- Whale accumulation and rising address activity suggested Dogecoin could soon break key resistance levels

- Mixed technical signals and low transaction counts highlighted caution

In a significant development that has caught the attention of the crypto market, Dogecoin [DOGE] whales have acquired over 90 million DOGE within the last 48 hours. This strategic accumulation is a sign of growing confidence among large investors, potentially positioning Dogecoin for a major price breakout.

At press time, Dogecoin was trading at $0.3155, following a slight 0.19% dip over the last 24 hours. However, the real question remains whether this momentum can ignite the next bullish phase or lead to further consolidation.

DOGE’s price action – A breakout or another consolidation?

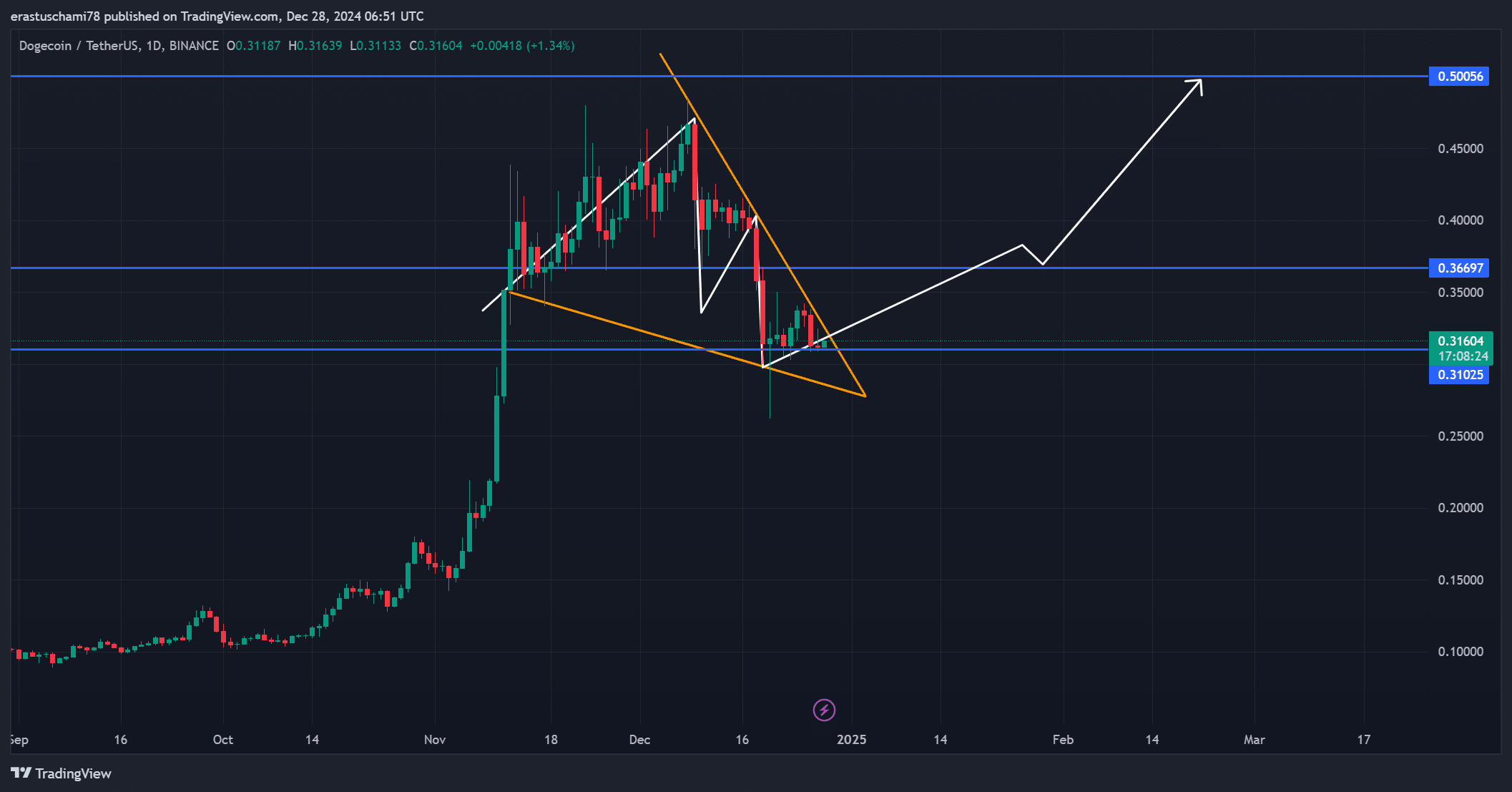

At press time, Dogecoin’s price action indicated a tightly coiled setup as it traded within a bullish pennant pattern. The critical resistance level stood at $0.366, which could serve as a launching pad for a rally towards $0.50 if breached.

However, a failure to break above this resistance might prolong the consolidation phase, frustrating bullish traders.

