- 2024 was a pivotal year for Bitcoin, with the same setting the stage to tackle the volatility of 2025

- Stablecoins are rising as the new gold, leading a financial revolution as the anti-dollar coalition grows

2024 was a wild ride for cryptos. Inflation skyrocketed, traditional markets got rocked by global drama, and more people started looking at crypto as their financial “Plan B.”

The so-called “Trump pump” gave Bitcoin a chance to prove itself as digital gold, and it didn’t disappoint. Now, as we look ahead to 2025, the crypto world is holding its breath, wondering what’s next. Speculation is high, but the stakes are even higher.

Crypto market remains tangled in the economic thread

It’s no coincidence – Bitcoin surged thanks to a triple-digit YTD growth, climbing as high as $108k on the charts, before retracing to $98,334 at press time. In fact, it might just be closing the year four times stronger than gold.

Why? Every fourth year is famously bullish for Bitcoin, setting off momentum that carries into the years ahead, fueled by a mix of internal and external factors. True to form, BTC once again lived up to its reputation.

However, the crypto market remains tightly connected to external forces. Investor sentiment is still largely shaped by macroeconomic trends, which dictate their ‘risk appetite’– A reality that became even more apparent as the year came to a close.

When the FOMC adopted a cautious stance on economic data and hinted at rising volatility, the crypto market took a hit. In just three days, the market cap dropped from an ATH of $3.77 trillion to $3.13 trillion – A steep 17% decline.

Meanwhile, the U.S Dollar surged to a three-year high. The impact wasn’t confined to Bitcoin alone – Major currencies like the Japanese Yen also struggled, hitting a five-month low on the charts.

Clearly, the Fed’s single announcement caused ripple effects across global markets, directly or indirectly influencing crypto demand. A deeper look at the metrics, however, revealed a massive shift in market behavior.

Bitcoin bucks its usual trend

June 2022 saw a post-pandemic inflation spike of over 9%, with the the Fed raising interest rates and pushing Bitcoin into its toughest cycle. At the time, the crypto was stuck between $20k and $25k on the charts.

However, the response this year has been different.

