- Solana faced another rejection from the two-month highs.

- The buying was steady but did not reach breakout levels.

Solana [SOL] was unable to clear the $163 resistance level on its third attempt since August. In the past two days, it saw short-term price volatility and is down by 3.4% since the local high at $161.8.

Increased whale holdings and rising social media activity suggested a bullish outlook for Solana in the coming days. On the other hand, a drop in the spot demand could be an early sign of a deeper pullback.

Solana price action remains bullish

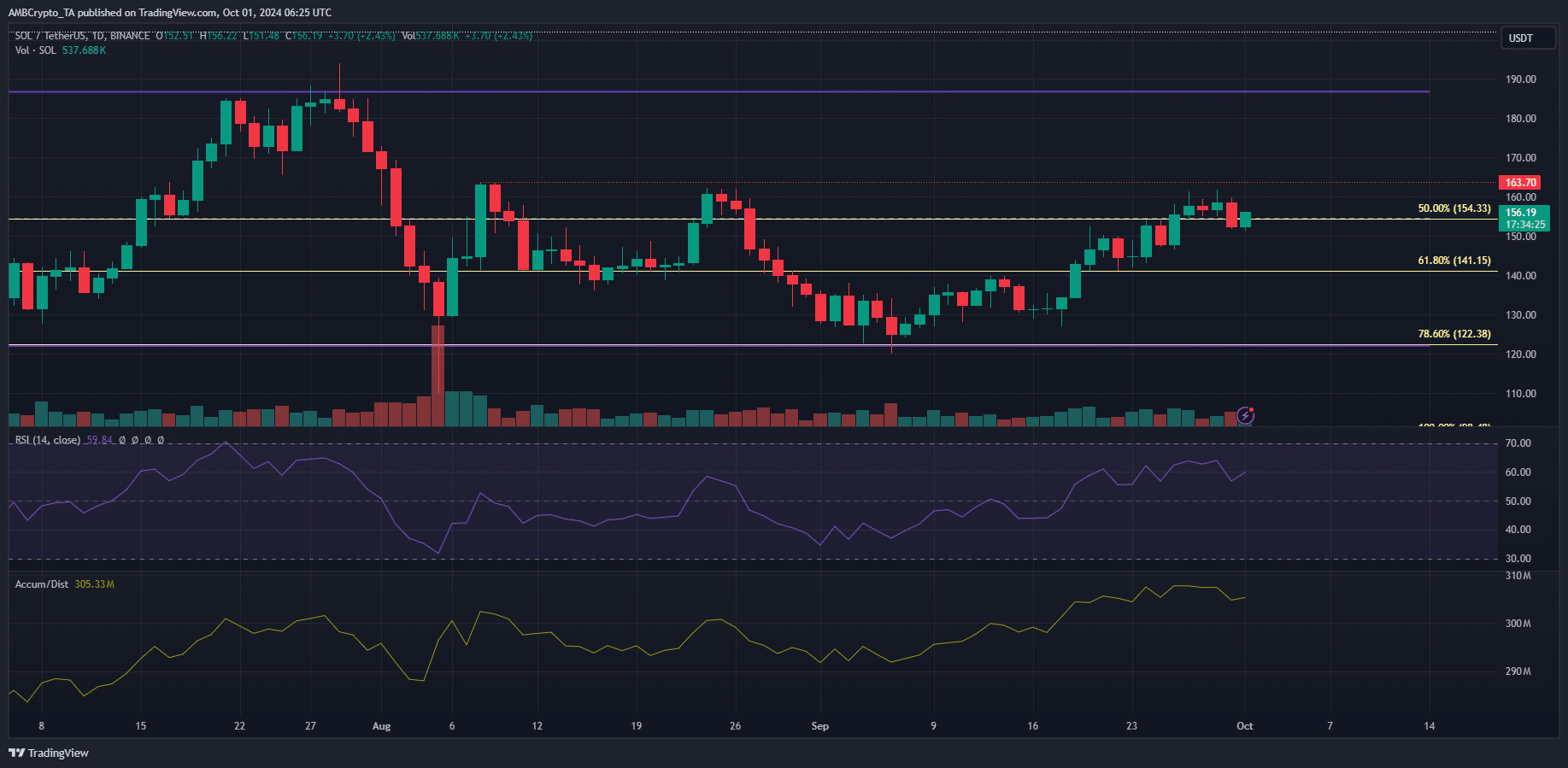

Source: SOL/USDT on TradingView

The bulls were fighting for control of the mid-range level at $154, which coincided with the 50% retracement level. However, the trend was bullish in September, after the $140 resistance level on the lower timeframes was breached.

