- Biggest Gainers: Story [IP], Sonic [S], Maker [MKR].

- Biggest Losers: Raydium [RAY], Jupiter [JUP], Official Trump [TRUMP].

The cryptocurrency market continues to exhibit sharp price movements, with some tokens achieving remarkable gains while others experience significant downturns.

This week witnessed explosive rallies among top-performing tokens, while some assets faced relentless selling pressure. Below is a deep dive into the biggest winners and losers of the past seven days.

Biggest winners

Story [IP]

Story [IP] dominated the crypto markets this week, skyrocketing 205% from $1.50 to $4.40.

The token’s meteoric rise began on the 20th of February, when a sustained buying spree pushed prices from $2.50 to a staggering peak of $5.80 on the 21st of February.

The rally was fueled by exceptional trading volume, particularly during the aforementioned explosive session, when IP hit its weekly high.

However, profit-taking emerged above the $5.50 mark, triggering a pullback that stabilized around $4.40.

Despite the retracement from peak levels, IP maintains robust support at $4.20, with buyers consistently stepping in at this price point.

The token’s price action forms a bullish consolidation pattern, suggesting potential for another leg up.

This week’s surge places IP among the top performers in the crypto market, with technical indicators firmly in bullish territory.

Sonic [S]

Sonic [S] captured significant attention this week, surging 60% from $0.52 to $0.81. The former FTM token displayed remarkable momentum, particularly during its mid-week rally that pushed prices to a peak of $0.95.

The bullish run kicked off on the 19th of February, with strong buying pressure driving a series of green candles that culminated in a high on the 21st of February.

Trading volume spiked notably during this period, reflecting substantial market interest in the token.

While profit-taking emerged above $0.90, causing a pullback to current levels, Sonic maintains its bullish structure. The token found solid support around $0.80, with buyers consistently defending this zone.

Technical indicators suggest the uptrend remains intact despite the consolidation phase. The $0.85 level now represents key resistance, with a break above potentially triggering renewed buying interest.

Maker [MKR]

Maker [MKR] showcased exceptional strength this week, surging 58% from $1,000 to $1,585.

The DeFi heavyweight gained significant momentum after breaking through key resistance levels, particularly the crucial $1,200 mark.

The bullish momentum accelerated on the 21st of February, when MKR recorded a substantial green candle, pushing prices from $1,200 to $1,400 in a single session.

Trading volume spiked dramatically, with the MACD indicator confirming strong bullish momentum as it crossed above the signal line.

Source: TradingView

Technical analysis reveals that MKR’s price action formed a powerful uptrend, with each retracement finding solid support at higher levels.

The token successfully breached its 200-day moving average at $1,487, turning it into a support level.

Recent sessions, at press time, showed MKR consolidating above $1,500, suggesting buyers remain in control. The MACD histogram continues to print higher highs, indicating sustained bullish momentum.

For traders eyeing entry points, the newly established support at $1,500 presents a key level to watch.

A successful defense of this zone could set up MKR for another leg higher, potentially targeting the $1,700 resistance level. However, any break below $1,400 might signal a short-term pullback.

Top 1,000 gainers

Beyond the top performers, the broader market saw notable surges.

Scotcoin [SCOT] led the top 1,000 tokens with a 742% gain, while Undeads Games [UDS] and Solana Social Explorer [SSE] posted 295% and 266% gains, respectively.

