- WIF’s social mindshare has dropped significantly.

- Investors’ interest has also waned, dragging WIF’s prices as a result.

Dogwifhat [WIF] has lost significant social traction and engagement. According to Kaito data, WIF’s social mindshare on X (formerly Twitter) has declined from its highest level seen between March and April.

Afterward, there wasn’t much engagement on WIF-related social posts.

‘From start to finish of the $WIF run up, key CT accounts had super high engagement on related tweets. And then… they moved on.’

Source: Kaito

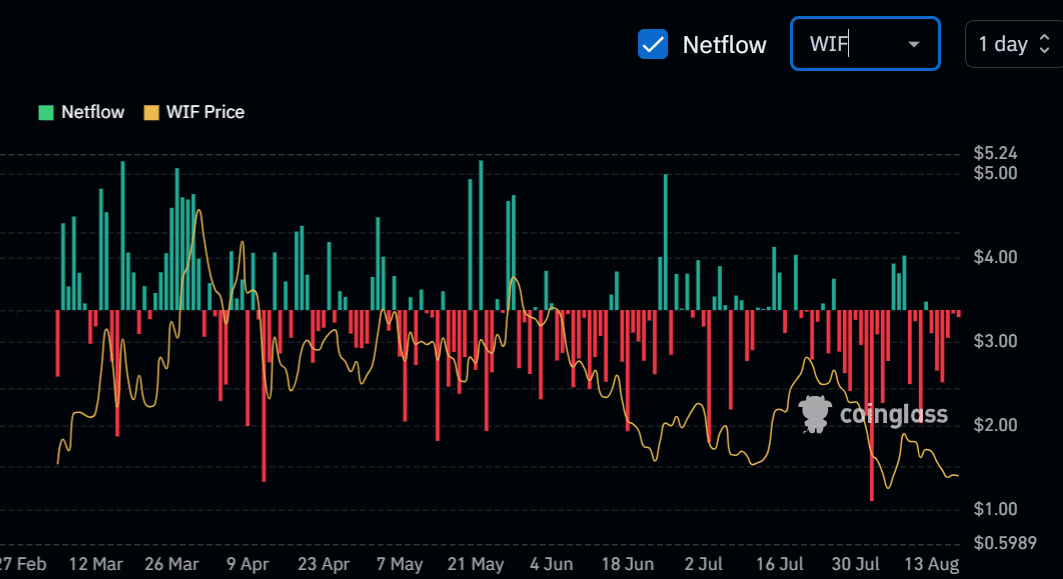

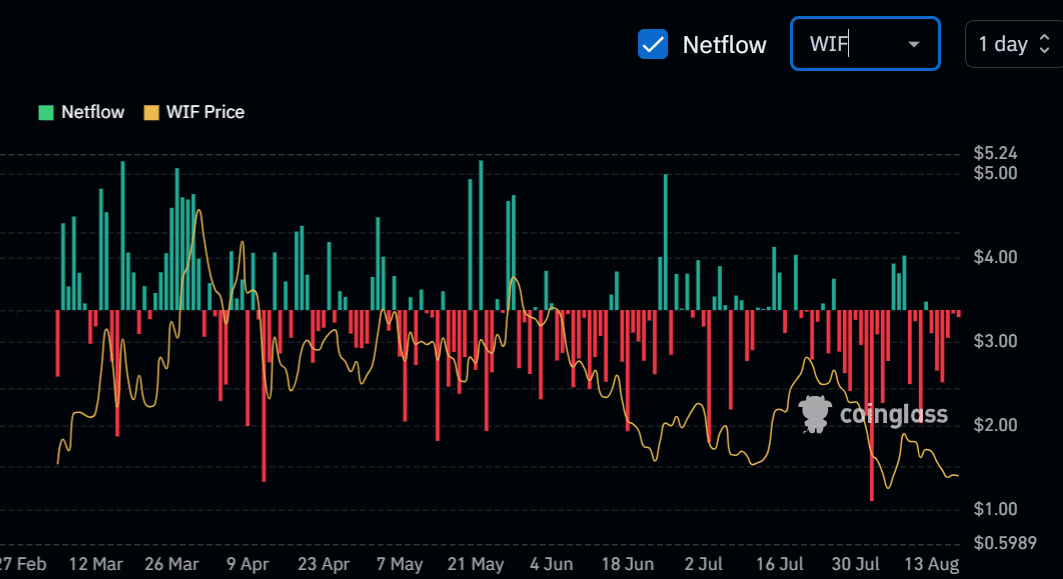

WIF’s investor interest dropped

The declining Social Volume and traction were also reflected in investors’ and traders’ sentiment over the same period. As shown in the WIF’s spot net flows chart, overall spot net flows have been negative.

In August, WIF’s outflows intensified, dragging the meme coin to a new low of $1.07.

About $24 million in outflows occurred between the 12th to the 18th of August, illustrating weak demand from investors and traders for the meme coin.