The A/D indicator has steadily trended higher since July, a sign that buyers were stronger in the past three months. The daily RSI was also bullish.

Yet, swing traders looking to go long will have to wait until the $162-$165 resistance zone is breached. Once this occurs, the bulls can target the range high of $187 next.

Despite the bullish signals from the accumulation/distribution, the trading volume was still at the average of the past six weeks. The lack of volume as SOL approached a key resistance was a worry for holders.

Coinalyze trends indicate heightened volatility

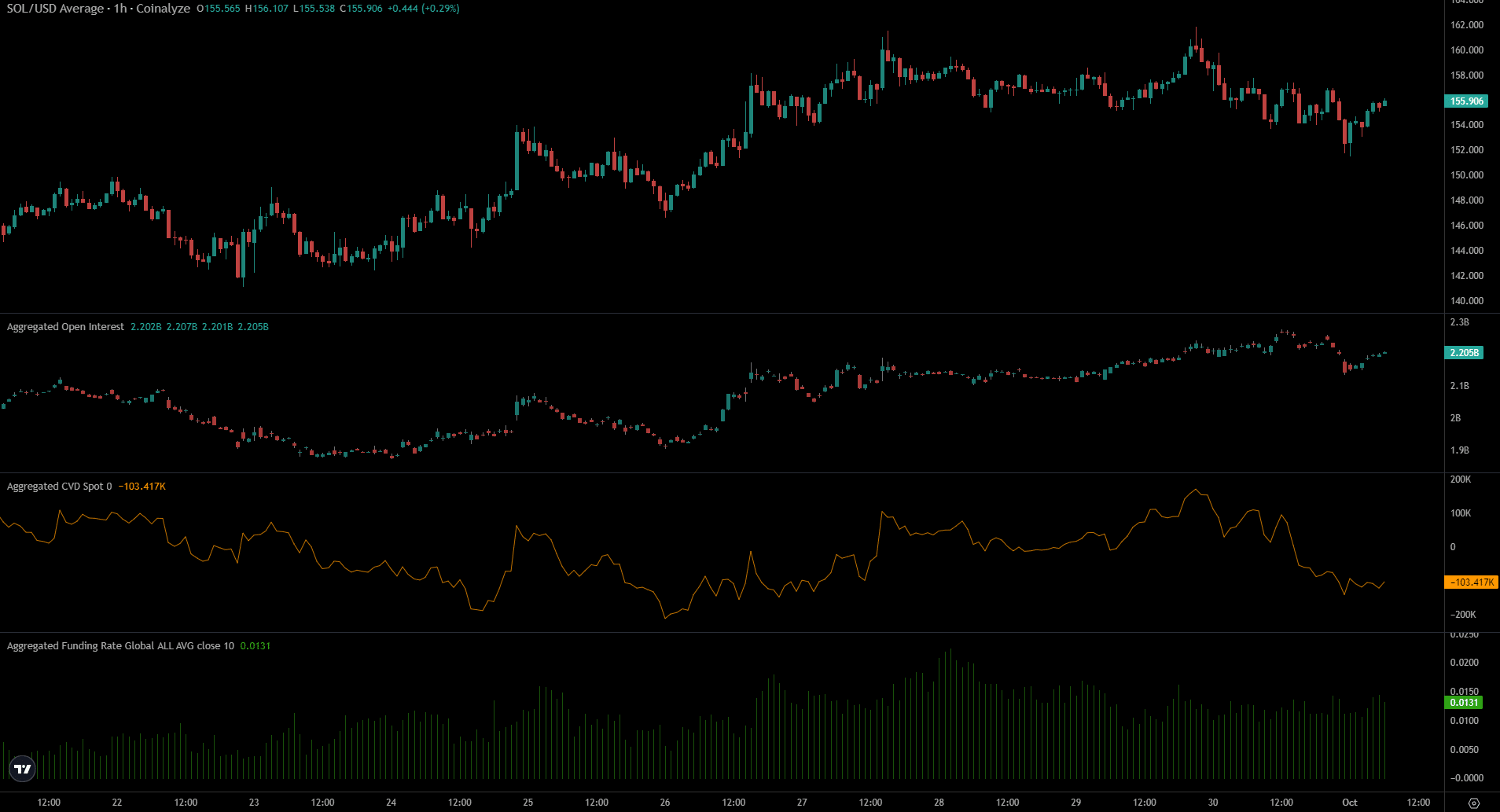

