- Cardano’s ascending triangle formation signals investor accumulation and higher chances of a bullish breakout.

- Rising Open Interest, network activity and bullish market sentiment allude to increased market participation.

Cardano [ADA] has been gearing up for potential strong price recovery following its short-heavy market a few days ago.

After facing a selling pressure, ADA’s latest uptrend inside an ascending triangle pattern suggests a shifting market sentiment as buyers step in.

The altcoin’s steady bullish momentum and market participation suggests a potential breakout above $0.83 key resistance level.

At press time, ADA was trading at $0.7809, a 1.08% price surge despite a decreased trading volume in the last 24 hours according to CoinMarketCap.

Market sentiment & on-chain signals

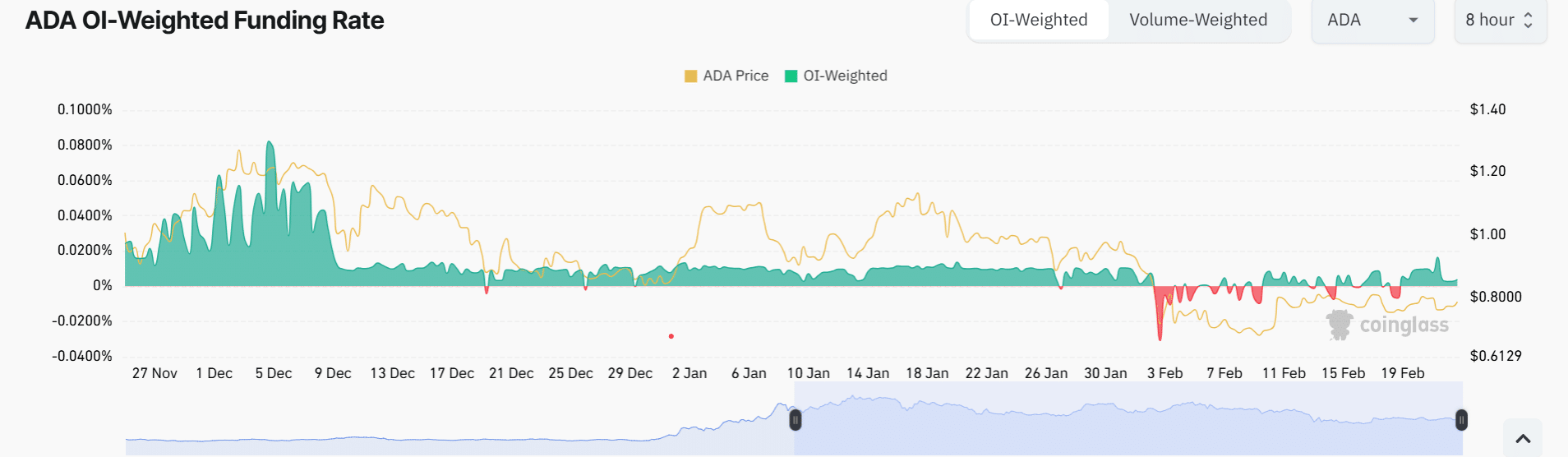

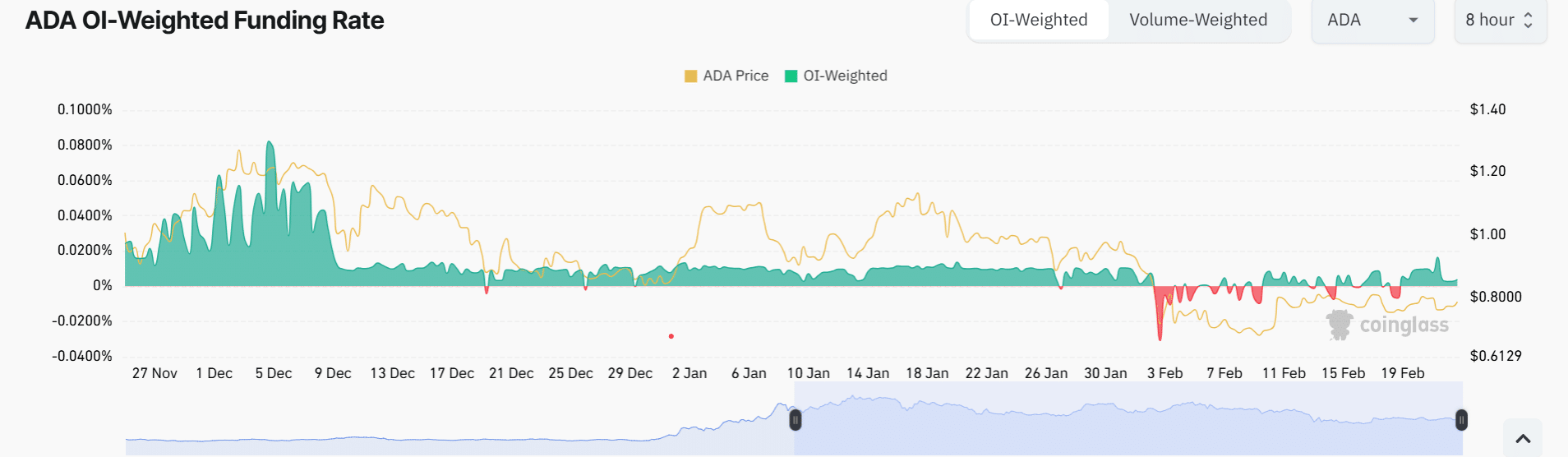

Cardano has seen its 24-hour Open Interest rise by 2.09% and its long-short ratio rise to a neutral zone (0.92) suggesting traders are entering positions, according to Coinglass data.

ADA’s Weighted Funding Rate has also turned positive as demand for long positions rose.

