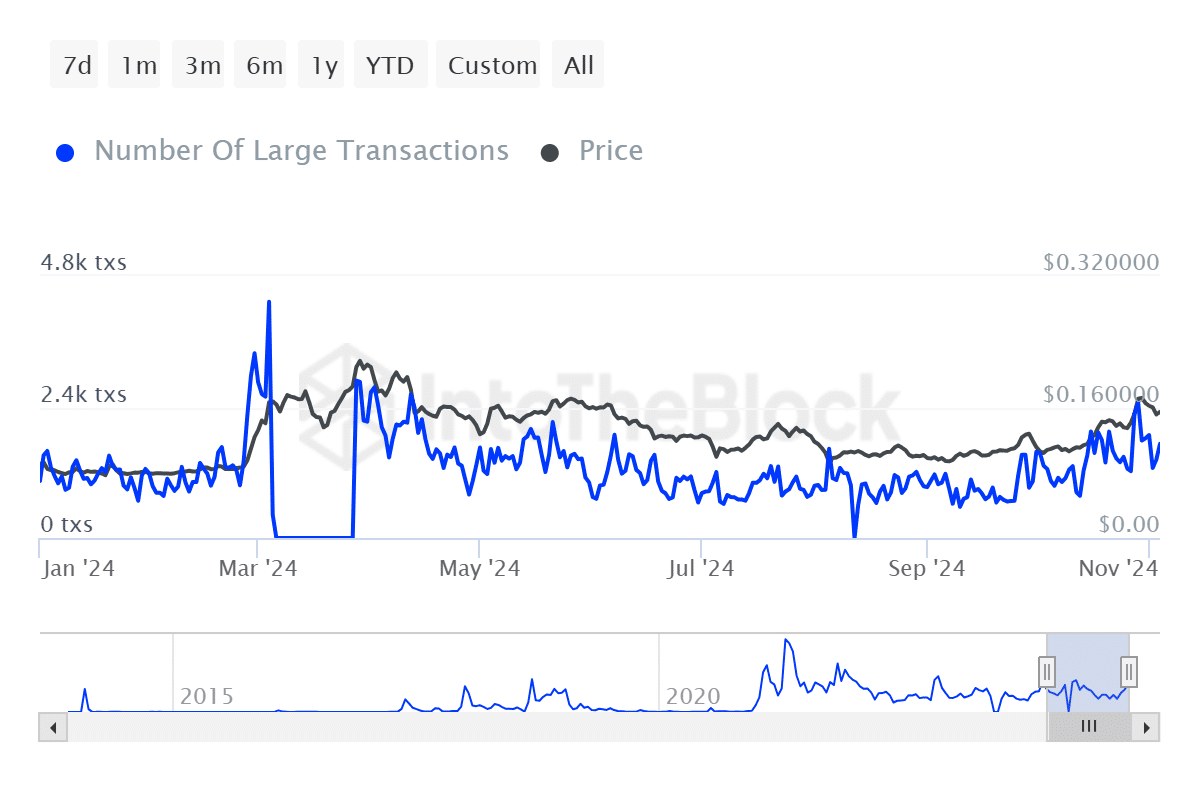

- Recent data showed a notable spike in large transactions and trading volume for DOGE, reaching its highest levels last week.

- DOGE’s price movements maintain a strong correlation with Bitcoin.

Following a month-long rally where Dogecoin [DOGE] climbed 131.22%, its upward momentum has slowed over the past week. During this period, the asset recorded modest but positive gains of 3.27% over the week and 1.87% in the last 24 hours.

These developments indicate that bullish sentiment persists, with investors engaging in accumulation—a strategy involving increased buying activity ahead of a potential breakout.

This behavior supports AMBCrypto’s hypothesis that a major price move could be imminent.

DOGE records a major spike in large transactions

In the last 24 hours, DOGE has seen a significant surge in large transactions. This surge has reached its highest levels in the past week, even surpassing previous records from recent years.

According to data from IntoTheBlock, transaction volume soared to 60.9 billion DOGE, equivalent to $23.35 billion. This was driven by a remarkable 9,410 large transactions within this period.

Source: IntoTheBlock

Large transactions are typically conducted by market participants holding at least 1% of the asset’s supply.

These players, often referred to as whales, have a substantial influence on market trends, triggering either rallies or declines.