Source: TradingView

Analyzing Dogecoin’s address activity

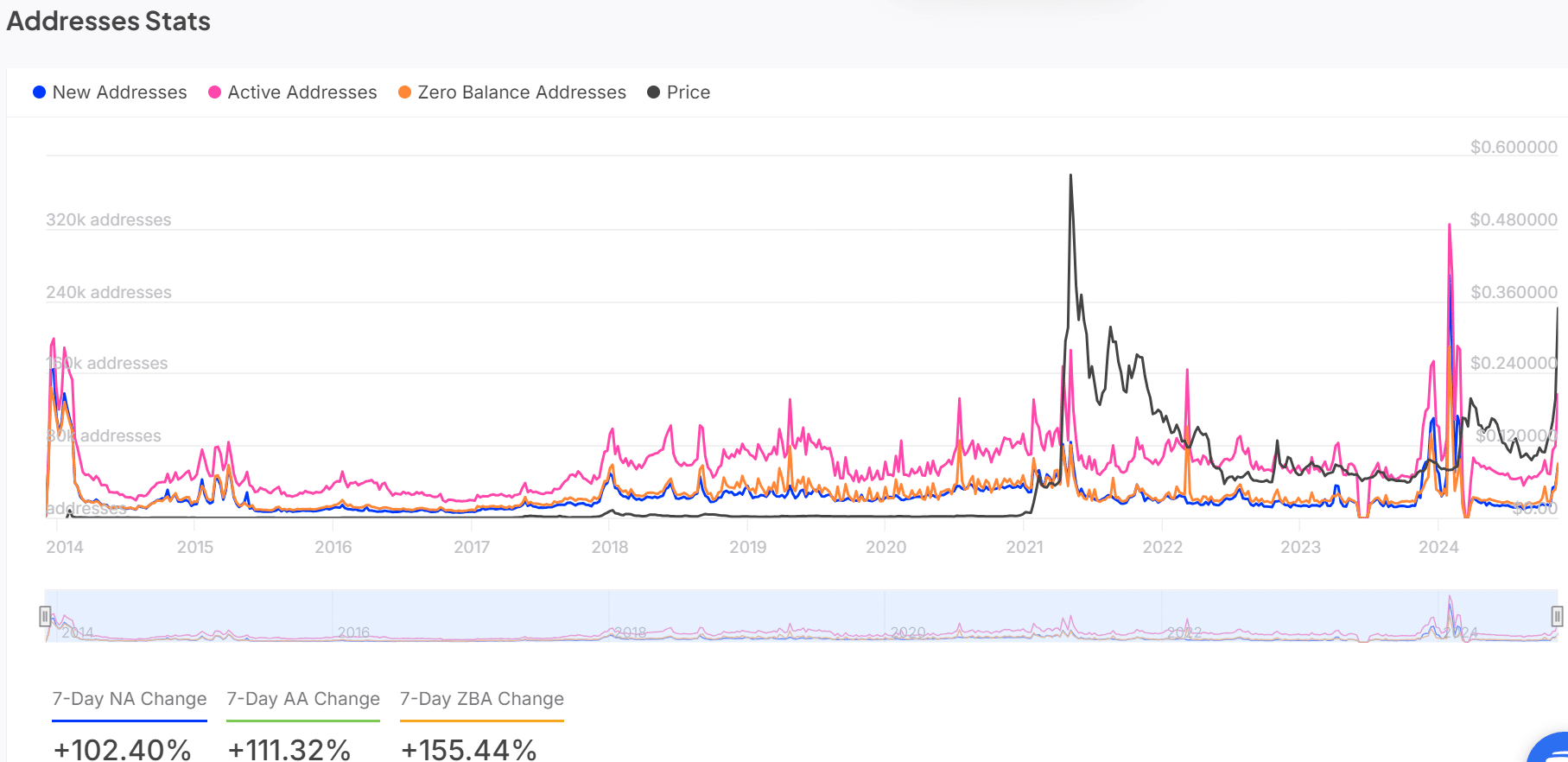

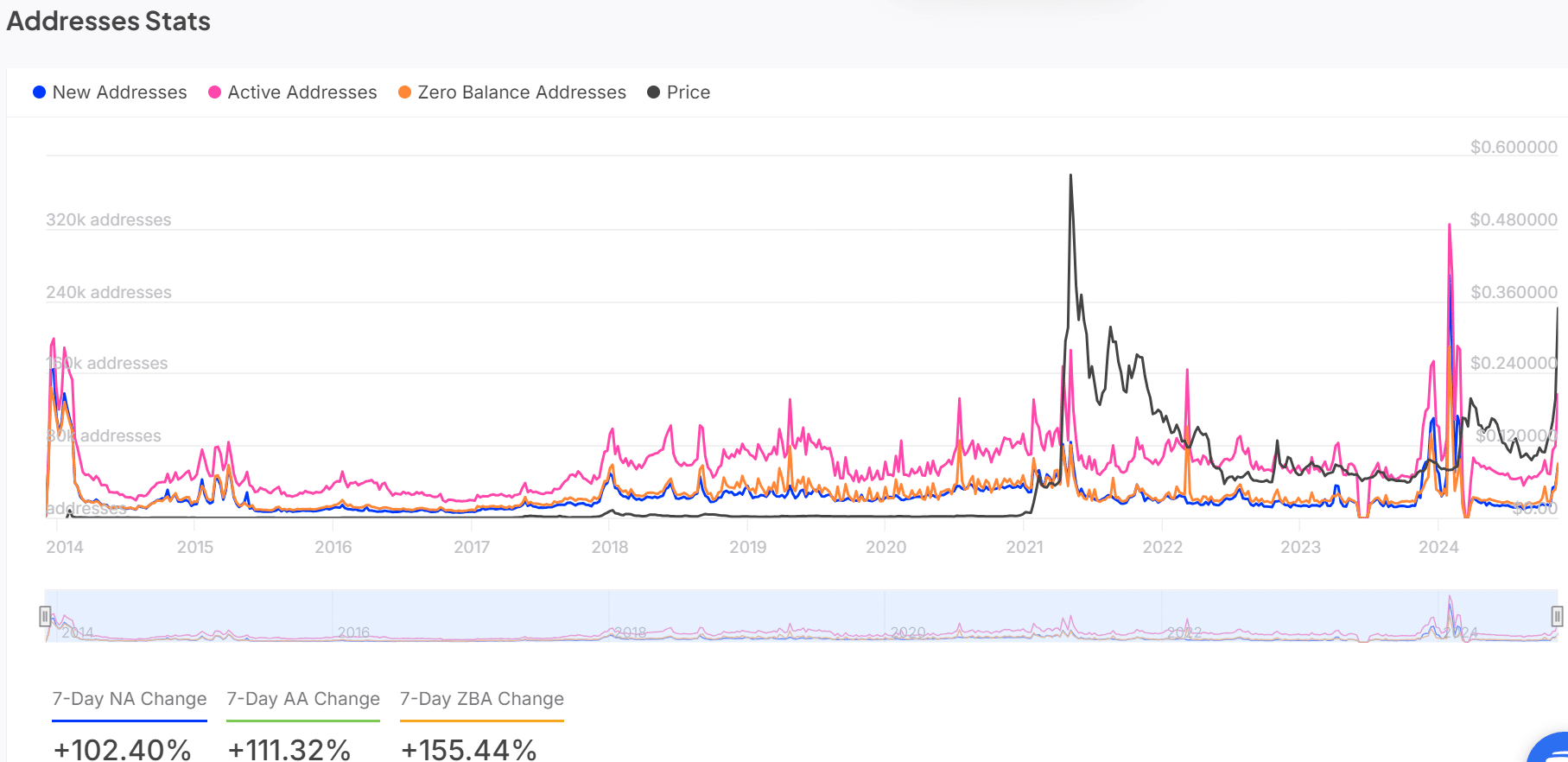

Examining Dogecoin’s address statistics revealed an encouraging trend in network activity. The past week has seen a 102.4% spike in new addresses, while active addresses have climbed by 111.32%.

These numbers pointed to a surge in user engagement – A metric often tied to price growth. Moreover, zero-balance addresses have risen by 155.44%, indicating an influx of new participants testing the ecosystem.

