- Cronos breaks out of a descending channel, targeting a 50% upside if momentum holds.

- On-chain activity and cautious market sentiment support CRO’s current bullish trend.

Cronos [CRO] has captured significant market attention with an impressive 25% surge in the past 24 hours, pushing its price to $0.137 at press time.

With a market cap rising to $3.64 billion, an 8.12% increase, and 24-hour trading volume spiking by over 62%, CRO’s bullish rally has captured widespread market attention. However, the question remains: can CRO sustain this momentum and continue climbing?

Breakout from a massive descending channel: What’s the next target?

CRO recently broke out of a prolonged descending channel, a pattern that typically signals a potential reversal in downtrending markets. This breakout, clearly seen in the chart, suggests that the downward pressure may have subsided, making way for a bullish reversal.

Given this breakout, the next major resistance target stands at $0.204, a key psychological level that, if achieved, could mark a substantial 48% upside from its current price.

However, reaching this target will require sustained buying pressure and increased momentum. Therefore, CRO’s ability to break and hold above nearby resistance levels will play a crucial role in determining whether this rally continues or stalls.

Source: TradingView

CRO technical indicators point to further volatility

Technical indicators further highlight CRO’s bullish trend. The recent moving average (MA) crossover, with the 9-day MA at $0.0964 crossing above the 21-day MA at $0.0838, confirms this momentum shift, signaling that buyers are gaining control.

Additionally, the Average True Range (ATR) has risen sharply to 0.0103, reflecting heightened volatility. This increased ATR suggests that CRO could experience significant price swings in the coming days, making it essential for traders to monitor support and resistance closely.

