- A dormant ETH whale woke after 4 years to withdraw 1202 tokens worth $2.2 million.

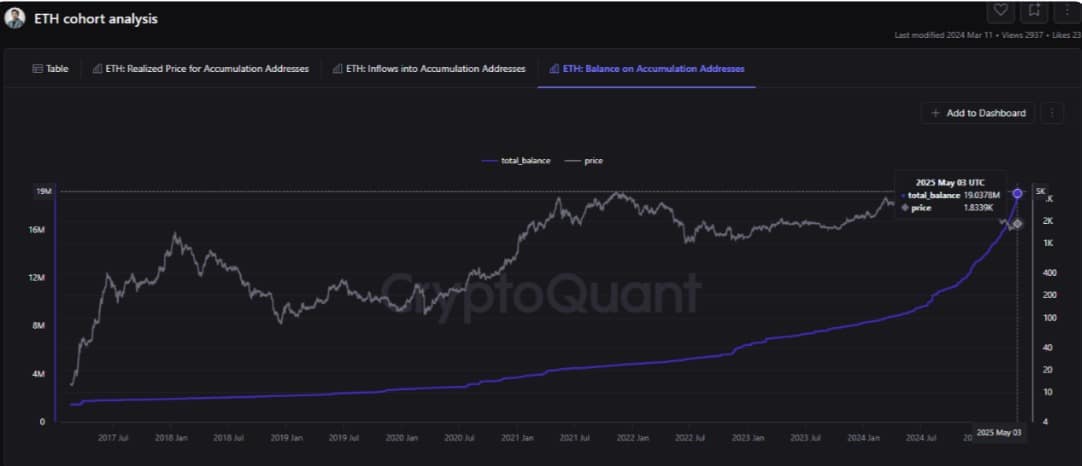

- Ethereum accumulating addresses have seen a significant increase in holdings, particularly among long-term holders.

After reclaiming $1.8k levels 10 days ago, Ethereum [ETH] has struggled to break out and make a major move to the upside.

The altcoin has continued to consolidate between $1727 and $1877. Despite the prolonged consolidation, holders are not giving up on ETH. As such, they continue to hold on.

While Ethereum has experienced a period of uncertainty, Ethereum holders have shown to hold strong even when sitting on unrealized losses.

In fact, amid this price stagnation, accumulating addresses have continued to increase their holdings.

According to CryptoQuant, the cohort has increased their Ethereum exposure by 22.54%. ETH holder’s holdings have increased from 15.5356 million to 19.037 million between the 10th of March and the 3rd of May.

Source: CryptoQuant

This accumulation trend is more observed among whales. As this accumulation trend has continued over the past day with dormant whales waking up after four years.

As reported by OnChainLens, this whale has withdrawn 1,202 ETH worth $2.2 million from Binance.

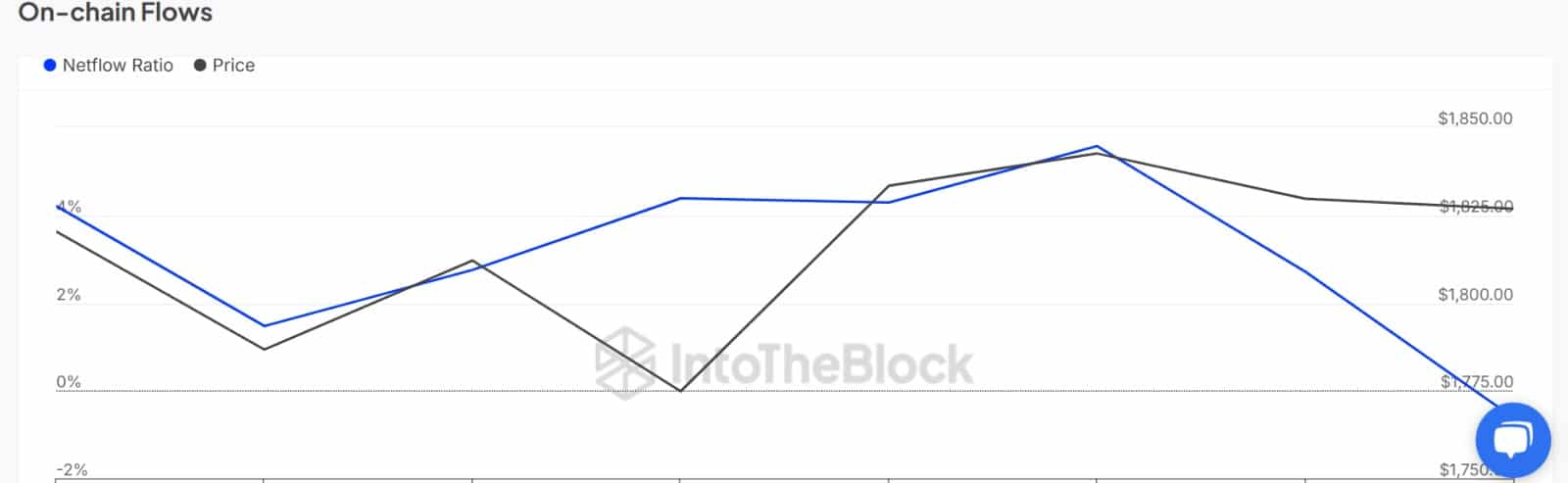

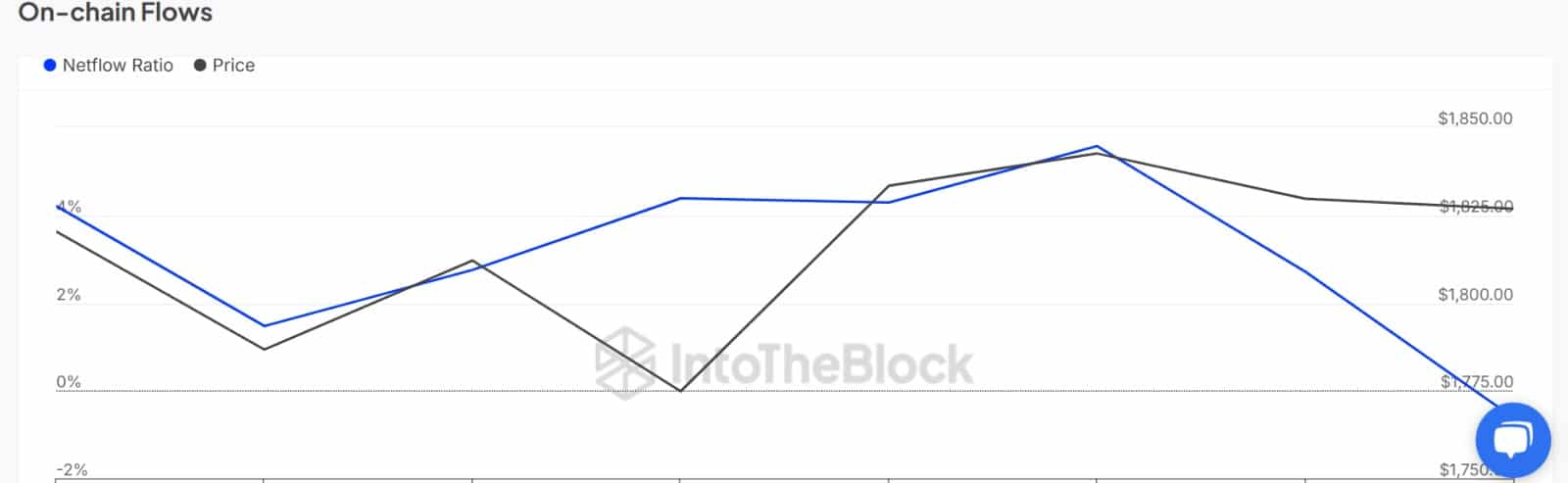

Source: IntoTheBlock

This trend is widespread among Ethereum whales, as reflected in the Large Holders’ Netflow to Exchange Netflow Ratio.

The metric shows that large holders are aggressively accumulating, with the exchange ratio dropping to -0.62%, its lowest recent level.

A negative value here indicates that whales are withdrawing more ETH from exchanges than they are depositing, signaling strong accumulation behavior.

Source: CryptoQuant

This market trend isn’t limited to large holders—it’s visible across all participant levels.

Ethereum’s Exchange Netflow has remained negative for six of the past seven days, with only one exception.

This suggests that retail investors and smaller holders are also withdrawing more ETH from exchanges than they are depositing. Such behavior signals growing confidence in Ethereum’s future price potential.

Source: Santiment

The growing cumulative addresses have pushed Ethereum’s scarcity to recent highs. As such, stock to flow ratio has spiked to a yearly high of 374. A spike in SFR reflects growing scarcity, with less ETH readily available to sell.

Often, a high scarcity while demand remains strong drives prices higher.

What does it mean for ETH

Despite ETH’s price struggles, accumulation continues, signaling strong belief in its asset value, project, and ecosystem.

This trend reflects structural conviction and clear expectations for short-term price appreciation.

Put simply, Ethereum holders are displaying bullish sentiment, positioning the altcoin for potential price gains.

If accumulation persists and outpaces selling pressure, ETH could break out of consolidation and push toward $2,000. However, if the tug-of-war between holders and speculative bears continues, ETH may remain range-bound for a longer period.