Source: IntoTheBlock

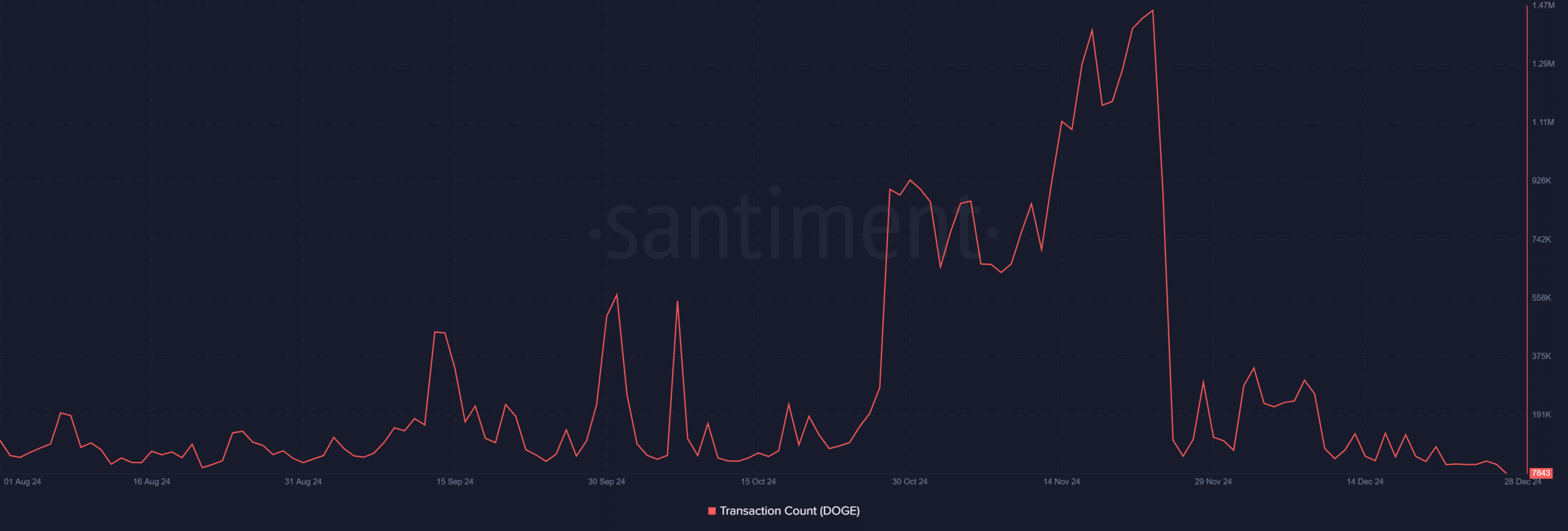

Dogecoin’s transaction count signals caution

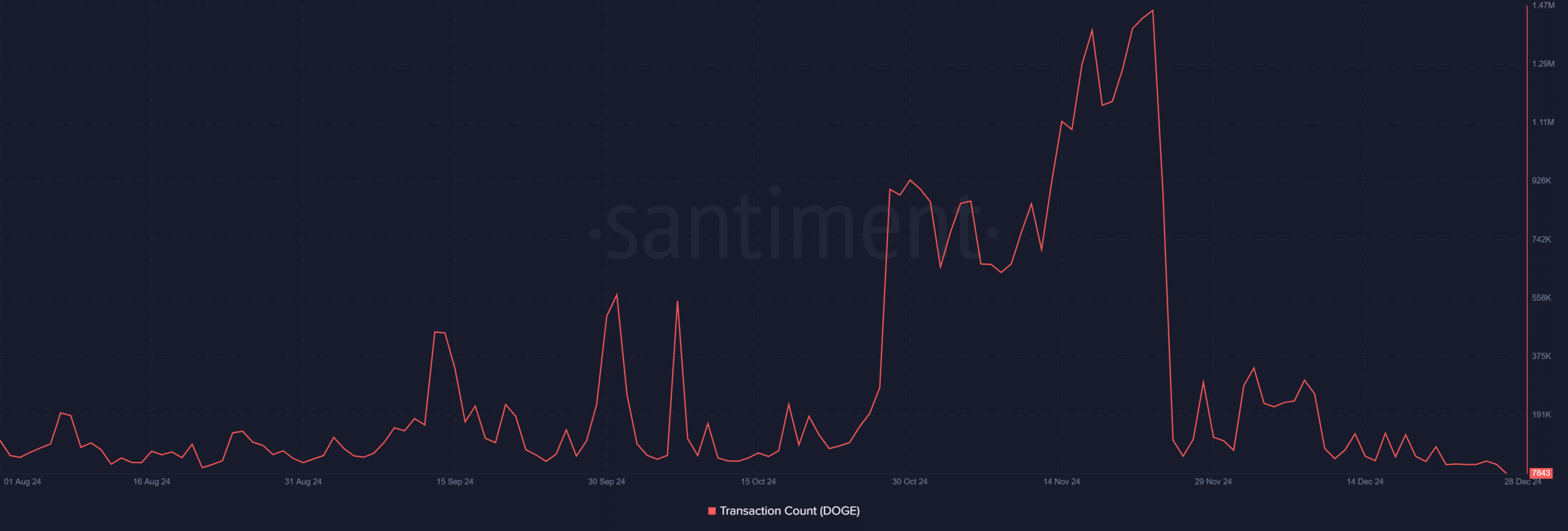

Despite growing whale interest, Dogecoin’s transaction count dropped significantly, with only 7,843 transactions recorded at press time. This decline underscored muted on-chain activity, which could act as a headwind against bullish momentum.

However, such quiet periods have historically preceded sharp price moves, making this a situation worth monitoring closely.