Source: Coinglass

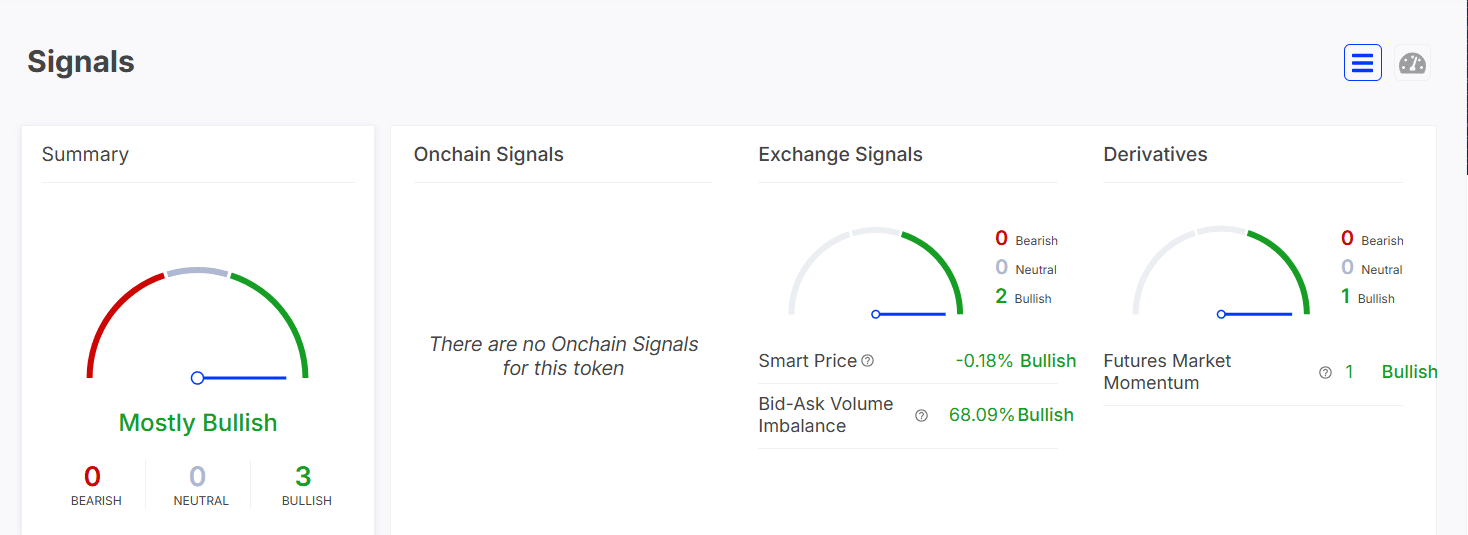

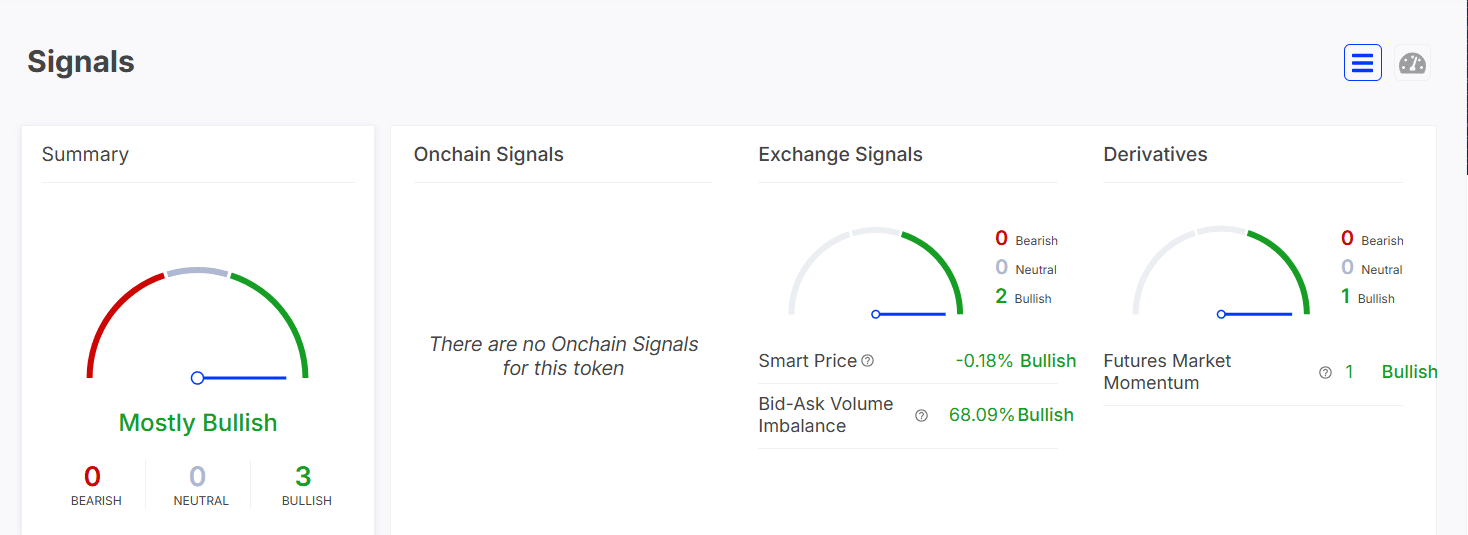

According to IntoTheBlock data, the bid-ask volume stood at 68.09%, with predominantly bullish exchange signals suggesting investor accumulation as ADA’s chances of a breakout increases.

Source: IntoTheBlock

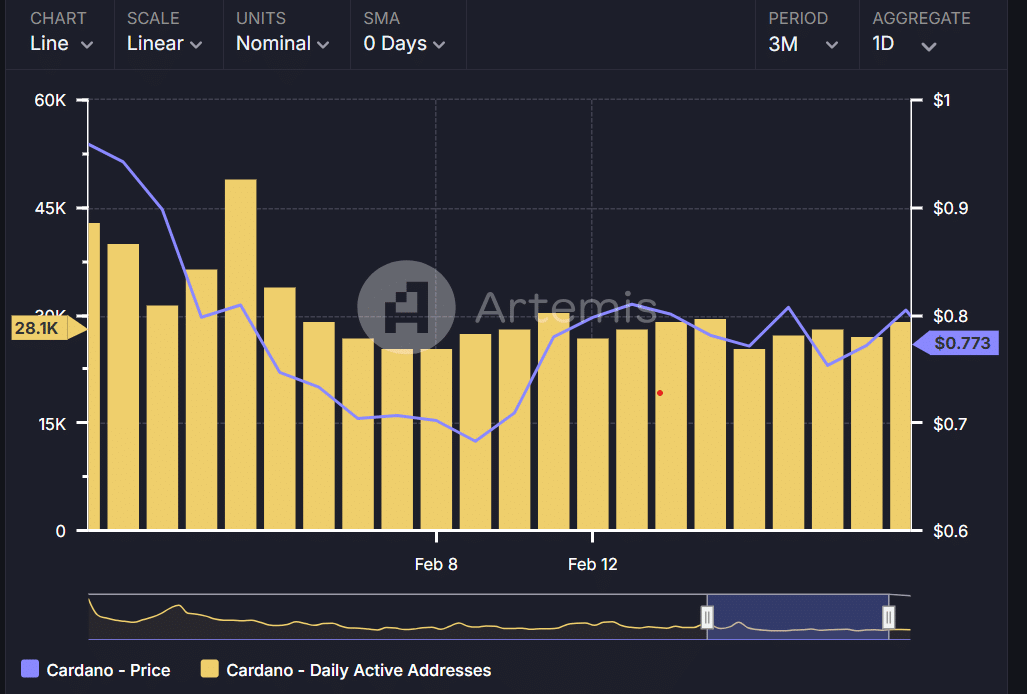

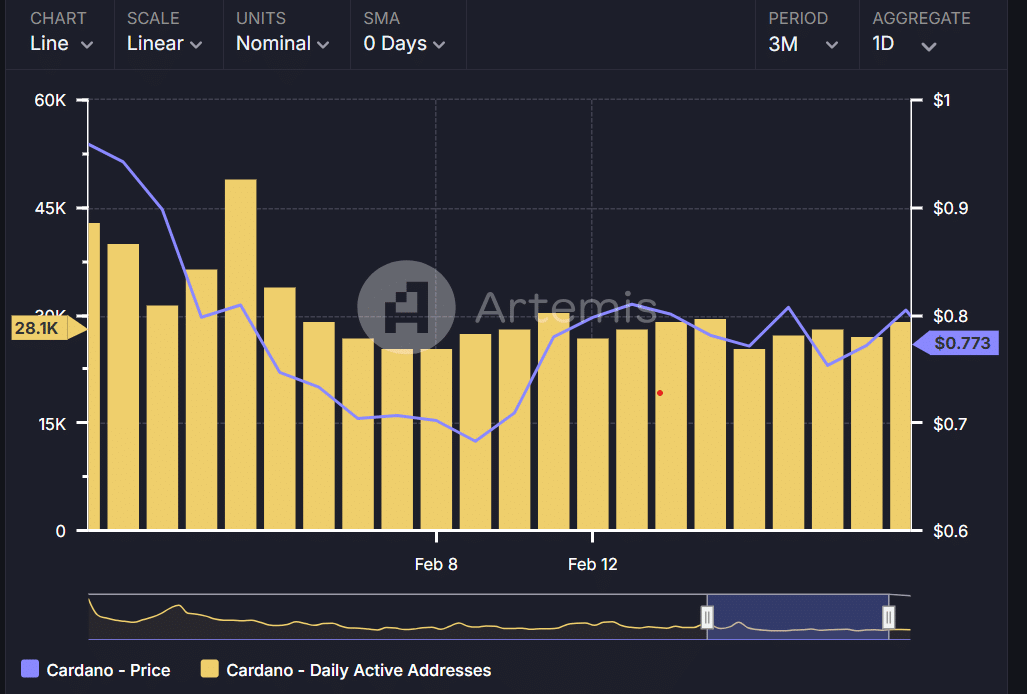

Cardano’s network active addresses have been gradually rising in the last 72 hours, showing increased market participation and mimicking ADA’s bullish uptrend on the hourly chart.

