- Virtual’s bullish price action breaks key resistance levels, supported by high on-chain profitability.

- Whale activity and technical indicators further strengthened the rally, despite overbought conditions.

Virtual Protocol [VIRTUAL] has captured the market’s attention with a massive 22.19% surge in just 24 hours, trading at $4.90 at press time.

With its market cap rising to $4.89 billion and a trading volume jump of 38.45% to $520.01 million, this token is experiencing rapid momentum.

Investors are now curious—what exactly is driving this extraordinary rally?

VIRTUAL:Climbing the charts

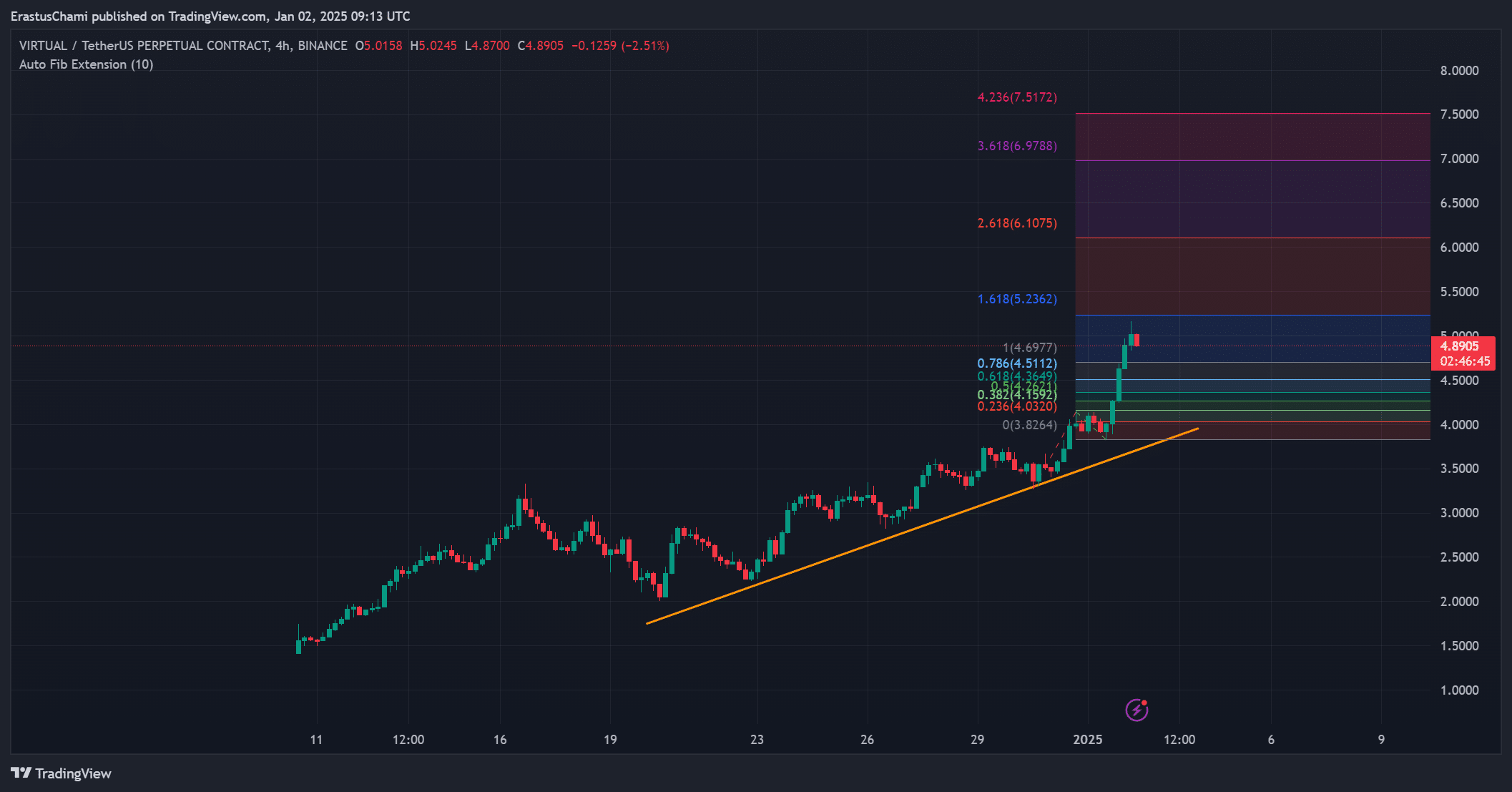

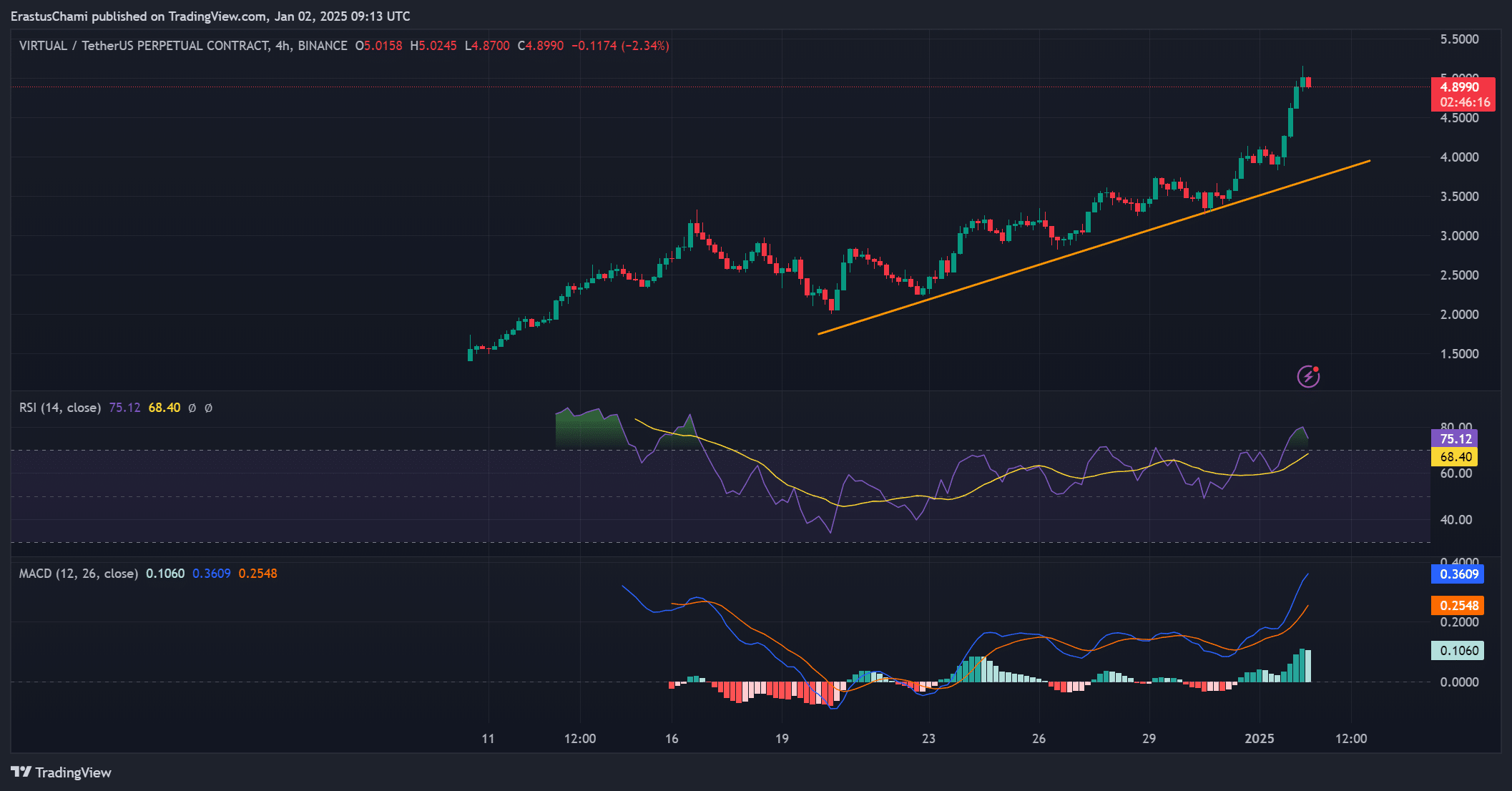

Virtual’s price action is a testament to its strong bullish momentum, as seen on the 4-hour chart.

