- COMP crypto soared 50% in the past 30 days; will the uptrend extend?

- The rally was marked by increased whale interest and reduced sell pressure.

The DeFi sector has been a top-performing segment in the past two weeks, and protocols like Compound [COMP] benefited from the windfall. COMP crypto token was up 50% in the past 30 days, rising from $38 to $74.

However, the rally hit a roadblock near $80K. Can COMP clear the hurdle and target the $100 it crossed in early 2024?

COMP crypto $80 hurdle

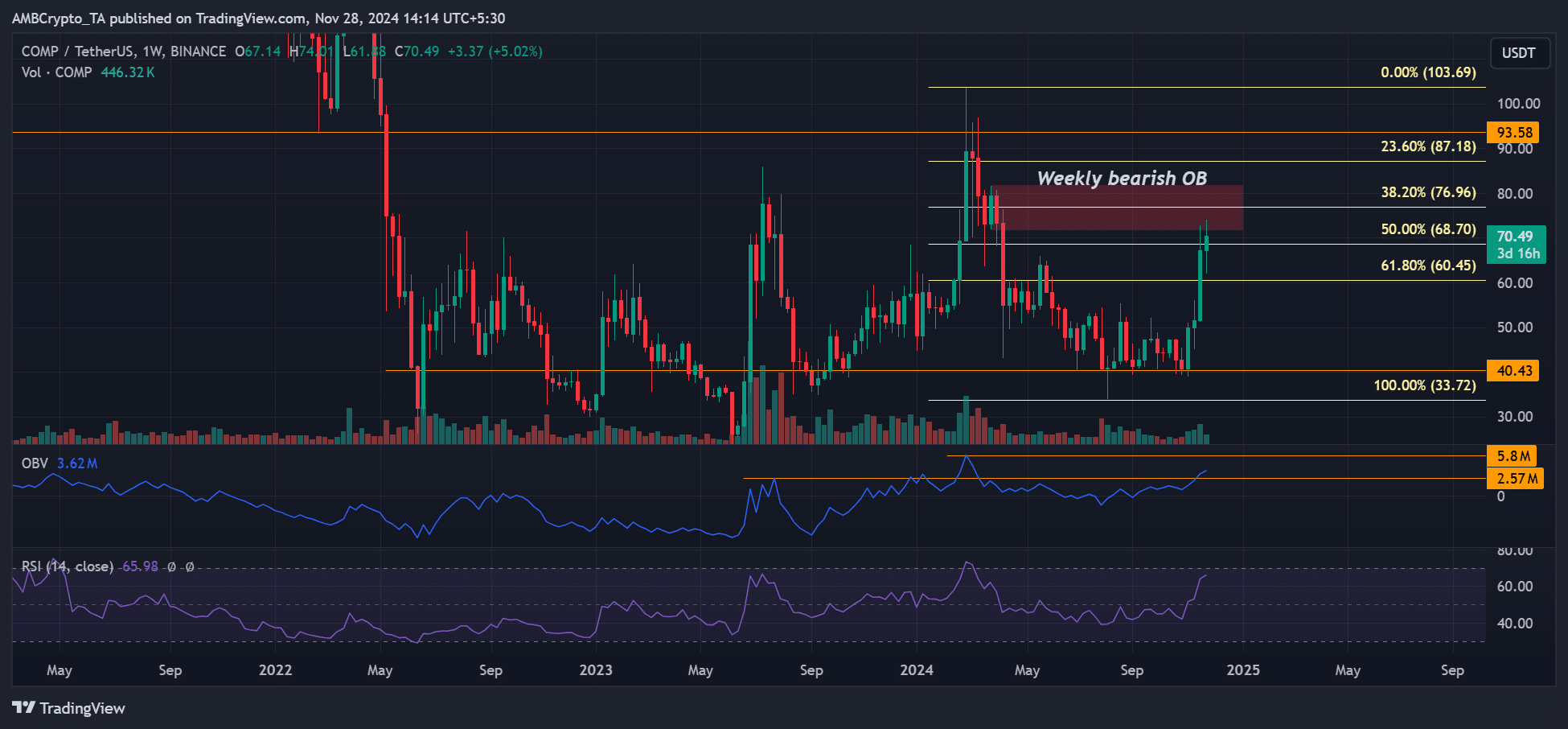

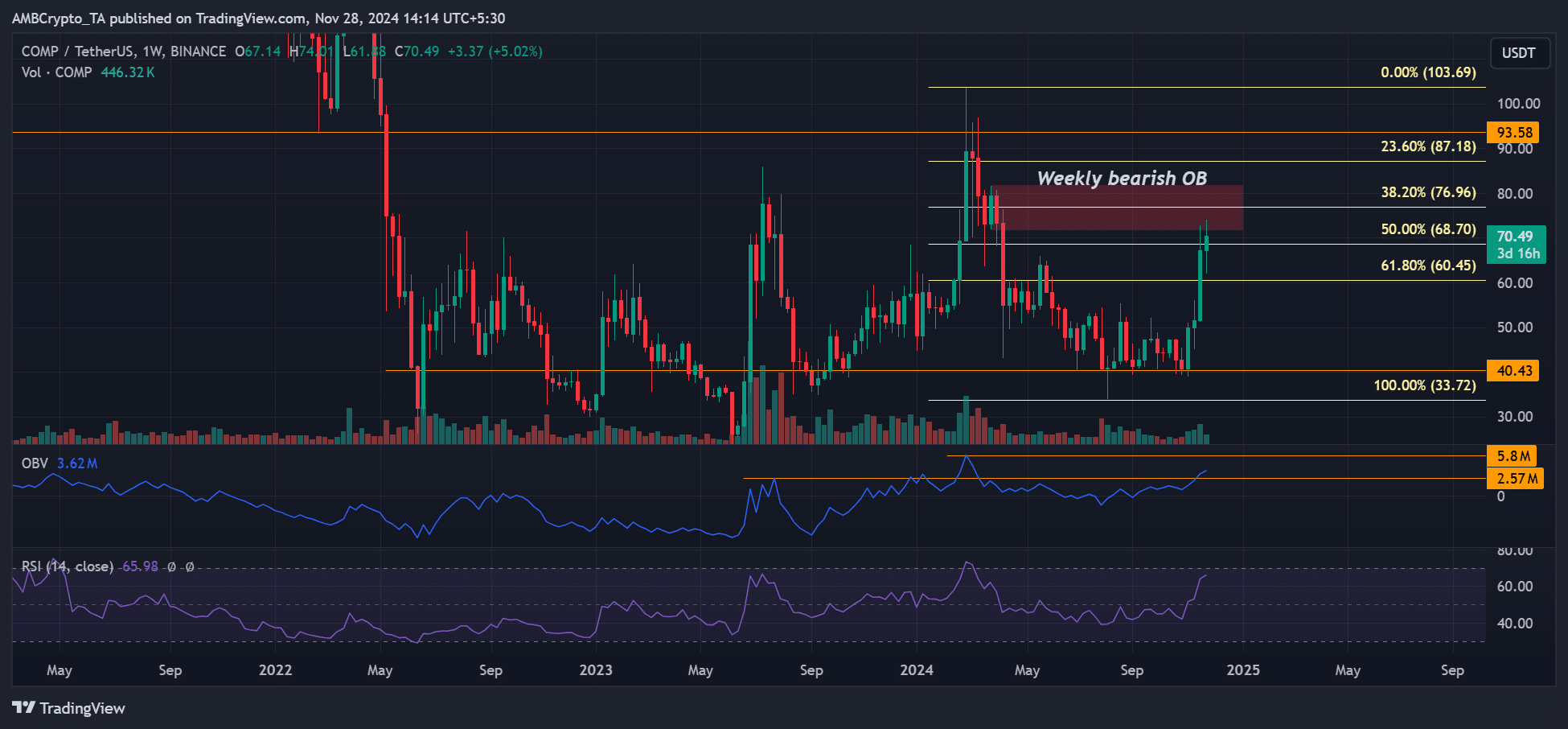

Source: COMPUSDT, TradingView

The weekly chart had a bearish order block (OB), marked red, $71-$81. In most cases, bearish OBs act as supply zones for large players to execute their trades.

The roadblock was hit last week, but COMP struggled below it into the new week, suggesting profit-taking at the level.

That said, a weekly candlestick close above $81 (the supply zone) could signal a likely continuation of the recovery.

If so, the $100 psychological level could be within reach. However, COMP had to flip $93 into support to accelerate to $100 and above.

The OBV (On Balance Volume) was below the March peak and suggested more upside potential. However, the RSI neared overbought territory and cautioned of a slight cool-off.