Source: Santiment

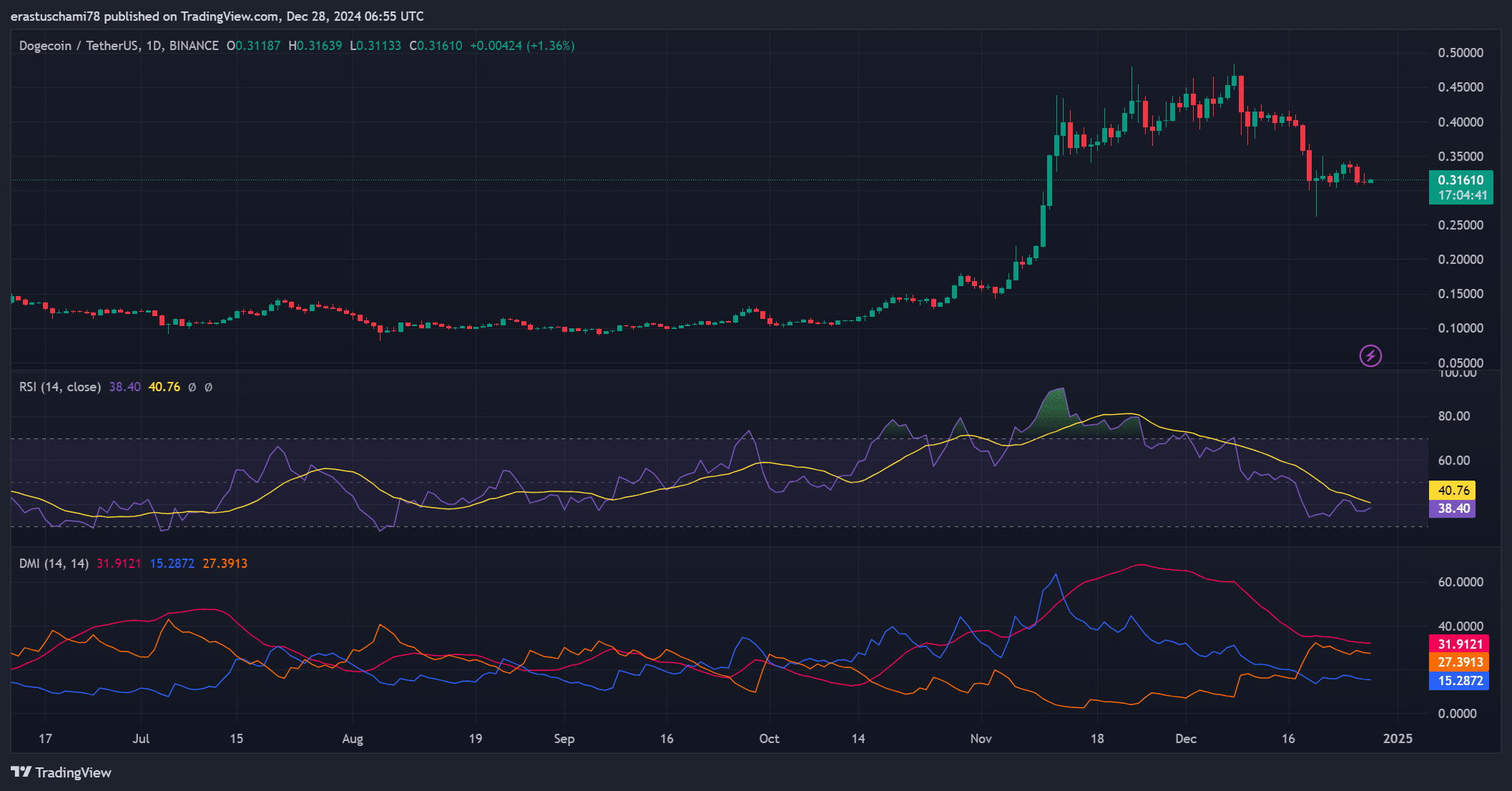

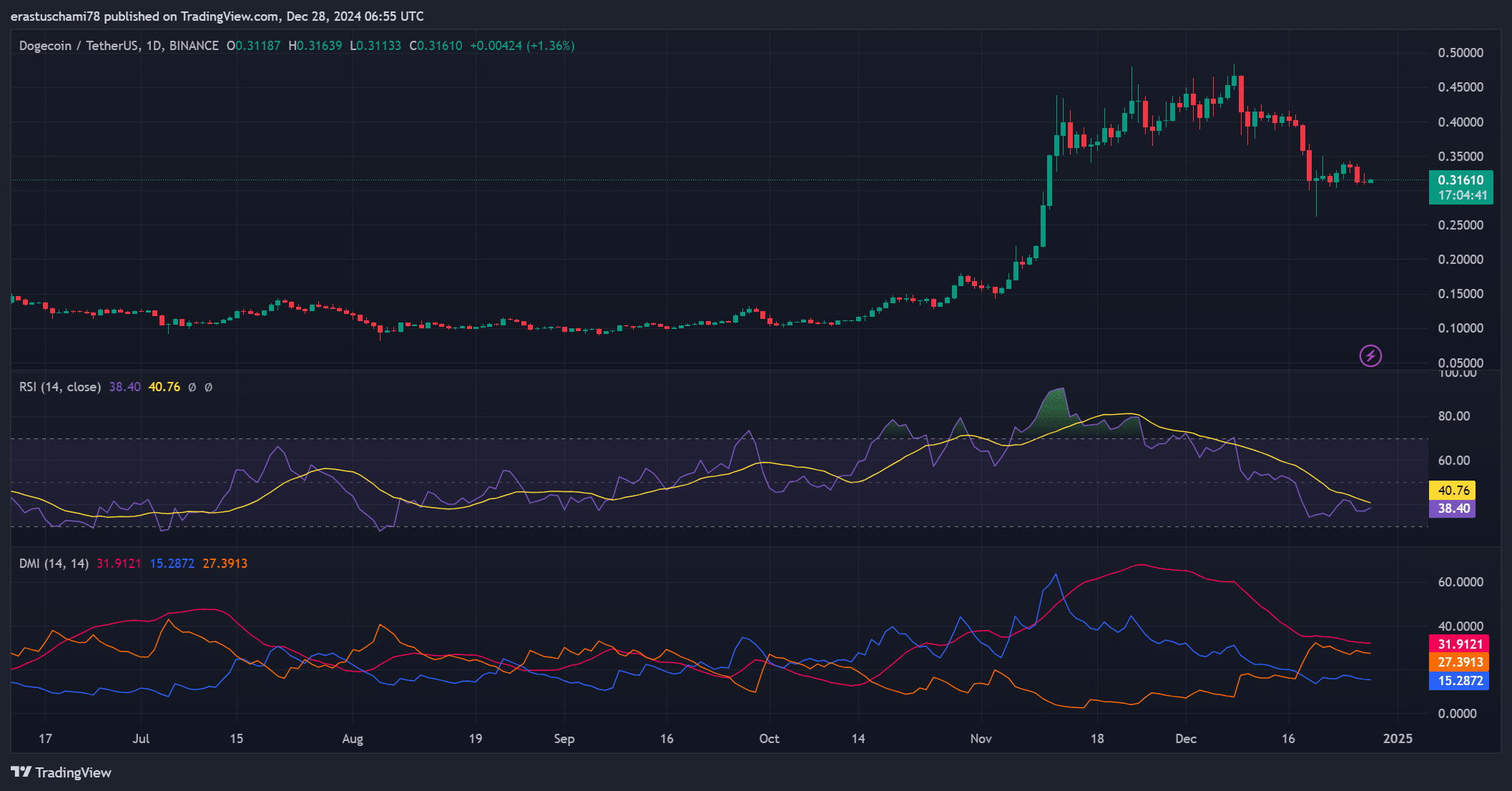

DOGE’s technical indicators

Dogecoin’s technical indicators highlighted a market at a crossroads. The Relative Strength Index (RSI) seemed to be hovering around 40.76, hinting at a market edging towards oversold conditions, but not quite there yet.

Meanwhile, the Directional Movement Index (DMI) alluded to bearish dominance, with the -DI at 31.91 overshadowing the +DI at 15.28. Therefore, while the technical outlook is not overtly bearish, it highlighted the importance of a strong catalyst to reverse the prevailing trend.