The token has maintained an ascending trendline, breaking key resistance levels and pushing towards Fibonacci targets at $5.23 and beyond.

However, the slight retreat from $5.00 suggested that some traders were taking profits. Therefore, while the upward trend is clear, a short-term pullback could provide buying opportunities before the next leg up.

Source: TradingView

Bullish momentum remains

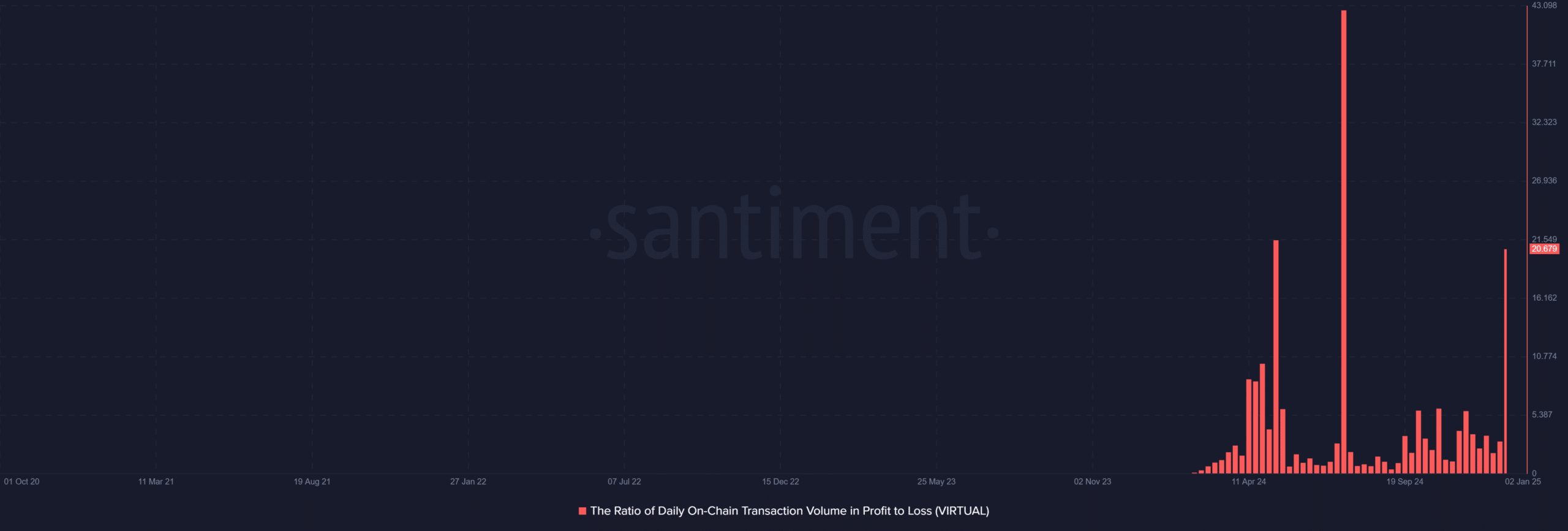

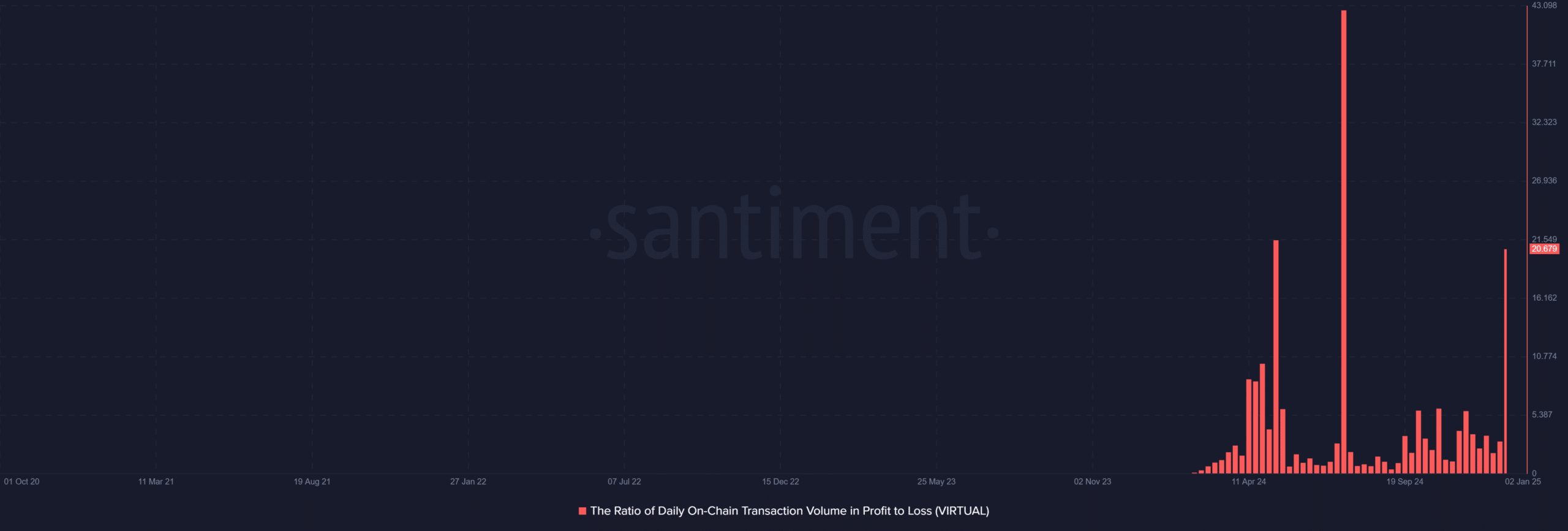

The on-chain profit-to-loss ratio stood at a staggering 20.68 at press time, highlighting heightened profitability among traders.

This surge in profitable transactions reflected strong market sentiment, often linked to sustainable upward trends.

This bullish indicator may continue to attract more traders looking to capitalize on VIRTUAL’s momentum. However, elevated profit-taking could trigger brief corrections as the market cools.