Correlation with BTC

DOGE has shown a strong correlation with BTC, the cryptocurrency with the largest market cap of $1.97 trillion, according to CoinMarketCap data at press time.

This correlation, measured at 0.97, indicates DOGE is closely mirroring BTC’s price movements. With Bitcoin recently achieving an all-time high of $104,000 and expected to see further gains in upcoming trading sessions, this correlation could positively impact DOGE’s price trajectory.

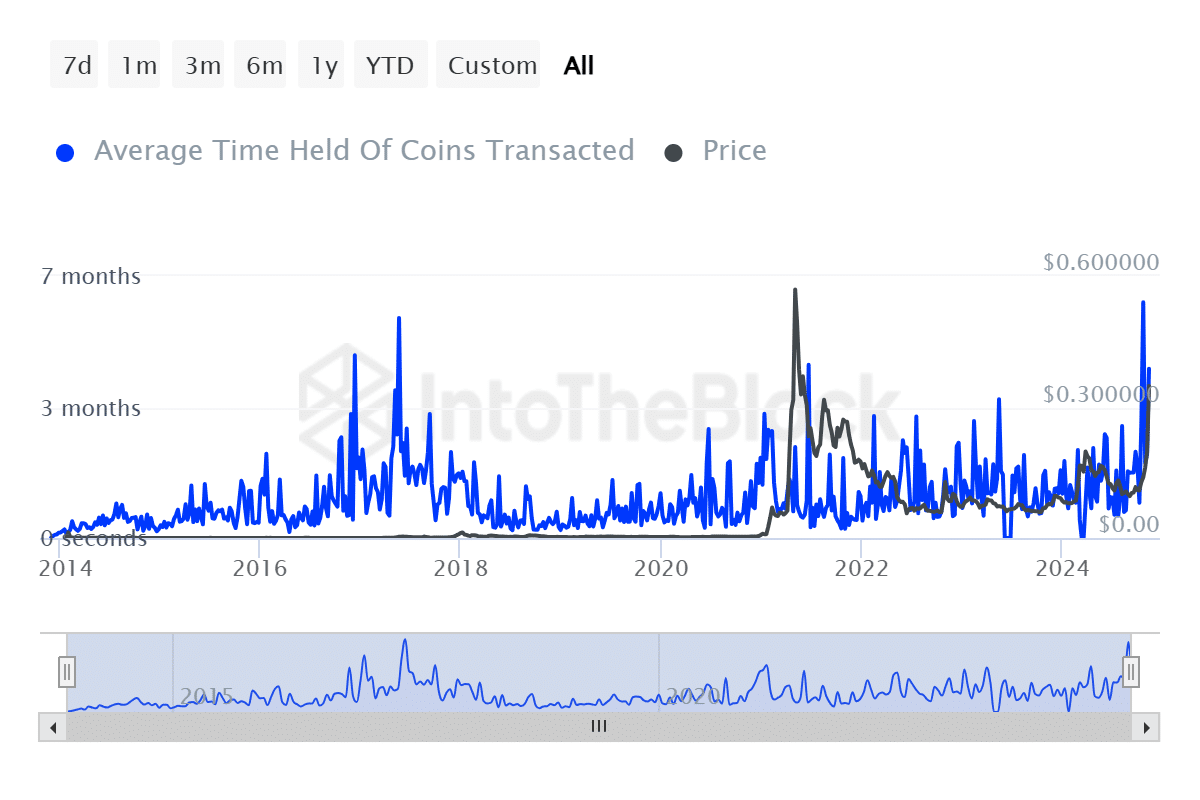

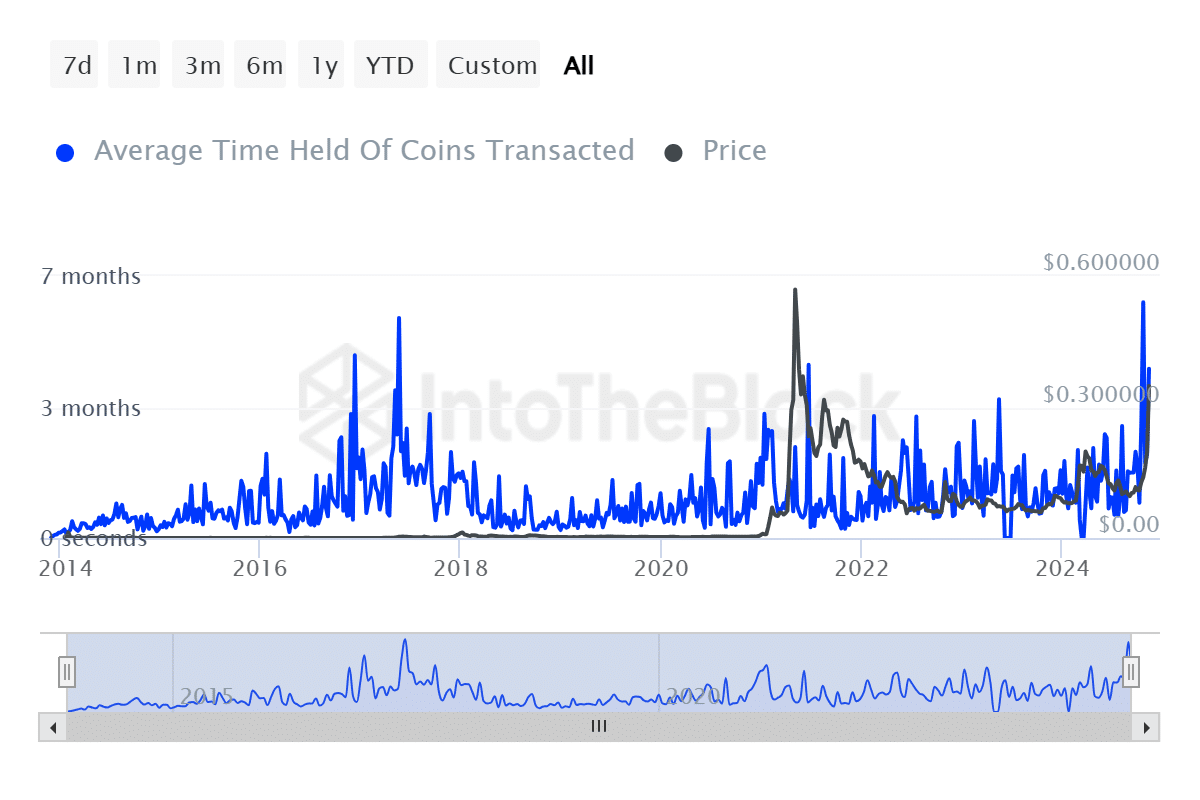

Furthermore, the holding time for transacted DOGE has surged. Over the last seven days, holding time increased by 301.99%, while a 90-day increase of 526.74% pushed the average holding duration to approximately four months.

Source: IntoTheBlock

This trend suggests that recent accumulation by larger traders reflects growing confidence in DOGE as a long-term investment.

These recent buyers, categorized as whales by AMBCrypto, are prepared to hold their positions for about four months. Interestingly, the 30-day holding metric deviates, showing an average holding time of two months before trading activity resumes.

What’s next for DOGE?