On-chain was bullish

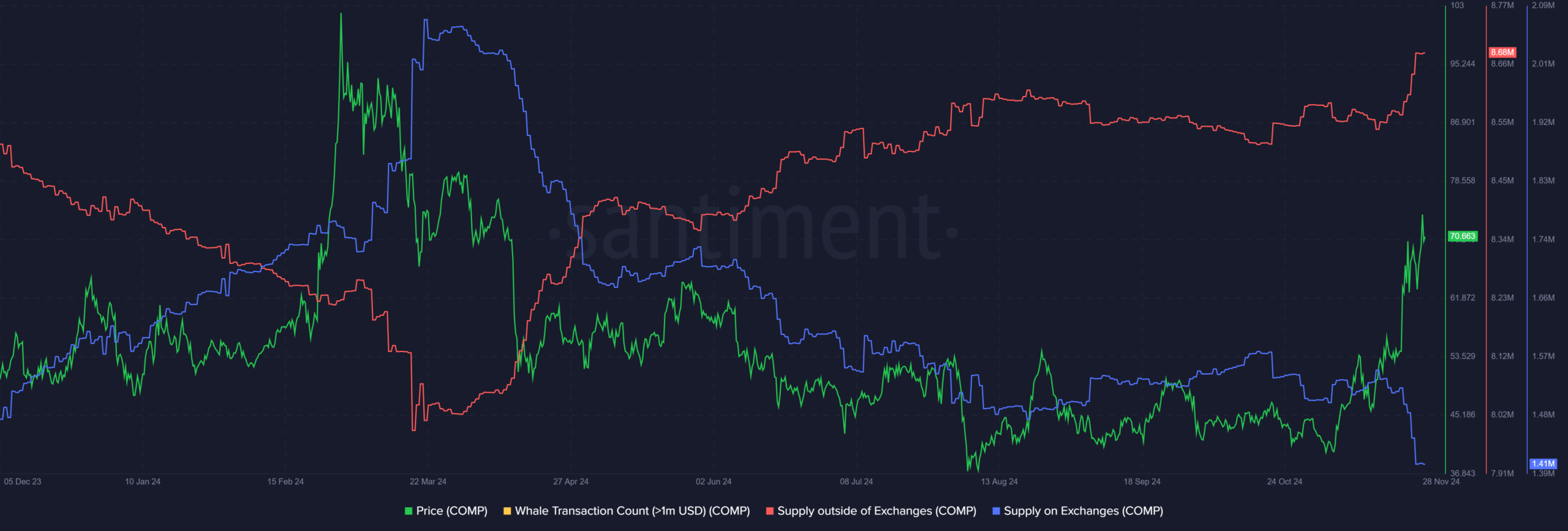

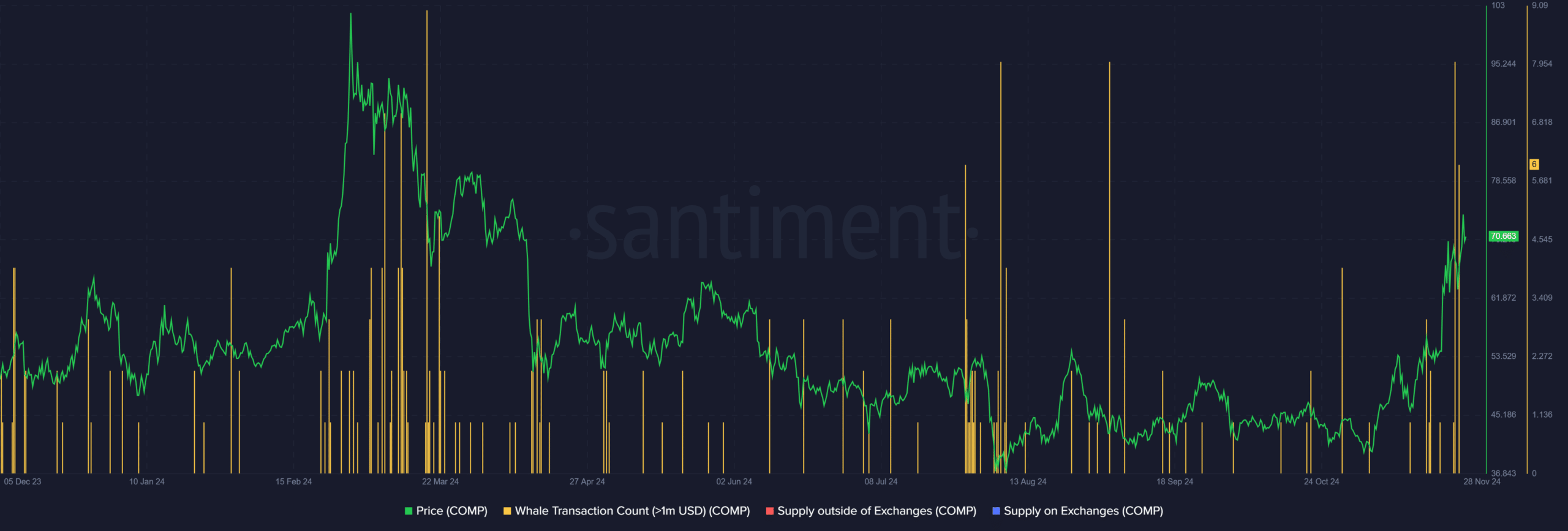

Source: Santiment

Santiment data revealed that the ongoing rally was majorly driven by strong accumulation (spot buying pressure), as noted by an uptick in Supply outside of Exchanges (red).

Interestingly, sell pressure on centralized exchanges (CEXes) dropped even lower, as shown by the declining supply on exchanges (blue).

This suggested COMP had less headwind, which could tip it to clear the overhead roadblock.

