- Weekly DEX volumes on BNB Chain have surged to $17.74 billion, marking the highest level since December 2021.

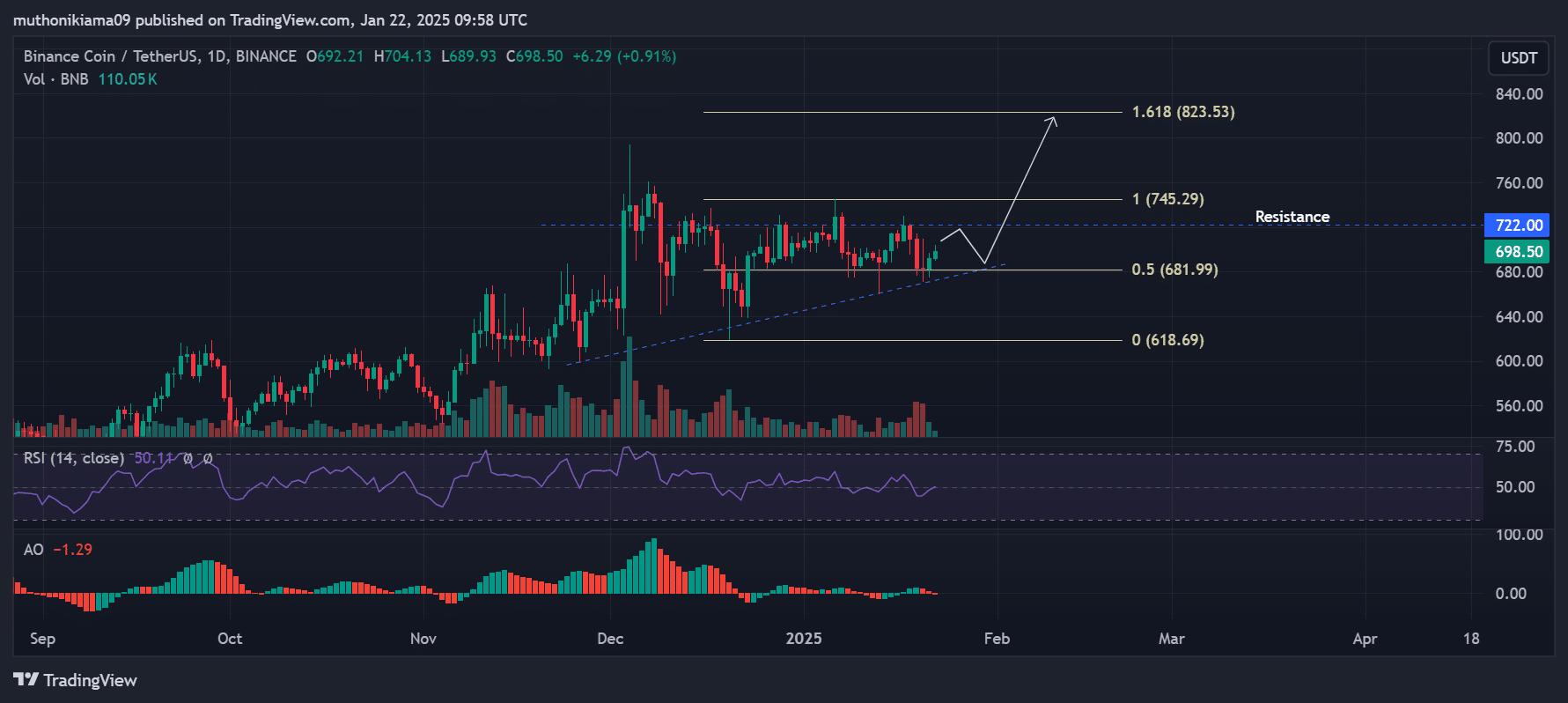

- BNB was also trading within an ascending triangle pattern on its daily chart, which could support a breakout toward the 1.618 Fib level.

Binance Coin [BNB], the sixth-largest cryptocurrency with a $100 billion market capitalization, had registered a 2% gain in 24 hours to trade at $697 at press time.

These gains mirrored a slight recovery across the broader market.

BNB formed an all-time high of $793 in early December. The subsequent attempts to reclaim this level and possibly break past $800 have been met with strong resistance at $722.

However, rising DeFi activity could aid this breakout in the near term.

DEX volumes soar to $17.74 billion

Data from DeFiLlama showed that the weekly DEX volumes on BNB Chain have surged to $17.74 billion, marking the highest level in three years.

Source: DeFiLlama

The two protocols driving this growth are PancakeSwap and THENA, which have seen a 298% and 111% increase, respectively, in their weekly volumes.

This rise could bode well for BNB, which is the native token for the blockchain. As more people rely on the network for DEX transactions, it could drive up demand for BNB and support a price rally.

Besides this optimistic look around BNB Chain, the token’s daily chart showed bullish trends that could also aid a breakout past $800.

Analyzing BNB’s ascending triangle pattern

BNB was trading within an ascending triangle pattern on its daily chart, suggesting that bulls were in control. The upper trendline of the pattern lies at $722.

If BNB breaches this level, it could lead to a sustained uptrend.

Source: TradingView

The Relative Strength Index (RSI) had tipped north and crossed the 50 mark, indicating that buyers were re-entering the market. A surge in buying pressure could support a breakout to the 1.618 Fibonacci level ($823).

However, traders need to watch out for the bearish trends shown by the red Awesome Oscillator (AO) bars.

If bears regain control and the price falls below support at the lower trendline of the ascending triangle, it could invalidate the bullish thesis.

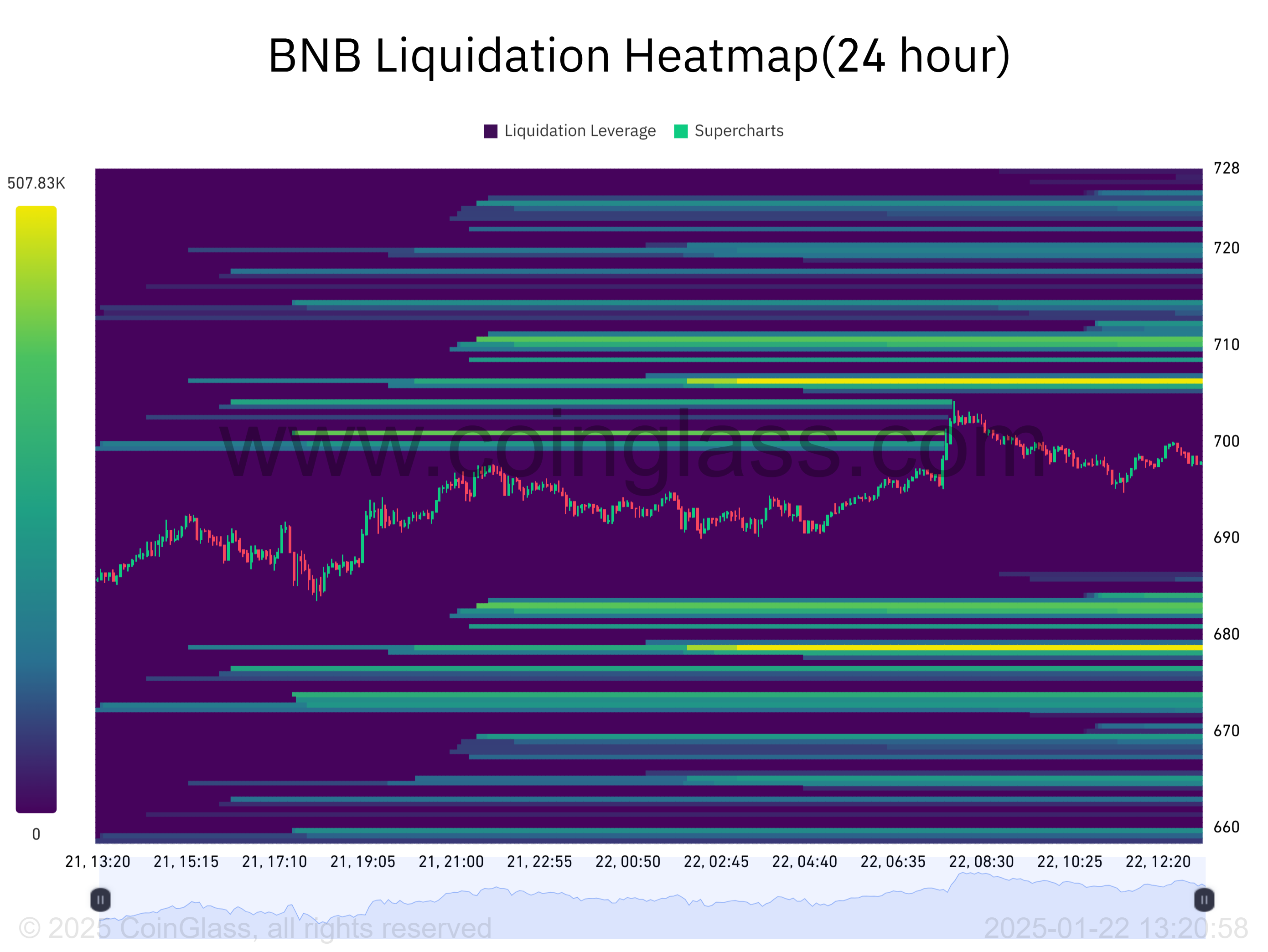

Is BNB headed for a short squeeze?

BNB’s liquidation heatmap with a 24-hour lookback period showed a large cluster of liquidations looming above the current price.

If BNB rallies past 706 and triggers these liquidations, a short squeeze would ensue, forcing short sellers to buy and close their positions. This action could fuel an uptrend.

Source: Coinglass

Read Binance Coin’s [BNB] Price Prediction 2025–2026

Additionally, there is another liquidation level below the price at $678. If BNB falls below the lower trendline of the ascending triangle and drops to this price, the resulting long liquidations will pull the price lower.

Therefore, traders should watch out for critical support at the 0.5 Fibonacci ($681) as a breach of this level could strengthen the bearish case.