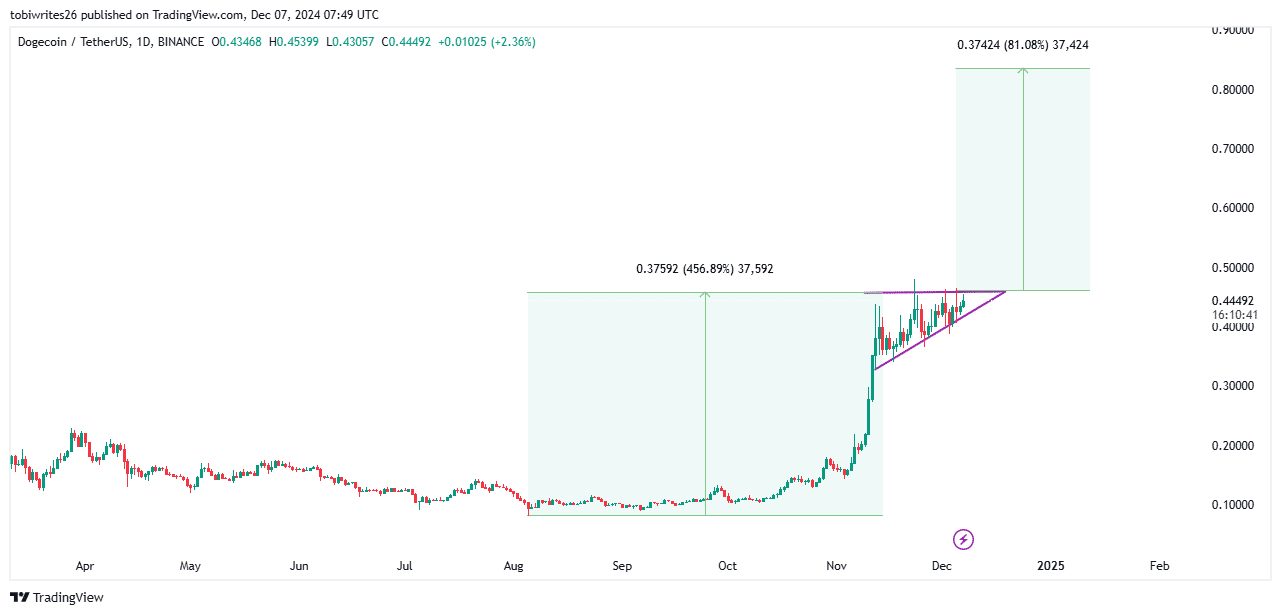

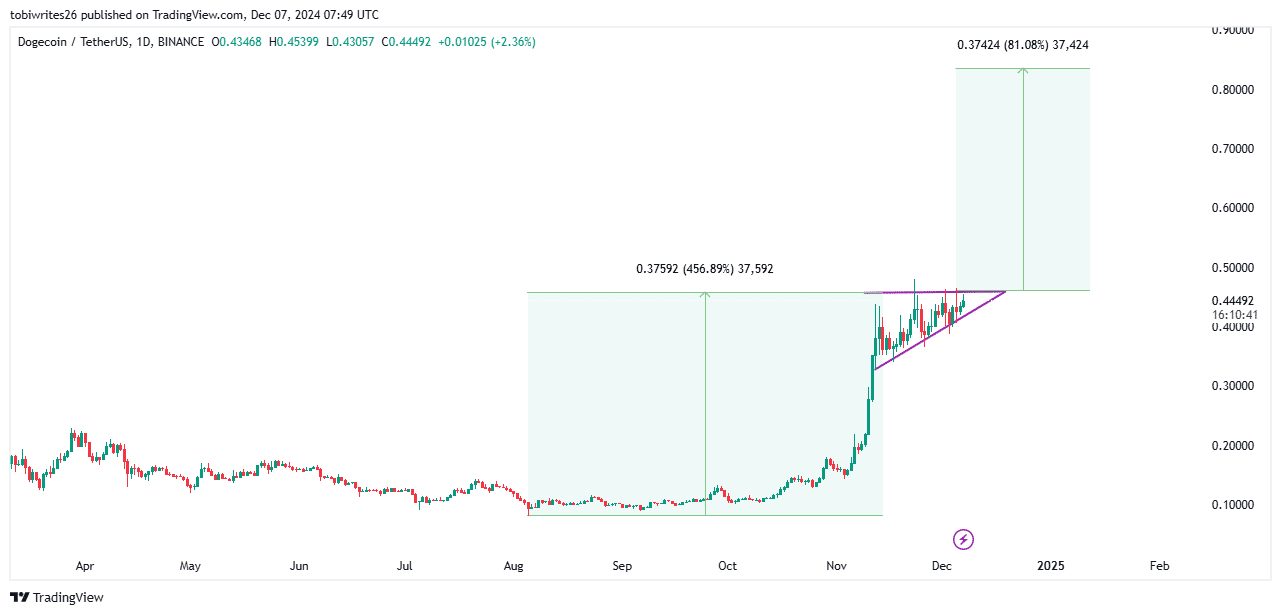

A technical analysis of DOGE suggests that the asset could achieve a significant gain of 81.08%, potentially trading at $0.84. This projection aligns with DOGE’s current position in an accumulation phase on the chart.

This accumulation phase is characterized by a horizontal resistance level and a converging diagonal support. Historically, when such patterns follow a strong upward rally, there is a high probability that the asset will replicate its previous upward momentum.

Source: TradingView

Read Dogecoin [DOGE] Price Prediction 2024-2025

If this scenario unfolds, the memecoin could see a breakout in upcoming trading sessions, driven by market whales.

Once the accumulation phase is breached, the anticipated rally may materialize, pushing the price to new heights.