Source: Coinglass

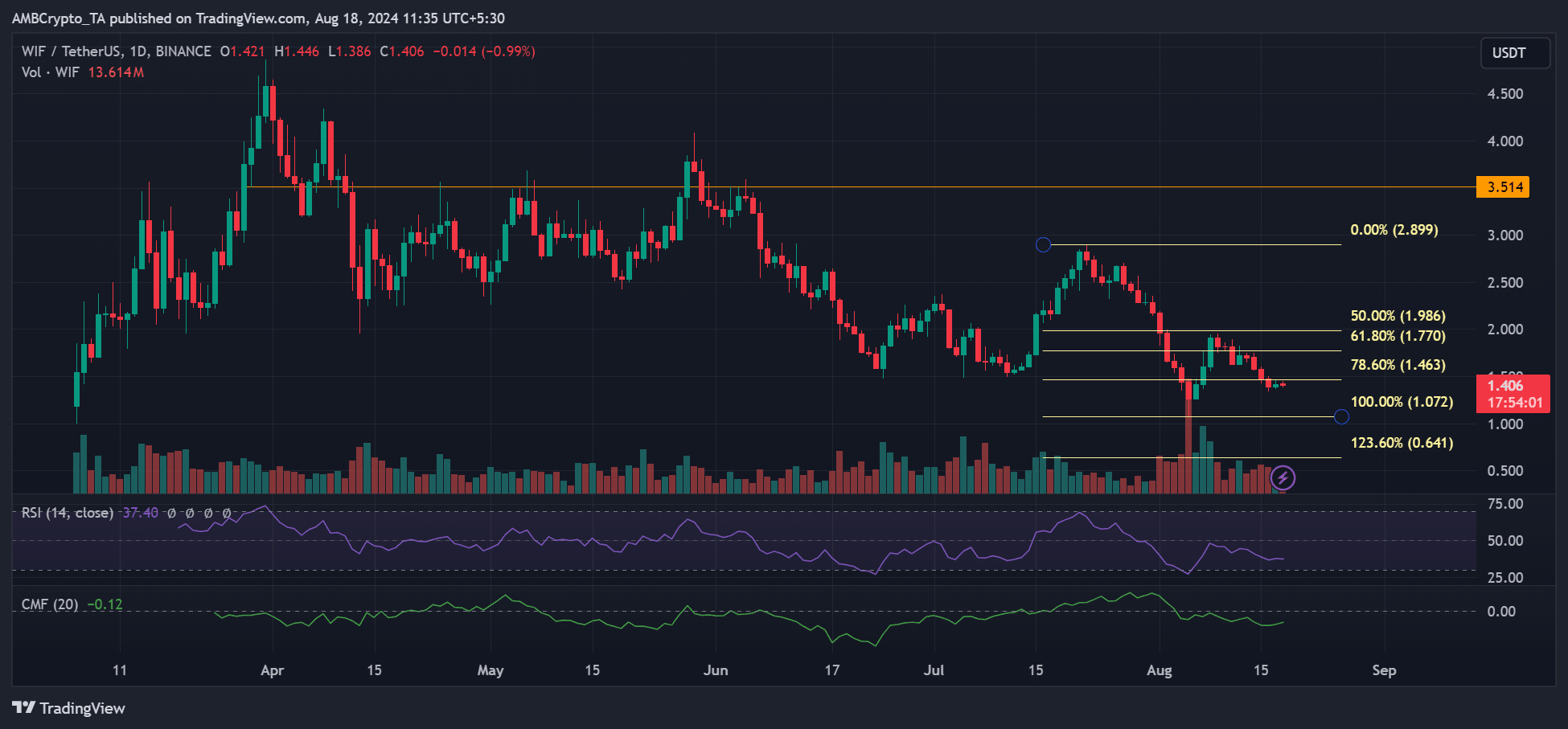

WIF price action

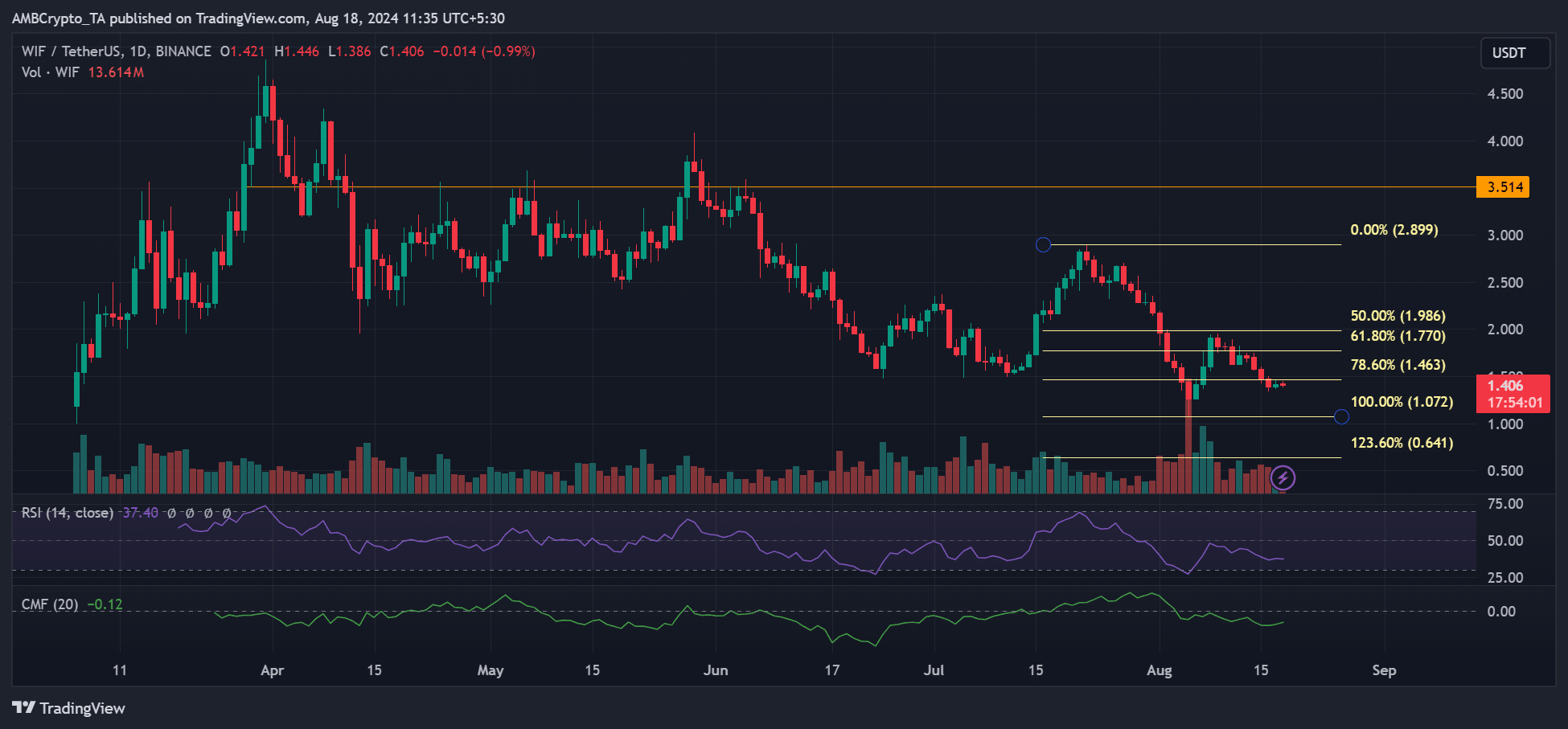

The weak demand for WIF in August was also demonstrated by the weak readings on the RSI (Relative Strength Index) and CMF (Chaikin Money Flow).

The technical chart indicators have been trending below average in August, further constraining WIF’s strong recovery prospects.

Interestingly, not even the recent recovery attempt flipped investors’ sentiment, despite WIF outpacing other memecoins like Dogecoin [DOGE] in the slight bump.

At the time of writing, WIF reversed the attempted recovery gains and traded below $1.5.

Source: WIF/USDT on TradingView

With Bitcoin [BTC] struggling to convincingly stay above $60K, WIF’s strong rebound could be delayed.

Meanwhile, based on the Fibonacci retracement tool, plotted between July highs and August lows, $2.0, $1.0 and $1.5 are key levels to watch in the short term.

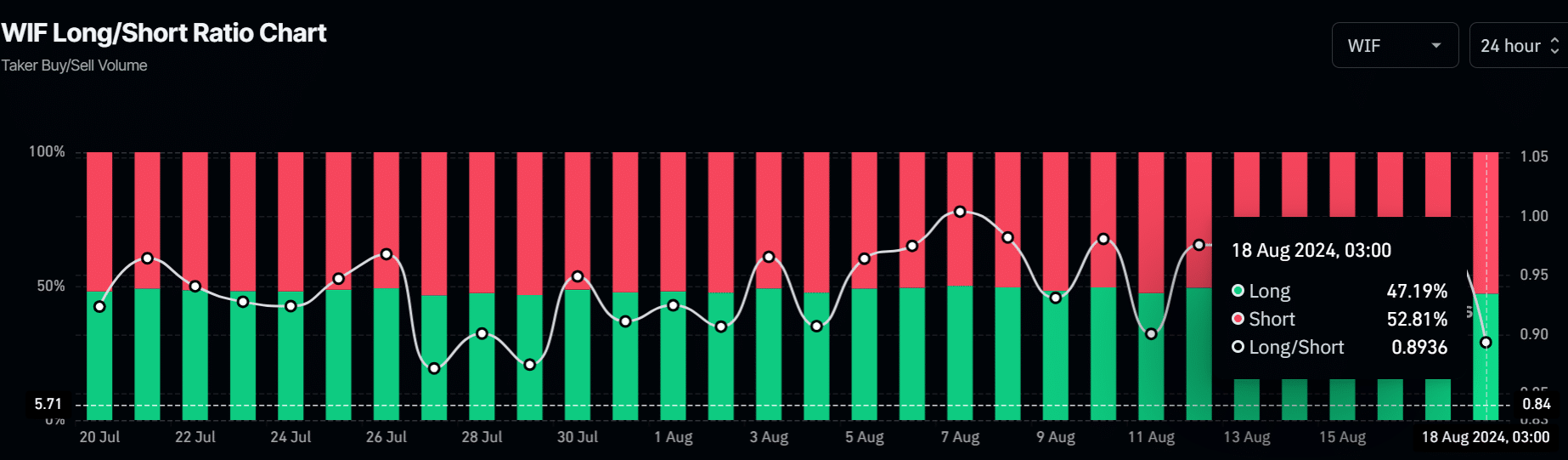

Additionally, more speculators on the Futures market were shorting the memecoin in record numbers.

Is your portfolio green? Check out the WIF Profit Calculator

Over the weekend, nearly 53% of future positions were betting against WIF’s recovery, reinforcing the bearish sentiment.

Source: Coinglass

In conclusion, WIF’s muted price action could persist amidst record-low social mindshare and choppy BTC price action.