- ETH attempted a recovery, but a rally could be subdued amid evidence of low demand.

- Assessing the impact of surging exchange reserves and the state of exchange flows.

Ethereum [ETH] finally managed to recovery slightly from last week’s massive wave of sell pressure.

Although it has recovered slightly in the weekend, there are some signs suggesting that it might not be a smooth recovery this week.

After concluding September on a bearish leg, ETH sell pressure finally eased on Thursday after a 15% retracement.

This was followed by a bit of bullish momentum during the weekend, leading to a 7% recovery from last week’s lows.

ETH exchanged hands at $2477 at press time. Its price action notably respected an ascending short-term trend line highlighted in yellow. So far, the slight upside indicates that there was some accumulation.

Source: TradingView

At first glance, the weekend rally may seem like a healthy rally and a potential indication of more upside in the coming days.

However, ETH’s money flow indicator reverted to the downside in the last 24 hours, suggesting that liquidity could be flowing out of ETH.

Source: TradingVIew

The MFI suggests that the latest rally may be characterized by weak demand. This also means that ETHs potential upside might be limited.

However, this is subject to changes in supply-demand dynamics during the week.

Will low excitement for ETH hinder its upside?

The above findings align with the declining interest in Ethereum cryptocurrency. It may be a sign that ETH may not be the best option for those looking for maximum short-term gains.

On top of that, on-chain data also revealed a sharp uptick in ETH exchange reserves in the next few days. Such an outcome could be consistent with expectations of more sell pressure.

Source: CryptoQuant

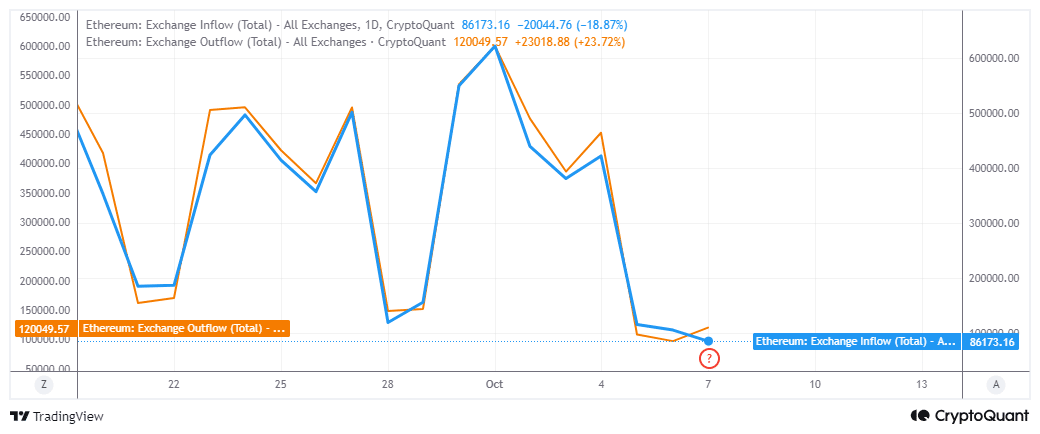

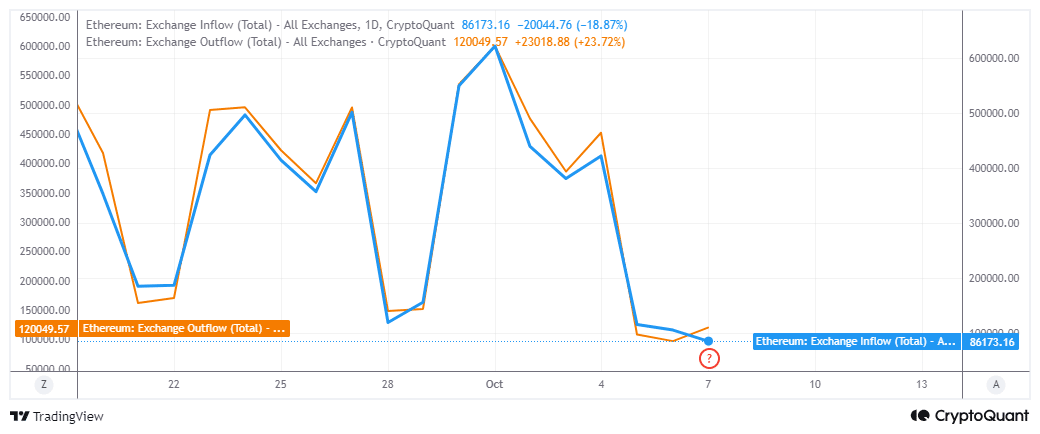

But what do exchange flows reveal about the current situation? According to CryptoQuant, ETH’s exchange flows pivoted at the start of the month, leading to slower volumes.

For example, exchange inflows peaked at 621,000 ETH at the start of October while exchange outflows were slightly lower at $599,778 ETH.

Fast-forward to the present, and exchange inflows amounted to 86,173 ETH. Exchange outflows were higher at just over 120,000 ETH.

This means there was a net demand of 33,827 ETH, which was equivalent to $83.5 million worth of demand.

Source: CryptoQuant

Read Ethereum’s [ETH] Price Prediction 2024–2025

Based on the above data, we can conclude that ETH is experiencing some demand, but in relatively low quantity.

In other words, there was low excitement in the cryptocurrency and hence the potential for a subdued outcome.