- ADA’s price decline sparked curiosity about its recovery potential as key on-chain metrics flashed mixed trends

- Insights into ADA’s MVRV and inflation rate shed light on its current market positioning and future trajectory

The broader crypto market has faced significant setbacks over the past week, with Cardano (ADA) sharing in the decline. In fact, data showed that ADA fell by over 13% in the last seven days, making it one of the biggest losers among the top ten. Amid heightened market volatility, investors are assessing ADA’s price trends, the state of its on-chain metrics like the 30-day MVRV, and its annual inflation rate.

Cardano price action – A reflection of market sentiment

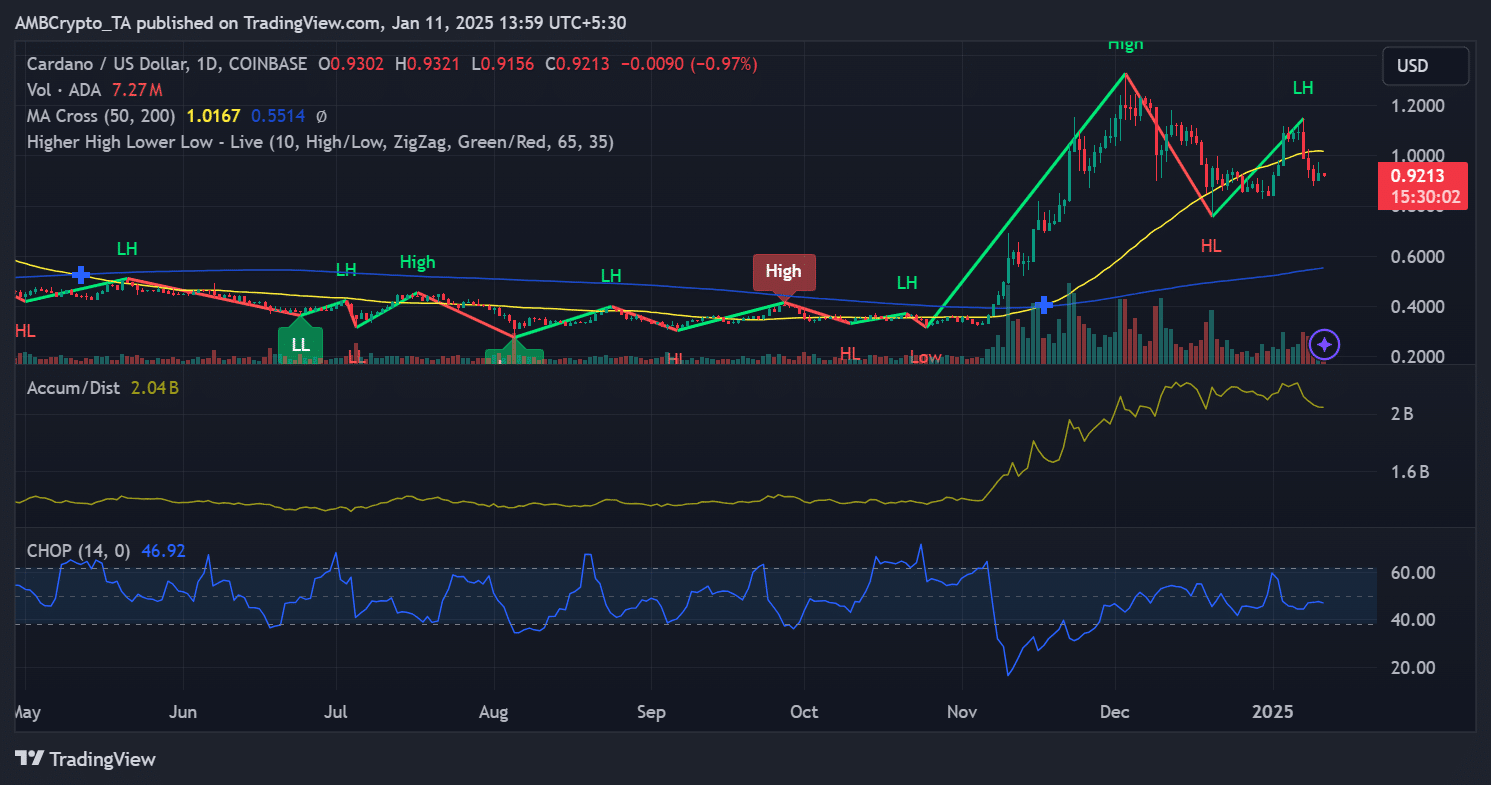

The altcoin’s price chart revealed a downtrend, with Cardano trading at approximately $0.9213 at the time of writing. Lately, the asset has struggled to maintain its recent upward trajectory, forming lower highs (LH), as visible on the price chart.

Source: TradingView

The Accumulation/Distribution (A/D) line indicated subdued buyer interest, correlating with reduced trading volumes. Furthermore, the Choppiness Index (CHOP) suggested that ADA’s price action remains range-bound and lacks definitive momentum, a typical characteristic of markets in consolidation phases.