Biggest losers

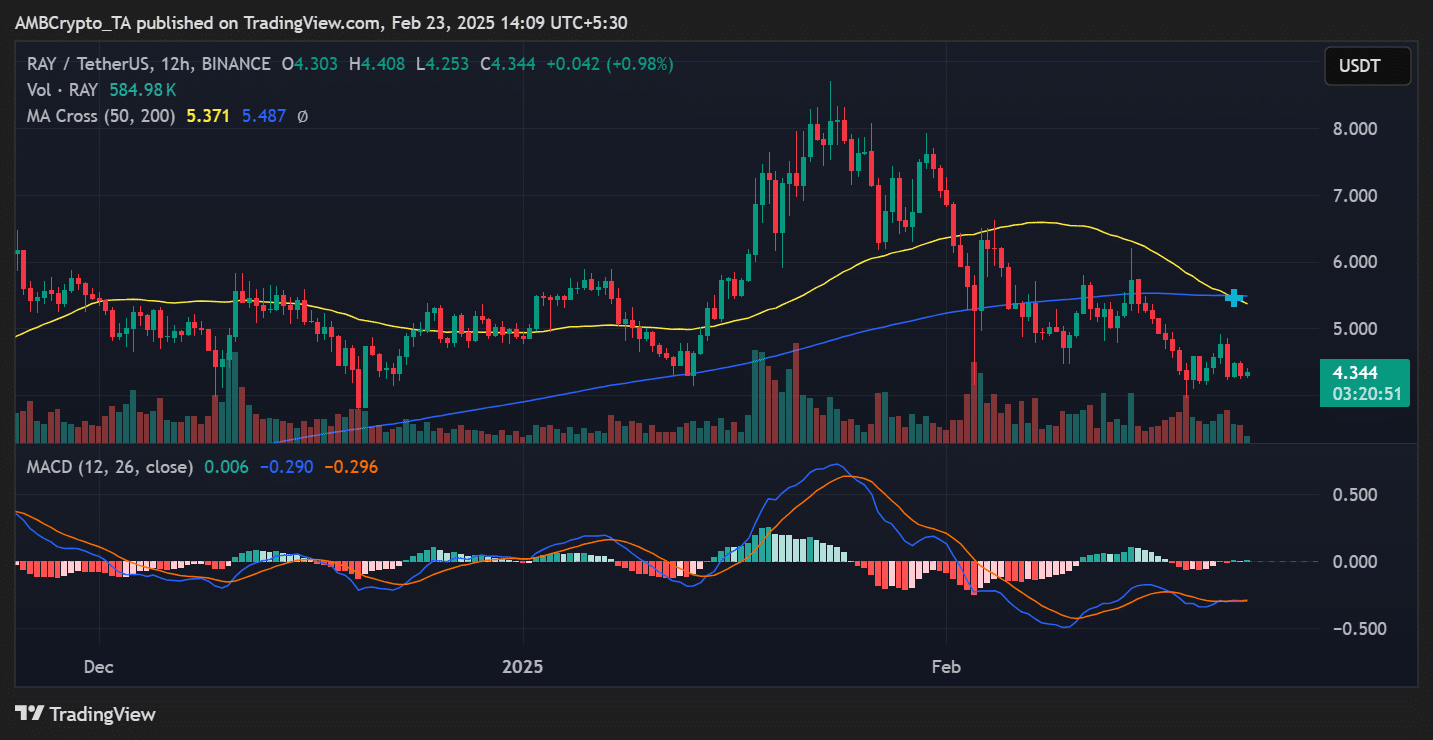

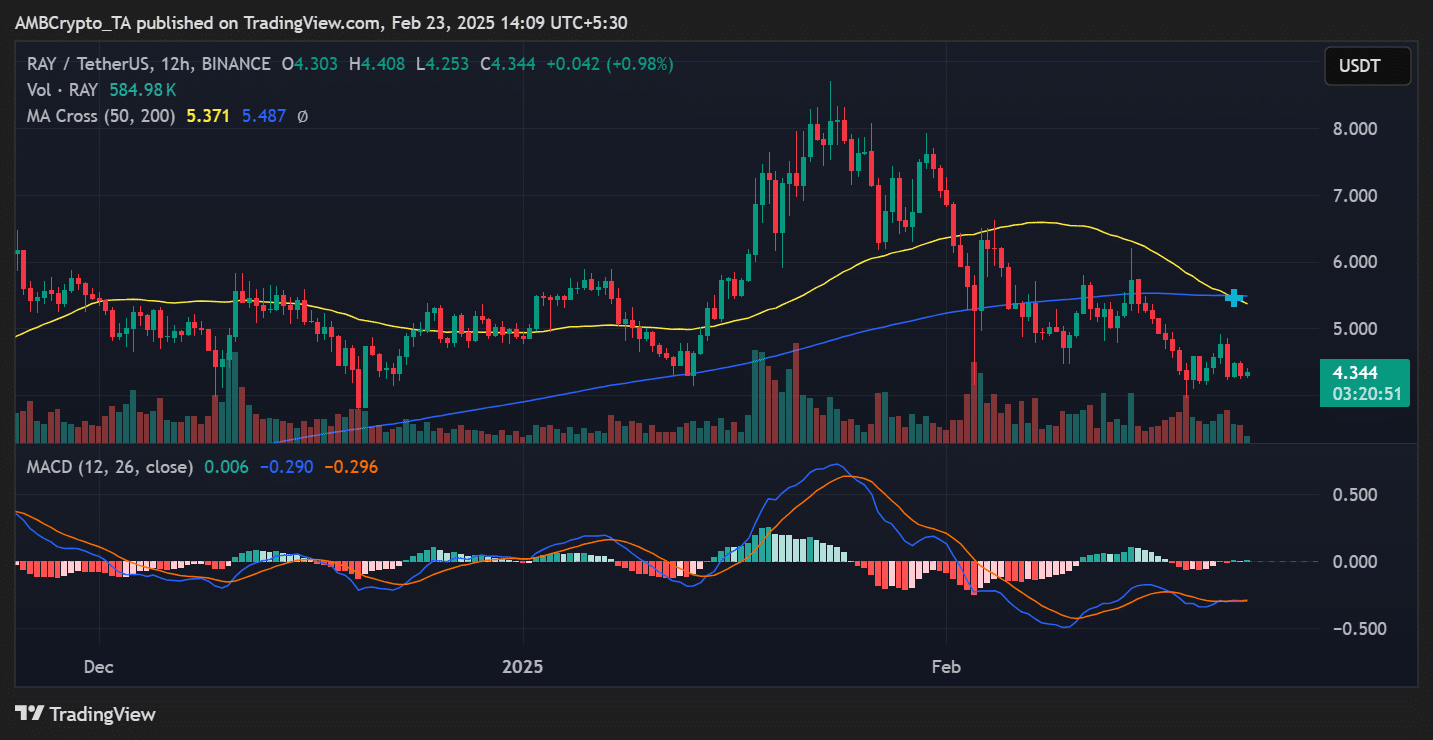

Raydium [RAY]

Raydium [RAY] emerged as this week’s biggest loser, plummeting 16% from $5.15 to $4.34.

The Solana-based DEX token faced relentless selling pressure, with bears dominating nearly every trading session since the 17th of February.

The sharp decline began with a series of large red candles breaching multiple support levels.

The most significant drop occurred in the first two days of the week, when RAY tumbled from $5.15 to $4.20, briefly bouncing at this support zone.

Source: TradingView

Despite a mid-week recovery attempt that pushed prices toward $4.80 on 21st February, sellers quickly regained control.

The MACD indicator remains negative, and a death cross pattern has formed, signaling prolonged downside pressure.

For any meaningful recovery, RAY needs to reclaim $4.50, followed by a break of the $4.80 resistance level. However, the current technical setup suggests bears remain in control.

Jupiter [JUP]

Jupiter [JUP] couldn’t escape broader market pressure, tumbling 14% from $0.92 to $0.78. The Solana-based DEX aggregator faced significant selling pressure, particularly during early-week sessions.