Source: TradingView

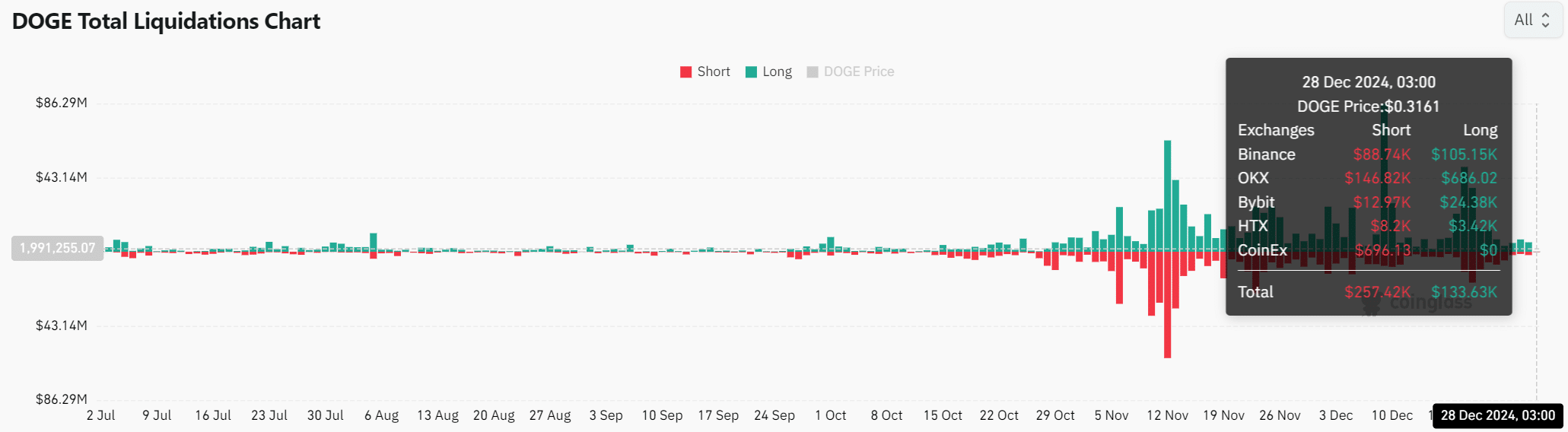

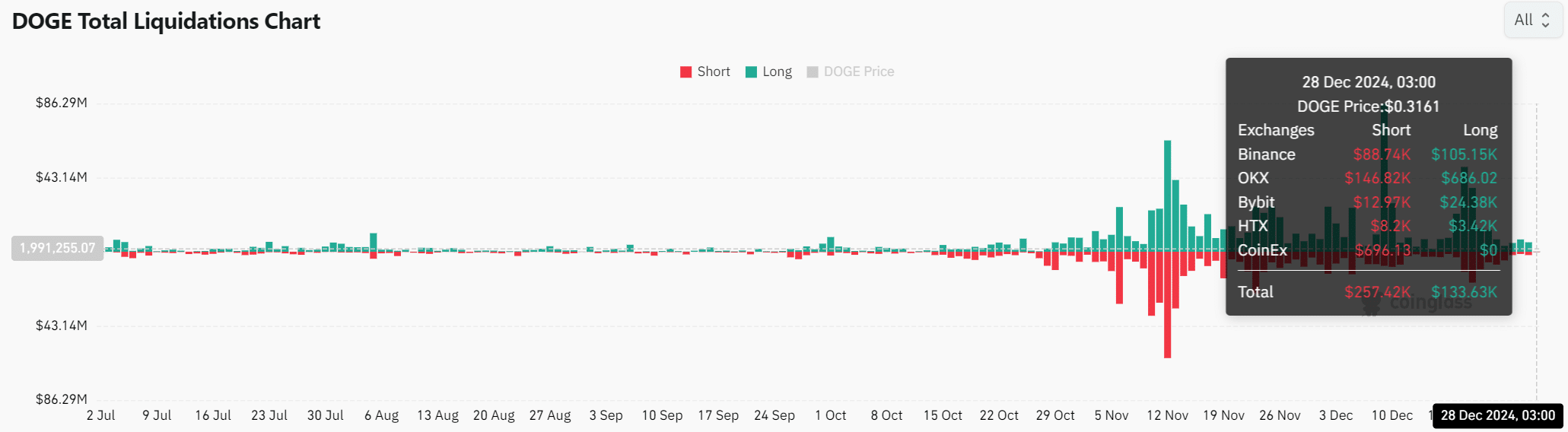

Liquidation data – Signs of shifting momentum?

Liquidation figures presented a nuanced perspective, with $257,420 in short positions liquidated compared to $133,630 in longs. This imbalance suggested that short-sellers are starting to lose control, potentially paving the way for a bullish reversal.

However, this shift will require sustained buying interest to turn the tide fully.

Source: Coinglass

Read Dogecoin’s [DOGE] Price Prediction 2024–2025

Dogecoin’s recent whale accumulation and rising address activity highlight its potential for a breakout.

However, with low transaction counts and mixed technical signals, the current market remains uncertain. If DOGE successfully clears $0.366, the next bullish phase could begin. For now, cautious optimism prevails.