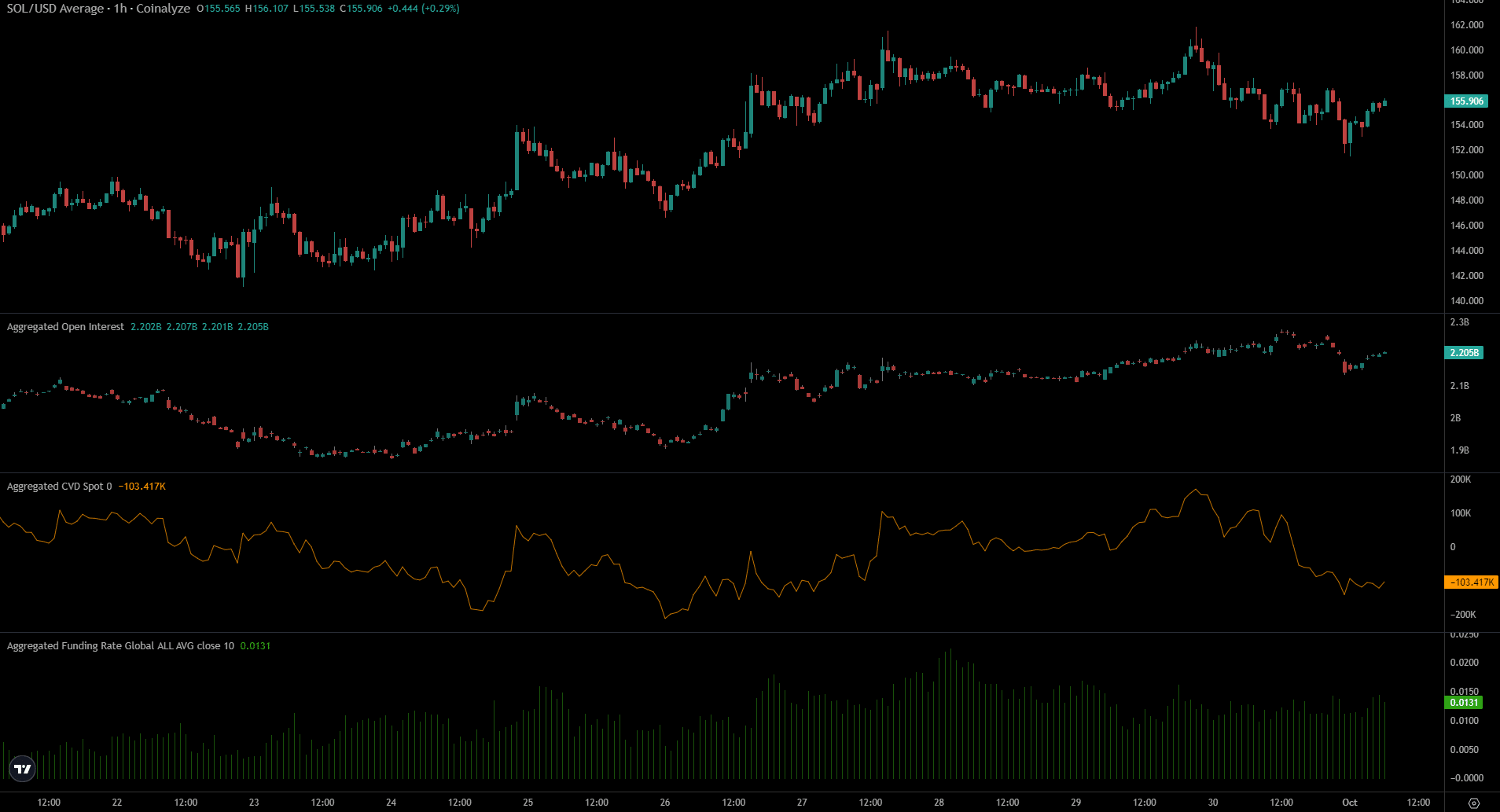

Source: Coinalyze

AMBCrypto found that the spot CVD has been falling over the past two days, coinciding with the pullback from $161.8. The increased selling near a resistance zone meant that the chances of a breakout were reduced in the short term.

Read Solana’s [SOL] Price Prediction 2024-25

The funding rate was still positive, and the Open Interest trend was still upward. The dip affected the OI too, but it has begun to recover in recent hours.

Overall, a pullback below $154 appeared likely due to the volume.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion