If the market sentiment turns bearish and BNB falls to the $593 level, nearly $280,000 worth of long positions will be liquidated.

Conversely, if the sentiment shifts and the price rises to the $607.5 level, approximately $2.30 million worth of short positions will be liquidated.

This data shows bulls are currently exhausted, while bears are highly active at the moment.

BNB’s bearish on-chain metrics

Meanwhile, other on-chain metrics further support this bearish outlook. Coinglass’s BNB Long/Short Ratio was 0.871 at press time, indicating bearish market sentiment among traders.

Source: Coinglass

Additionally, its Futures Open Interest has dropped by 3.5% over the past 24 hours, showing that traders were hesitant to build new positions.

53.44% of top traders hold short positions at the time of writing, while 46.56% held long positions.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

Current price momentum

At press time, BNB was trading near $596 after a price decline of over 1.4% in the past 24 hours.

During the same period, its trading volume dropped by 13%, indicating lower participation from traders amid the bearish outlook.