Source: Santiment

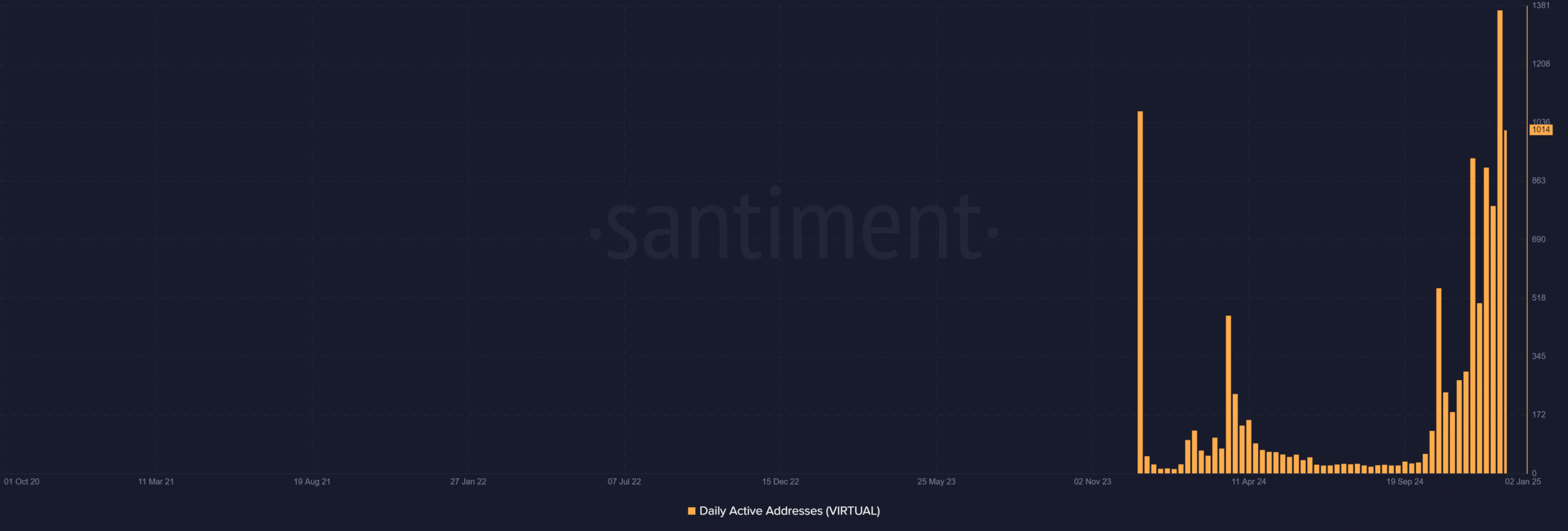

Growing network: Daily active addresses skyrocket

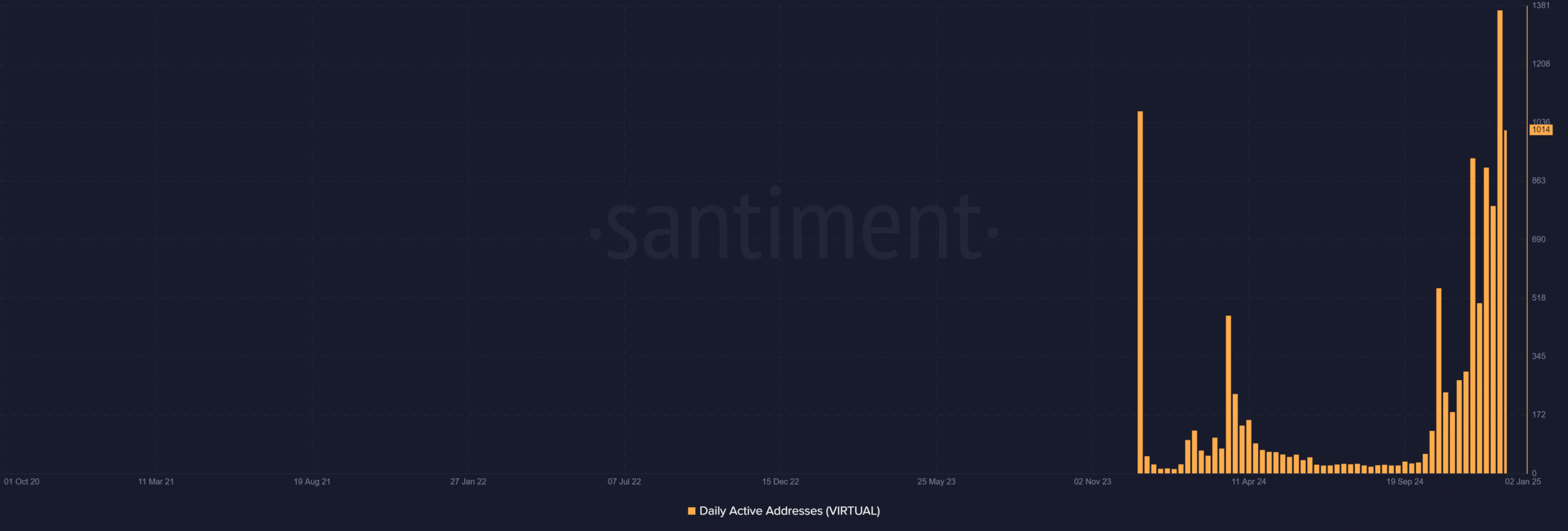

Virtual’s daily active addresses have surpassed 1,000, marking a significant increase in user engagement.

This rise showcases growing interest and adoption within the Virtual ecosystem, which often contributes to long-term sustainability.

Additionally, higher address activity suggested an expanding user base, reinforcing the token’s bullish case.

However, sustaining this growth will depend on Virtual’s ability to maintain its upward trajectory and deliver on ecosystem expectations.

Source: Santiment

Reading the charts: Technical momentum builds

Technical indicators suggested that the rally has room to run, but with caution. The RSI was at 75.12, indicating overbought conditions that could lead to short-term pullbacks.

However, the MACD remained bullish, with a positive crossover confirming upward momentum.

Additionally, the histogram’s expansion suggested growing buyer strength, making the current setup favorable for continued gains. Therefore, traders should monitor these signals closely for potential shifts.