Source: TradingView

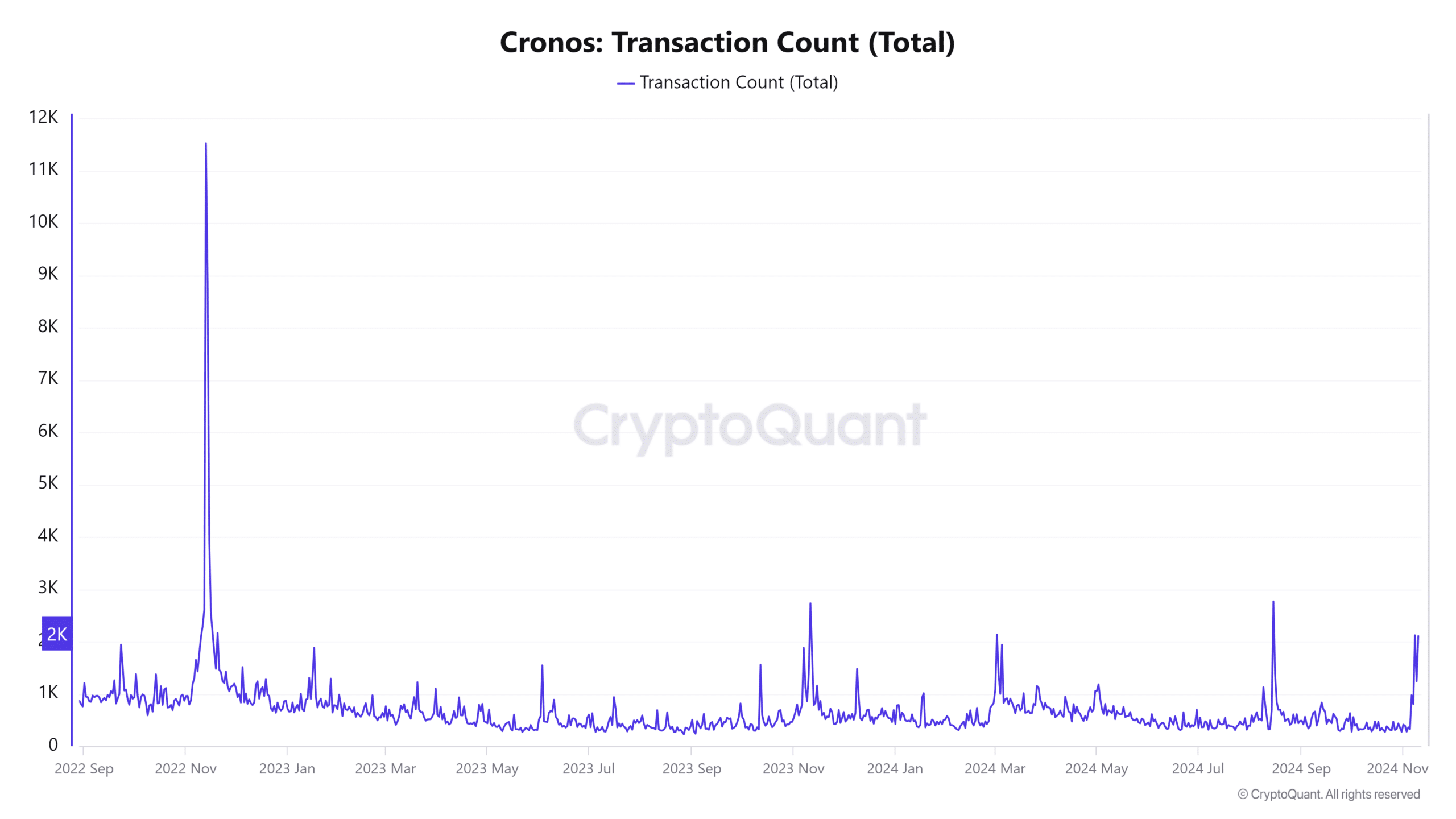

On-chain metrics show rising engagement

On-chain data shows that CRO’s network activity has also increased, reinforcing the bullish outlook according to CryptoQuant analytics. Active addresses grew by 1.44% in the past 24 hours, while transaction counts rose by 1.47%, now totaling 2,317K.

This uptick in network activity demonstrates greater engagement within the CRO ecosystem, a sign of growing confidence and participation among users and investors.

Source: CryptoQuant

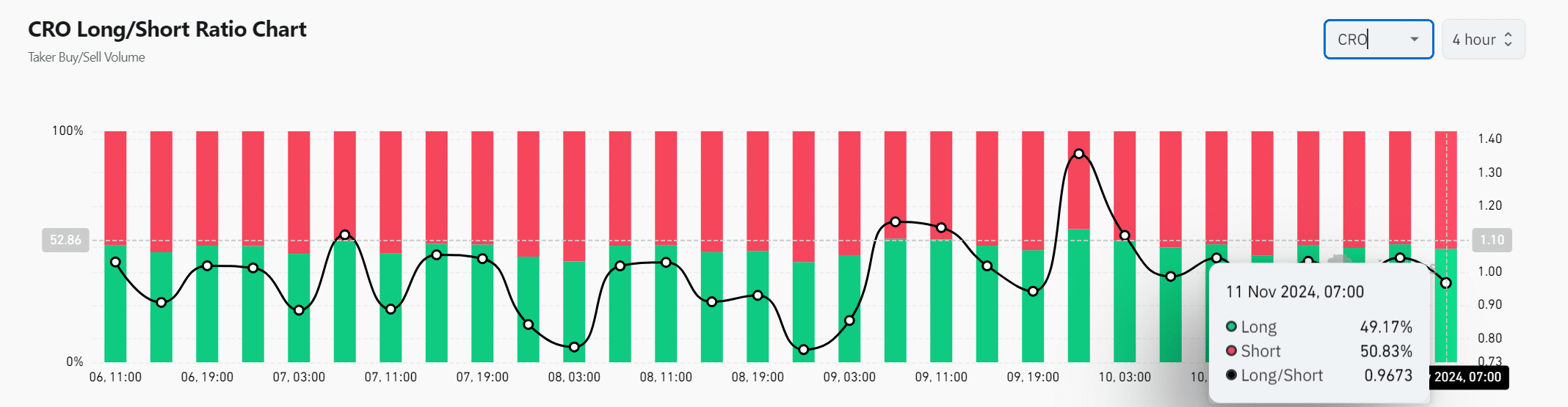

Market sentiment: Long/short ratio indicates cautious optimism

Market sentiment, as illustrated by the long/short ratio, currently hovers around an even split, with 49.17% of positions long and 50.83% short. This balanced ratio reflects cautious optimism among traders, with a slight lean towards short positions, suggesting some uncertainty about the rally’s sustainability.

However, a shift in sentiment could quickly fuel further gains if the ratio begins favoring longs.

Source: Coinglass

Can CRO maintain its upward momentum?

With a powerful breakout from a descending channel, positive technical indicators, rising on-chain activity, and cautious market sentiment, Cronos appears primed for further gains.

However, the token’s ability to maintain its upward trajectory will depend on sustained buying interest and resilience at critical resistance levels.

As volatility increases, CRO’s performance over the next few days will reveal whether this rally has lasting power in the competitive altcoin landscape.