Key levels to monitor include $0.90 as immediate support and $1.00 as resistance. Failing to hold above the support zone may lead to further downside pressure.

MVRV Ratio signals possible undervaluation

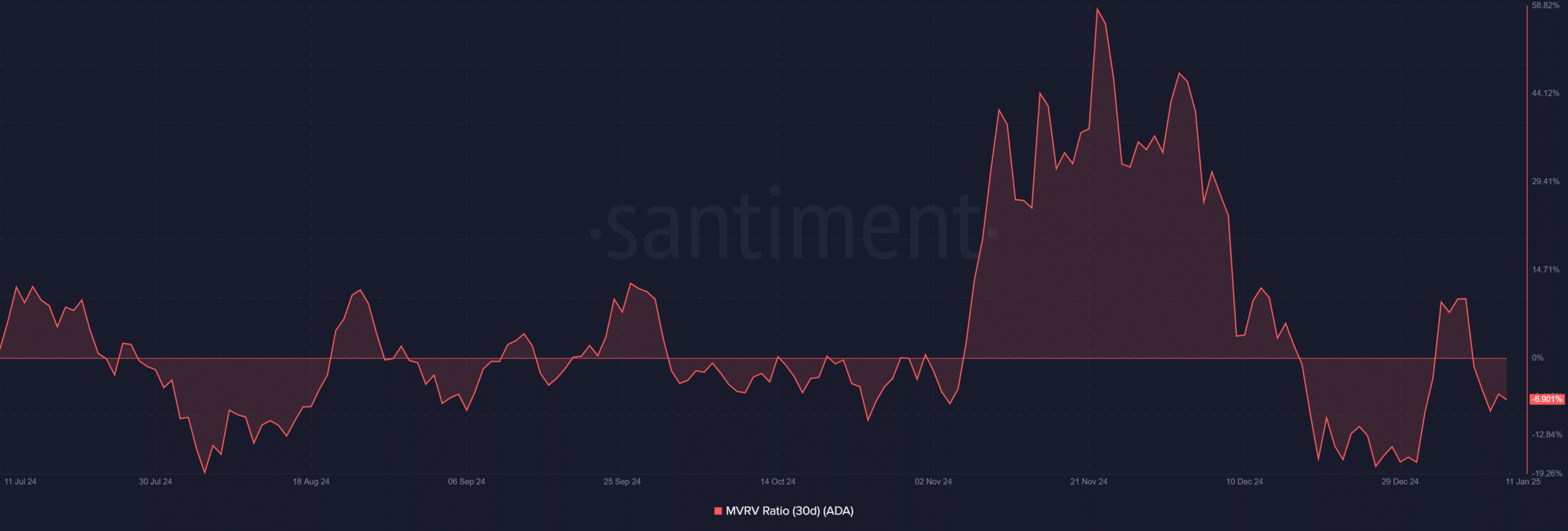

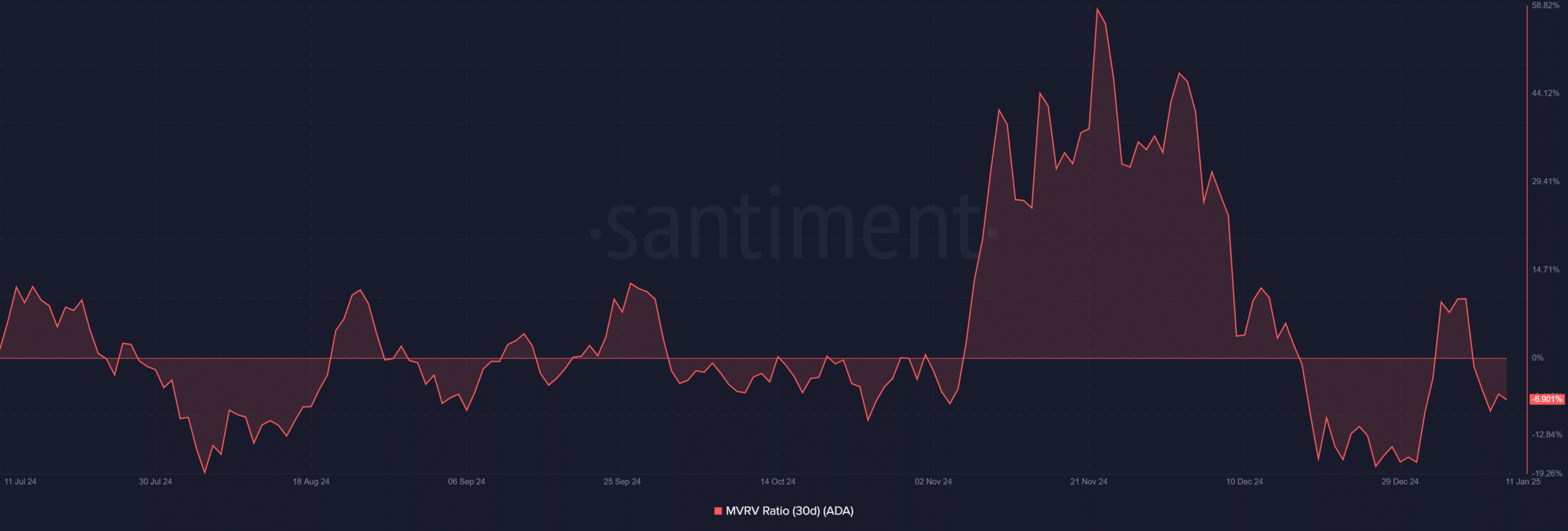

The 30-day MVRV (Market Value to Realized Value) ratio, which reflects the profitability of short-term holders, was negative at -6.90% at press time.

This suggested that Cardano is in a phase of undervaluation now, with the average holder facing unrealized losses. Historically, such levels have occasionally preceded a reversal, though that’s not always a guarantee.

Source: Santiment

This data implied that while ADA could present an opportunity for accumulation, broader market conditions may delay immediate recovery. A sustained improvement in market sentiment and ADA’s price stability will likely determine whether a significant uptick occurs or not.

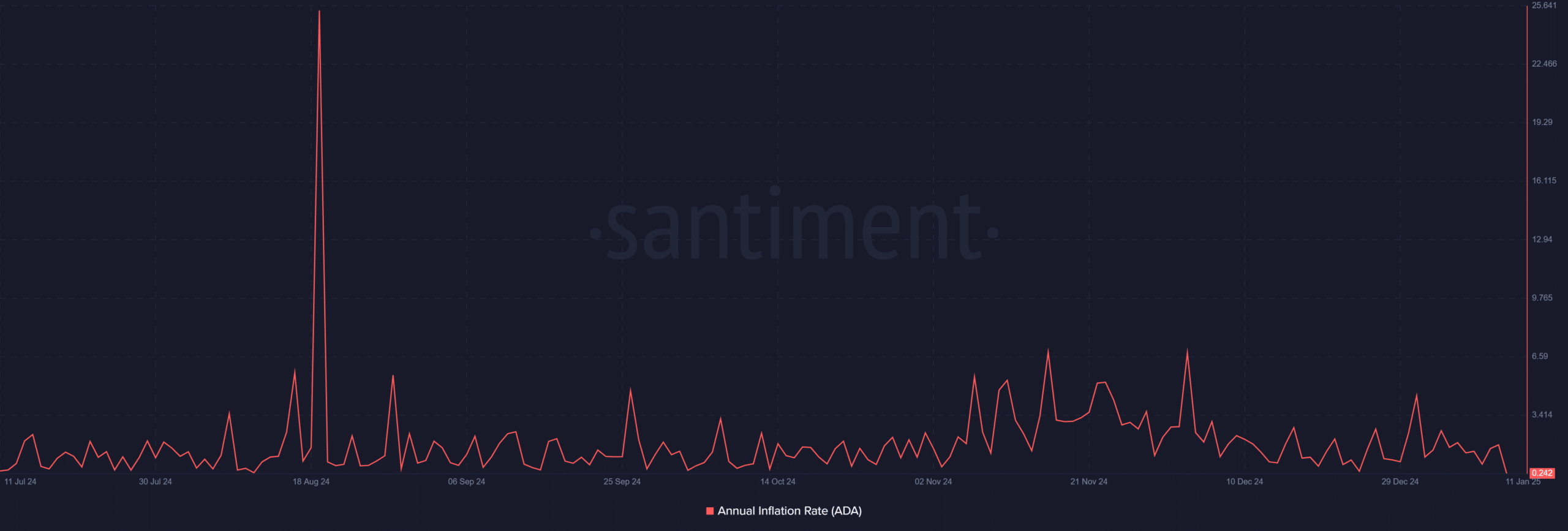

Annual inflation rate – A steadying factor?

Cardano’s annual inflation rate has remained relatively low at 0.242%, showcasing the network’s deflationary attributes and appeal for long-term holders.

Compared to other blockchain networks, this figure underlines ADA’s ability to mitigate excessive token supply growth, supporting its value proposition.

Source: Santiment

However, as the inflation rate dips further, it would align with decreasing network activity and transactional volume. This could signal a need for renewed utility or incentivization mechanisms to spur activity and maintain network health.

What lies ahead for ADA?

Cardano’s future trajectory hinges on several factors. The broader crypto market recovery will heavily influence ADA’s price action. Positive changes in network participation metrics, such as wallet activity and transactions, could support a bullish rebound. Additionally, ADA must break through the resistance at $1.00 and hold above $0.90 to reignite investor confidence.

– Is your portfolio green? Check out the Cardano Profit Calculator

Cardano’s press time market position reflected broader crypto headwinds, with a negative MVRV signaling possible undervaluation and a low inflation rate emphasizing its sustainable supply dynamics.

While the charts presented mixed signals, they also underscored the need for improved market sentiment and network engagement to restore ADA’s momentum.