Source: Artemis

Cardano’s recovery and potential breakout

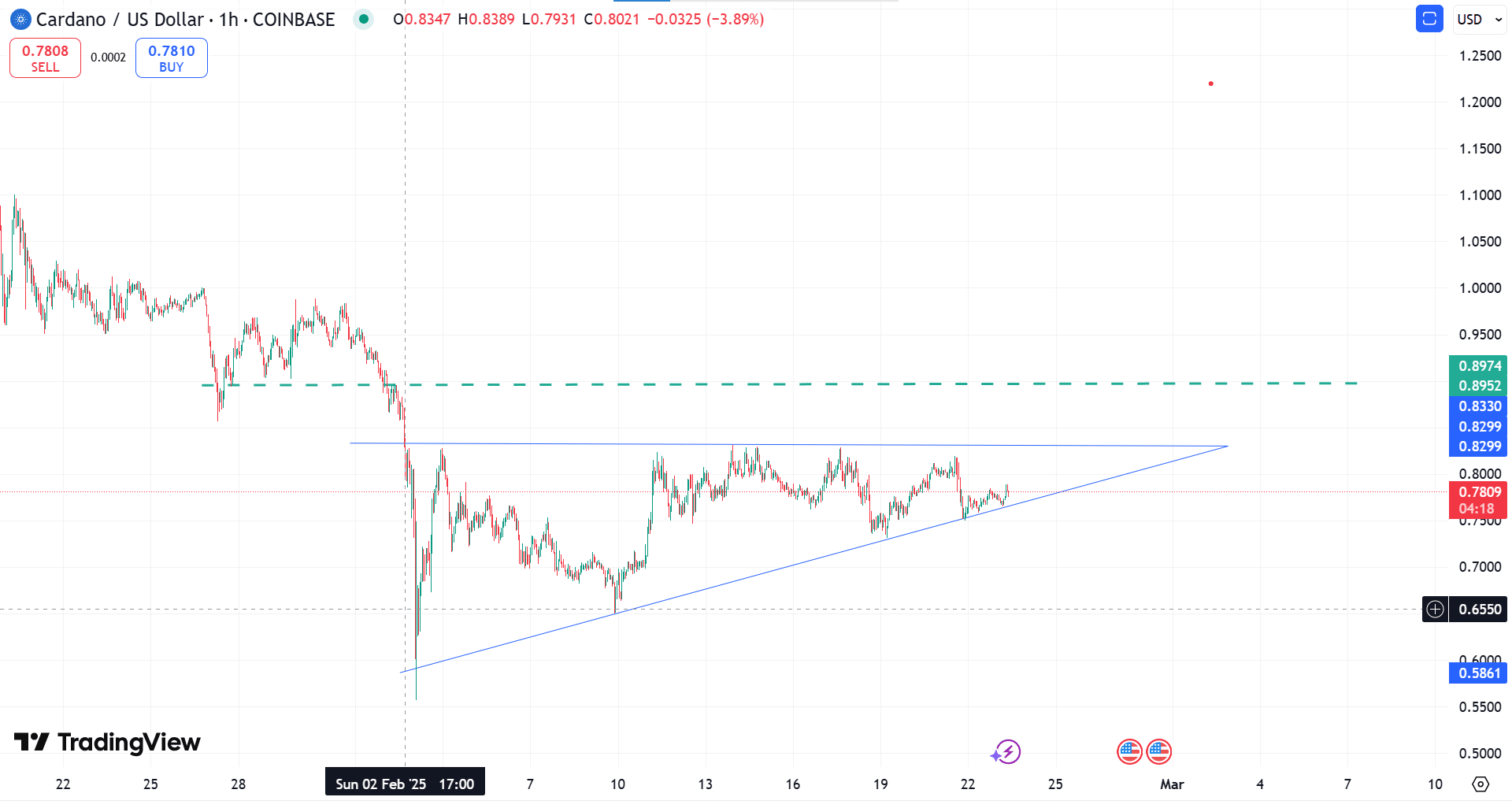

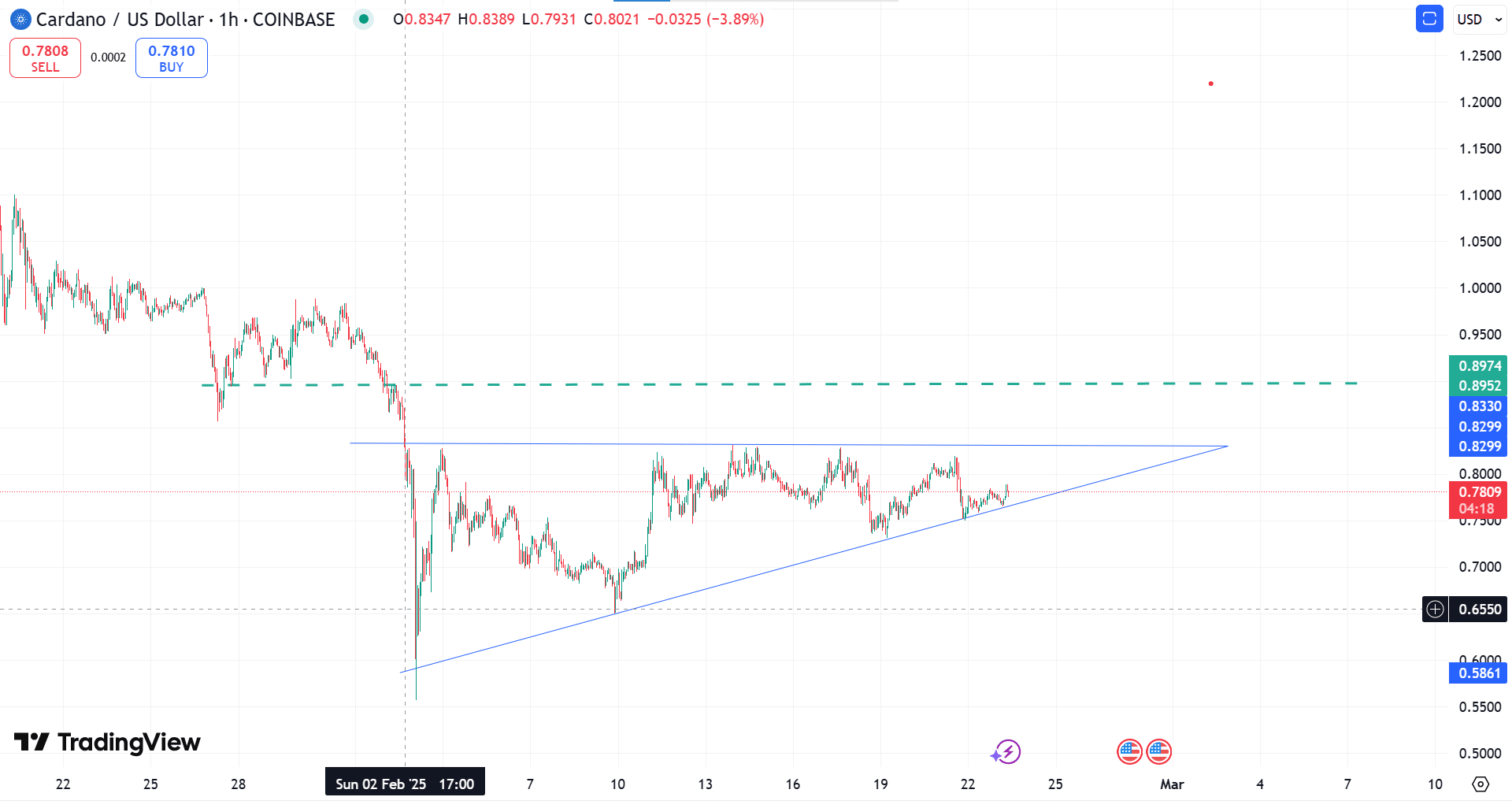

Looking at Cardano’s technical setup, ADA has been trading inside an ascending triangle by forming higher lows, signaling accumulation.

If the bullish momentum holds, a potential breakout above the $0.83 key resistance level could happen.

With a strong buying volume, ADA could hit $0.90 key resistance zone before rallying to $1.00 psychological level.

Source: TradingView

What’s next for Cardano?

ADA’s (EMA 200) at $0.7301 and (SMA 200) at $0.6547 were below its press time price, signaling buy and confirming its long-term bullish momentum according to TradingView data.

The Relative Strength Index (RSI) stood at 44, suggesting that Cardano was slightly oversold, and the asset was recovering from a bear market.

So, Cardano could see more buying pressure in the next few days, boosting its bullish momentum and the potential for a breakout.