Source: TradingView

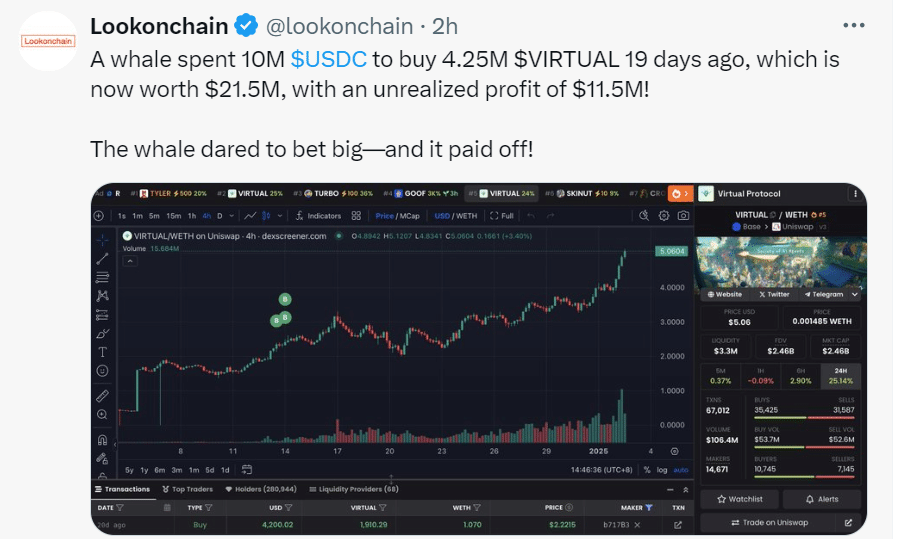

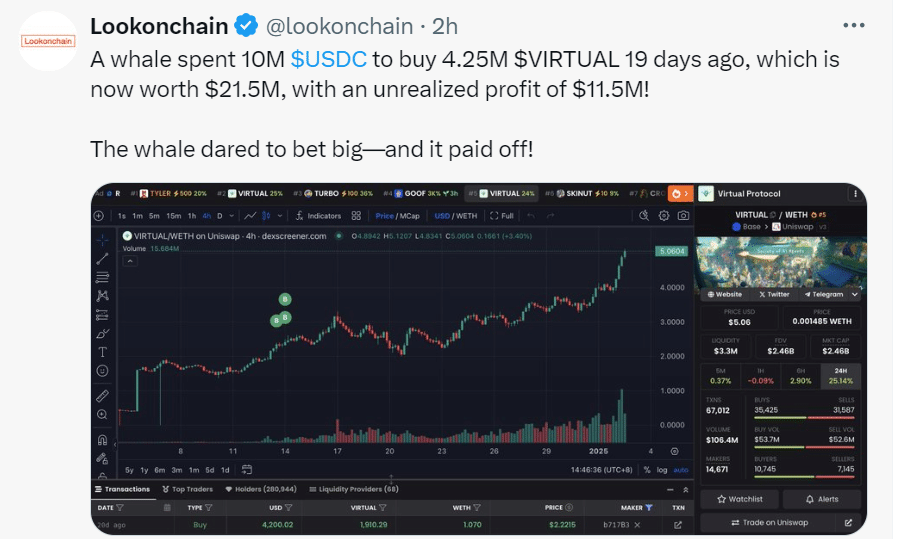

Whales make waves: High-stakes bets pay off

Whales have played a key role in Virtual’s rally, with one investor turning a $10 million bet into a $21.5 million portfolio, reaping $11.5 million in unrealized profit.

These large transactions injected confidence into the market, often inspiring retail participation.

Additionally, whale activity tends to amplify upward momentum, drawing in more attention. However, sudden whale sell-offs could create volatility, making it essential to stay vigilant.

Source: X/Lookonchain

Read Virtuals Protocol’s [VIRTUAL] Price Prediction 2025–2026

Conclusion: What’s next for VIRTUAL?

Virtual’s explosive rally is fueled by strong technicals, increasing user activity, and whale-driven confidence.

While the bullish momentum appears sustainable, overbought signals and profit-taking could introduce short-term risks.