The steepest decline occurred between the 17th to the 19th of February, when JUP plummeted from $0.92 to $0.70, marking a local bottom. While buyers emerged at this support level, the rebound was unsustainable.

JUP was consolidating between $0.77 and $0.80 as of this writing, with lower highs and lower lows defining the trend.

The $0.75 level now represents crucial support, with any break below likely triggering another wave of selling.

Official Trump [TRUMP]

Official Trump [TRUMP] meme token struggled this week, dropping 12% from $0.35 to $0.31. The politically-themed token faced persistent selling pressure, continuing its downward trend.

The decline accelerated mid-week, briefly touching $0.29 before seeing a minor bounce. Despite attempts to stabilize around $0.32, selling pressure remained dominant.

For any meaningful recovery, TRUMP needs to reclaim and hold above the $0.33 resistance level. However, the $0.30 support level remains a critical test for the token.

Top 1,000 losers

In the broader market, Unchain X [UNX] led the declines with a 62% drop, followed by Libra [LIBRA] and Griffain [GRIFFAIN], which fell 61% and 44%, respectively.

Conclusion

Here’s the weekly recap of the biggest gainers and losers. It’s crucial to bear in mind the volatile nature of the market, where prices can shift rapidly.

Thus, doing your own research [DYOR] before making investment decisions is best.