The above scenario differed from the early 2024 local top when demand declined and selling increased. This indicated the uptrend could continue unless accumulation drops and sell pressure intensifies.

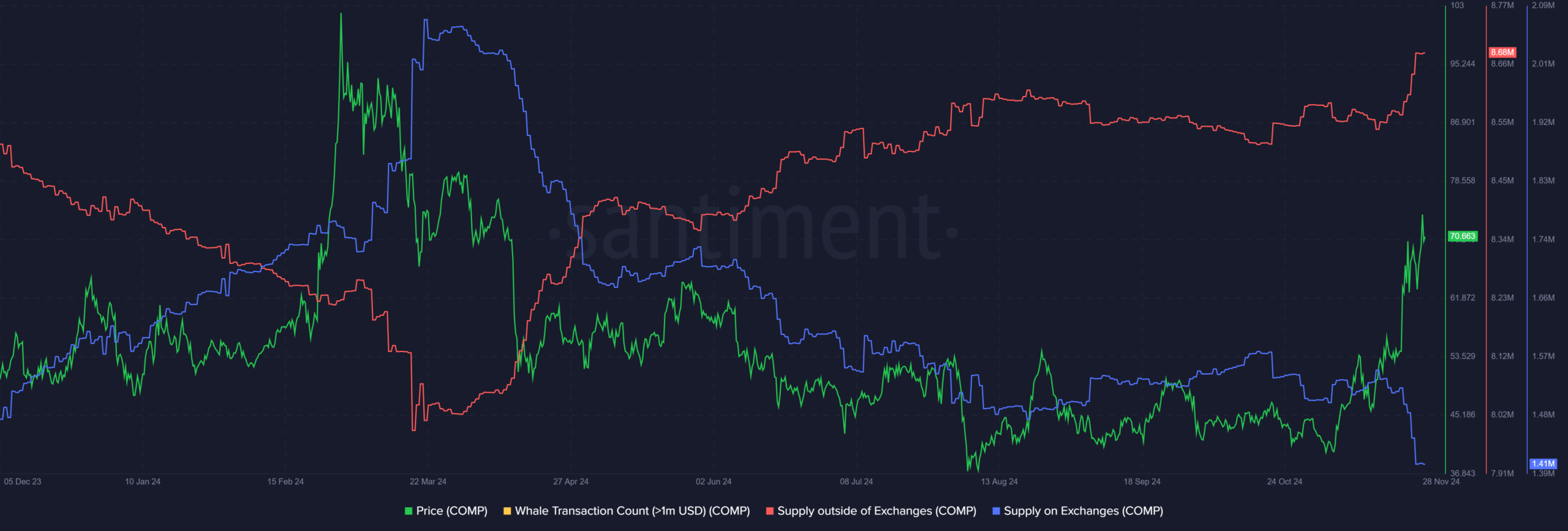

Source: Santiment

Read Compound [COMP] Price Prediction 2024-2025

Another bullish on-chain signal was the spike in whale actions. The increased whale interest could boost COMP’s price unless they are selling.

In conclusion, COMP’s uptrend could continue amid a DeFi resurgence and reduced sell-pressure from CEXes.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion