- The Ethereum Foundation unveiled a new management structure and vision.

- ETH’s market reaction to the update was modestly positive.

On the 28th of April, the Ethereum [ETH] Foundation (EF) announced its new management structure and vision.

Per the statement, EF formalized two appointments of Co-Executive Directors (EDs) Hsiao-Wei Wang and Tomasz K. Stańczak to drive strategic and operational execution division.

In addition, the EF will have four board of directors, including the founder, Vitalik Buterin, and Aya Miyaguchi as the president.

The board will ensure compliance and oversight of high-level strategies. Per the EF announcement,

“The recent appointments…are part of a broader effort to strengthen the Ethereum Foundation, and this structure is designed to ensure our vision, strategic and balanced execution, technical direction, and ecosystem development.”

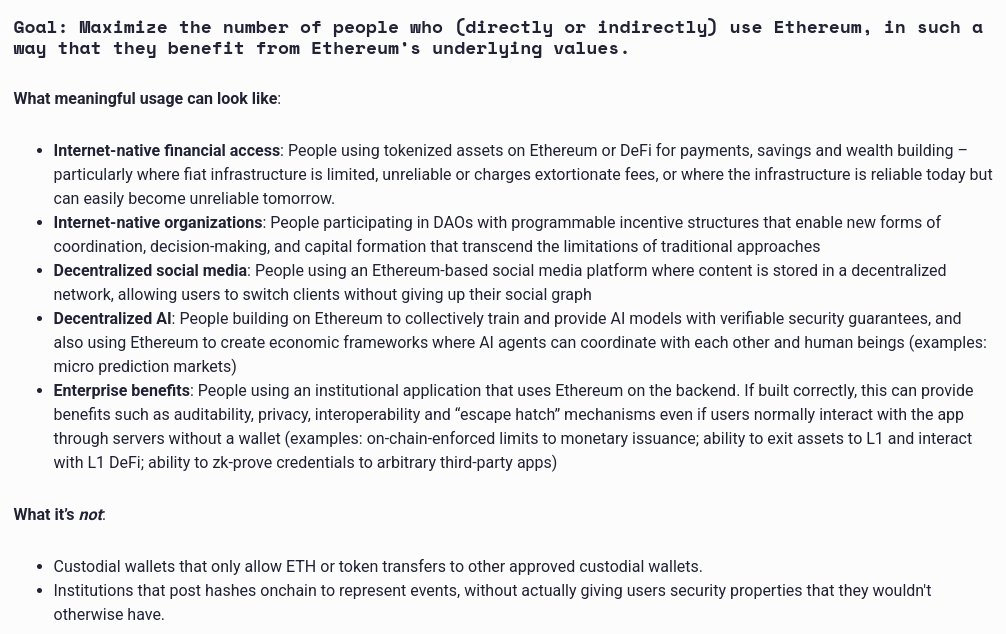

Ethereum Foundation’s new vision

Apart from the management shake-up, the EF also revealed a new vision. Buterin reiterated the EF twin goals of real-world usage and decentralization.

“Twin goals of EF: Usage of Ethereum – but usage of a type where users are actually benefiting from Ethereum’s underlying properties. Resilience and decentralization of Ethereum – viewed holistically, focused on addressing points of weakness anywhere in the stack.”

Source: EF (excerpt of the new vision)

The replacement of former EF executive director Aya Miyaguchi (now president) happened after an intense community backlash. The criticism also followed a series of ETH sell-offs from EF.

The community complained about EF’s lack of transparency and called for a more technical and experienced developer within the Ethereum ecosystem to take her place.

Stanczak will lead the role for two years, alongside his position at Nethermind and a private venture focused on Ethereum.

While some hailed the move, some, like Pierre Rochard, downplayed the update. He said,

“These two goals do nothing to help ETH accrue value…EF should instead IPO on the NASDAQ and run the ETH treasury company playbook with convertible bonds.”

Source: Santiment

That said, the update boosted ETH’s market sentiment, as revealed by a jump to positive territory. The Supply on Exchanges also slipped slightly, suggesting increased accumulation after the EF announcement.

In fact, ETH was above key moving averages on the price charts, a bullish indicator on the possibility of the altcoin tapping the $1900 hurdle. However, the trendline support could be retested if $1,755 supports cracks.

Source: ETH/USDT, TradingView