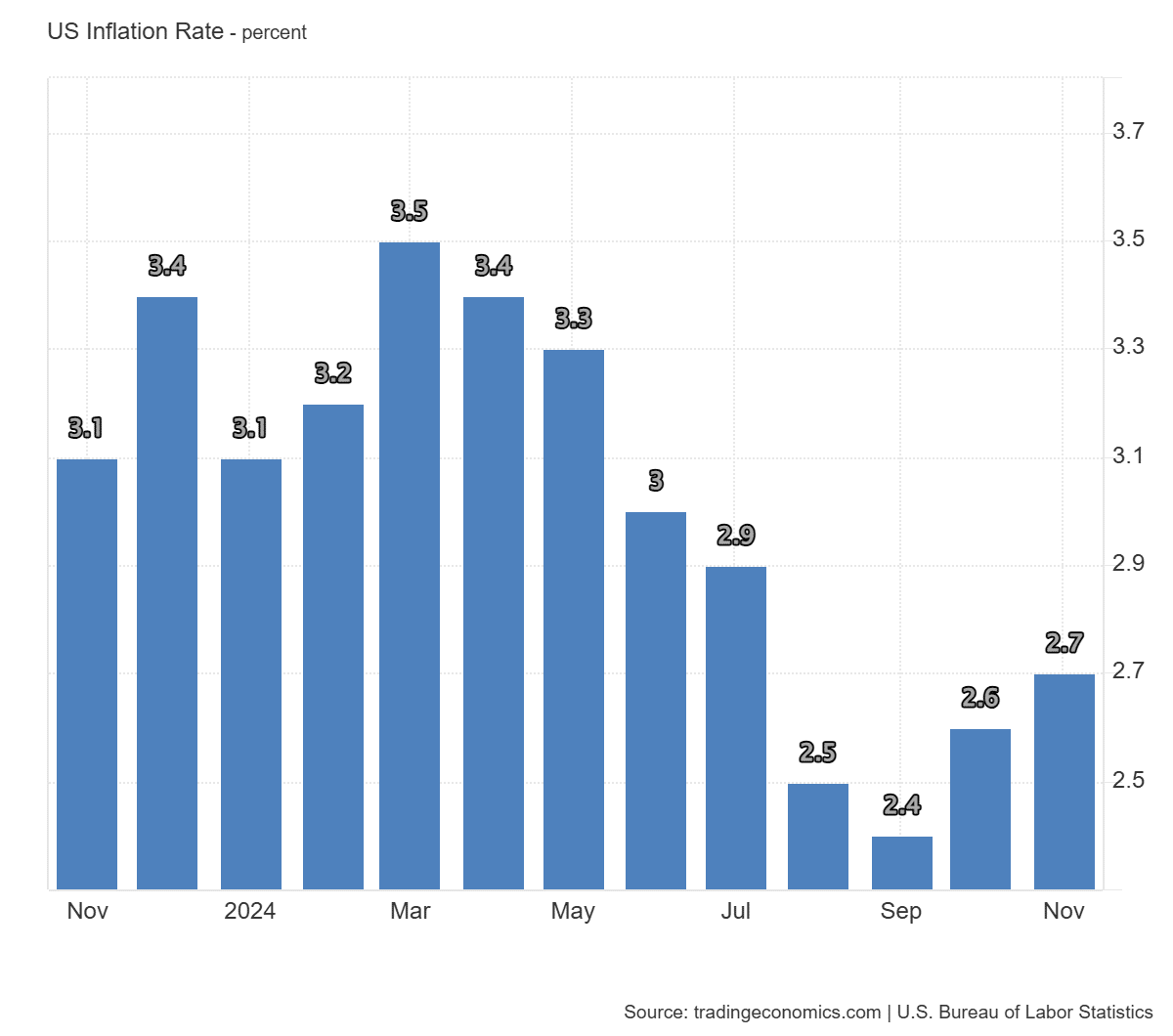

Source : Trading Economics

Even as inflation reached a yearly high of 3.5% in March, driven by soaring oil prices, Bitcoin didn’t flinch. Instead, it soared, posting a new all-time high of $73k.

What’s even more impressive is how Bitcoin has far outpaced traditional assets. With a YTD growth of nearly 140%, BTC has left other major indexes like Gold (+27%), the S&P 500 (+33%), and NASDAQ (+33%) in the dust.

In a year marked by skyrocketing war supply costs, fractured supply chains, political chaos, and escalating trade sanctions, Bitcoin remained unwavering.

But, why does this matter? In times of economic pressure, investors usually retreat from “risky” assets. Capital floods into banks as people seek safety in savings and higher borrowing costs tighten liquidity, pushing investors into traditional assets with guaranteed returns.

And yet, despite tightening household budgets and overall market uncertainty, Bitcoin emerged as a “safe haven,” – living up to its reputation as “digital gold.” This marks a pivotal shift for BTC and means that 2025 could be a game-changer.

So, is this the beginning of something new?

Undoubtedly, Bitcoin’s dominance over traditional assets, particularly gold – the age-old safe haven – has set the stage for a new era in global investment.

With a pro-crypto administration at the helm and Bitcoin reserves gaining mainstream attention, BTC’s strength seems set to endure. However, the road ahead is far from smooth.

Renewed China tariffs, tax cuts, and tighter government spending could push the Federal Reserve to keep interest rates high, challenging markets – and Bitcoin – alike.

The driving factor? Inflation. While these policies aim to boost domestic reliance, they carry economic risks that could ripple across global markets.

Read Bitcoin’s [BTC] Price Prediction 2025-26

As these challenges unfold, Bitcoin’s resilience will face renewed scrutiny, and the U.S dollar’s dominance will hang in the balance. Clearly, the shifts we’ve seen this year are far from ordinary. They’ve been groundbreaking, setting the stage for Bitcoin to tackle the volatility that lies ahead.

Meanwhile, stablecoins are carving out their own niche. Tether (USDT), the largest dollar-pegged stablecoin, hit an all-time high market cap of $140 billion.

With practical use cases, it is also challenging traditional fiat currencies. Case in point – In October 2024, Tether enabled the $45 million transportation of 670,000 barrels of Middle Eastern crude oil.

So, with stablecoins gaining traction as inflation hedges and alternatives to traditional fiat, the anti-dollar movement is growing stronger. This could mark the dawn of a new financial era – One where Bitcoin and stablecoins lead the charge.